Closing a small estate in Maryland for administration refers to the legal process of winding up the affairs of a deceased individual with limited assets. This process ensures that the assets are distributed to the rightful heirs and creditors are paid off appropriately. The following are key steps and important keywords related to closing a small estate in Maryland: 1. Determine eligibility: To begin the process of closing a small estate in Maryland for administration, it is important to determine if the estate qualifies for the simplified procedures. The decedent must have died within the state, and the total value of their assets should not exceed a certain threshold, typically $50,000. 2. Petition for administration: The process starts with filing a Petition for Administration with the local Maryland Orphans' Court. This legal document formally requests the court's appointment of a personal representative for the estate. 3. Notification of interested parties: As part of the process, interested parties, such as heirs and known creditors, must be notified about the estate administration. This can be done through a Notice to Creditors and a Notice of Appointment. 4. Asset inventory: The personal representative is responsible for preparing an inventory of all assets owned by the decedent at the time of their death. This includes real estate, bank accounts, investments, personal property, and any other assets with monetary value. 5. Valuation of assets: The value of the estate's assets must be determined to ensure proper distribution. This can involve obtaining professional appraisals or using market values for more liquid assets. 6. Payment of debts and taxes: Before distributing the remaining assets to the heirs, all valid debts and taxes owed by the estate must be paid off. This includes notifying and resolving any outstanding creditor claims or liabilities. 7. Final accounting and distribution: Once all debts and taxes are settled, the personal representative files a final accounting with the court. This document shows how the estate's assets were handled during the administration period. Once approved, the remaining assets can be distributed to the rightful heirs based on Maryland's inheritance laws. Different types of closing a small estate in Maryland for administration include: 1. Regular estate administration: This applies to estates that do not qualify for simplified procedures due to exceeding the maximum threshold value or other specific circumstances. The process may involve more complex legal proceedings and longer timelines. 2. Expedited estate administration: Also known as the small estate affidavit process, this simplified method applies if the value of the estate does not exceed $10,000. It allows for a quicker closing of the estate without the need for a formal court-appointed personal representative. 3. Ancillary estate administration: This type of estate administration occurs when the decedent owned property in multiple states. In Maryland, ancillary administration may be required for out-of-state assets to ensure proper distribution and compliance with applicable laws. In summary, closing a small estate in Maryland for administration involves various steps such as filing a petition, consolidating assets, paying debts and taxes, and distributing remaining assets. Expedited and ancillary estate administrations are alternative approaches depending on the specific circumstances. Understanding these processes and keywords is crucial for anyone involved in the settlement of a small estate in Maryland.

Closing A Small Estate In Maryland For Administration

Description

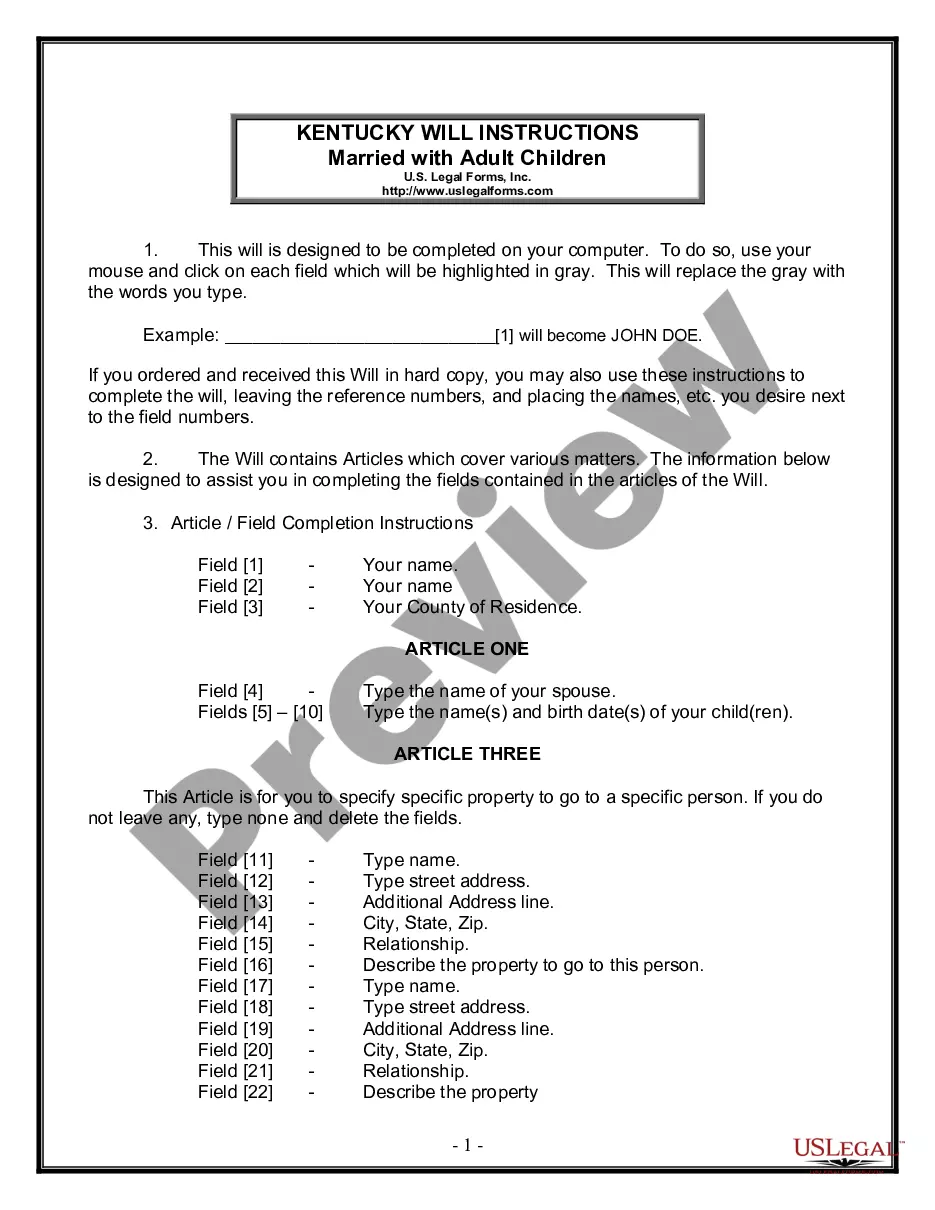

How to fill out Closing A Small Estate In Maryland For Administration?

Drafting legal documents from scratch can often be a little overwhelming. Certain scenarios might involve hours of research and hundreds of dollars invested. If you’re searching for a simpler and more affordable way of preparing Closing A Small Estate In Maryland For Administration or any other paperwork without jumping through hoops, US Legal Forms is always at your disposal.

Our online catalog of more than 85,000 up-to-date legal documents covers virtually every element of your financial, legal, and personal affairs. With just a few clicks, you can instantly access state- and county-specific templates carefully put together for you by our legal experts.

Use our platform whenever you need a trusted and reliable services through which you can quickly find and download the Closing A Small Estate In Maryland For Administration. If you’re not new to our services and have previously set up an account with us, simply log in to your account, select the template and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No problem. It takes minutes to register it and explore the library. But before jumping directly to downloading Closing A Small Estate In Maryland For Administration, follow these tips:

- Review the form preview and descriptions to ensure that you are on the the document you are searching for.

- Check if form you select complies with the requirements of your state and county.

- Pick the best-suited subscription option to get the Closing A Small Estate In Maryland For Administration.

- Download the file. Then complete, sign, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of expertise. Join us today and transform document completion into something simple and streamlined!

Form popularity

FAQ

How to Close an Estate in Maryland: A Comprehensive Guide Open the Probate Process: First, the executor needs to file the will and a petition to open probate with the Register of Wills. ... Take Inventory of the Estate: ... Notify Creditors and Pay Debts: ... Distribute the Assets and Pay Inheritance Taxes: ... Close the Estate: How to Close an Estate in Maryland: A Comprehensive Guide stoufferlegal.com ? blog ? how-to-close-an-... stoufferlegal.com ? blog ? how-to-close-an-...

Estate Administration ? Step-by-Step Guide and Timeline Decedent dies. Locate Estate Planning Documents. File Petition to Probate the Estate. List of Interested Persons. File Inventory and Information Report. File First Account. Claims Against the Estate. File Subsequent Accounts. Estate Administration ? Step-by-Step Guide and Timeline People's Law Library ? estate-administration-st... People's Law Library ? estate-administration-st...

What are Letters of Administration in Maryland? Obtaining Letters of Administration grants the personal representative the authority to handle the deceased person's assets, pay off their debts, address any tax liability, and distribute their remaining assets to the rightful heirs. A Brief Guide to Letters of Administration in Maryland PathFinder Law Group ? letters-of-admi... PathFinder Law Group ? letters-of-admi...

Depending on the number of claims and the state of the deceased's financial affairs, this process can take a few months to over a year. Distributing the Remaining Assets: The final step in the estate settlement process is distributing the remaining assets to the beneficiaries as outlined in the will.

$50,000 or less Small Estate - property of the decedent subject to administration in Maryland is established to have a value of $50,000 or less ($100,000 or less if the spouse is the sole heir). Office Of The Register Of Wills - What To Do If You Need To Open An Estate maryland.gov ? publications ? newestate maryland.gov ? publications ? newestate