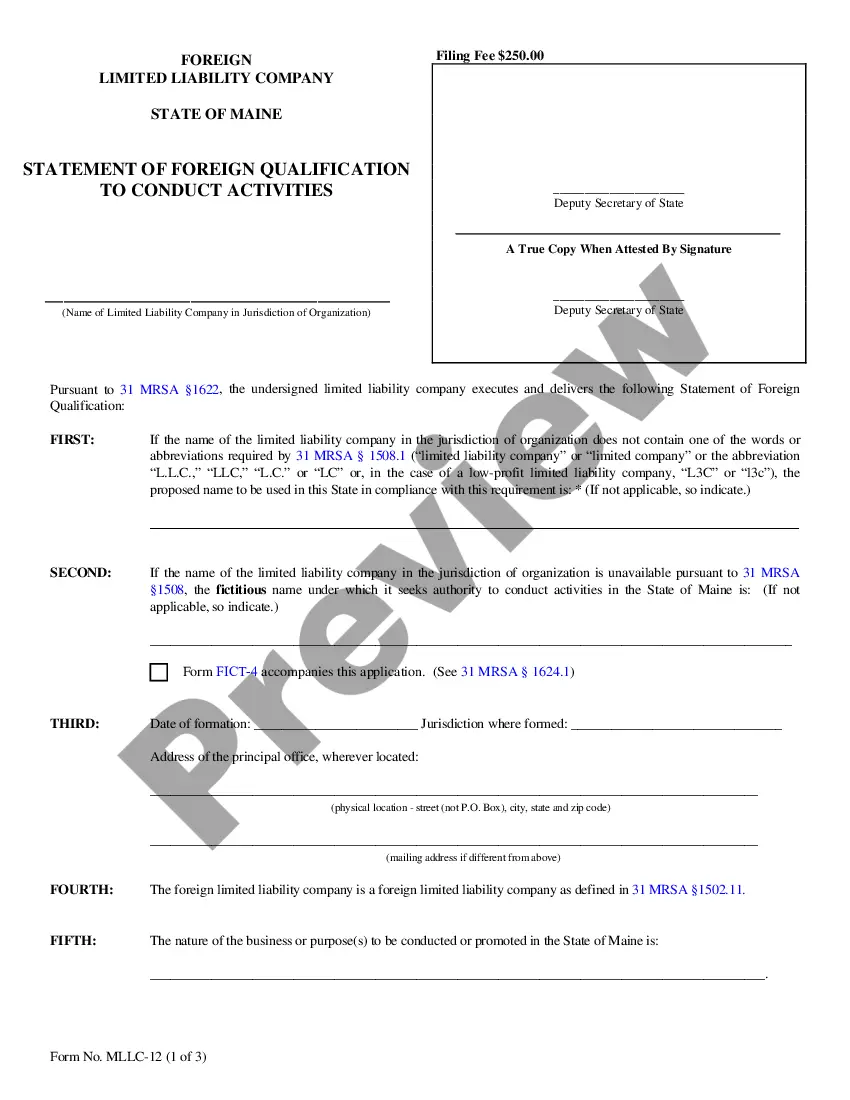

Maine Foreign Llc Withdrawal

Instant download

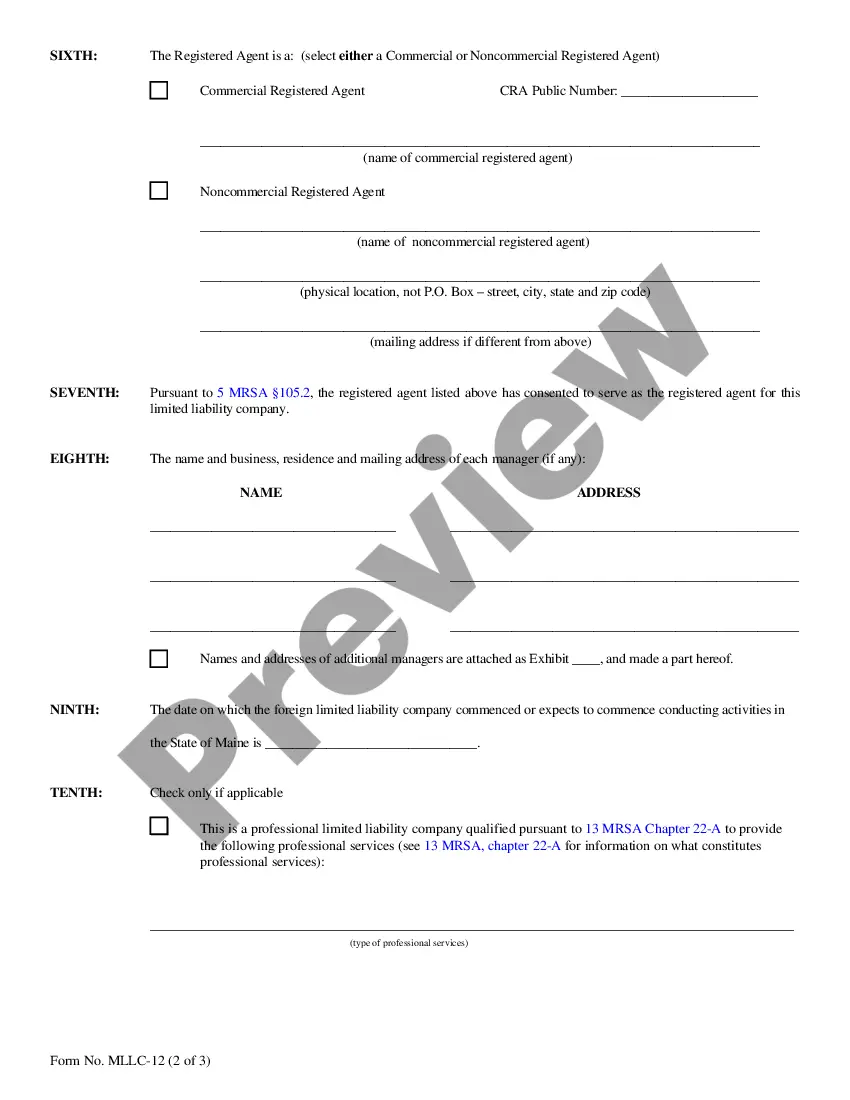

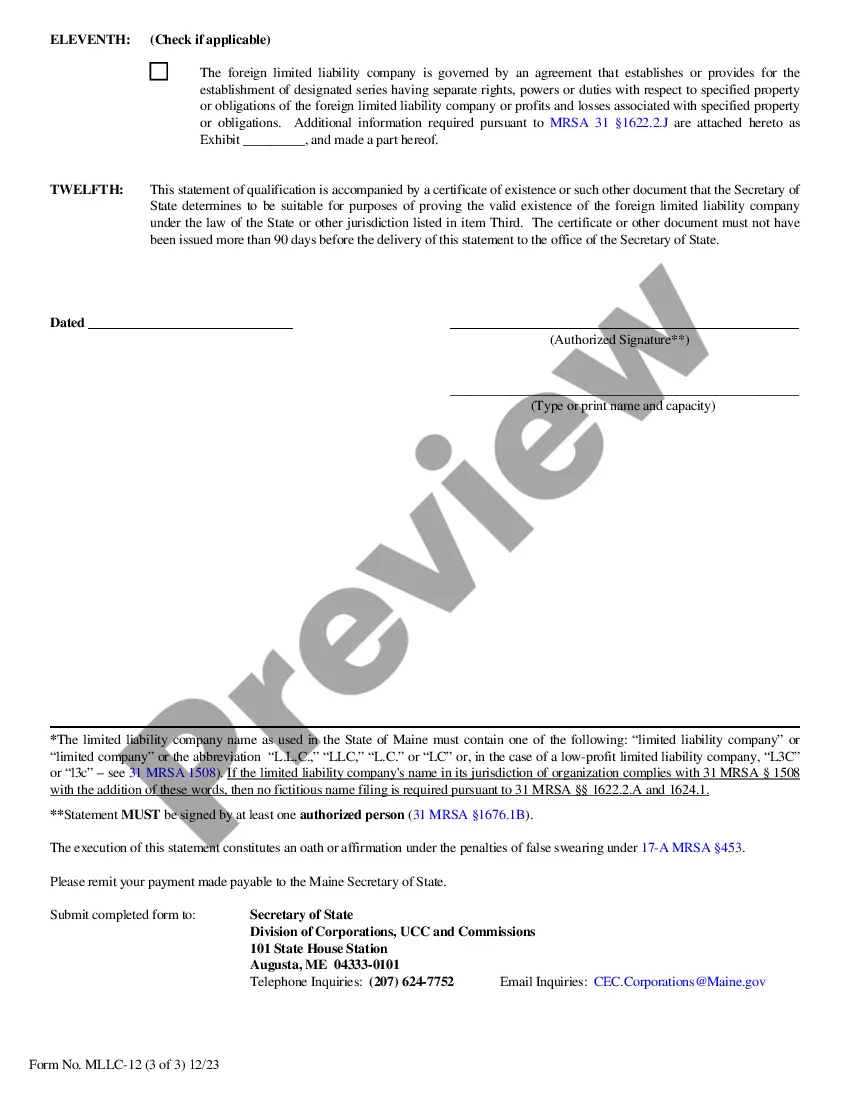

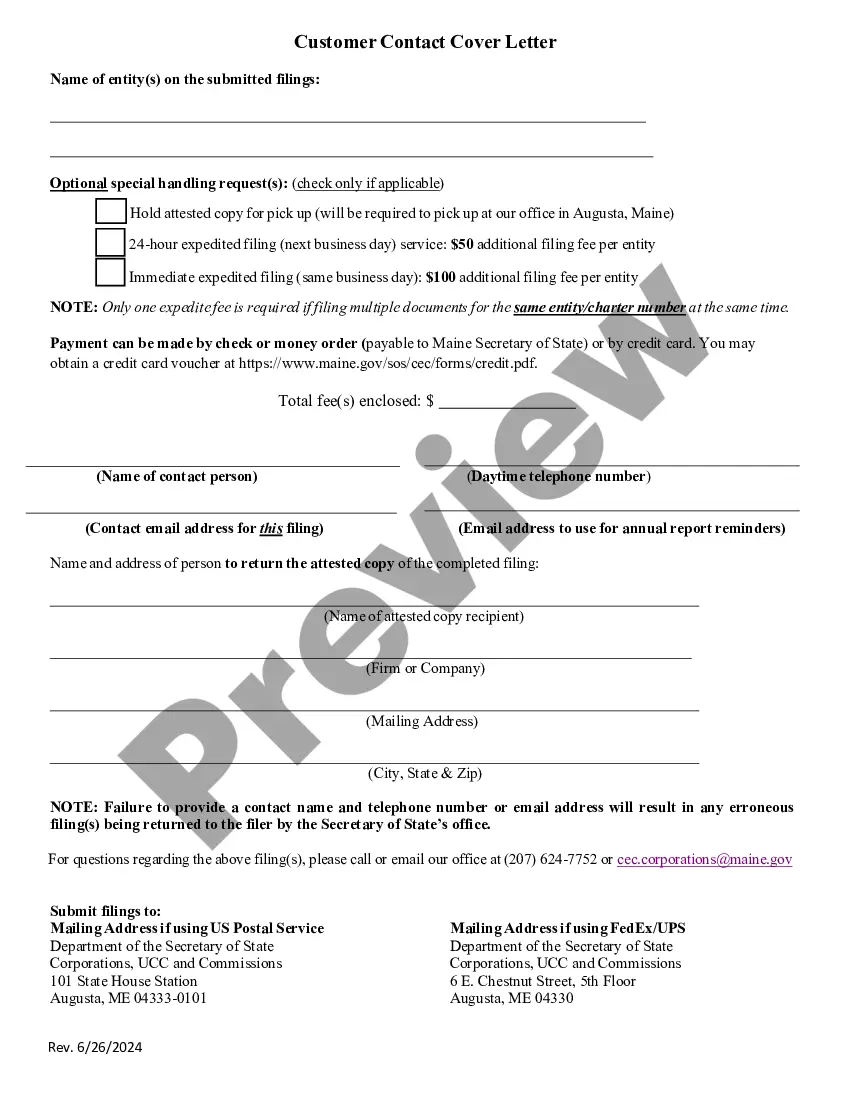

Description Maine Llc Registration

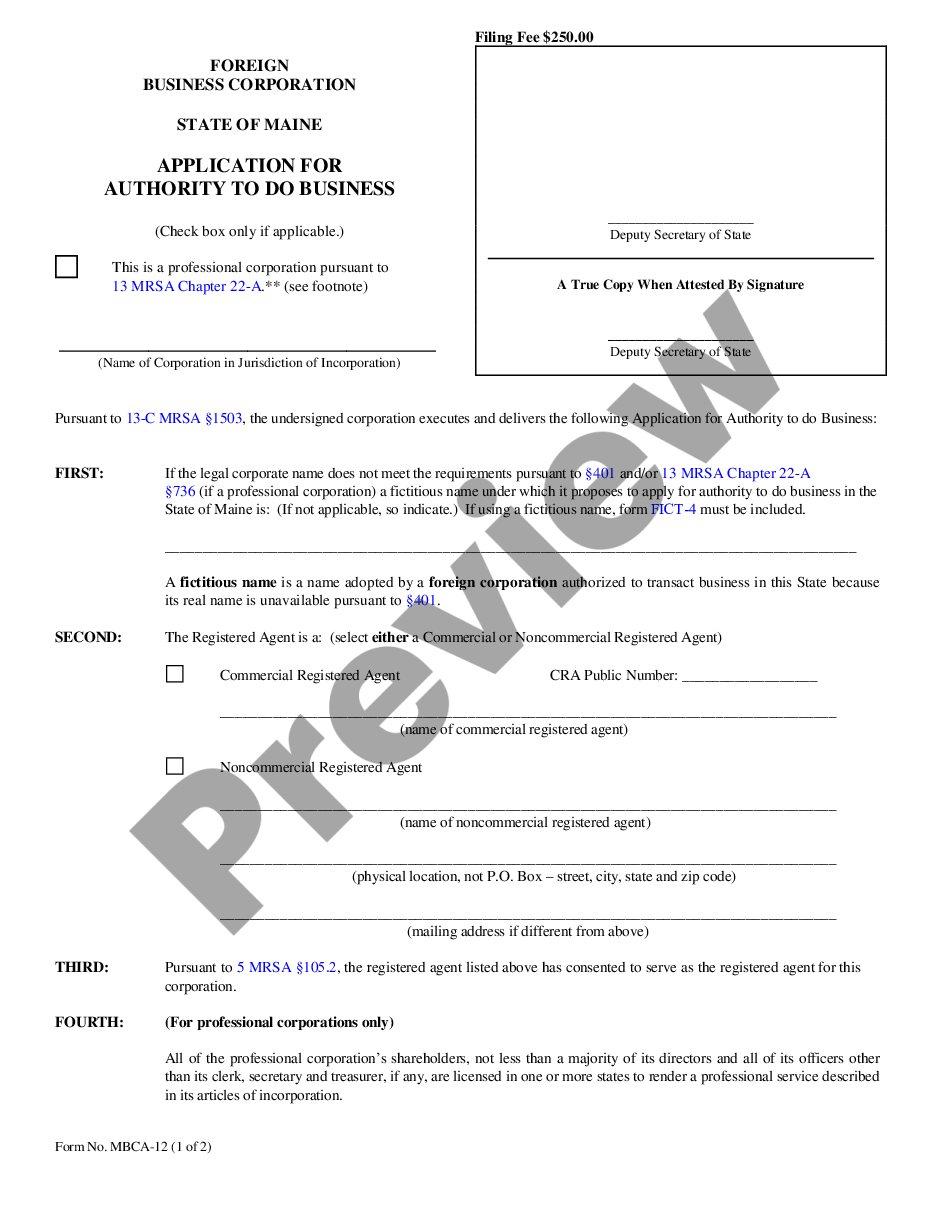

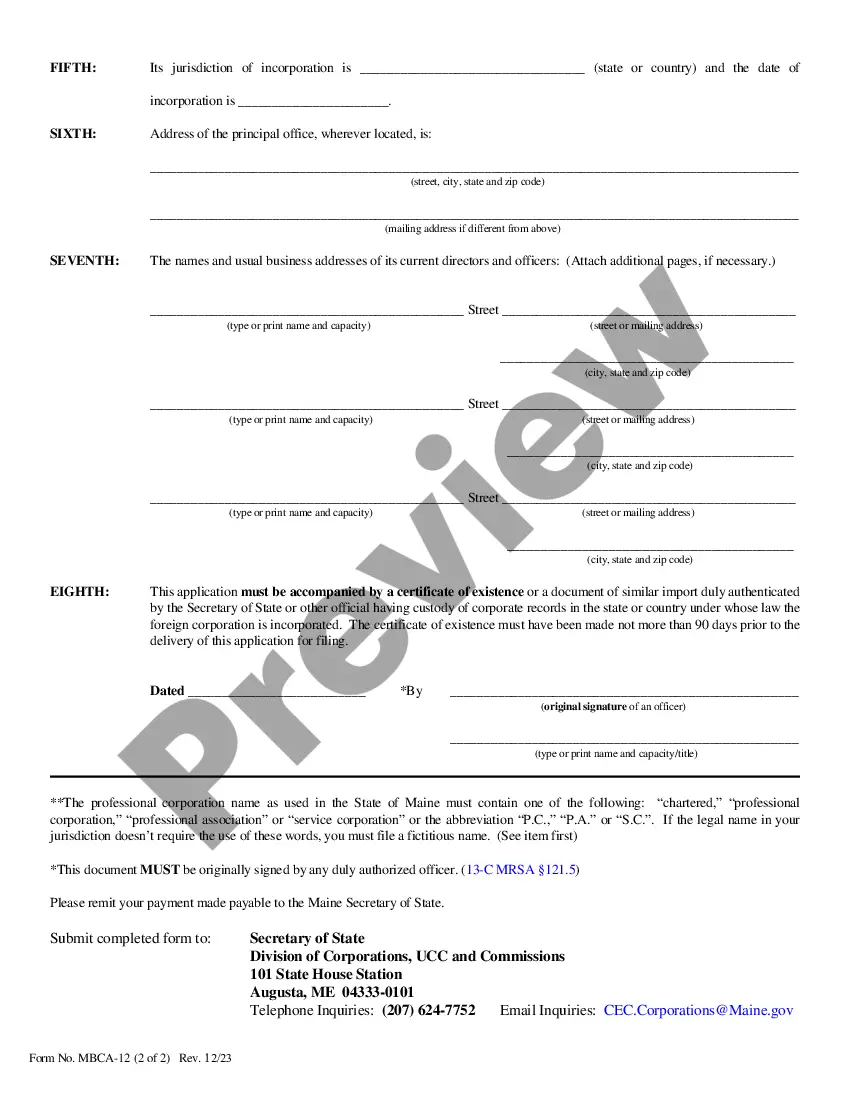

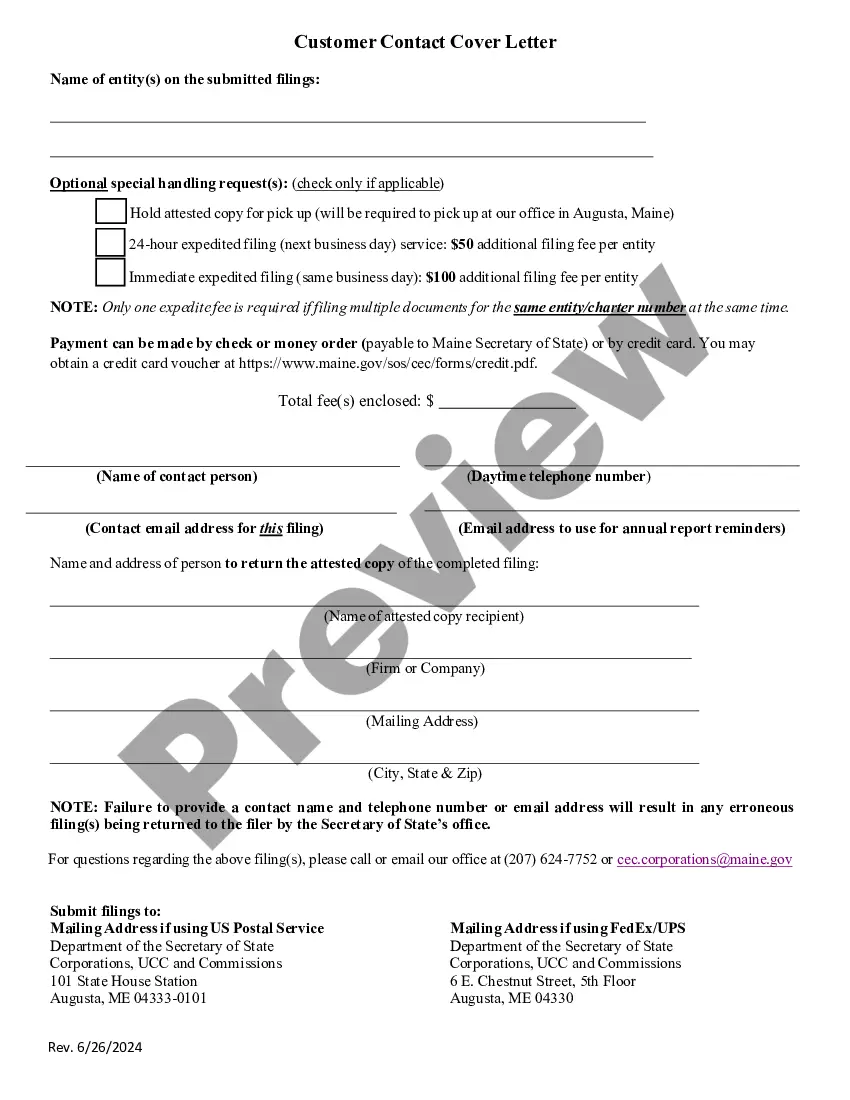

Register a foreign corporation or LLC in Maine.

Free preview Maine Foreign Corporation Registration