Trustee Appointment Form With Decimals

Description

Form popularity

FAQ

A trust can indeed deduct medical expenses for a beneficiary as long as specific conditions are met. These deductions may reduce the taxable income of the trust, benefiting its overall financial health. Always keep thorough records of these expenses and consider referencing the trustee appointment form with decimals when organizing this information. Using our platform can assist in understanding the complexities of these deductions.

Yes, a trustee can claim expenses that are necessary for managing the trust. These expenses may include costs for investment management, legal fees, and maintenance of trust property. It's important to maintain clear records and documentation, including the trustee appointment form with decimals, to support these claims. This practice ensures transparency and adherence to fiduciary duties.

To submit form 3520, you must complete it thoroughly, detailing transactions with foreign trusts or gifts. Ensure that you file it by the deadline, which usually aligns with your tax return due date. Use the mailing address specified in the form instructions for submission. To streamline this process, the trustee appointment form with decimals can help organize necessary information beforehand.

Form 706 Schedule G deals with transfers made during life that are subject to estate tax. It lists all property transferred to a trust, including details about the trust and its beneficiaries. Completing this form correctly is crucial for an accurate estate tax return, along with the trustee appointment form with decimals. For detailed guidance, consider resources available on platforms like uslegalforms.

Yes, you can put utilities in the name of a trust. This process often enhances asset protection and simplifies management of these services. To proceed, you will need to provide utility companies with the appropriate trust documentation, including the trustee appointment form with decimals. Consulting legal advice can clarify requirements specific to your situation.

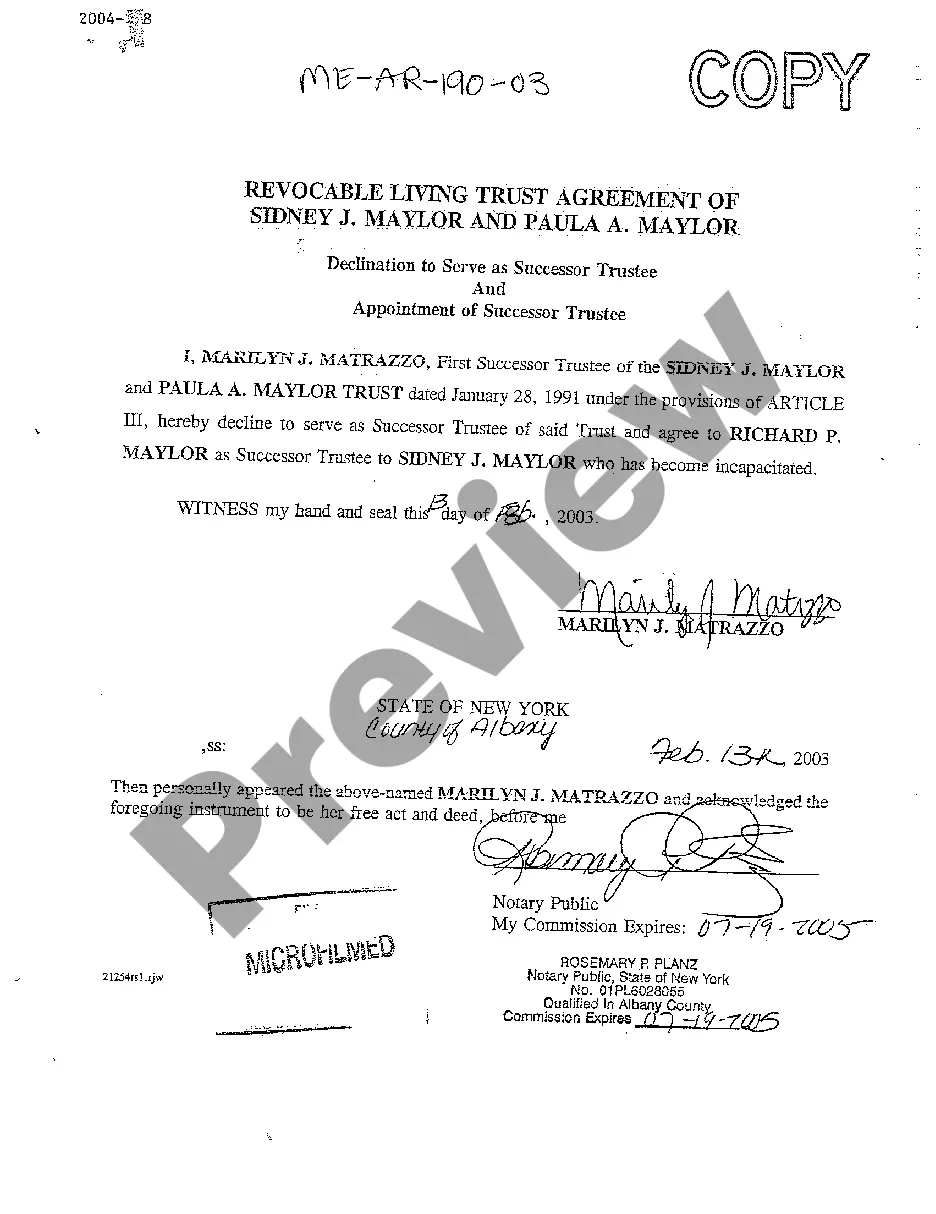

The procedure generally involves selecting an appropriate candidate and documenting this choice formally. You will then complete a trustee appointment form with decimals, which clarifies their role and responsibilities. This form should be signed and often notarized to provide legal validity, ensuring a smooth transition for trust management.

A trustee can manage assets, make distributions to beneficiaries, and make investment decisions according to the trust's terms. However, they cannot make changes to the trust document or act in their own self-interest. Understanding these limitations is essential before completing a trustee appointment form with decimals to ensure compliance with legal standards.

The process typically involves selecting a trustworthy individual or institution to fulfill this role. Once chosen, the new trustee must complete a trustee appointment form with decimals, which provides the necessary legal framework for their responsibilities. The appointment usually requires witnessing and may involve notifying beneficiaries of the change.

A trustee must manage the trust assets responsibly and act in the best interest of the beneficiaries. This includes adhering to the terms of the trust and keeping accurate records. Understanding these duties is crucial when filling out a trustee appointment form with decimals, as it ensures that the trustee is prepared for these responsibilities.

The 5 percent rule generally states that beneficiaries can only receive distributions from a trust that do not exceed five percent of the trust's total assets annually. This rule ensures that the trust remains intact and can provide for beneficiaries over the long term. Understanding this principle will be crucial as you fill out your trustee appointment form with decimals.