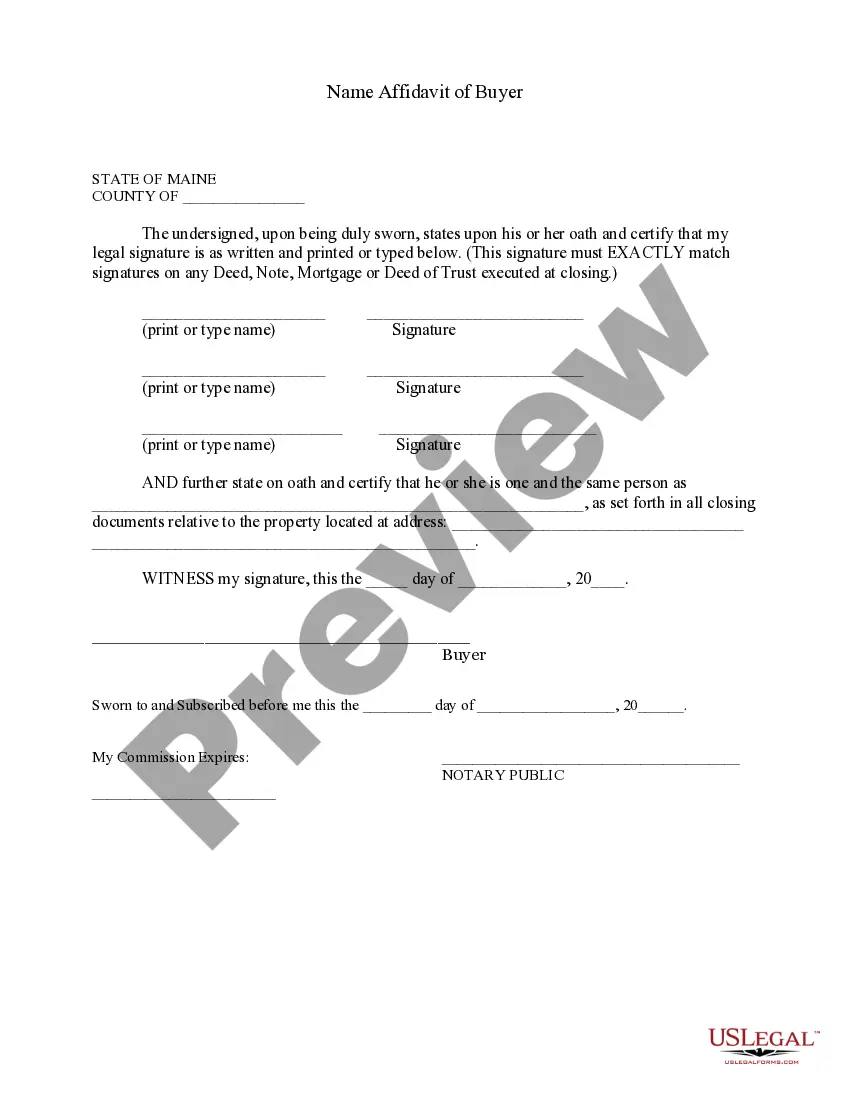

The Buyers Name Affidavit is for the Buyer to provide a statement of his or her legal name and signature, as well as to certify to other "known as" names. Many times persons sign documents in different ways and the name affidavit is necessary to clarify that the signatures are one and the same person. i.e. John Jones, John T. Jones and J.T. Jones are one and the same person.

Same Name Affidavit Maine Withholding

Description

How to fill out Same Name Affidavit Maine Withholding?

There are no further justifications to waste time searching for legal documents to adhere to your local state guidelines.

US Legal Forms has compiled all of them in a single location and made them more accessible.

Our site provides over 85k templates for any business and personal legal situations categorized by state and area of application.

Using the Search field above, explore for another template if the one currently displayed doesn’t meet your requirements.

- All forms are correctly drafted and verified for accuracy, ensuring that you receive an up-to-date Same Name Affidavit Maine Withholding.

- If you are acquainted with our platform and already have an account, make sure your subscription is active before accessing any templates.

- Log In/">Log In to your account, choose the document, and click Download.

- You can also revisit all saved documents anytime needed by accessing the My documents tab in your profile.

- If this is your first experience with our platform, the process will require a few additional steps to complete.

- Here’s how new users can acquire the Same Name Affidavit Maine Withholding from our library.

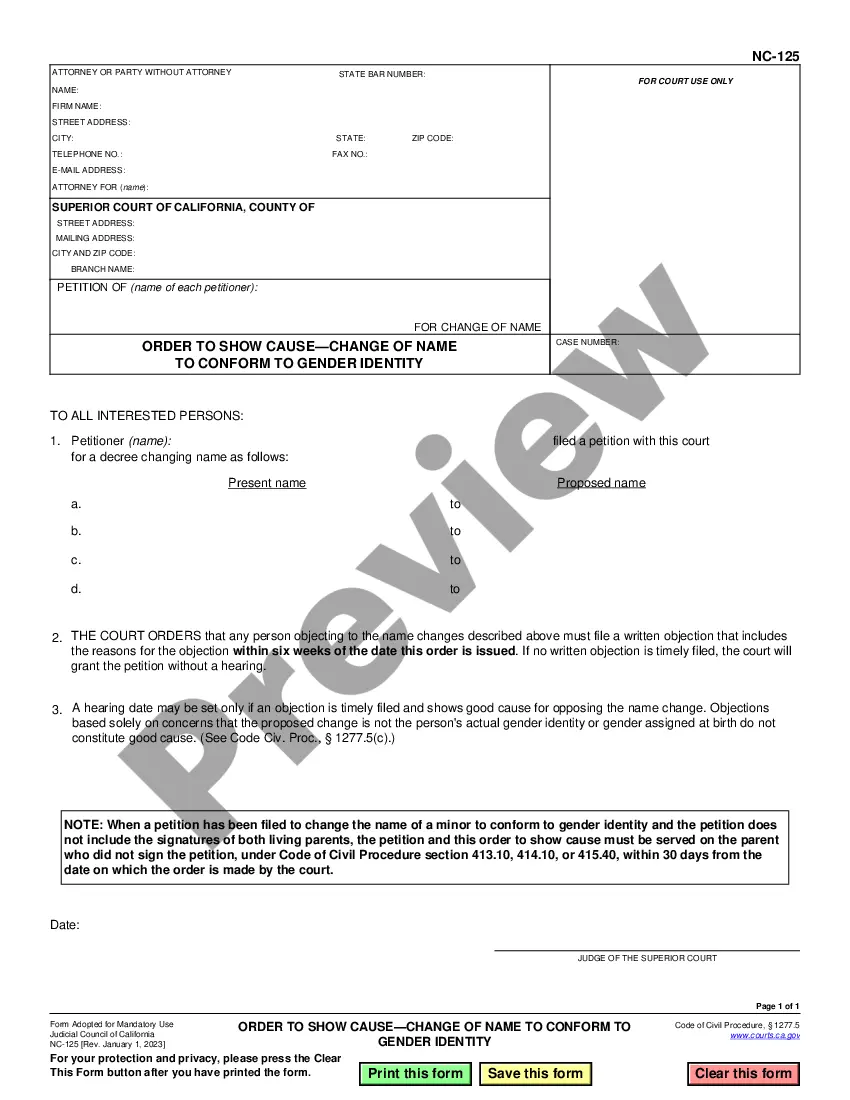

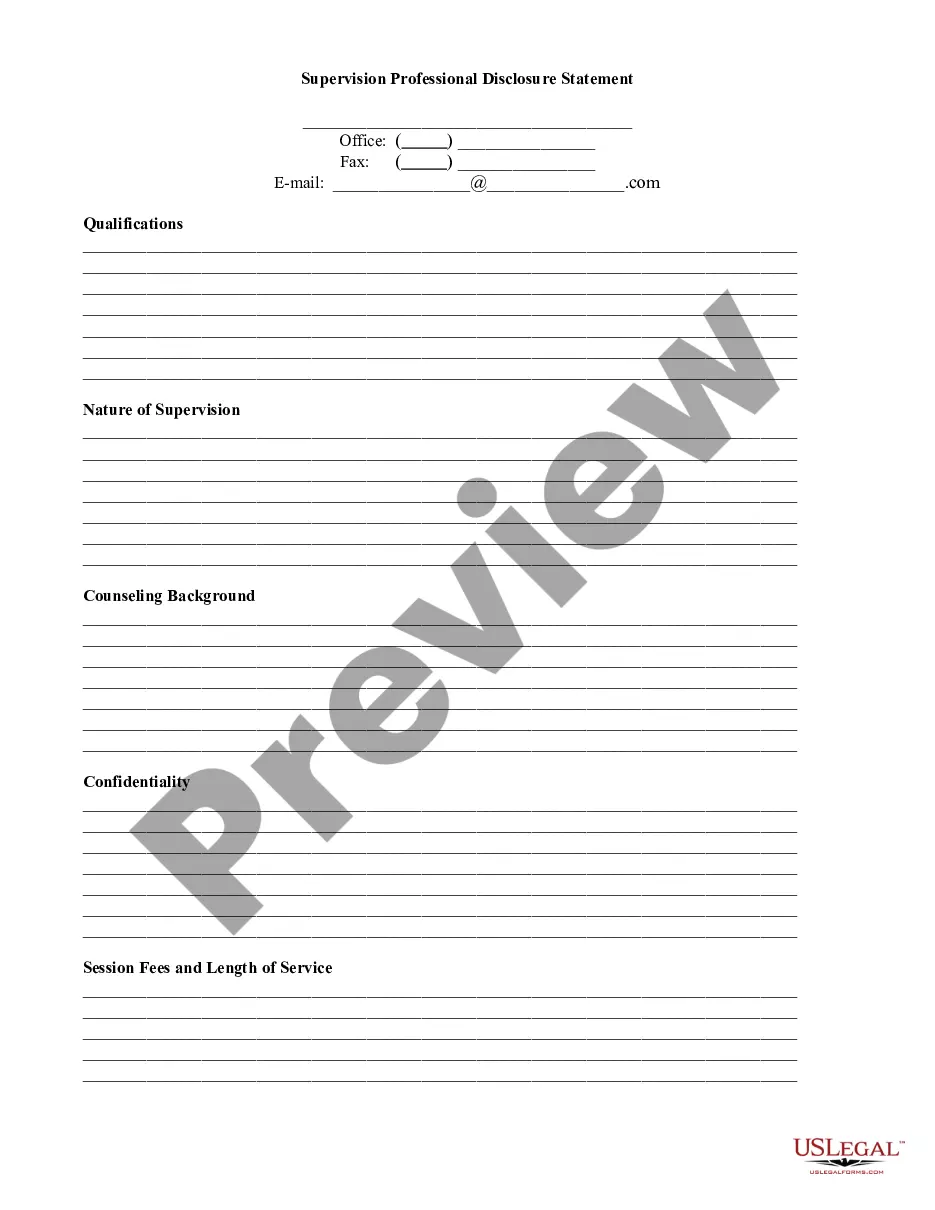

- Review the page content thoroughly to confirm it contains the example you need.

- To assist with this, utilize the form description and preview options if available.

Form popularity

FAQ

Pass-through taxation refers to businesses that do not pay taxes on the entity level. Instead, the income passes to the owners of the business who pays personal income taxes for their share of the business.

Claiming 1 allowance is typically a good idea if you are single and you only have one job. You should claim 1 allowance if you are married and filing jointly. If you are filing as the head of the household, then you would also claim 1 allowance. You will likely be getting a refund back come tax time.

It should be the first name, middle name and last name in that order. Enter your social security number and write your address. Your address should contain street, city, town, state and zip code. Step 3: For line 1, check the box if you do not want any federal income tax withheld from your pension or annuity.

Purpose: Complete Form W-4ME so your employer/payer can withhold the correct Maine income tax from your pay. Because your tax situation may change, you may want to recalculate your withholding each year.

200bPass-through withholding is the amount required to be reported and paid by the pass-through entity on behalf of its nonresident partners, shareholders, and beneficiaries.