Life Estate Deed With Powers Maryland

Description

How to fill out Life Estate Deed With Powers Maryland?

How to obtain professional legal templates that adhere to your state regulations and prepare the Life Estate Deed With Powers Maryland without hiring an attorney.

Numerous online services offer templates to address various legal situations and formal requirements. However, it can require time to discover which samples meet your specific needs and legal standards.

US Legal Forms is a trusted provider that assists you in locating official documents created in line with the latest updates in state laws, saving you money on legal services.

If you do not have an account with US Legal Forms, follow these steps: Review the page that has opened and verify if the form meets your requirements. Utilize the form description and preview options if available. If necessary, search for another sample in the section referencing your state. Click the Buy Now button after locating the suitable document. Choose the most appropriate pricing plan, then Log In or create an account. Select your payment method (by credit card or via PayPal). Choose the file format for your Life Estate Deed With Powers Maryland and click Download. The templates you obtain belong to you: you can access them later in the My documents section of your account. Join our resource library and create legal documents independently, just like a seasoned legal professional!

- US Legal Forms is not a typical online directory.

- It is a repository of over 85,000 verified templates for numerous business and personal circumstances.

- All documents are categorized by industry and state to streamline your search process.

- Additionally, it features robust PDF editing and eSignature solutions, allowing users with a Premium subscription to easily complete their documents online.

- You can acquire the necessary paperwork with minimal time and effort.

- If you already possess an account, Log In and confirm your subscription is active.

- Download the Life Estate Deed With Powers Maryland using the designated button next to the file title.

Form popularity

FAQ

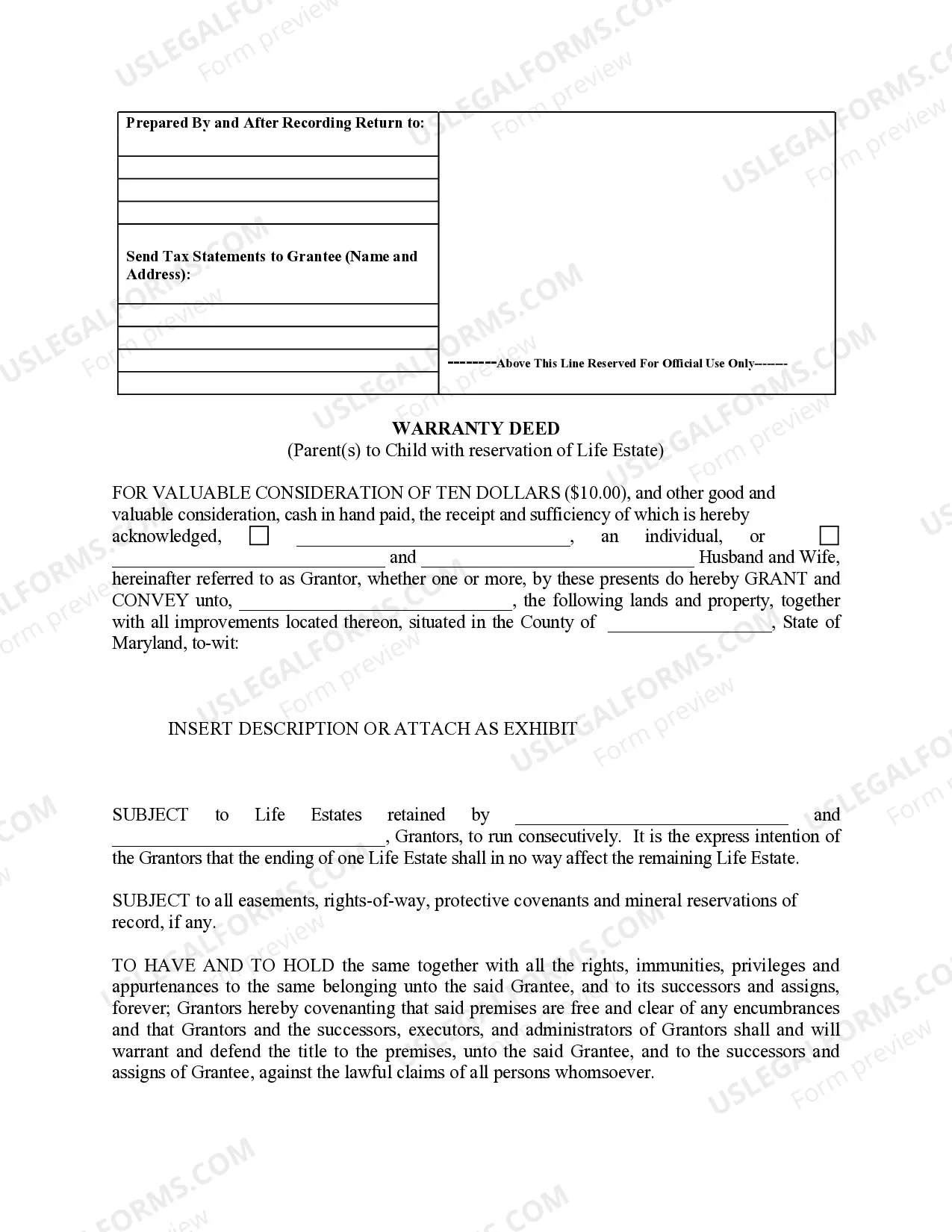

Life Estate WITH Powers. Under this type of Deed, the Life Tenant is not restricted from doing anything the Life Tenant would like to do with the property including selling, gifting, leasing, conveyancing or mortgaging the property.

If one person owns a parcel of property in fee simple, she has the most complete form of ownership allowed by law. She may do with the property practically anything she chooses. The estate lasts perpetually and may be transferred from heir to heir.

Life Estate WITH Powers. Under this type of Deed, the Life Tenant is not restricted from doing anything the Life Tenant would like to do with the property including selling, gifting, leasing, conveyancing or mortgaging the property.

No, Maryland does not recognize transfer on death deeds. These types of deeds allow for property to transfer to a named recipient as soon as the property owner dies. The purpose of transfer on death deeds is to avoid probate.

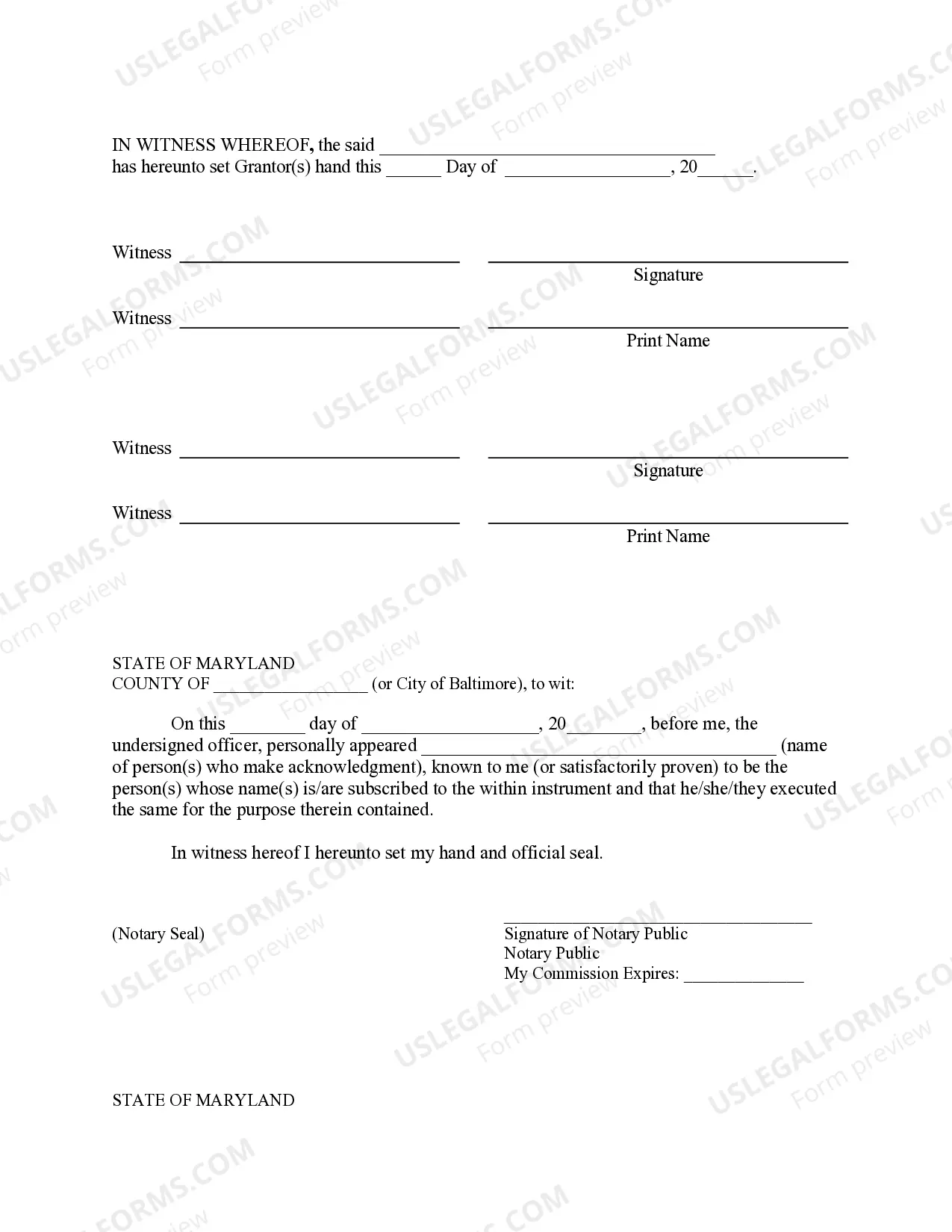

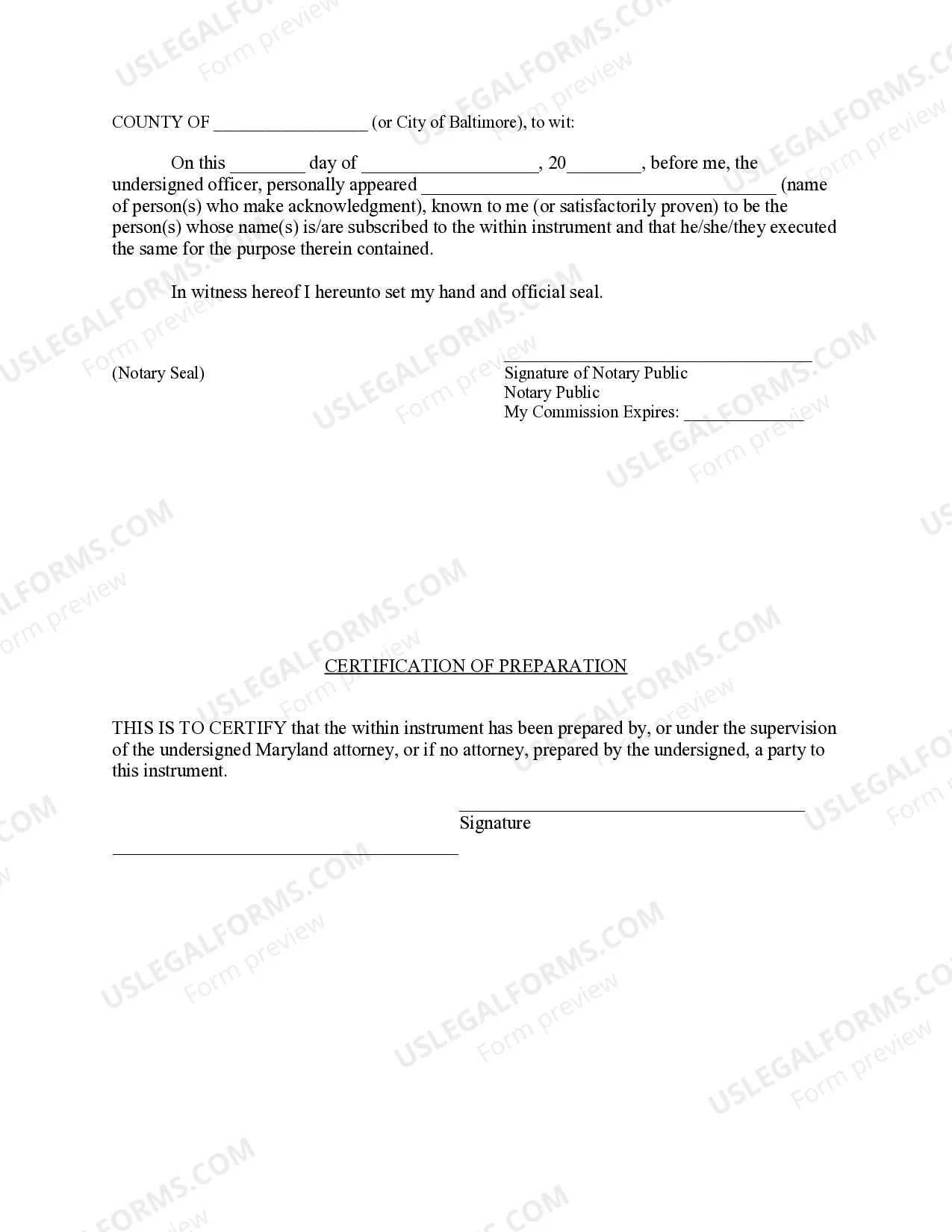

A deed must be notarized (signed in person before a notary public). A "lien certificate" must be attached, if required. This will show any unpaid taxes or liens on the property which must be paid before property can be deeded or transferred. A "State of Maryland Land Instrument Intake Sheet" must be filled out.