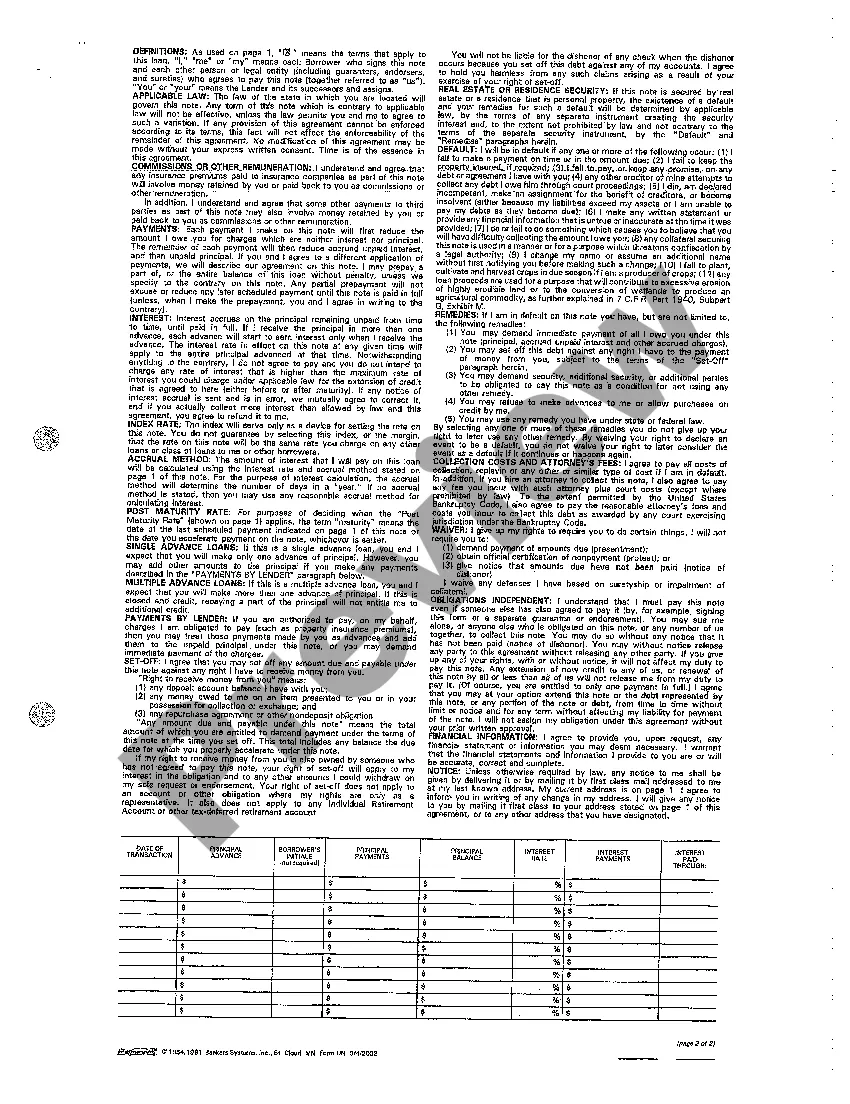

Selling An Unsecured Promissory Note With Balloon Payment

Description

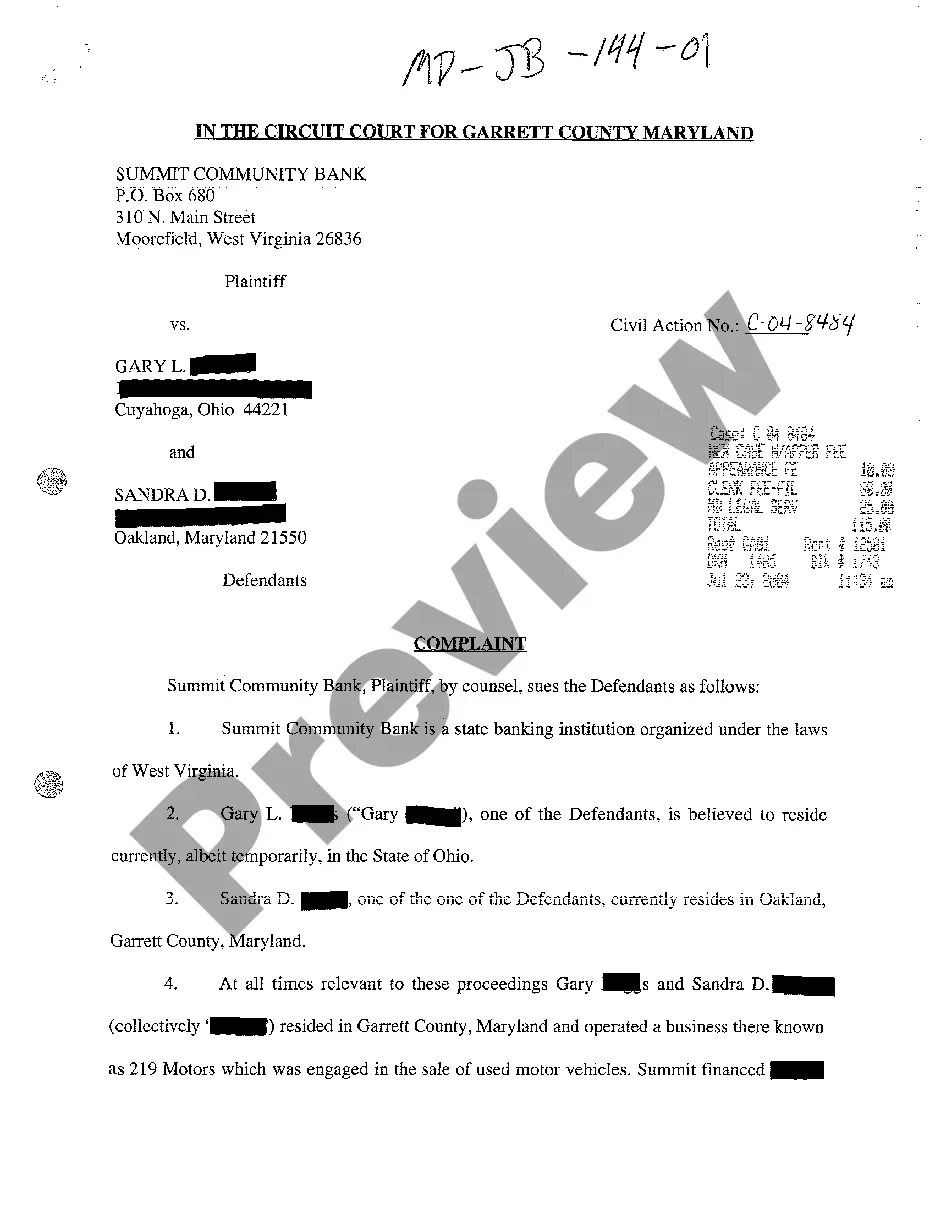

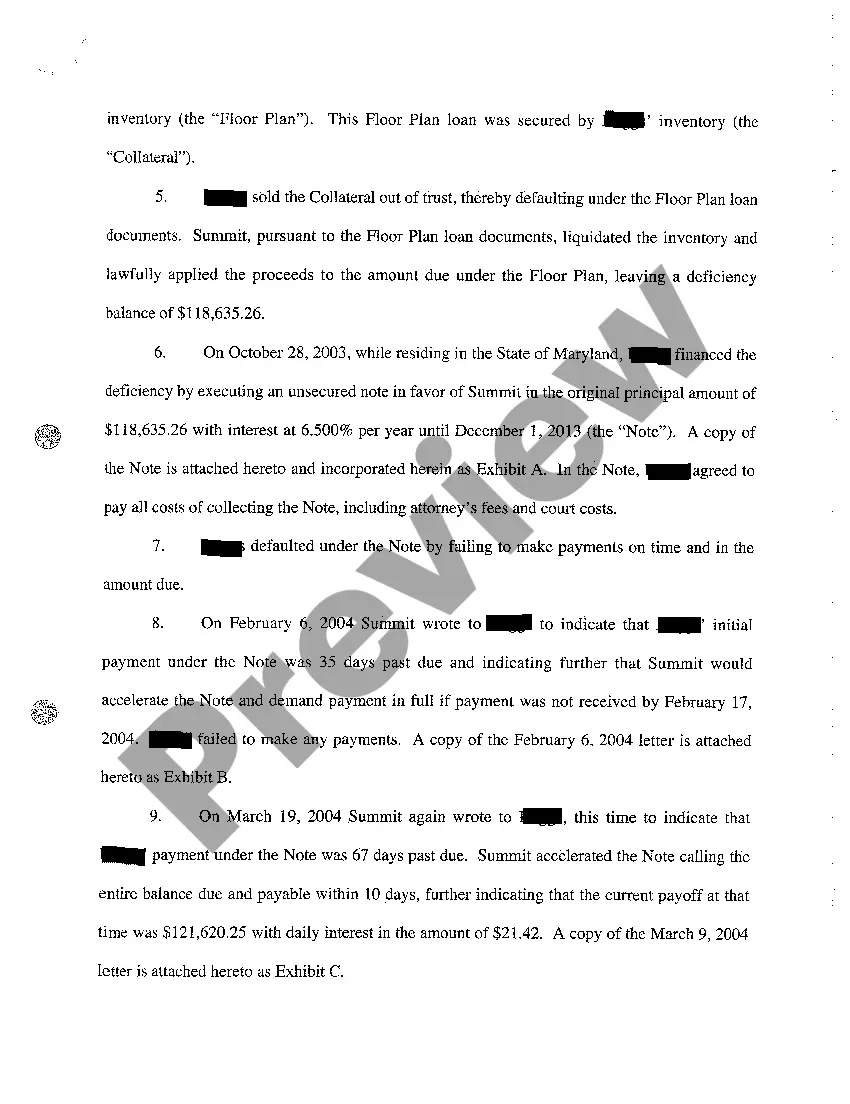

How to fill out Maryland Complaint For Breach Of Promissory Note By Selling Collateral Security?

Traversing the red tape of official documentation and formats can be challenging, particularly when one does not engage in such tasks professionally.

Even selecting the appropriate template for Selling An Unsecured Promissory Note With Balloon Payment can be labor-intensive, given that it must be legitimate and accurate to the very last digit.

However, you will need to invest considerably less time locating a suitable template if it originates from a source you can trust.

Obtaining the correct form takes just a few straightforward steps: Enter the document name in the search bar, select the appropriate Selling An Unsecured Promissory Note With Balloon Payment from the results, review the description or open its preview. If the template meets your needs, click Buy Now. Then, choose your subscription plan. Register an account at US Legal Forms using your email and create a secure password. Select a credit card or PayPal payment method. Finally, save the template file on your device in the format you prefer.

- US Legal Forms serves as a platform that streamlines the process of finding the right forms online.

- US Legal Forms is a single destination you need to obtain the latest samples of documents, learn about their use, and download these samples for completion.

- It is a repository of more than 85K forms that apply to various professional fields.

- When searching for a Selling An Unsecured Promissory Note With Balloon Payment, you can rest assured of its authenticity as all forms are verified.

- Establishing an account at US Legal Forms will guarantee that you have all the essential samples within reach.

- You can store them in your history or add them to the My documents collection.

- Access your saved forms from any device by simply clicking Log In on the library site.

- If you do not yet possess an account, you can always initiate a new search for the template you need.

Form popularity

FAQ

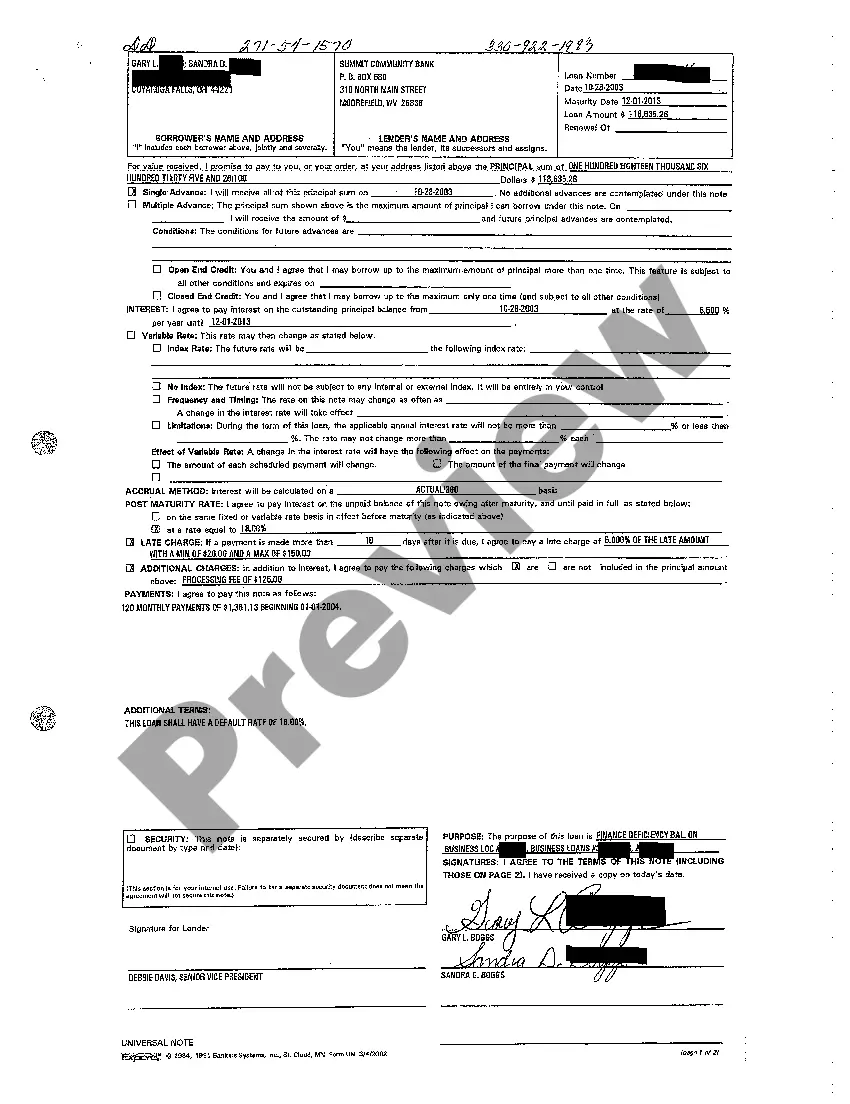

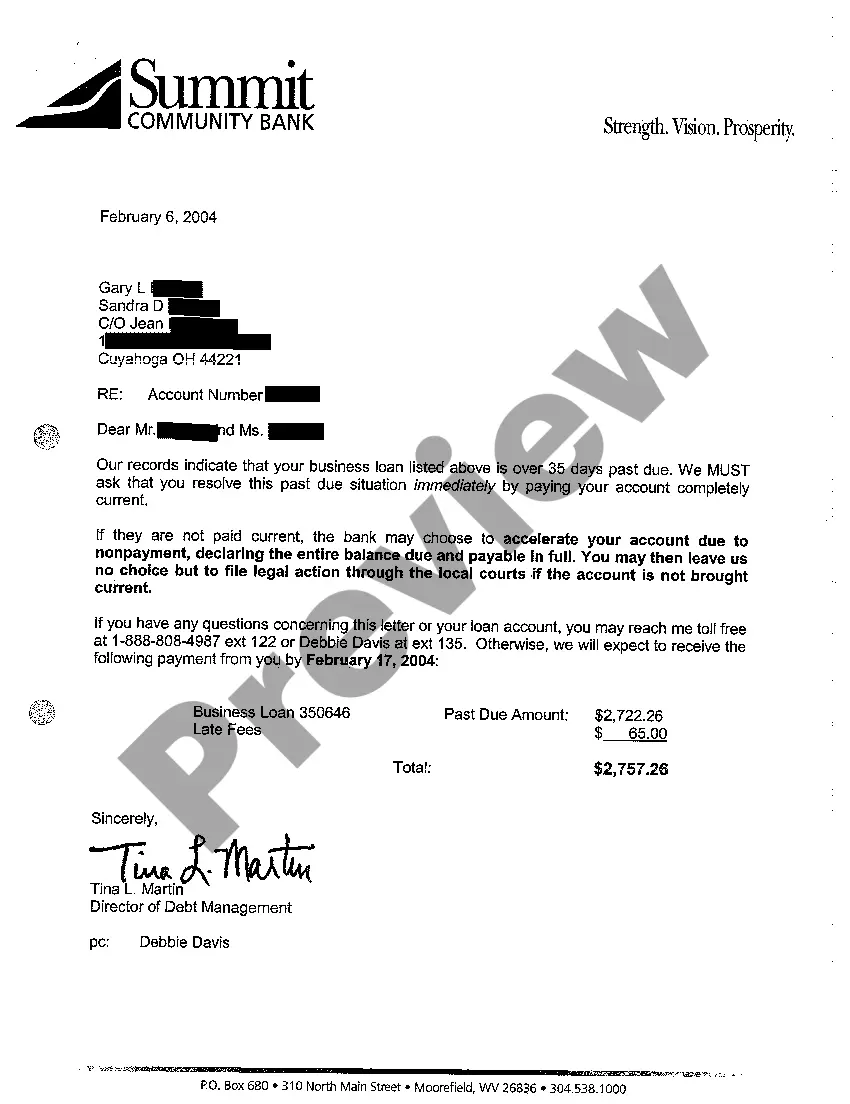

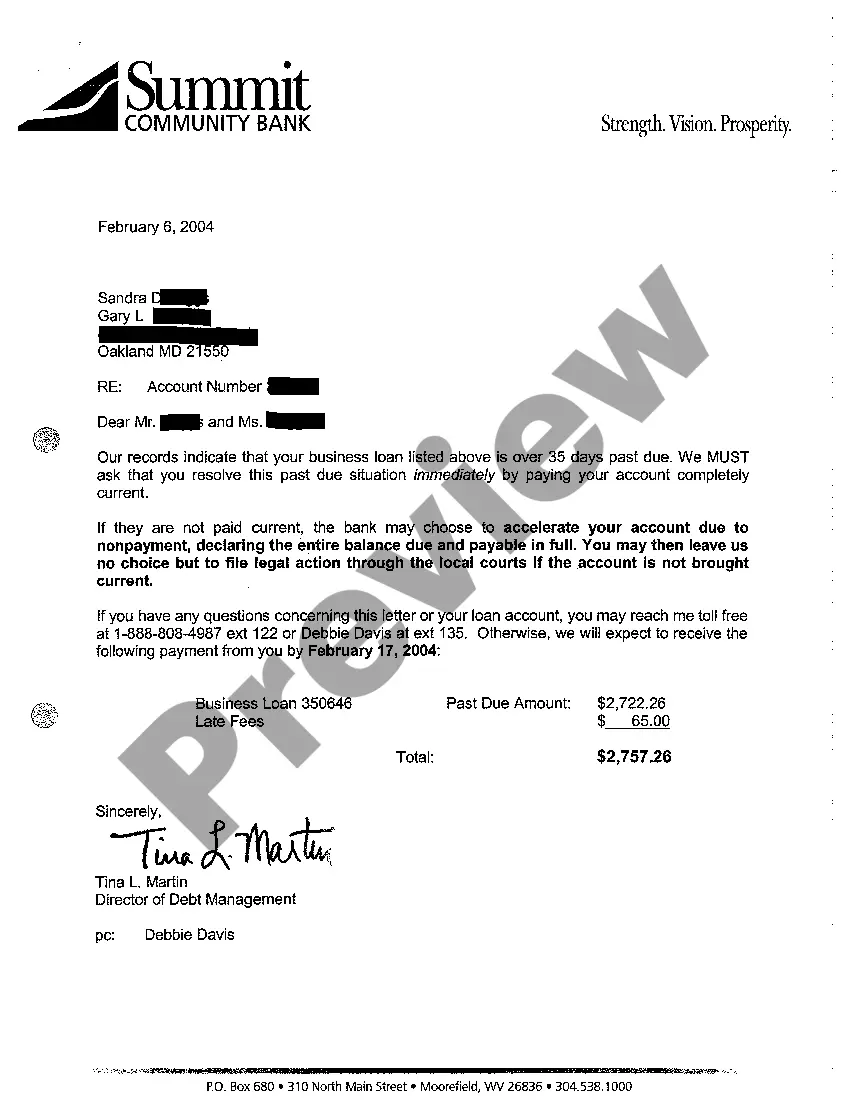

Promissory notes and titles can be sold. The person who owns the promissory note may sell it. Lenders typically sell promissory notes when they no longer want to be responsible for the loan or they need a lump sum of cash.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

Unless specifically prohibited in the language of the note, a promissory note is assignable by the lender. That is, the lender can sell or assign the note to a third party who the borrower must then repay.

Promissory notes are a common type of financial instrument in loan transactions. As the payer of such a note, it's important to know that, unless a note expressly stipulates that it is not negotiable, promissory notes are negotiable instruments that can be transferred or assigned by the original payee to a third party.

Unsecured Promissory NotesAn unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.