Md Articles Of Incorporation Form

State:

Maryland

Control #:

MD-PC-TL

Format:

Word;

Rich Text

Instant download

Description Sample Articles Of Incorporation Maryland

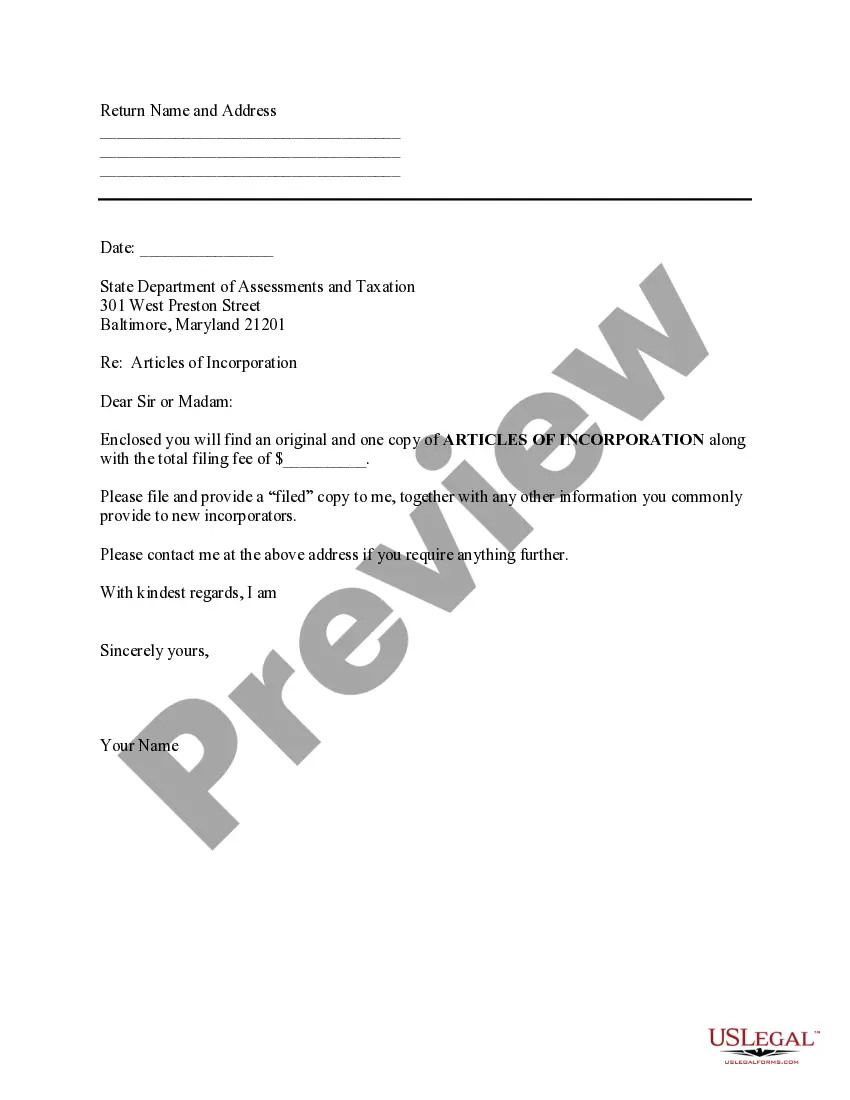

This sample transmittal letter can accompany the Articles of Incorporation when filed with the Secretary of State.