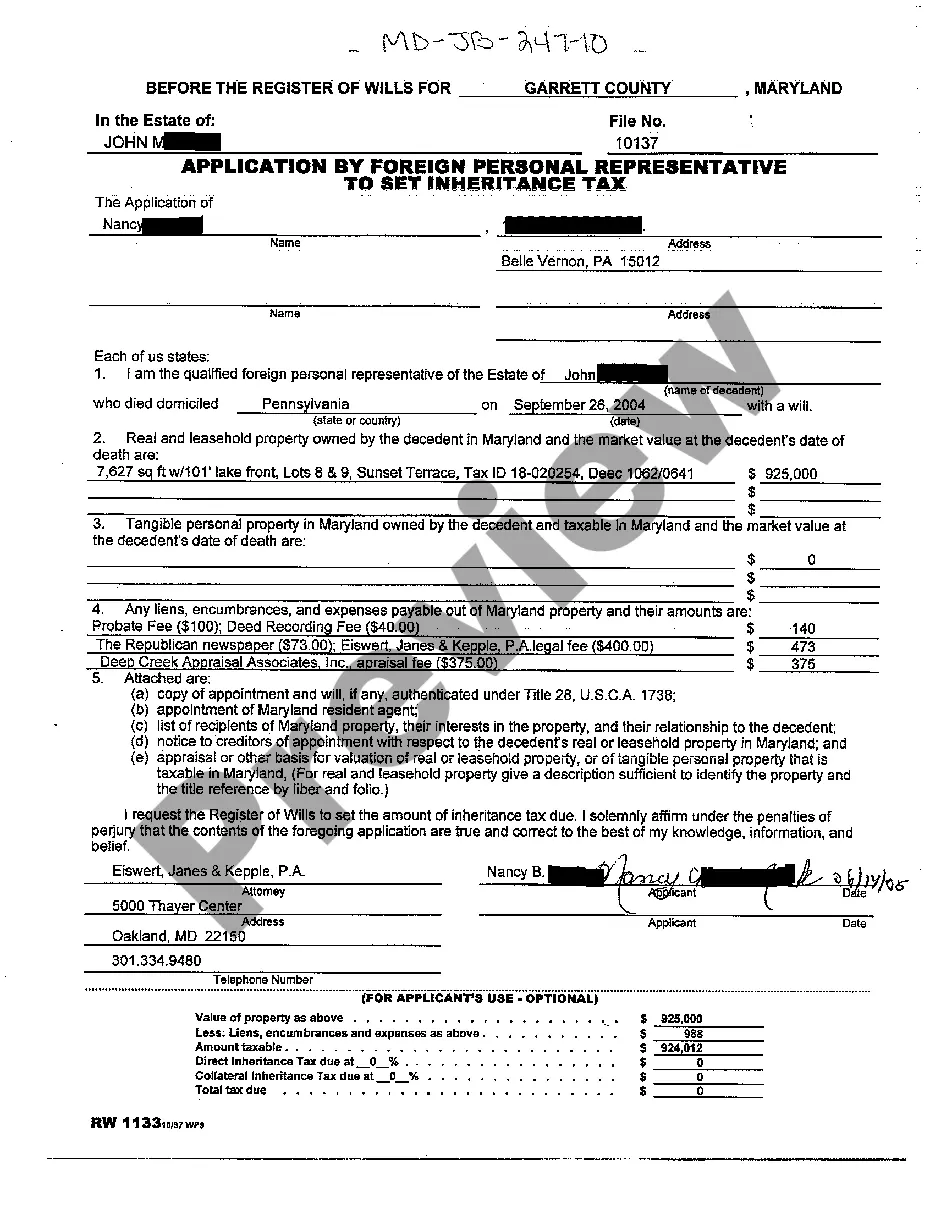

Maryland Inheritance Tax Waiver Form With Example

Description

How to fill out Maryland Application By Foreign Personal Representative To Set Inheritance Tax?

Creating legal documents from the ground up can frequently be somewhat daunting.

Certain situations may require extensive investigation and a significant amount of money.

If you’re looking for a simpler and more economical method of producing the Maryland Inheritance Tax Waiver Form With Example or any other documents without unnecessary complications, US Legal Forms is continually available to assist you.

Our online library of more than 85,000 current legal templates encompasses nearly every aspect of your financial, legal, and personal matters.

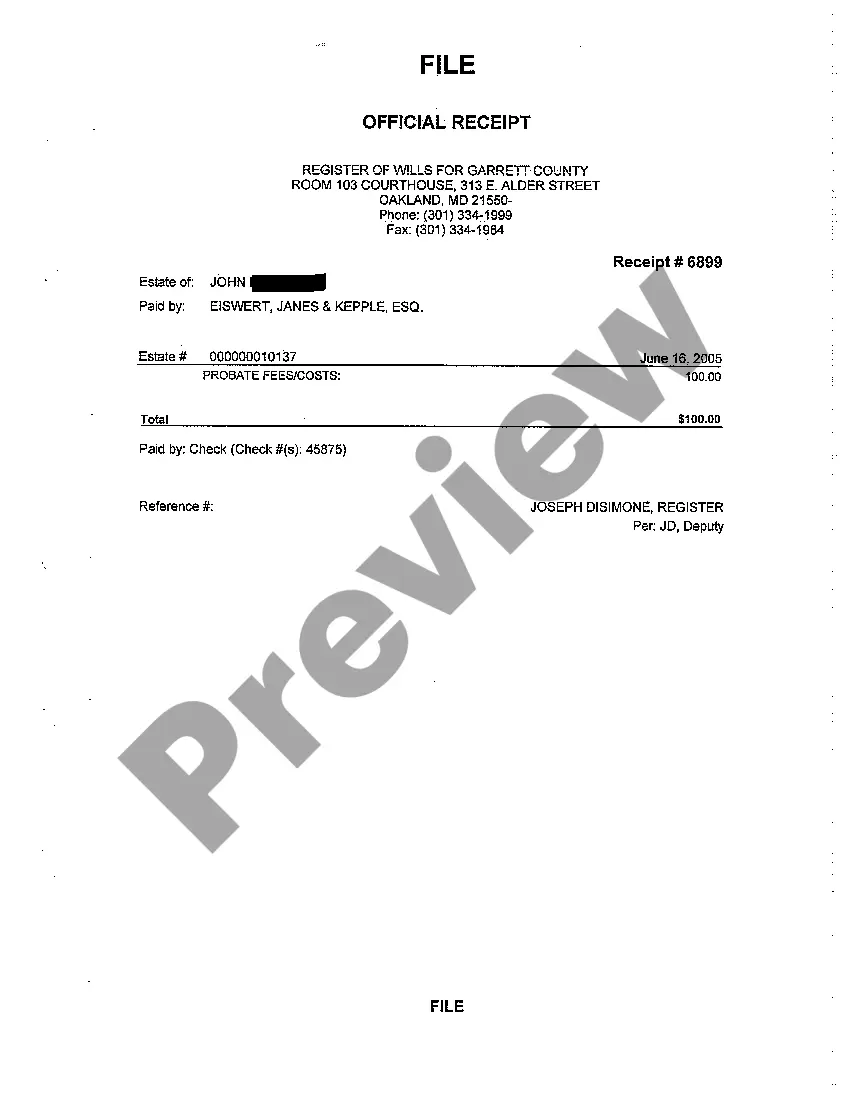

However, before proceeding to download the Maryland Inheritance Tax Waiver Form With Example, consider these tips: Review the document preview and descriptions to confirm you’ve located the form you need. Ensure the template you choose meets your state and county requirements. Select the appropriate subscription option for the Maryland Inheritance Tax Waiver Form With Example. Download the file, then fill it out, certify it, and print it. US Legal Forms enjoys an impeccable reputation and has over 25 years of experience. Join us today and make document completion a much easier and more efficient process!

- With just a few clicks, you can swiftly obtain forms that comply with state and county regulations, meticulously prepared by our legal experts.

- Utilize our site whenever you require a trustworthy and dependable service that allows you to easily find and download the Maryland Inheritance Tax Waiver Form With Example.

- If you are already familiar with our services and have set up an account, simply Log In to your account, find the template, and download it, or access it again at any later time from the My documents section.

- Not registered yet? No problem. Registering only takes a few minutes so you can explore our catalog.

Form popularity

FAQ

In Maryland, you may inherit up to a certain threshold without incurring taxes, which is subject to change based on laws. It's essential to check the specifics of the Maryland inheritance tax waiver form with example details for current limits. Particularly, the relationship of the beneficiary to the deceased can affect tax obligations. For accurate and updated information, consulting with a tax professional or legal expert is highly recommended.

Opting out of inheritance typically involves formally rejecting the inheritance through legal means. You might need to complete a Maryland inheritance tax waiver form with example information to ensure your refusal is recognized by the estate. Consulting with a legal expert can clarify the steps necessary to complete this process correctly. Always consider the estate's situation before making your final decision.

Yes, you have the option to refuse an inheritance. This process usually requires submitting a Maryland inheritance tax waiver form with example proof to document your decision. It is important to know that declining an inheritance can have implications, both for you and the estate. Make sure to evaluate the potential financial and emotional consequences before making your choice.

To avoid the Maryland inheritance tax on property, you can use specific exemptions or seek to establish certain trusts. Familiarizing yourself with the Maryland inheritance tax waiver form with example exceptions can help in planning your inheritance strategy effectively. It’s advisable to work with legal professionals who can offer tailored advice for your situation. This proactive approach could save you from unnecessary tax burdens.

Yes, a beneficiary can choose to waive their inheritance. This decision often involves filing a Maryland inheritance tax waiver form with example documentation to formally relinquish their rights. Consulting an attorney might help to navigate the legal implications of this choice. Ensure you understand the possible effects on your estate and other beneficiaries.

Yes, Maryland does have an inheritance tax waiver, which allows certain inheritors to avoid paying tax on inherited property. To apply for this waiver, you will need to fill out the Maryland inheritance tax waiver form with example to ensure your application is processed correctly. This waiver is particularly beneficial for immediate family members, such as spouses and children. To navigate the paperwork easily, USLegalForms offers valuable templates and guidance tailored to Maryland's requirements.

To waive inheritance in Maryland, you need to complete the Maryland inheritance tax waiver form with example documentation. This process typically involves gathering necessary paperwork, such as the will or trust, and submitting it to the appropriate state authority. Utilizing the correct form simplifies the process and helps ensure you meet all legal requirements. For guidance, consider platforms like USLegalForms to provide the necessary resources and templates.

Yes, Maryland requires an inheritance tax waiver for certain transactions and distributions of an estate. This waiver confirms that any applicable taxes have been settled before assets can be transferred to beneficiaries. By utilizing the Maryland inheritance tax waiver form with example, you can streamline this process and avoid potential delays in accessing inherited assets.

Calculating Maryland inheritance tax involves determining the value of the estate and identifying taxable assets. The state imposes a tax rate of 10% on most assets, though certain exemptions apply. To ensure accurate calculation, you may find it helpful to refer to the Maryland inheritance tax waiver form with example, which outlines the necessary steps and details needed for proper assessment.

To avoid inheritance taxes in Maryland, consider strategies such as setting up trust funds or gifting assets to beneficiaries before your passing. Utilizing a Maryland inheritance tax waiver form with example can help clarify the process to file for exemptions. Additionally, consult with a tax advisor to understand applicable deductions and exemptions that may reduce or eliminate your tax liability.