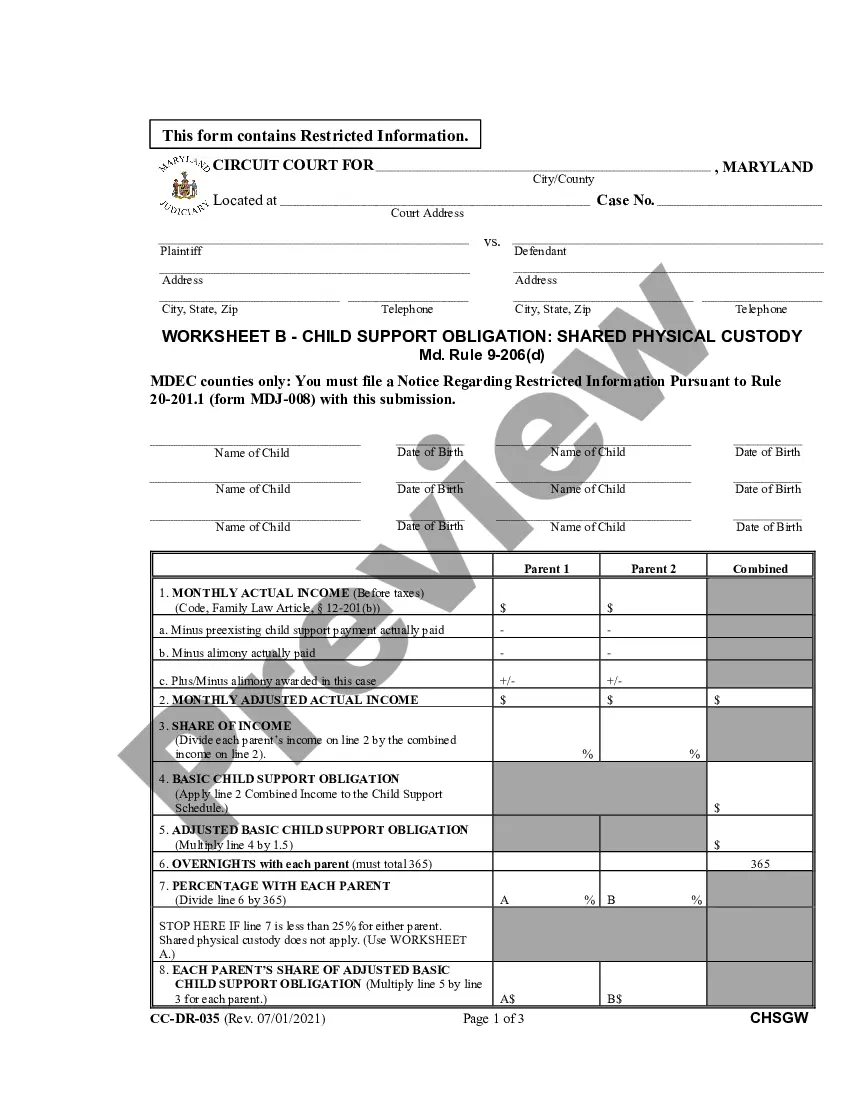

Maryland Child Support Calculator Withholding Order

Description

How to fill out Maryland Child Support Guidelines Worksheet A?

Bureaucracy requires exactness and correctness.

If you do not handle filling in forms like the Maryland Child Support Calculator Withholding Order on a regular basis, it may lead to some confusions.

Selecting the appropriate sample from the outset will ensure that your document submission proceeds smoothly and avoid any hassles of re-sending a file or doing the same job entirely from the beginning.

If you are not a subscribed user, finding the necessary sample will take a few additional steps.

- You can always discover the suitable sample for your paperwork in US Legal Forms.

- US Legal Forms is the largest online library of forms that provides over 85 thousand templates for various topics.

- You can find the latest and the most suitable version of the Maryland Child Support Calculator Withholding Order by simply searching it on the site.

- Find, store, and save templates in your account or refer to the description to ensure you have the correct one available.

- With an account at US Legal Forms, you can conveniently gather, keep in one place, and search through the templates you save for quick access.

- When on the website, click the Log In button to authenticate.

- Then, move to the My documents page, where your form history is maintained.

- Review the description of the forms and save those you require at any given time.

Form popularity

FAQ

The deadbeat dad law in Maryland addresses non-payment of child support, emphasizing legal action against parents who fail to meet their obligations. This law aims to ensure that children receive the financial support they deserve. Utilizing the Maryland child support calculator withholding order can help ensure that payments are made accurately and on time, reducing the risk of falling behind. Parents should be proactive and informed about their support responsibilities.

In Mississippi, the minimum child support is typically established based on a set formula that considers the paying parent's income. While this varies depending on the circumstances, guidelines help determine fair minimum amounts. For those interested in understanding how this applies to Maryland, the Maryland child support calculator withholding order can provide clarity on your obligations. It's vital to check local regulations, as laws may change.

The biggest factor in calculating child support is usually the income of both parents. Courts often consider how much each parent earns to set appropriate payments. Additionally, the Maryland child support calculator withholding order provides a framework to assess different incomes, allowing for a more accurate estimation. Other factors, such as the number of children and their needs, also play a crucial role.

When you initiate an income withholding order for child support, it typically requires a few weeks to process. The timeframe can vary based on factors such as how quickly the employer responds. The Maryland child support calculator withholding order can help you understand the timeline in your situation. It's important to stay proactive in communication to ensure everything moves smoothly.

In Maryland, a warrant for non-payment of child support may be issued if payments are significantly overdue, usually after several months of arrears. The court typically provides notices before taking drastic measures. To avoid such scenarios, consider employing a Maryland child support calculator withholding order, which can help maintain consistency in payments and prevent falling behind.

Typically, child support in Maryland may vary based on income and the number of children involved. The Maryland child support calculator withholding order helps determine the exact amount to be deducted from your paycheck. This structured approach ensures that payments are fair and adequate, directly benefiting the child's well-being and stability.

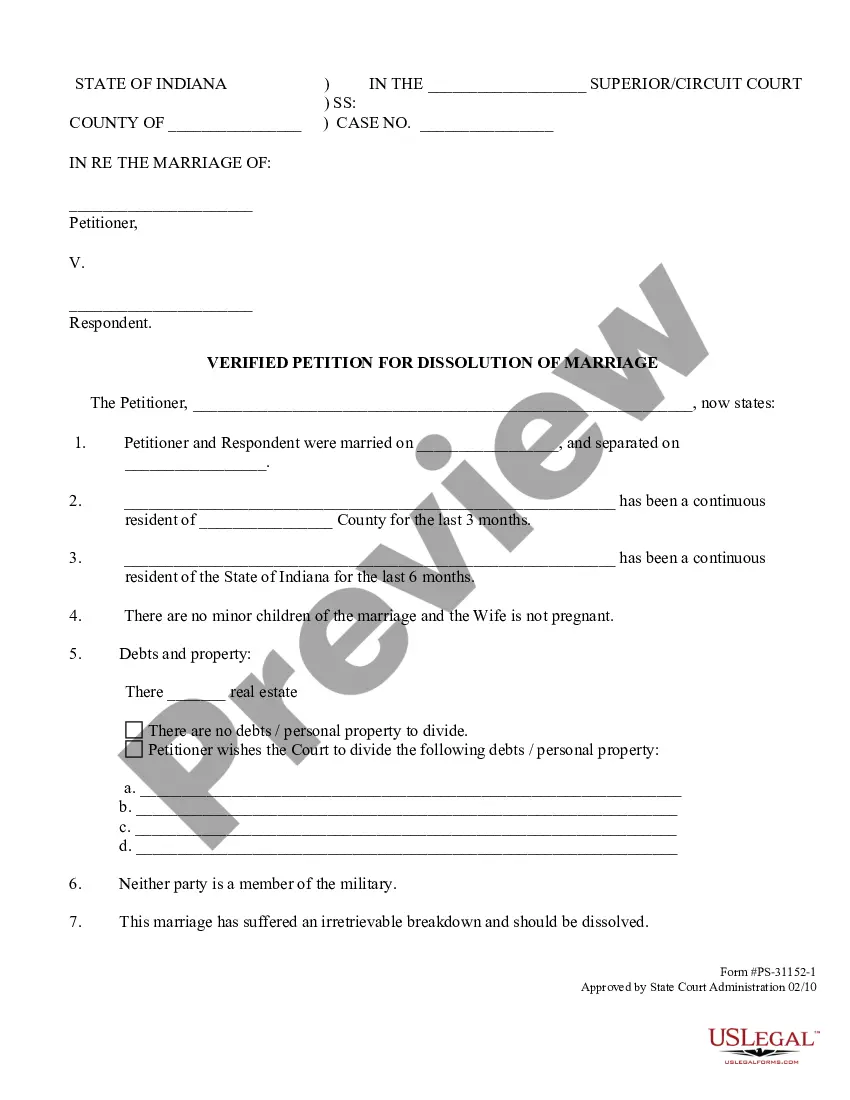

To file for child support in Maryland, you need to gather necessary documents and complete the appropriate forms, which can be accessed easily online. After submitting your forms to the local child support office, the agency will review your case and may schedule a hearing. The Maryland child support calculator withholding order also assists in estimating payments to aid in your preparation.

Employers cannot ignore a child support order, as doing so may lead to legal repercussions. They have a legal obligation to comply with IWOs and must begin withholding within a specified time frame. If you're an employer unsure of your responsibilities, the Maryland child support calculator withholding order clarifies these obligations and helps streamline compliance.

The maximum amount that can be withheld for child support is typically 50% to 65% of disposable income, depending on whether the non-custodial parent supports additional children. It is crucial to comply with these limits to avoid legal complications. The Maryland child support calculator withholding order provides insights into your specific obligations and limits.

The process of income tax refund interception for child support can take several weeks to complete. Typically, the state ensures that any tax refund owed to the non-custodial parent is redirected to cover child support arrears. Utilizing the Maryland child support calculator withholding order helps clarify any pending payments or obligations associated with your case.