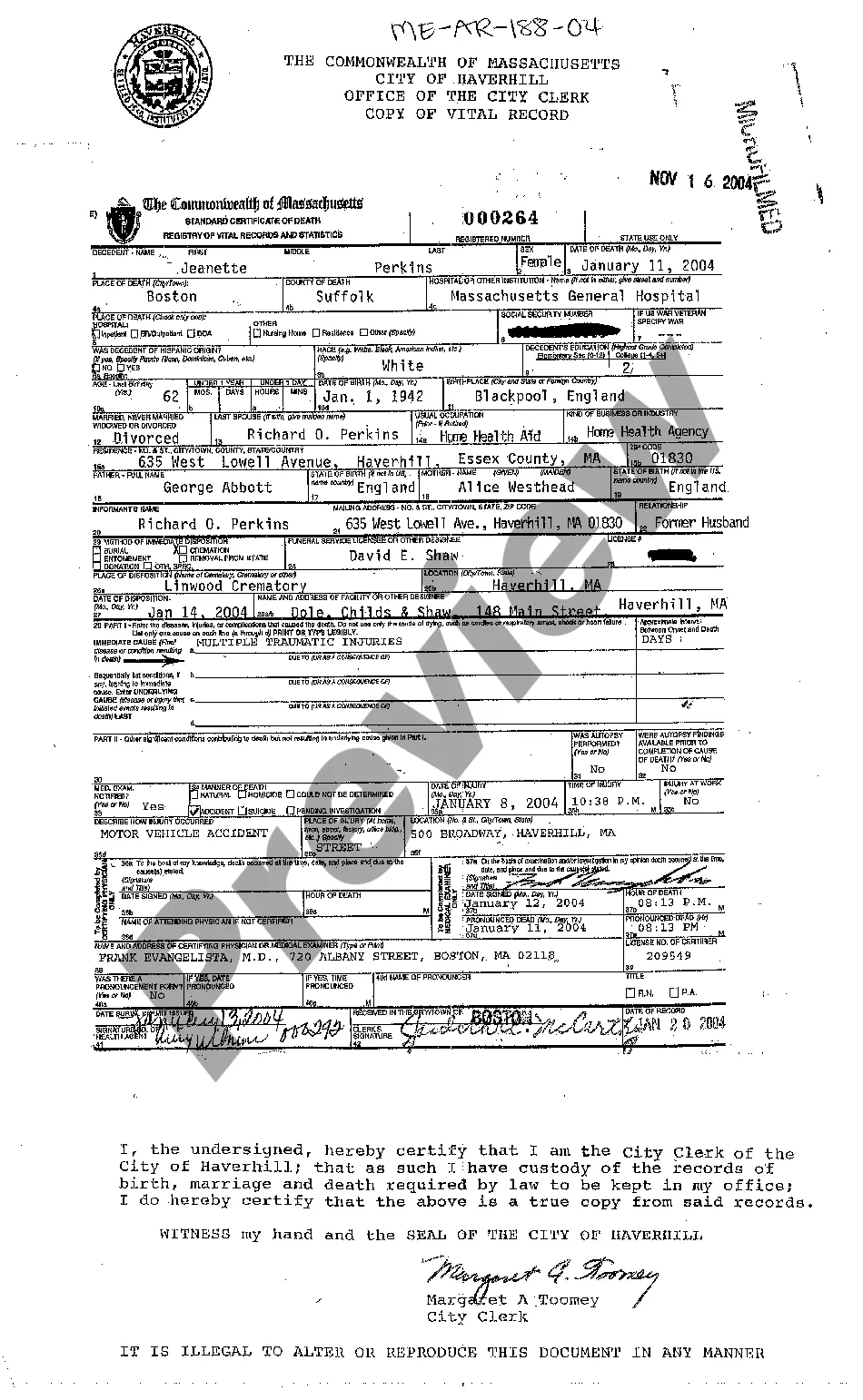

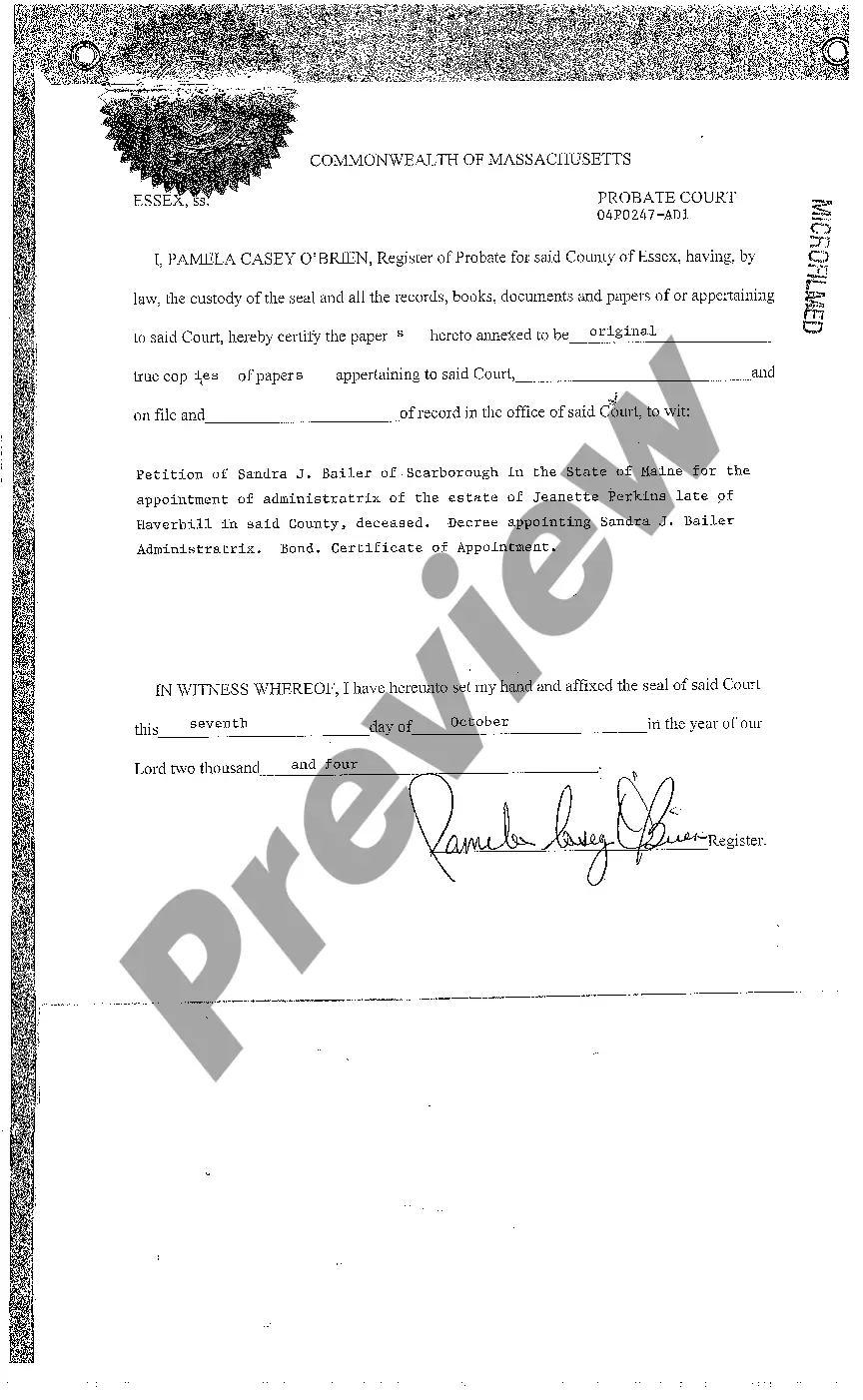

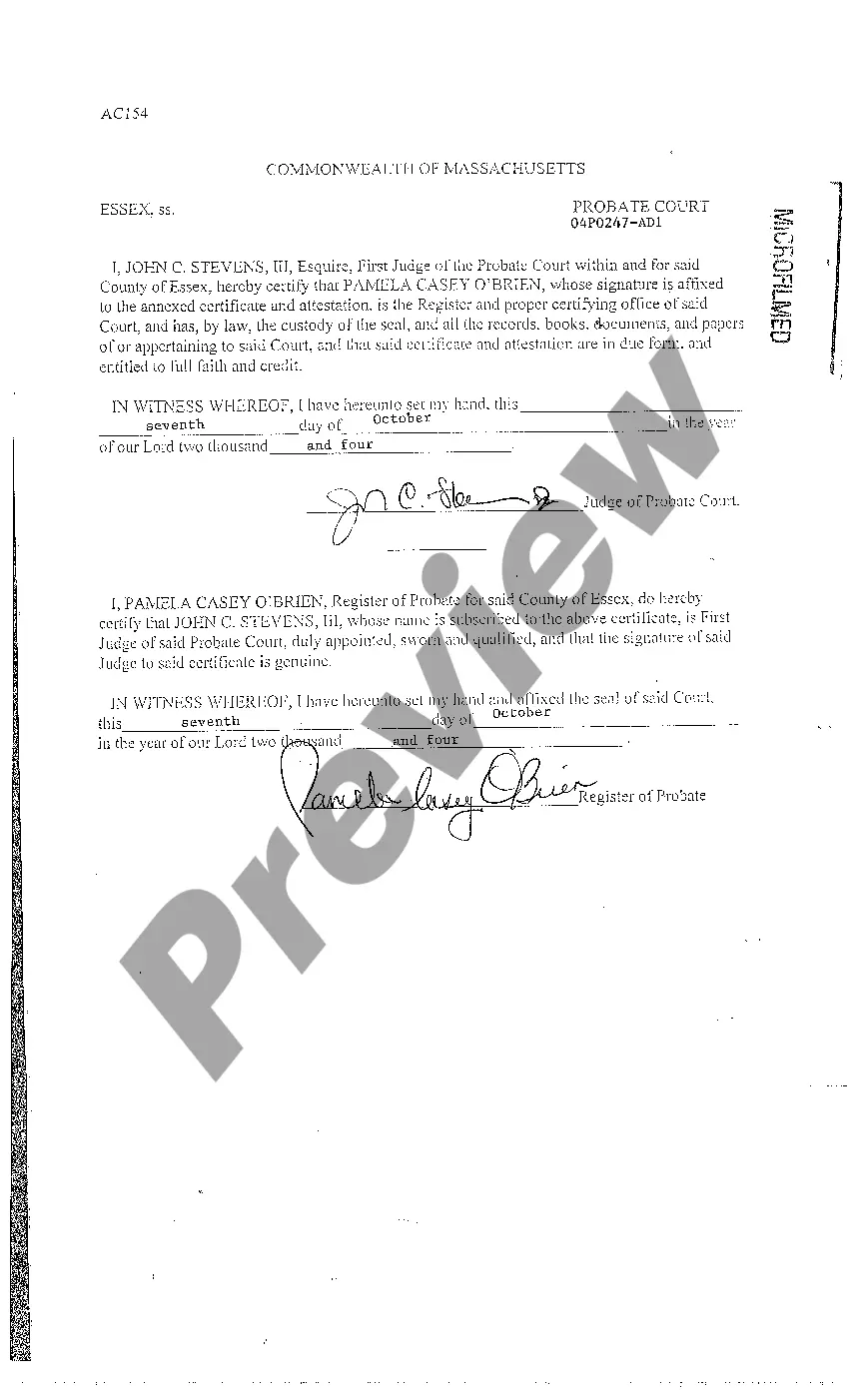

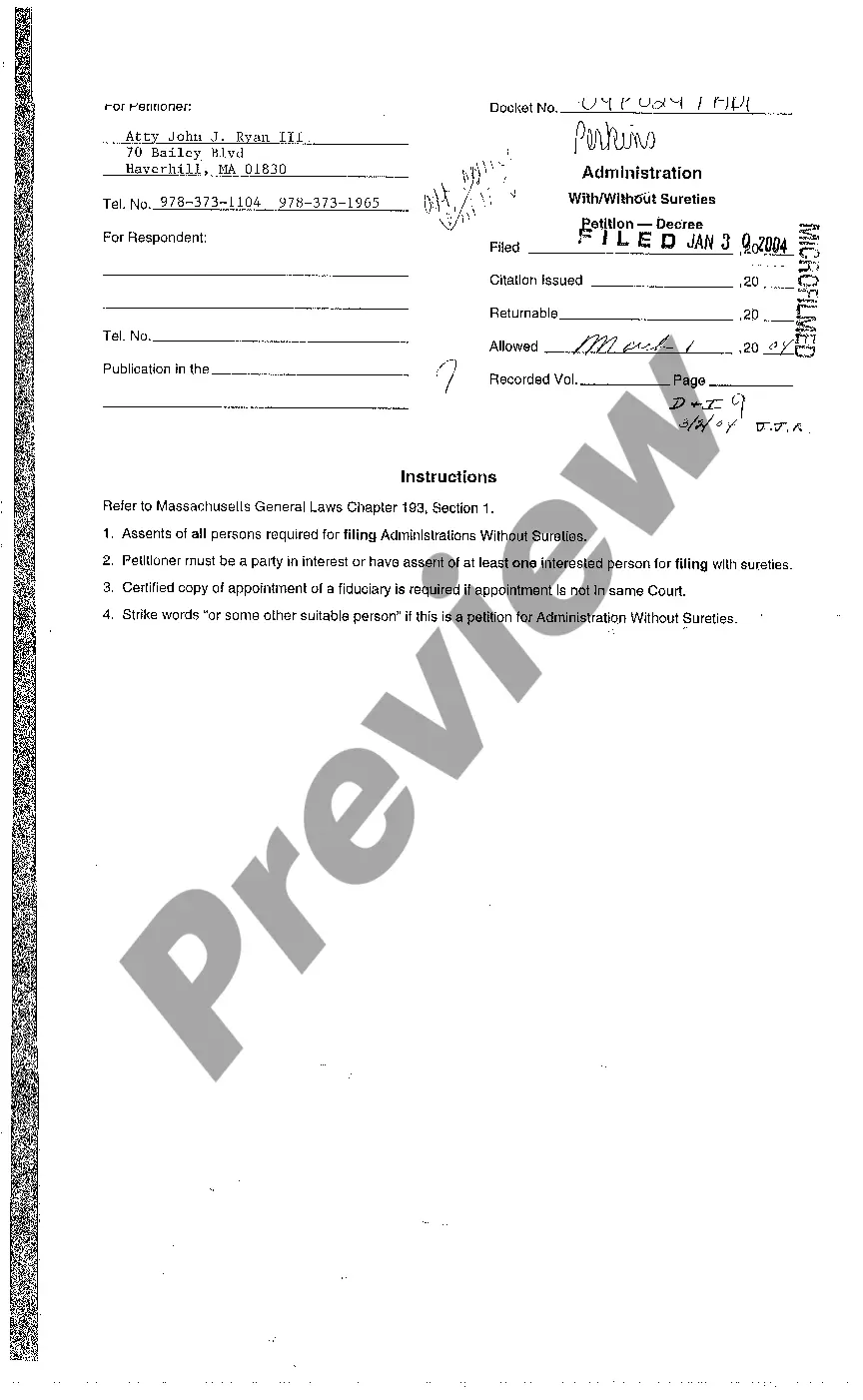

Death Certificate Maine Withholding

Description

How to fill out Death Certificate Maine Withholding?

Irrespective of whether you handle documents frequently or occasionally need to submit a legal document, it is essential to have a resource containing samples that are pertinent and current.

The first step you should take with a Death Certificate Maine Withholding is to ensure that it is the latest version, as this determines its eligibility for submission.

If you wish to streamline your search for the most recent document examples, look for them on US Legal Forms.

Utilize the search function to find the desired form.

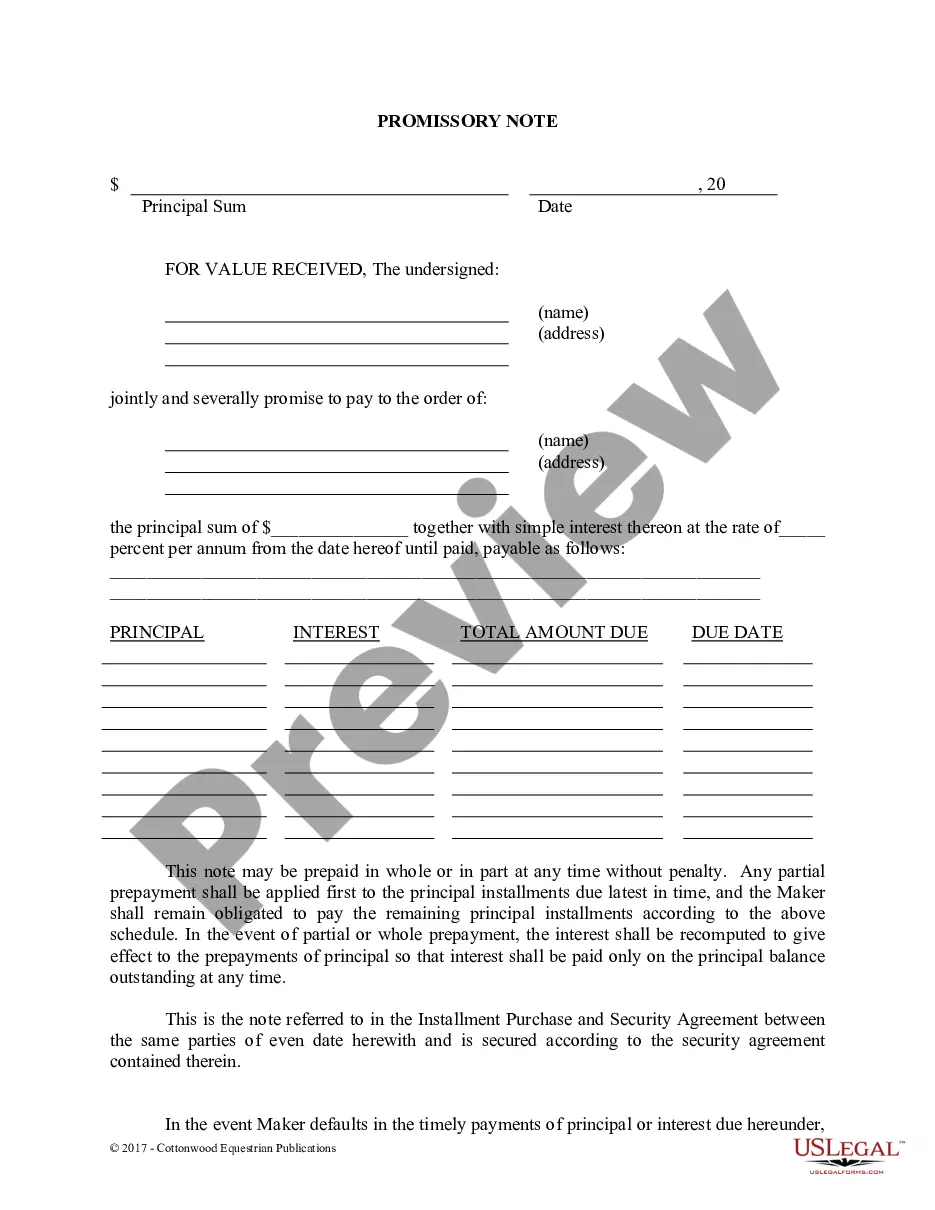

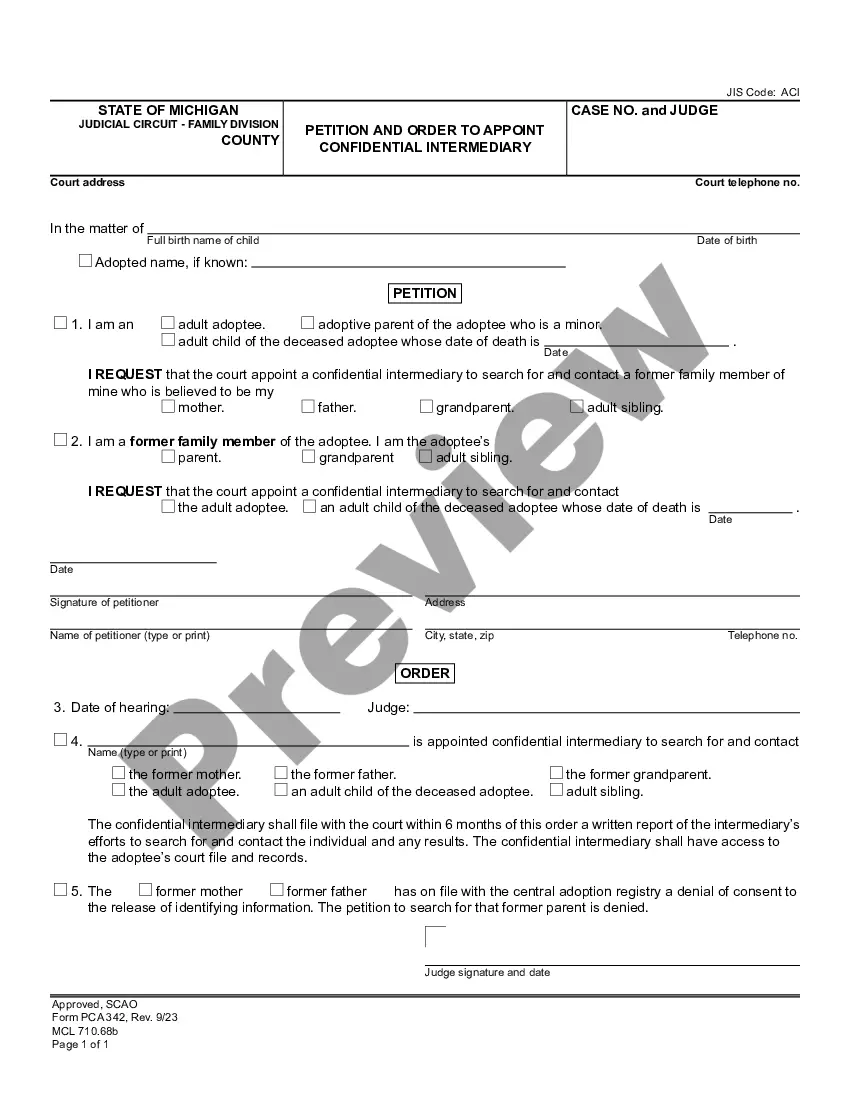

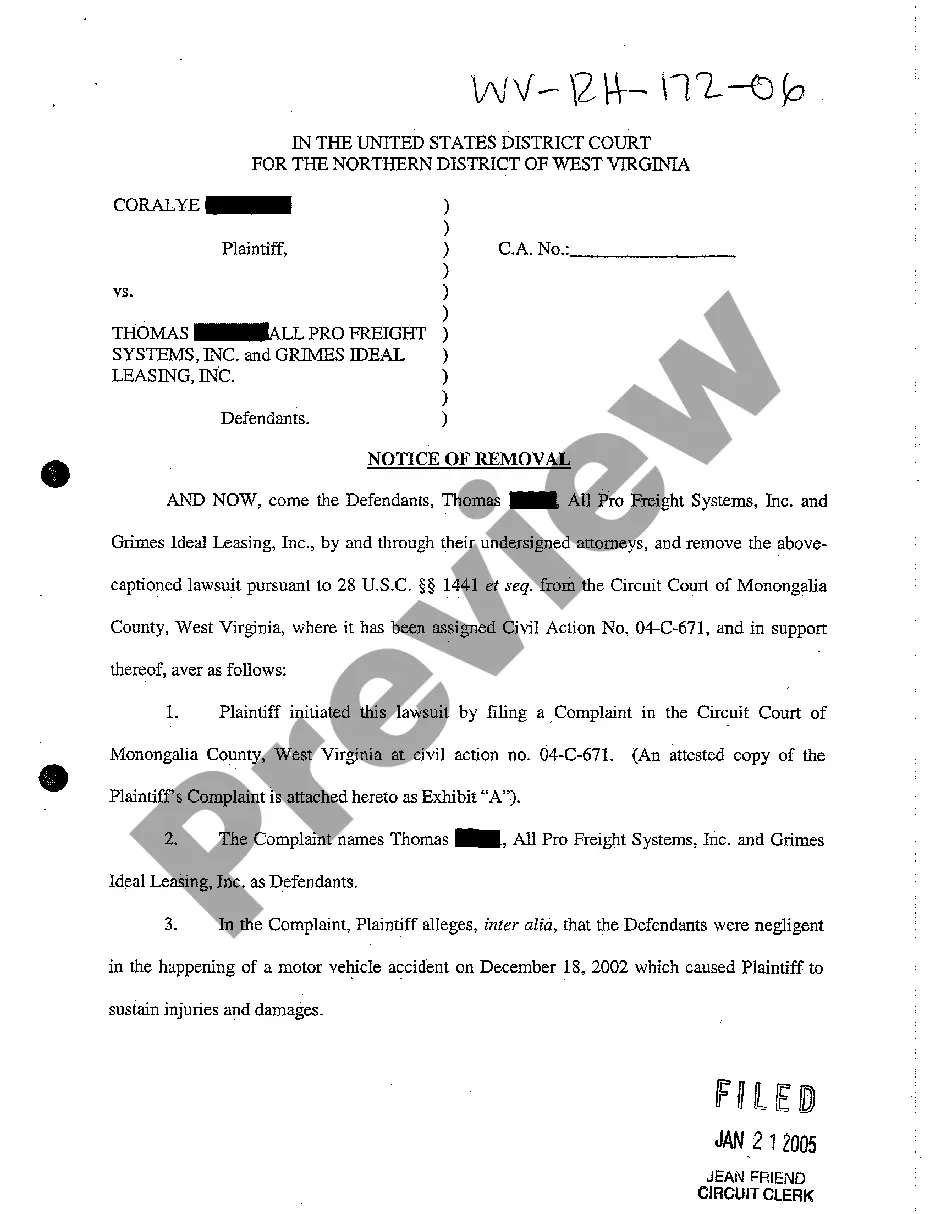

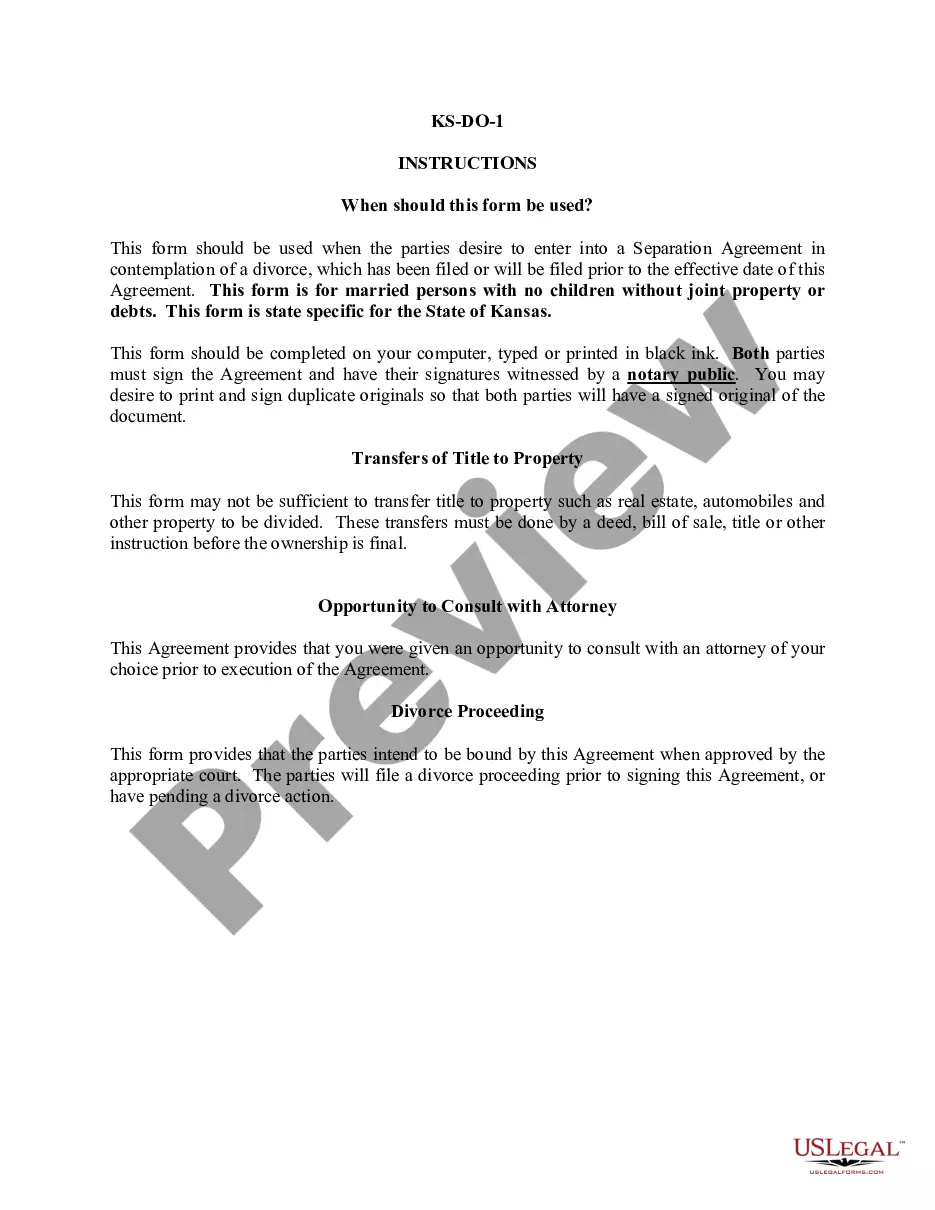

- US Legal Forms is a repository of legal forms that includes nearly every document example you could need.

- Search for the templates you want, immediately check their applicability, and learn more about their usage.

- With US Legal Forms, you gain access to over 85,000 form templates across a broad range of fields.

- Find the Death Certificate Maine Withholding samples in just a few clicks and save them at any time in your account.

- An account with US Legal Forms enables you to access all the samples you need with comfort and minimal effort.

- Simply click Log In in the site header and navigate to the My documents section where all your necessary forms are at your fingertips, eliminating the need to spend time searching for the right template or verifying its authenticity.

- To obtain a form without an account, complete these steps.

Form popularity

FAQ

Maine is a closed record state and maintains death records as confidential records for the first 25 years after creating them. For fetal death, records are considered confidential and private for 50 years. During these periods, Maine death records are only available to those deemed eligible.

If Yes, a Maine estate tax return (Form 706ME) is required if (1) the decedent was a Maine resident at the time of death or (2) the decedent was a nonresident and owned real and/or tangible personal property located in Maine at the time of death.

There is no inheritance tax in Maine.

Maine is a closed record State. Individuals requesting a certified copy of a vital record must complete a written request or application, provide acceptable identification, and depending on the record requested, may have to demonstrate their direct and legitimate interest and/or lineage.

The following is a general, simplified, explanation of how the Maine estate tax works. The first $5.87 million of a resident decedent's estate is exempt from tax. The tax is 8% on the amount between $5.87 million and $8.8 million; 10% on the amount between $8.8 million and $11.8 million, and 12% on the excess.