Trustee Appointment Form With Irs

Description

Form popularity

FAQ

As of now, the IRS does not offer an option to schedule appointments online. However, you can check their website for updates or use the telephone option for scheduling. If you are dealing with issues related to your Trustee appointment form with IRS, it’s advisable to have all necessary documents ready prior to your call.

To make an appointment with your local IRS office, you need to call the IRS at 1-844-545-5640. When you reach an agent, explain your need clearly, especially if it’s regarding a Trustee appointment form with IRS. Appointments are essential for specific inquiries, so be sure to specify your situation when scheduling.

Submitting Form 56, which notifies the IRS of the creation of a fiduciary relationship, can be done easily by mailing the completed form to the IRS. Ensure you include your contact information and the details related to the Trustee appointment form with IRS. Properly filling out this form helps in managing your tax responsibilities effectively.

To submit Form 2848, also known as the Power of Attorney and Declaration of Representative, you can either mail it to the IRS or fax it. Make sure to include all required information to ensure that your request regarding the Trustee appointment form with IRS is processed smoothly. For quicker submission, double-check the correct fax number listed on the IRS website based on your location.

To reach a live person at the IRS, you first need to call their customer service hotline at 1-800-829-1040. Once you connect, follow the prompts provided by the automated system. Be patient, as wait times can vary. If you have questions about your Trustee appointment form with IRS, be sure to have all relevant documentation handy.

To file an IRS appointment certificate, you need to complete the designated form, typically Form 2848. This form acts as your Trustee appointment form with IRS, allowing you to officially designate your representative. Once completed, send the form to the appropriate IRS office, or have your representative submit it on your behalf. This process secures representation and facilitates smoother communication with the IRS regarding your tax issues.

The IRS appointment of representative form allows a taxpayer to designate a trusted individual to represent them before the IRS. This form is essential for effectively managing your tax matters, as it authorizes the representative to communicate and act on your behalf. When you use the Trustee appointment form with IRS, you ensure that your agent can receive confidential information and address any issues directly with the IRS. This streamlines the process and helps resolve tax matters more efficiently.

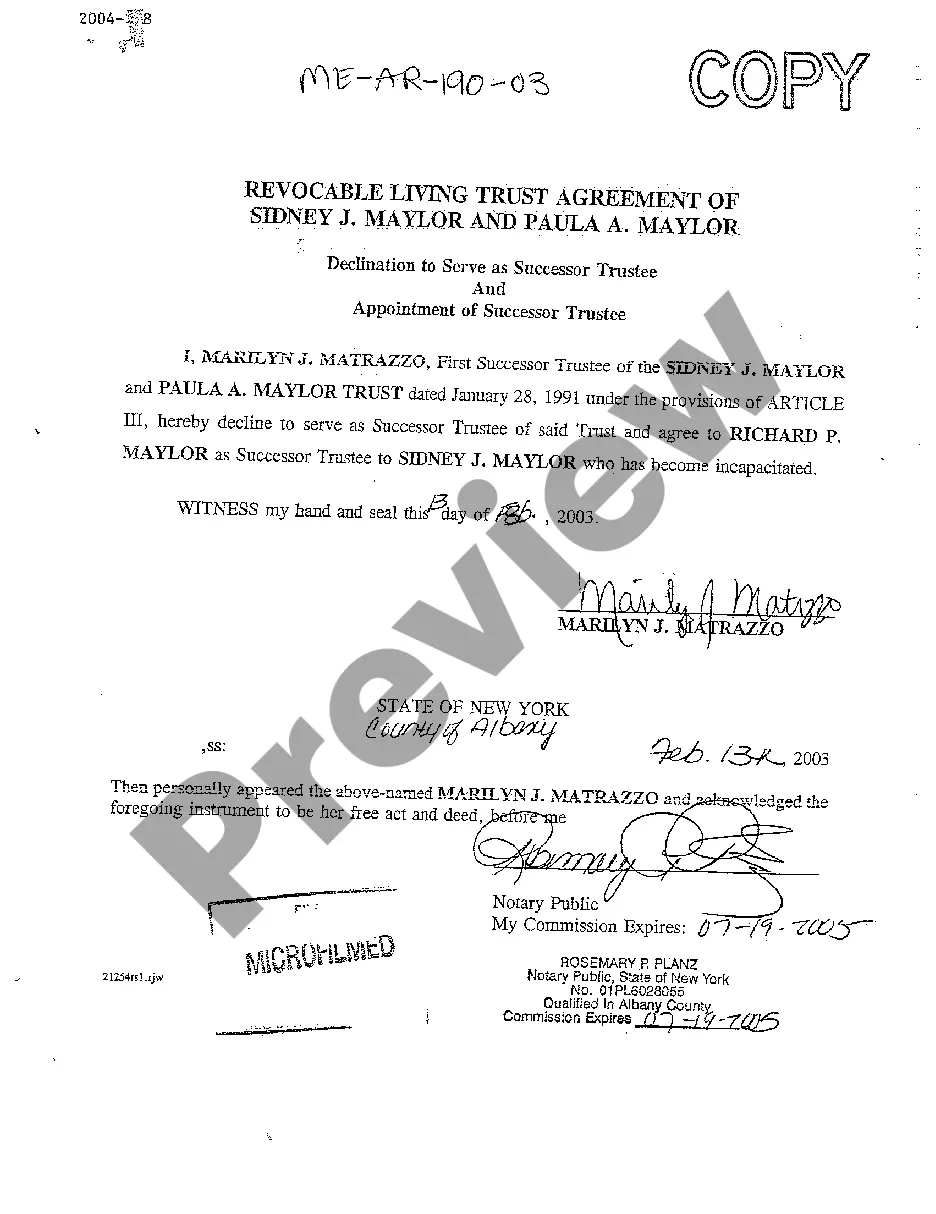

The primary IRS form used for a trust is Form 1041, which is an income tax return specifically for estates and trusts. However, when appointing a trustee, filing Form 56 is equally important. Both forms are essential for properly setting up your trustee appointment form with IRS and ensuring you meet all tax reporting requirements.

Yes, a trustee must file Form 56 to formally notify the IRS of their appointment. This filing establishes your legal authority to act on behalf of the trust and manage its tax obligations. Proper completion of the trustee appointment form with IRS is essential for complying with IRS regulations and protecting your position as a trustee.

Filing a certificate of appointment with the IRS involves submitting Form 56 along with any necessary documentation that proves your appointment as fiduciary. You can send the form by mail to the designated IRS address or submit it electronically if available. Ensuring that your paperwork is complete can streamline the process of your trustee appointment form with IRS.