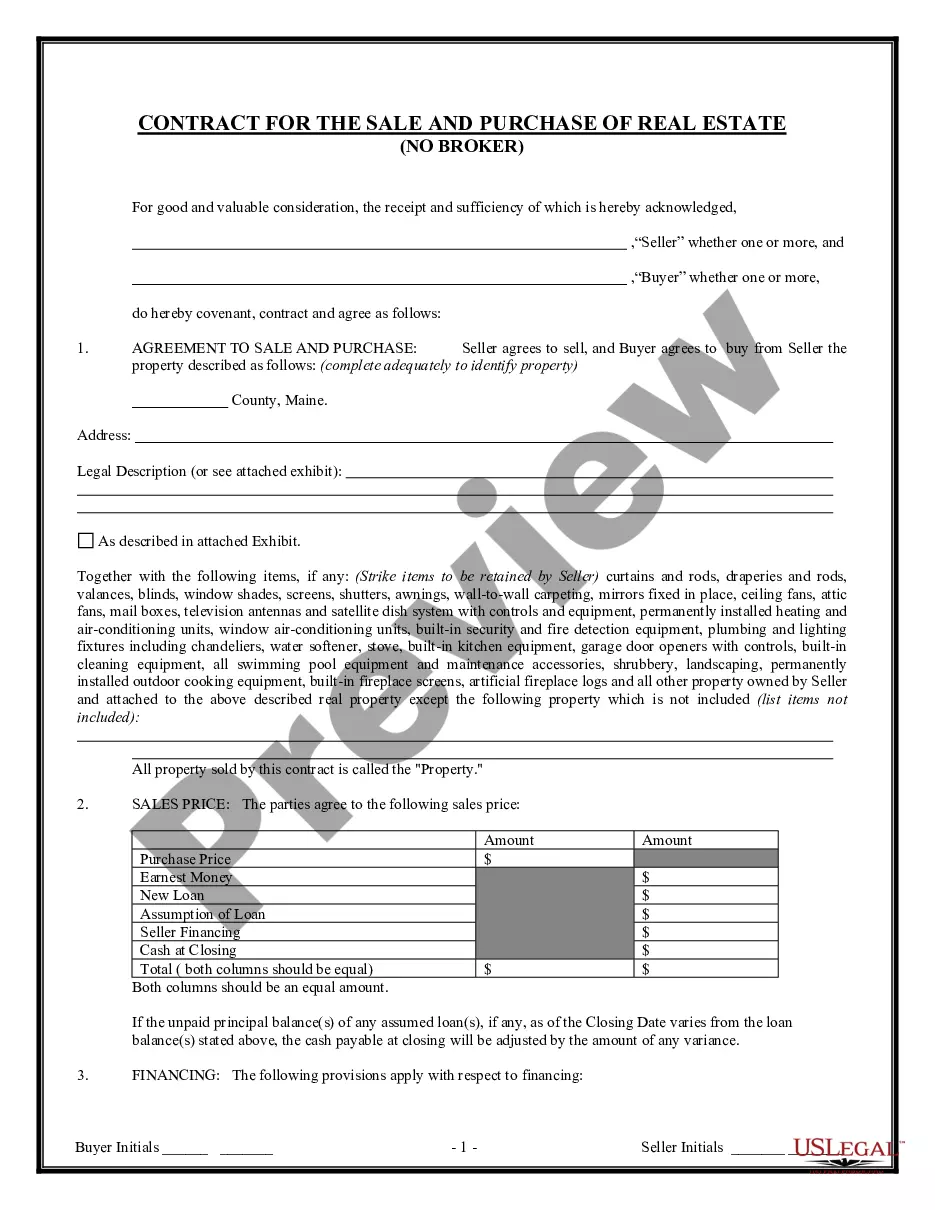

This form is a Contract for the sale of real estate for use in Maine. It can be used for a cash sale, assumption or new loan buyer. The contract contains provisions common to a real estate transaction. No broker involved.

Home Sale And Purchase Agreement With Gift Of Equity

Description gift of equity

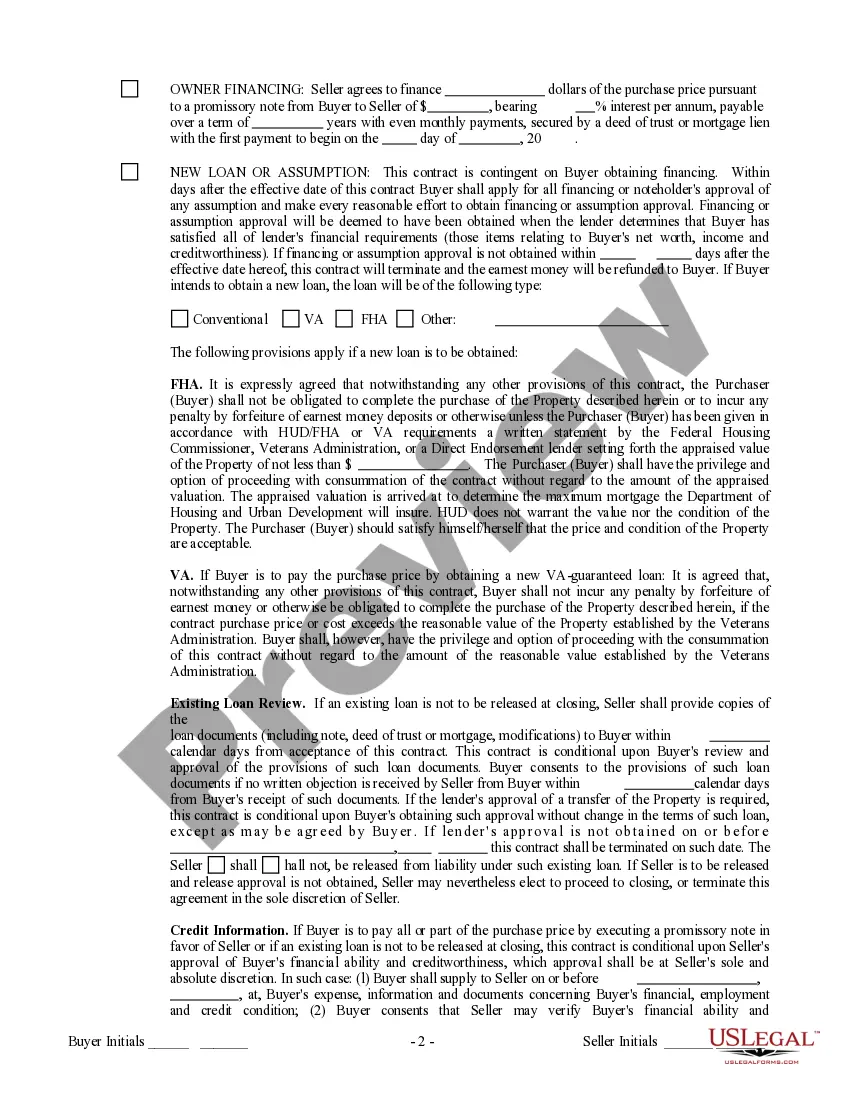

How to fill out Gift Of Equity Letter Template Pdf?

Steering through the red tape of official records and formats can be daunting, particularly if one does not engage in that field professionally.

Even sourcing the appropriate format for the Home Sale And Purchase Agreement With Gift Of Equity will take considerable time, as it must be valid and accurate down to the final detail.

However, you will need to invest vastly less time locating a suitable format from a reliable source.

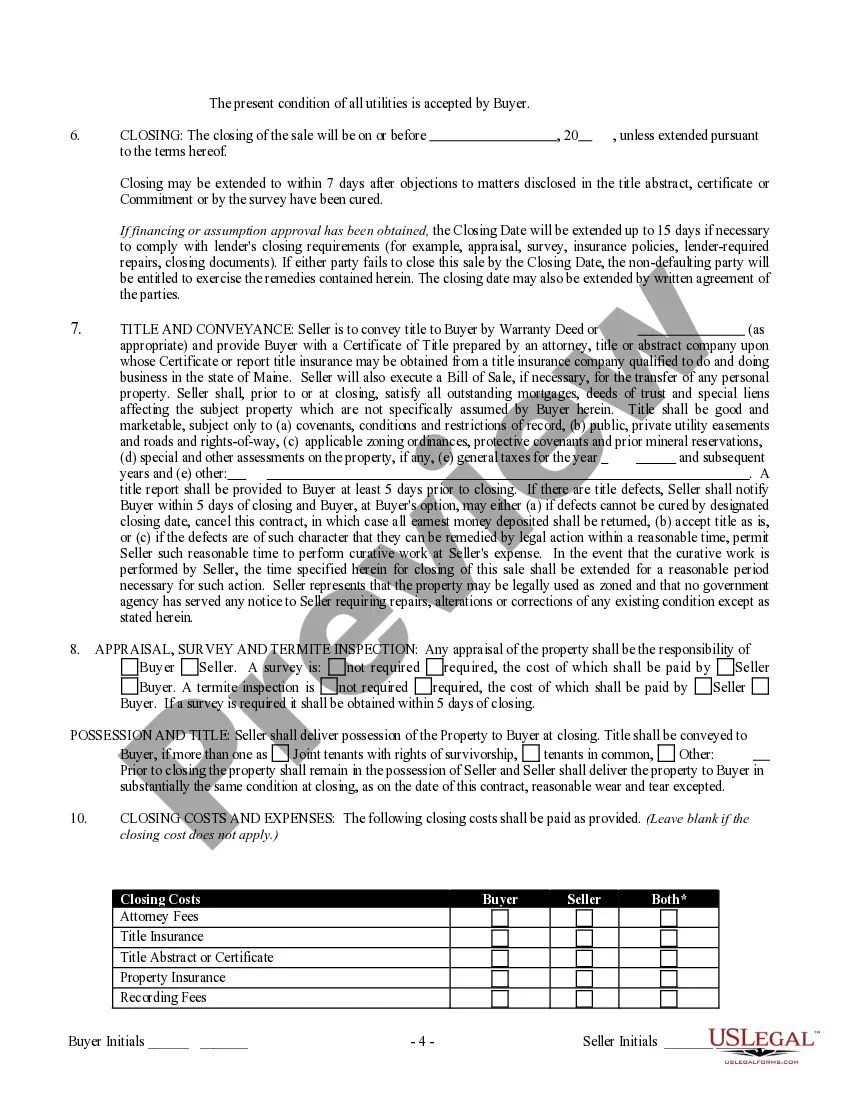

Obtain the correct form in a few straightforward steps: Enter the document's name in the search box. Locate the appropriate Home Sale And Purchase Agreement With Gift Of Equity from the list of outcomes. Review the summary of the sample or view its preview. If the template aligns with your needs, click Buy Now. Move forward to select your subscription plan. Utilize your email and establish a secure password to set up an account at US Legal Forms. Choose a credit card or PayPal method for payment. Store the template document on your device in your preferred format. US Legal Forms can save you substantial time determining whether the form you found online meets your requirements. Establish an account and gain unlimited access to all the templates you desire.

- US Legal Forms is a platform that streamlines the process of locating the correct documents online.

- US Legal Forms is a singular destination you require to discover the latest samples of paperwork, consult their application, and download these samples for completion.

- This is an archive with over 85K forms that pertain to various fields of work.

- When searching for a Home Sale And Purchase Agreement With Gift Of Equity, you will not need to question its authenticity as all the forms are validated.

- An account with US Legal Forms will guarantee you have all the essential samples at your fingertips.

- Store them in your records or add them to the My documents catalog.

- You can access your saved documents from any device by clicking Log In on the library's website.

- If you still lack an account, you can always search for the template you require.

family gift agreement template Form popularity

example of purchase agreement Other Form Names

sample gift agreement FAQ

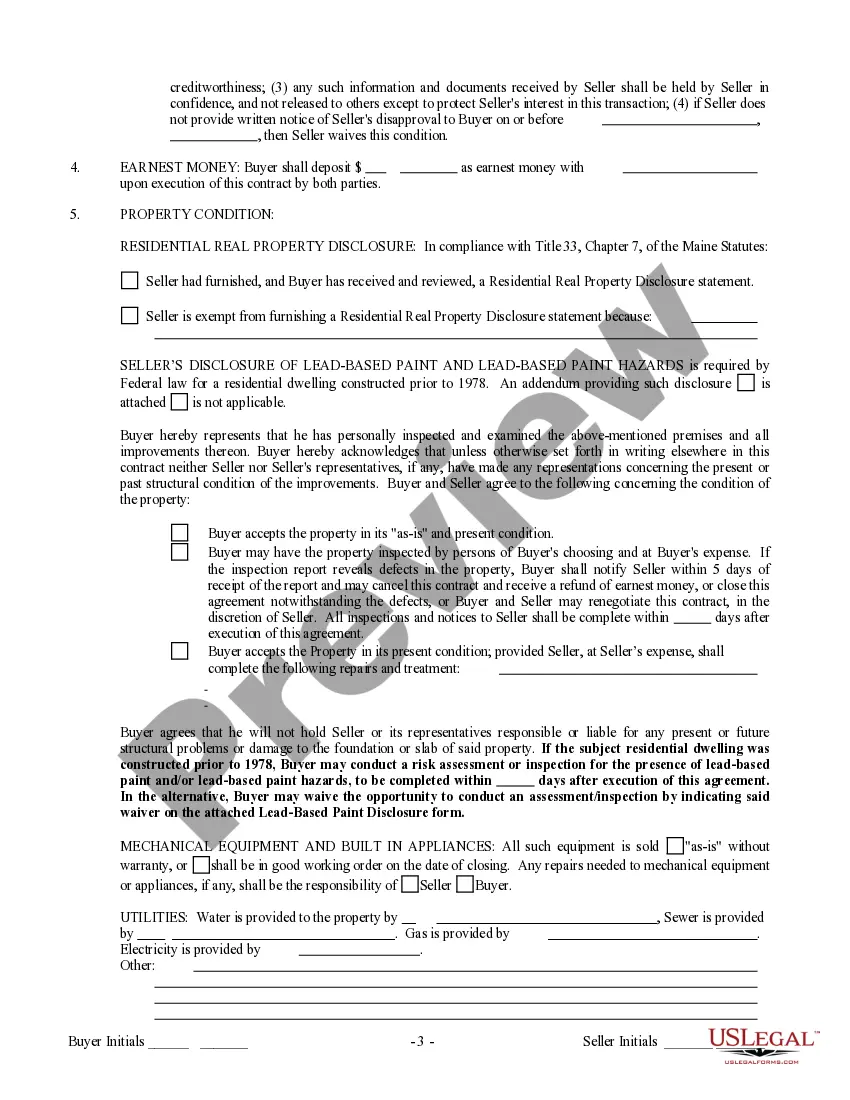

Gifted equity means that the difference between the value of the property and the amount required by the parents is treated as a full deposit and no savings from the siblings are required. This will be treated as a 15% deposit by the lender and no further deposit required.

A gift of equity is not allowed when the seller is an estate. This is even true when the buyer is family of the deceased. This will not take the place of a transfer on death deed or a life estate. The only way a gift of equity works is if there is actual equity that already exists.

Gifts of equity, like other gifts, aren't taxable to the recipient. The seller might have to file a gift return. They're allowed to give $15,000 per person each year without having to file a gift return. So, if the gift of equity they gave you is less than $30,000, they don't have to file the return.

In the case of a family gift, the amount is disclosed as an other credit in the cost to close section of the Loan Estimate (LE) and the Closing Disclosure (CD).

When parties plan to use a financial gift of equity, the homeowner sells the residence to the buyer at a rate below its market value. No money changes hands between the two parties. Instead, the gift creates equity in the home for the buyer.