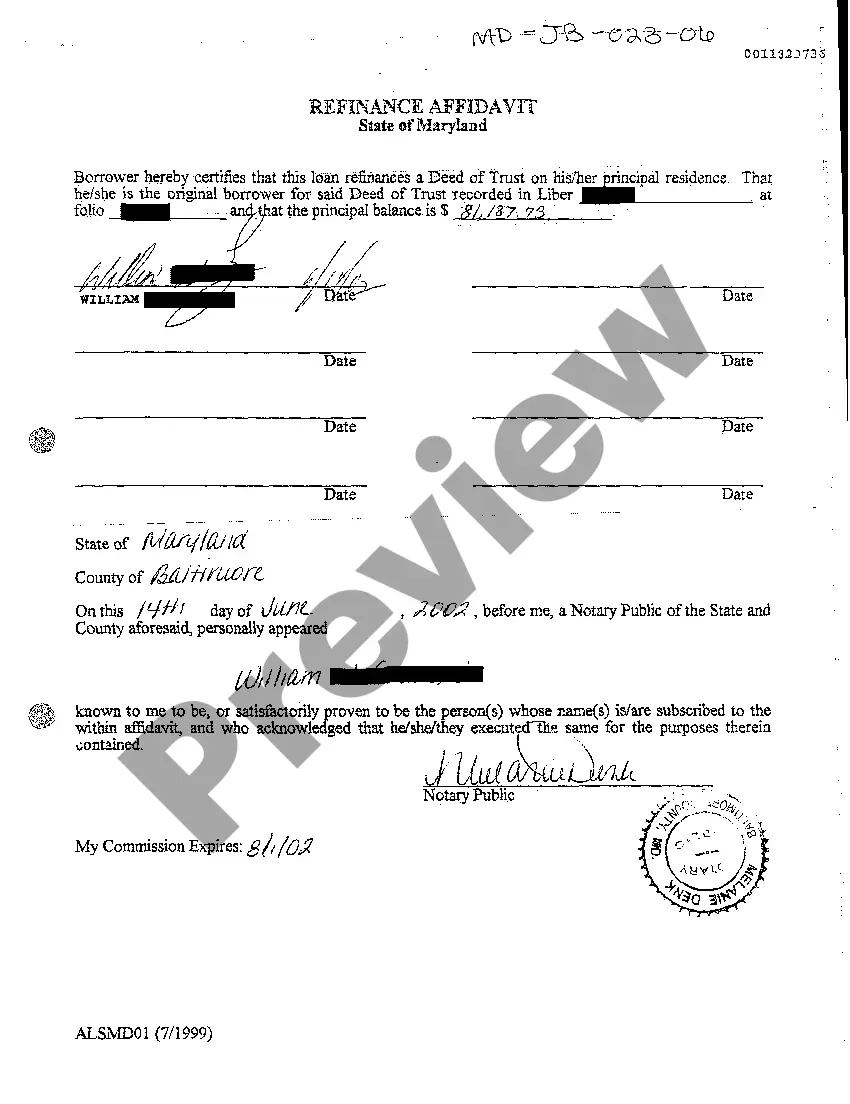

Maryland Refinance Affidavit Form Withdrawal

Description

How to fill out Maryland Refinance Affidavit Form Withdrawal?

How to locate professional legal documents that comply with your state's regulations and prepare the Maryland Refinance Affidavit Form Withdrawal without consulting a lawyer.

Numerous online services provide templates to address various legal needs and requirements. However, identifying which of the available samples satisfy both your use case and legal standards may require some time.

US Legal Forms is a trusted platform that assists you in finding official documents crafted in accordance with the latest updates in state law, helping you save on legal fees.

If you do not have an account with US Legal Forms, follow these steps: Review the webpage you’ve accessed and ascertain if the form meets your requirements. Utilize the form description and preview options if available. If necessary, search for another template in the header specific to your state. Once you locate the correct document, click the Buy Now button. Select the most suitable pricing plan, then sign in or register for an account. Choose the payment option (either credit card or PayPal). Select the file format for your Maryland Refinance Affidavit Form Withdrawal and click Download. The acquired templates remain yours: you can always revisit them in the My documents section of your profile. Subscribe to our platform and create legal documents independently like a seasoned legal professional!

- US Legal Forms is not just an ordinary online library.

- It is a compilation of over 85,000 verified templates for assorted business and personal situations.

- All documents are categorized by field and state, streamlining your search experience.

- Moreover, it features powerful tools for PDF editing and eSignatures, allowing users with a Premium subscription to conveniently complete their documents online.

- It requires minimal time and effort to obtain the necessary paperwork.

- If you already possess an account, Log In and ensure your subscription is active.

- Download the Maryland Refinance Affidavit Form Withdrawal using the appropriate button beside the file name.

Form popularity

FAQ

NOTE: Standard deduction allowance is 15% of Maryland adjusted gross income with a minimum of $1,500 and a maximum of $2,000 for each taxpayer. spouse - An additional $1,000 may be claimed if the taxpayer and/or spouse is at least 65 years of age and/or blind on the last day of the tax year.

Regarding transfer taxes, most jurisdictions in Maryland do not require you to pay new transfer taxes at the time of your refinance settlement. However, in most jurisdictions, you must pay the State Revenue Stamps (this amount varies by county) on the new money being borrowed.

Neither Maryland State law nor Montgomery County require that property taxes be paid when refinancing a mortgage. However, often mortgage lenders will require that property taxes be current before the new mortgage is issued to the taxpayer.

The Refinance Exemption allows that, in the event the amount secured by a refinance deed of trust is greater than the unpaid principal balance of the loan secured by the existing deed of trust, State Recordation Tax is calculated on the amount of the increase, as opposed to on the entire new principal amount.

Regarding transfer taxes, most jurisdictions in Maryland do not require you to pay new transfer taxes at the time of your refinance settlement. However, in most jurisdictions, you must pay the State Revenue Stamps (this amount varies by county) on the new money being borrowed.