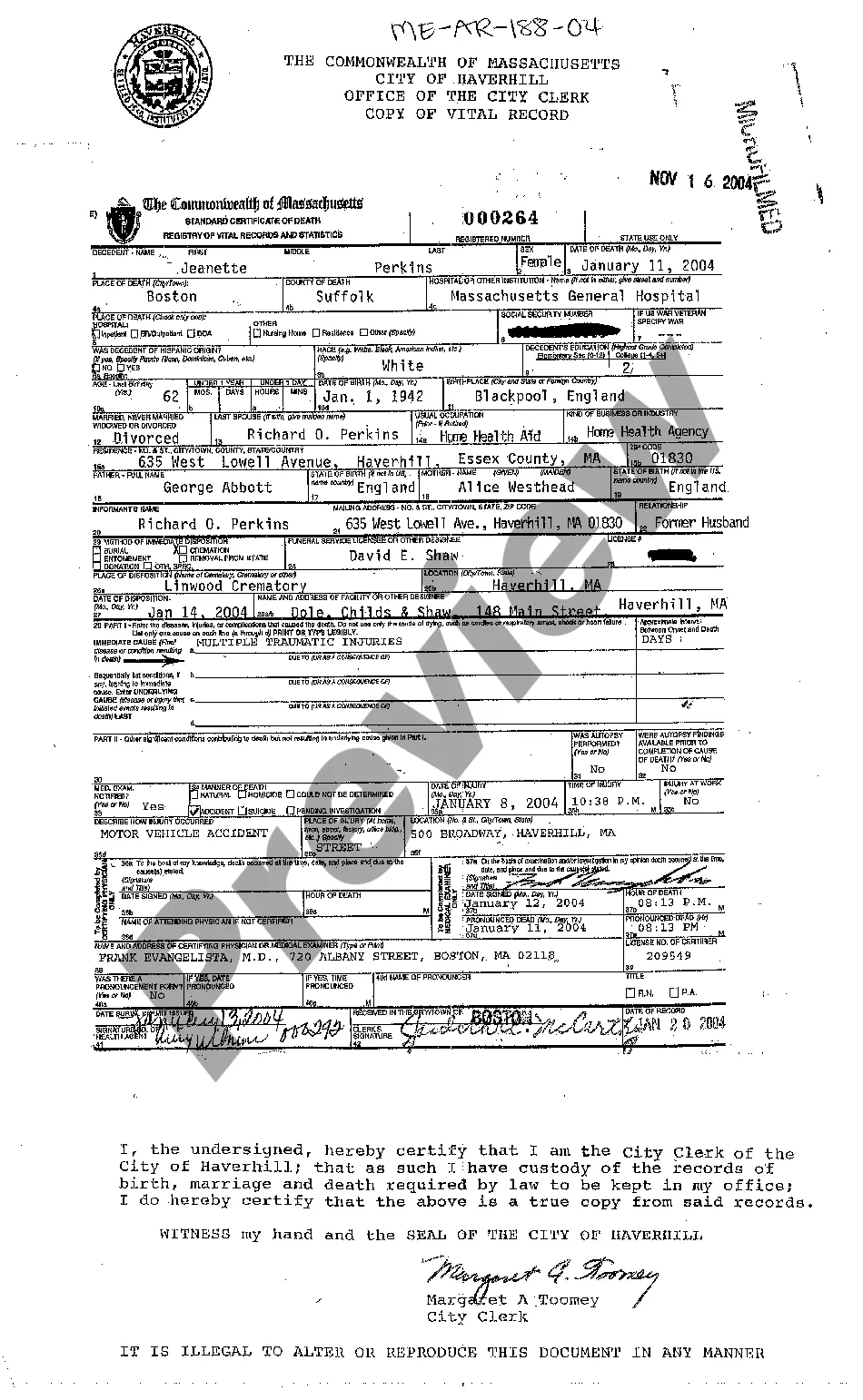

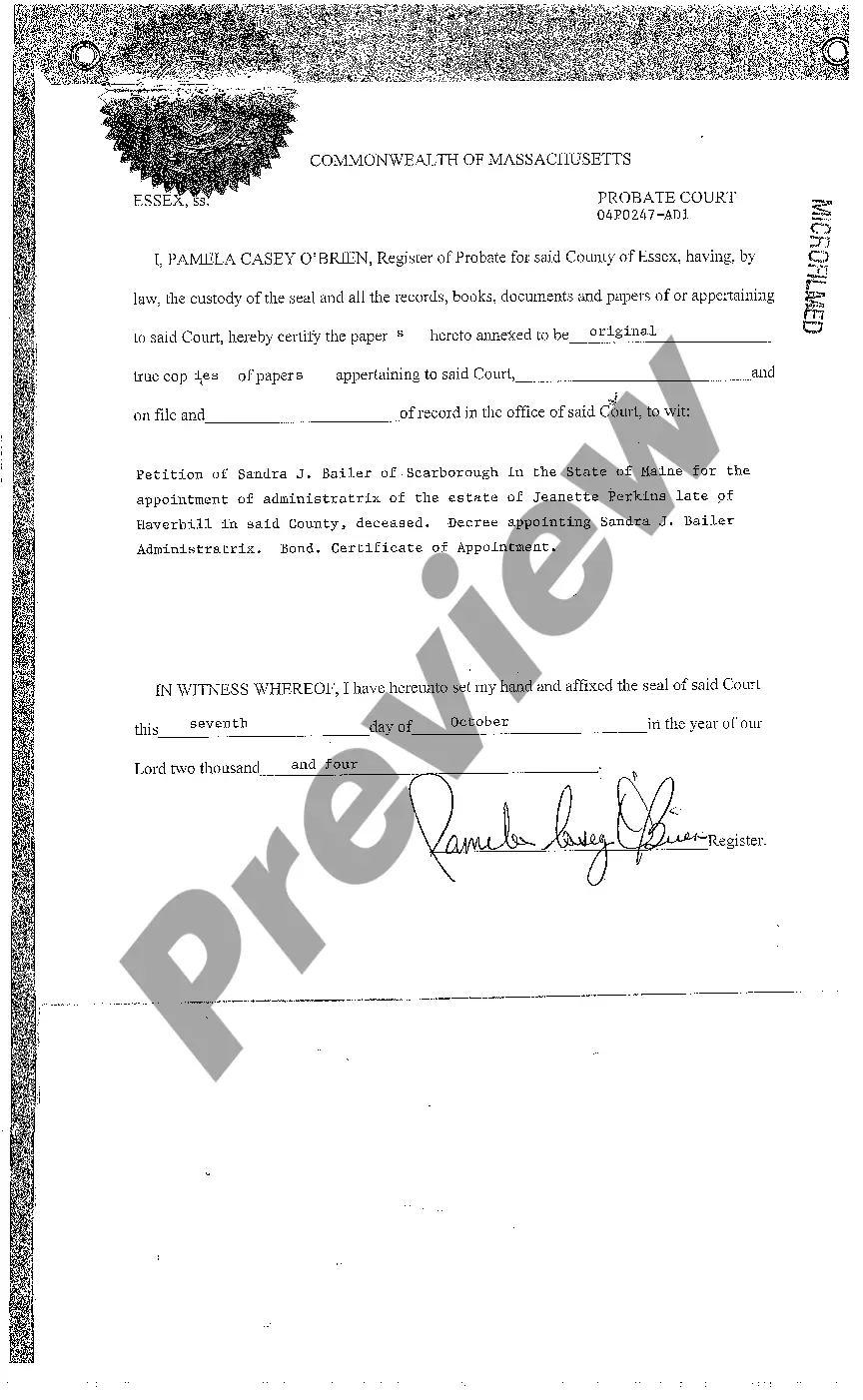

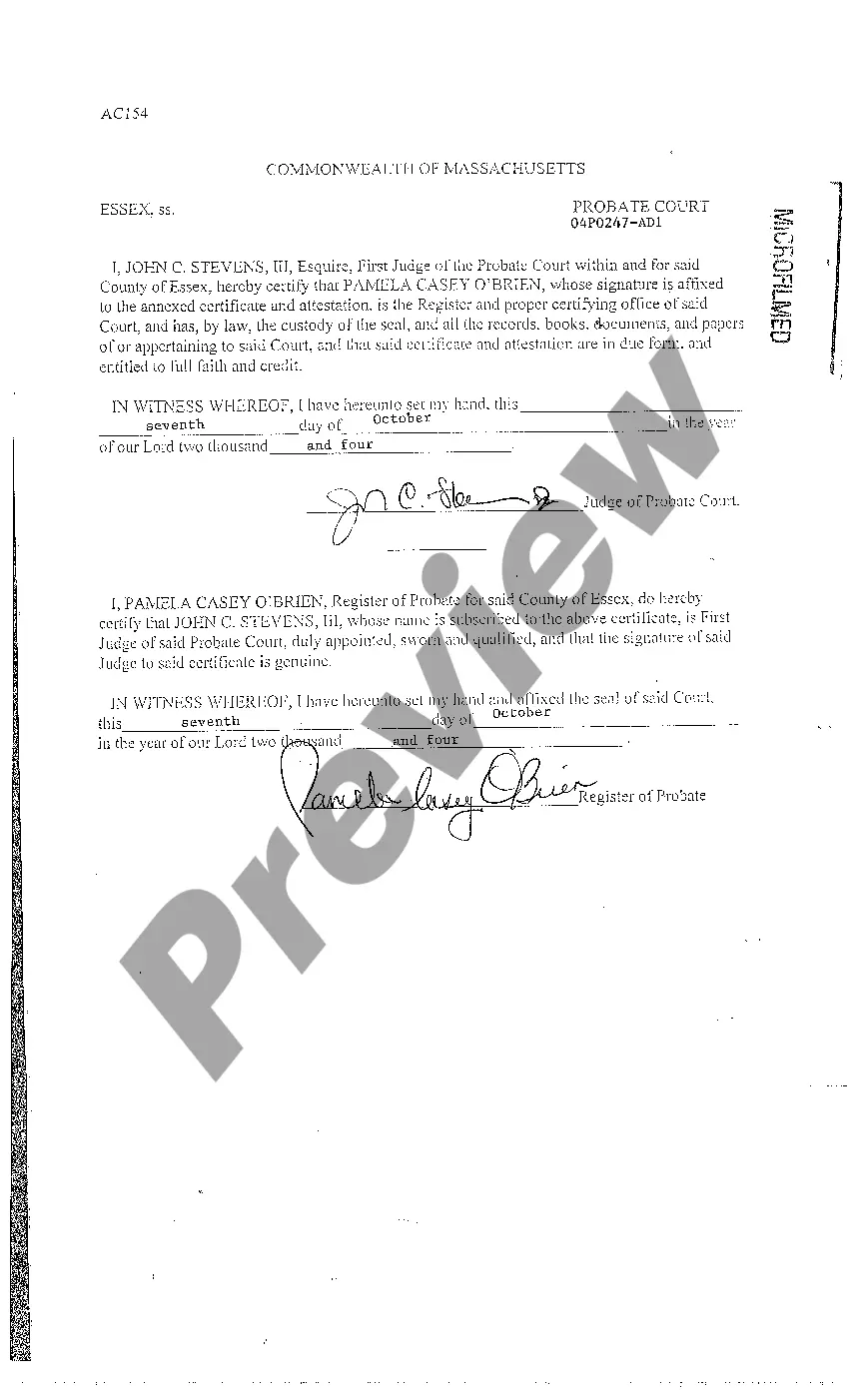

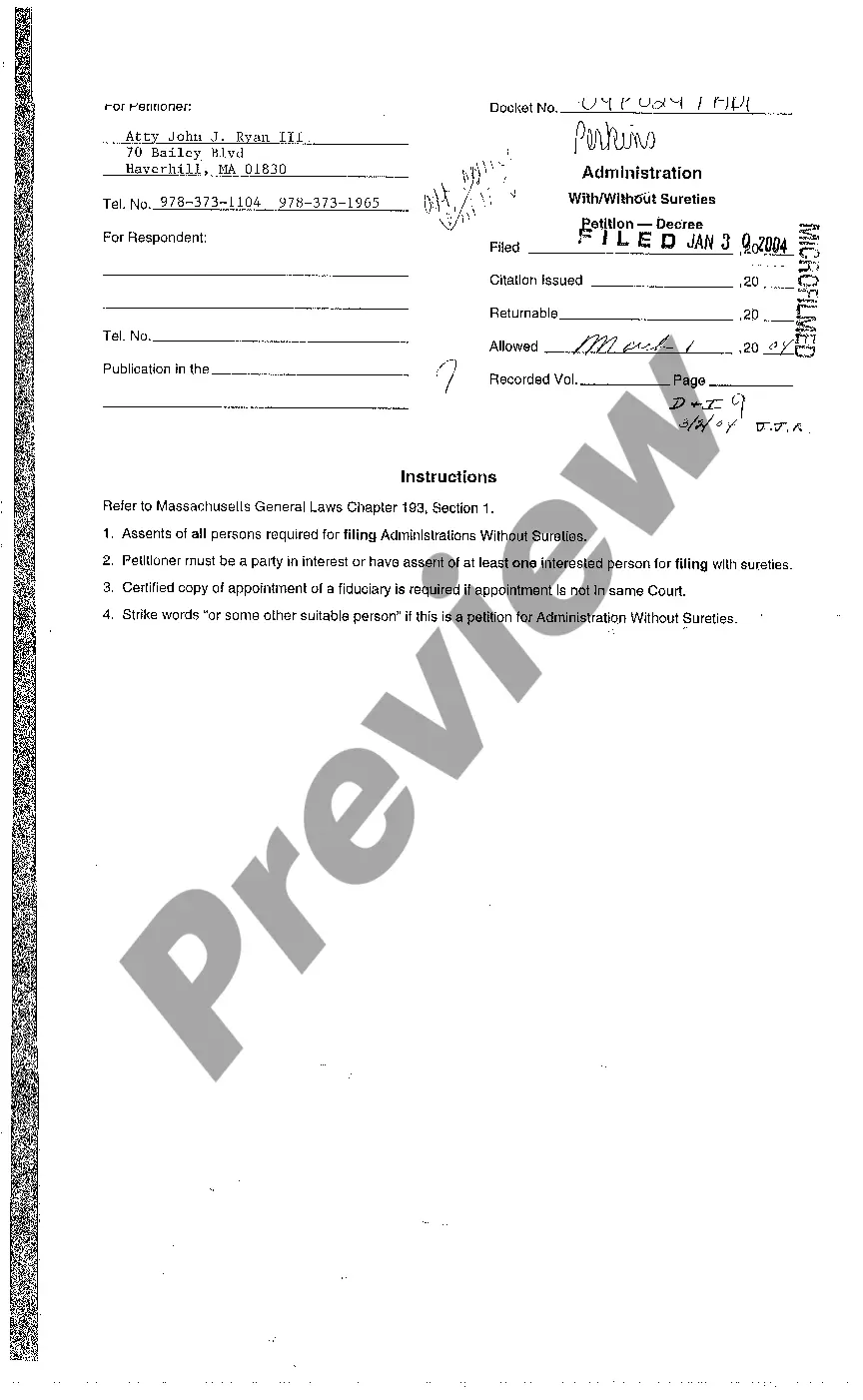

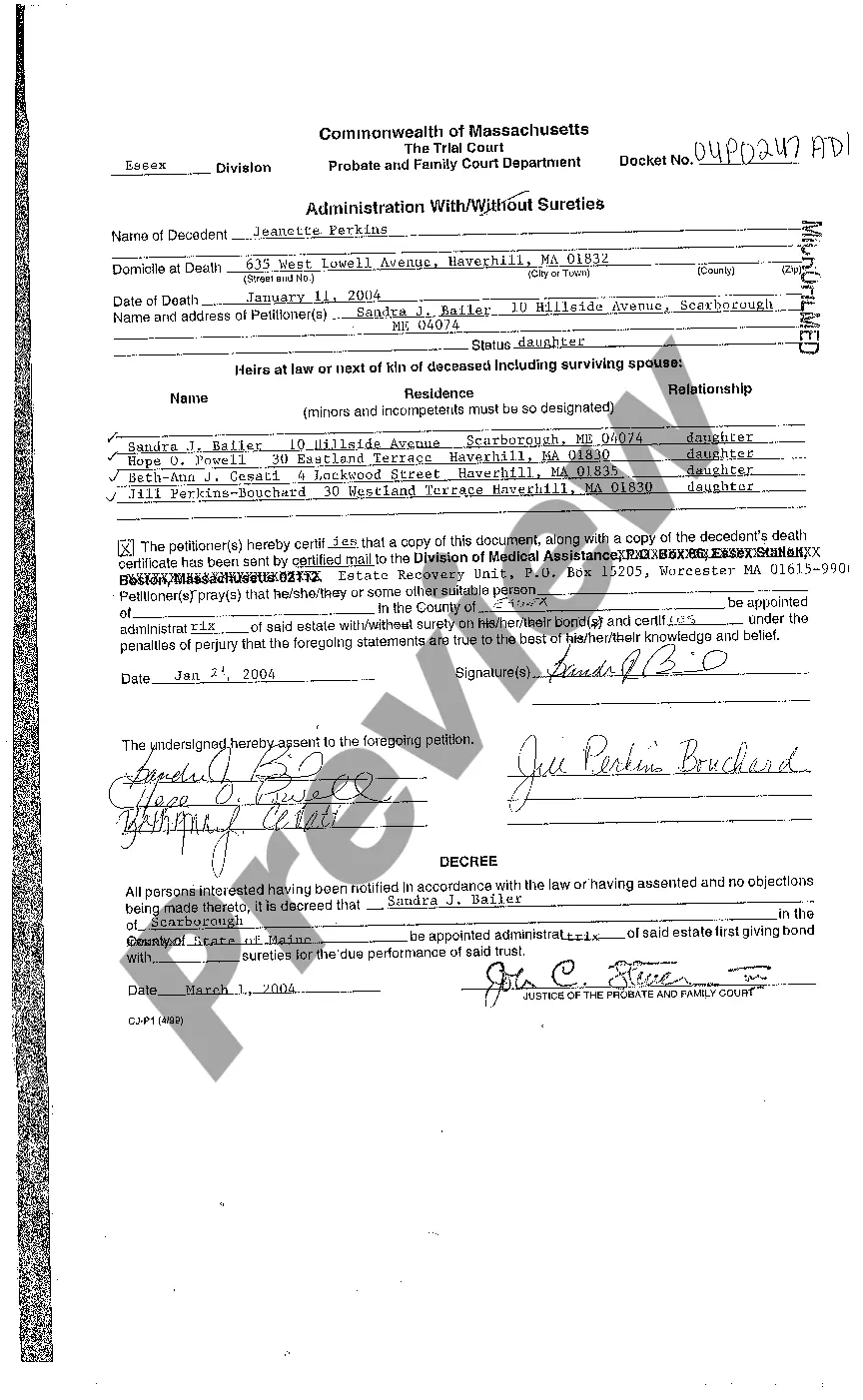

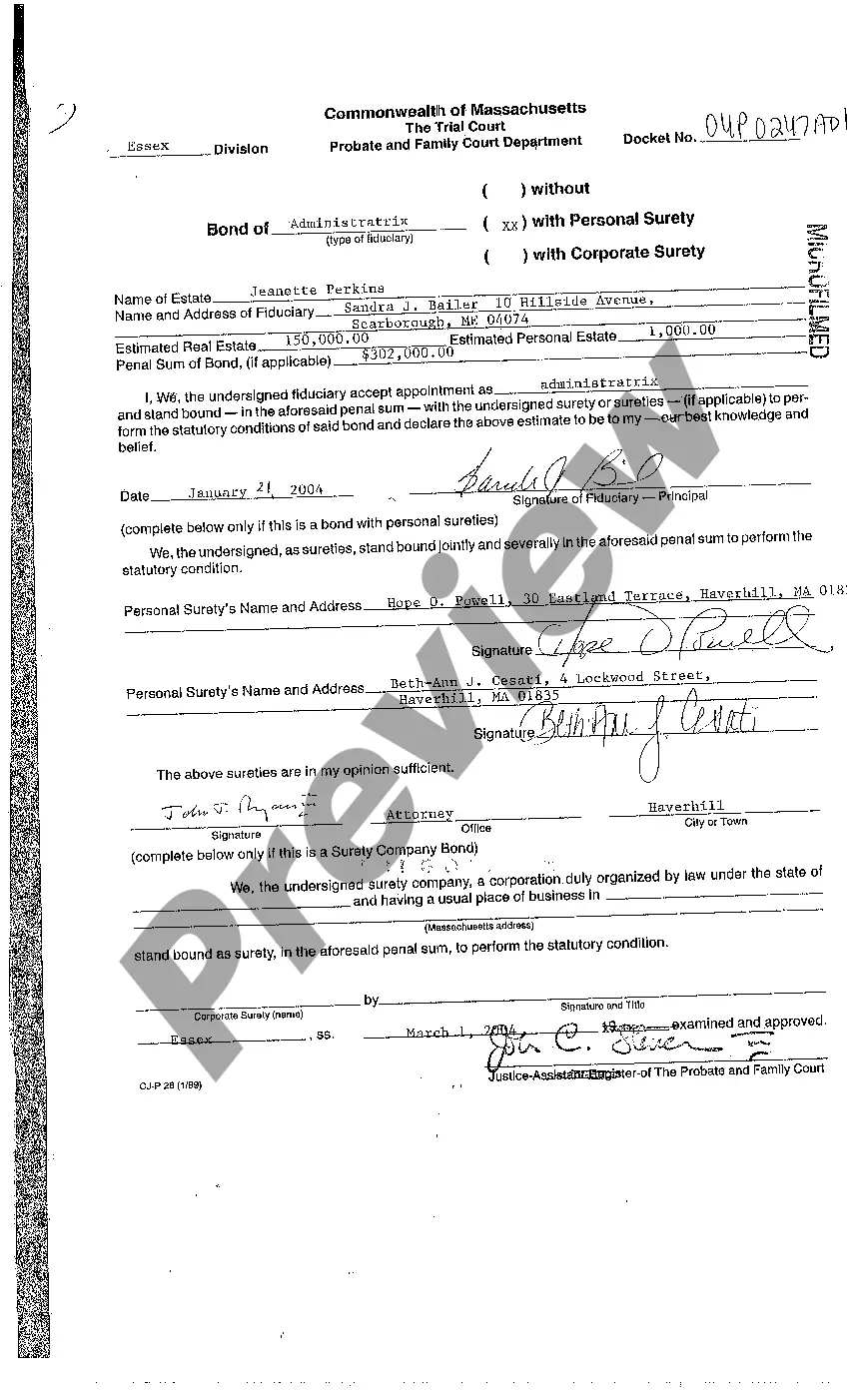

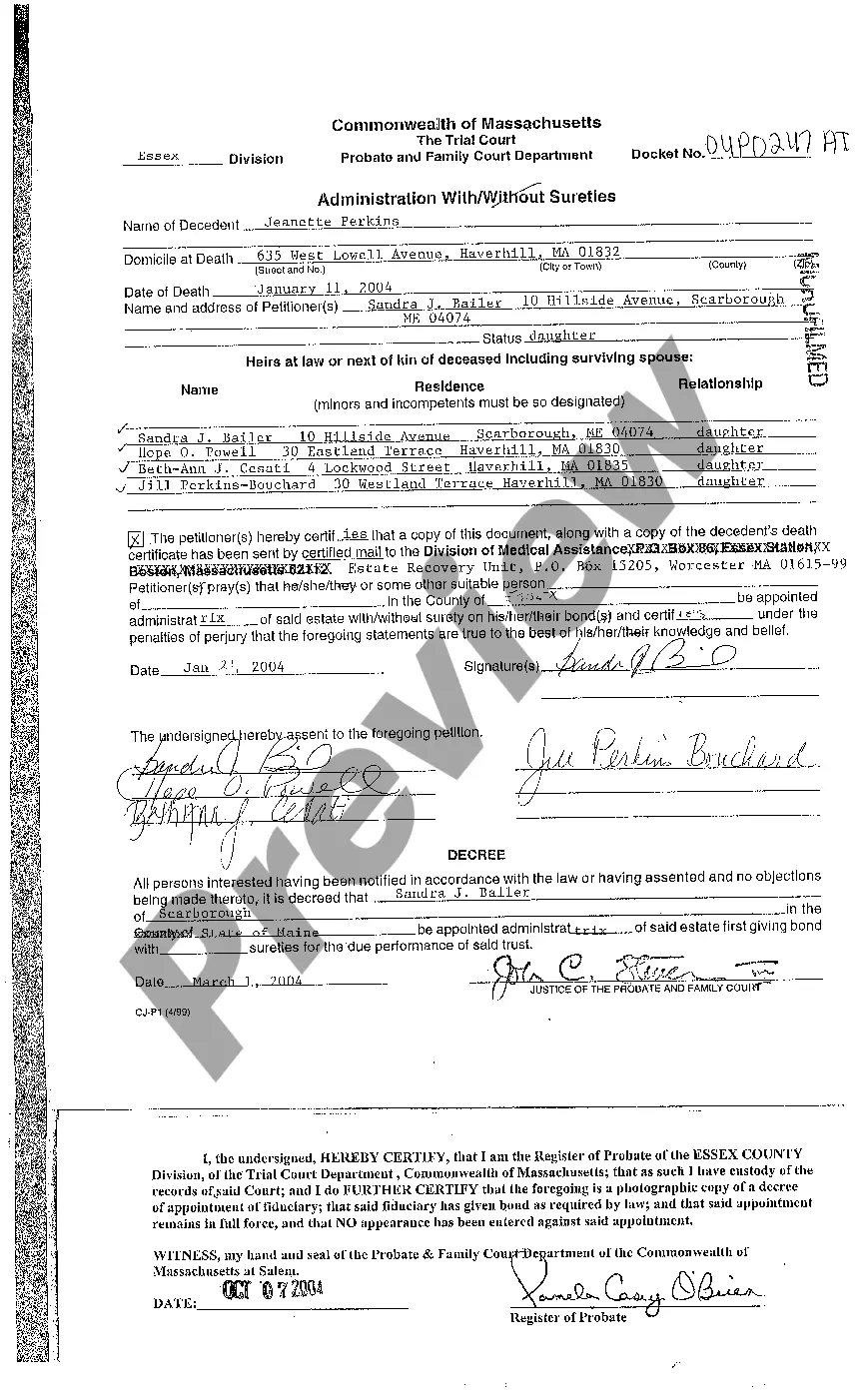

Death Certificate Maine Withholding Allowance

Description

How to fill out Death Certificate Maine Withholding Allowance?

No matter if you handle documentation regularly or need to file a legal report now and then, it's essential to find a reliable resource where all the samples are pertinent and current.

One action you should take with a Death Certificate Maine Withholding Allowance is to verify that it is indeed the most recent version, as this determines its acceptability.

If you want to make your search for the most recent document samples easier, check them out on US Legal Forms.

Utilize the search bar to locate the form you need, inspect the Death Certificate Maine Withholding Allowance preview and synopsis to confirm it is precisely what you're searching for. After confirming the form, simply click Buy Now, select a subscription plan that suits you, create an account or Log Into your existing one, provide your credit card information or PayPal details to complete the transaction, choose the download file format and confirm it. Forget about the stress associated with legal documents; all your templates will be arranged and validated with an account at US Legal Forms.

- US Legal Forms serves as a database of legal documents featuring nearly every document sample you might need.

- Look for the templates you need, verify their relevance instantly, and learn more about their usage.

- With US Legal Forms, you gain entry to over 85,000 document templates across diverse areas.

- Locate the Death Certificate Maine Withholding Allowance samples in just a few clicks and save them anytime in your account.

- Having a US Legal Forms account grants you the ability to access all the templates you need with ease and minimal hassle.

- Simply click Log In in the site header and navigate to the My documents section where all your needed forms are readily available, eliminating the need to spend time looking for the right template or verifying its usefulness.

- To acquire a form without creating an account, follow these instructions.

Form popularity

FAQ

What Is the Federal Inheritance Tax Rate? There is no federal inheritance taxthat is, a tax on the sum of assets an individual receives from a deceased person. However, a federal estate tax applies to estates larger than $11.7 million for 2021 and $12.06 million for 2022.

The federal estate tax (sometimes called the death tax) is a one-time tax that is imposed at death. If you die with a certain dollar amount of assets currently, estates under $11.4 million are exempt, but this reverts back to $5 million in 2026 a federal estate tax return is required and a tax will be due.

With the inheritance tax, the person who inherits the assets pays. The estate tax, charged by the federal government and some state governments, is based on the value of property and assets at the time of the owner's death. As of 2021, the federal estate tax ranges from 18% to 40% of the inheritance amount.

There is no inheritance tax in Maine.

Your beneficiaries (the people who inherit your estate) do not normally pay tax on things they inherit. They may have related taxes to pay, for example if they get rental income from a house left to them in a will.