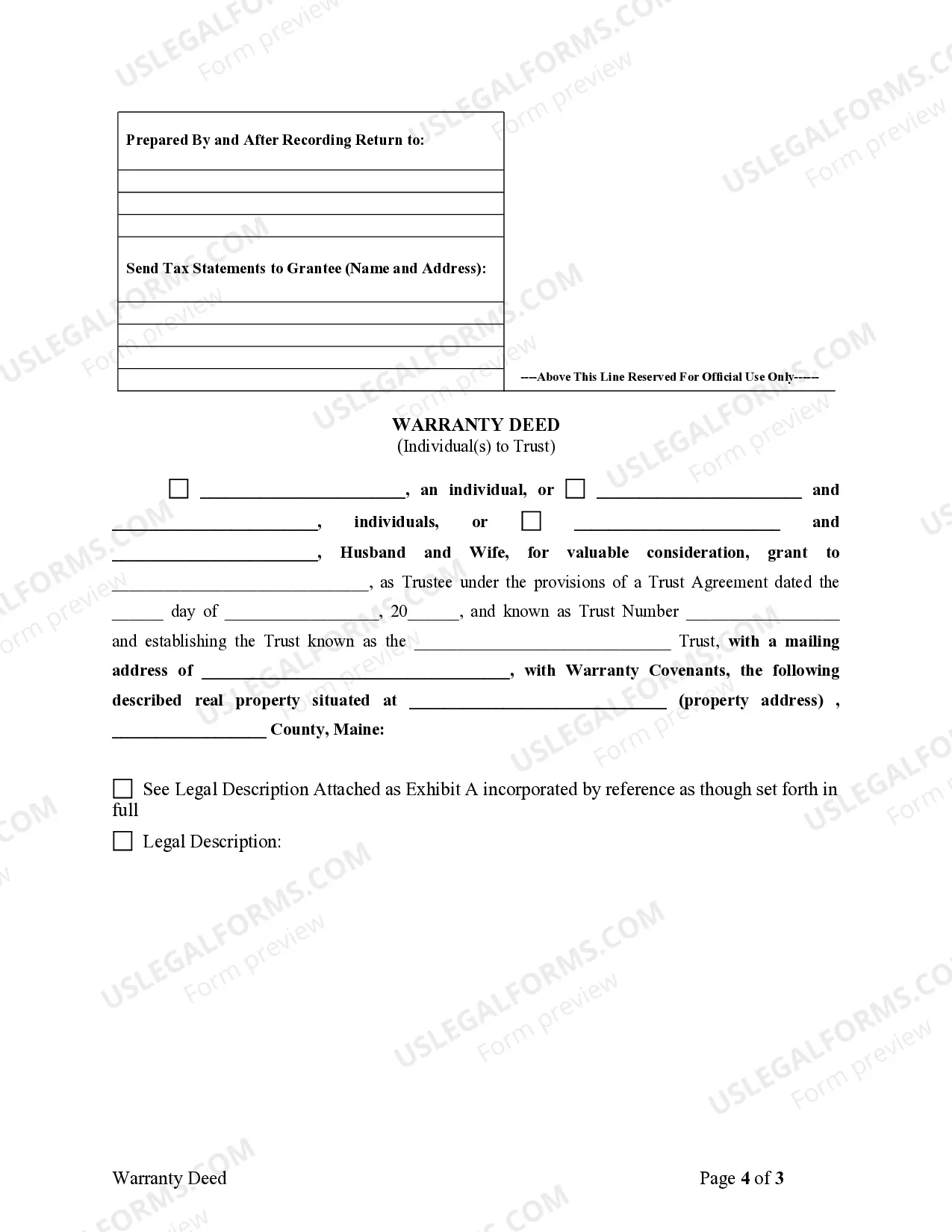

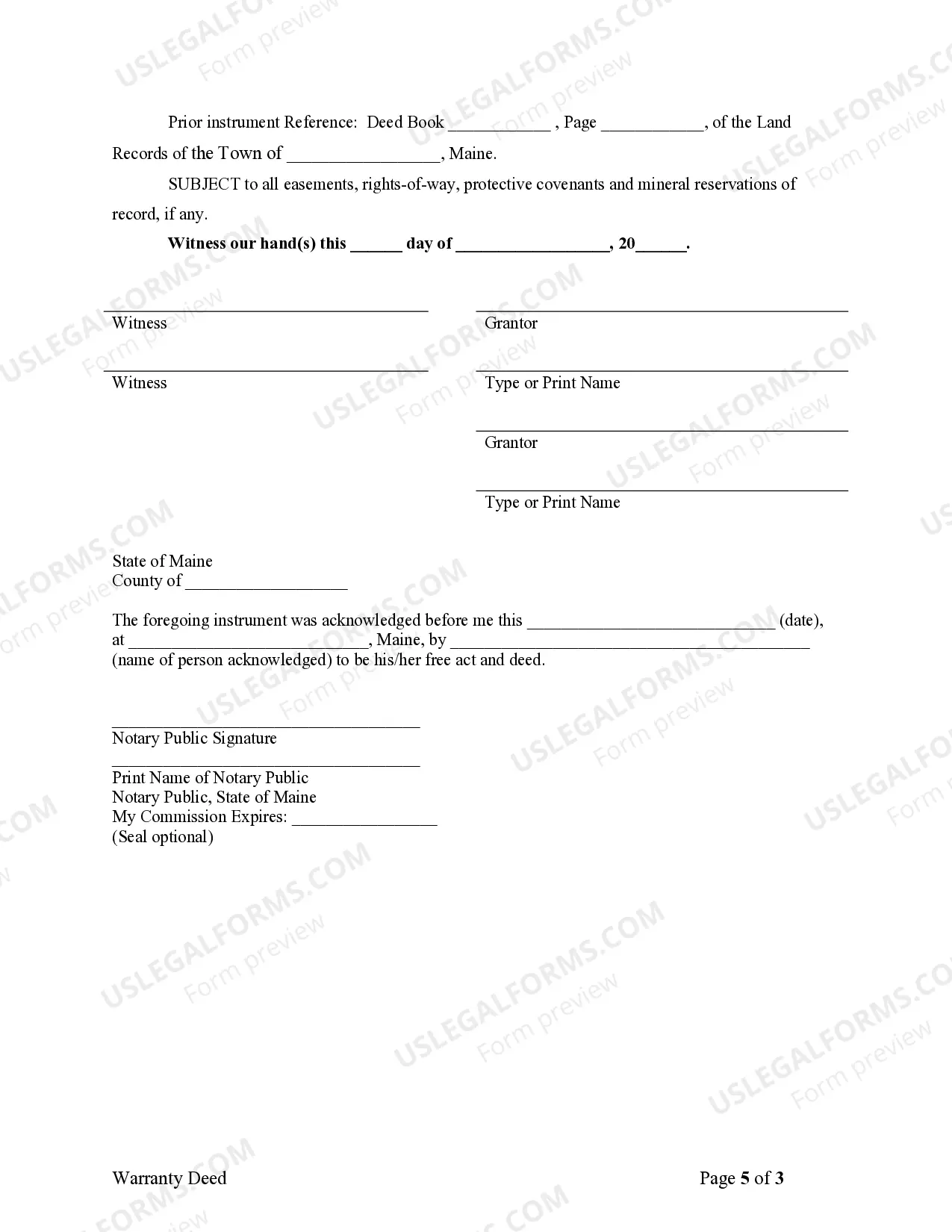

This form is a Warranty Deed where the grantor is an individual and the grantee is a trust.

Maine Deed Trust For Sale

Description

How to fill out Maine Deed Trust For Sale?

There's no longer a need to waste hours searching for legal documents to meet your local state obligations.

US Legal Forms has gathered all of them in one convenient location and enhanced their availability.

Our platform provides over 85,000 templates for any business or individual legal needs organized by state and area of application. All forms are properly drafted and verified for accuracy, so you can trust that you are obtaining a current Maine Deed Trust For Sale.

Select the most suitable pricing plan and create an account or Log In. Process your payment for the subscription using a card or PayPal to continue. Choose the file format for your Maine Deed Trust For Sale and download it to your device. Print your form to finish it in writing or upload the document if you prefer to complete it using an online editor. Creating official documents under federal and state laws and regulations is quick and easy with our platform. Try US Legal Forms today to keep your records organized!

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before retrieving any templates.

- Log In to your account, select the document, and click Download.

- You can also access all saved documents whenever required by selecting the My documents tab in your profile.

- If you are using our platform for the first time, the process will require a few additional steps to complete.

- Here's how new users can find the Maine Deed Trust For Sale in our catalog.

- Review the page content carefully to ensure it includes the sample you need.

- To do this, use the form description and preview options if available.

- Utilize the Search field above to find another template if the previous one did not suit your needs.

- Click Buy Now next to the template title once you locate the appropriate one.

Form popularity

FAQ

Maine operates primarily under a mortgage system rather than a deed of trust system. This means that lenders use mortgages to secure loans instead of deeds of trust, which are more common in other states. If you are interested in a Maine deed trust for sale, understanding local regulations can help you make informed decisions.

You can find liens on a property in Maine by searching public records at the county registry of deeds or through the Maine Secretary of State's website. You may also consider hiring a title search company for a thorough investigation. If you are looking for a Maine deed trust for sale, ensuring a clear title is essential to avoid future complications.

To add someone to a house deed in Maine, you must create a new deed that includes both the current owner's and the new owner's names. After preparing this deed, file it with the county registry of deeds to make it official. Consider using a Maine deed trust for sale as a solution to manage property ownership effectively.

Gifting a house in Maine involves a few steps. First, you must prepare a new deed that names the recipient as the new owner. Next, you should file the deed with the appropriate county office, while also considering any potential tax implications. If you are considering a Maine deed trust for sale, ensure your gift aligns with your broader estate planning goals.

The capital gains rate in Maine generally aligns with the state’s income tax rates, which can range from 5.8% to 7.15%. Understanding how capital gains tax applies when selling property is important, especially if you are dealing with a Maine deed trust for sale. To get the most out of your investment, seeking advice from a tax professional is wise. They can help you navigate any potential tax obligations and maximize your profits.

Typically, the seller pays the recording fees for the deed in a real estate transaction. However, this can vary based on the terms negotiated in the sales agreement. If you’re managing a Maine deed trust for sale, it's important to clarify these details in your contract to avoid any misunderstandings. Being aware of these expenses will help you plan better financially.

To file a deed in Maine, you need to prepare the deed document according to state requirements. You'll then file the deed with the appropriate county registry of deeds. Electronic filing is also available in some counties, making the process easier. If you have a Maine deed trust for sale, understanding the filing process ensures that you can manage your property efficiently.

Maine does have an estate tax, but it does not impose an inheritance tax. Instead, estate taxes are calculated based on the value of the estate at the time of death. When considering a Maine deed trust for sale, it's crucial to understand how these taxes may affect you. Consulting a legal expert can ensure you navigate these tax implications effectively.

Recording a deed means submitting it to the local government office, which officially documents the property's ownership transfer. This process creates a public record that protects your ownership rights and provides legal proof of your interest in the property. If you are exploring a Maine deed trust for sale, recording the deed is a crucial step to finalize your transaction.

A deed transfer in Maine involves preparing a new deed that accurately reflects the property being transferred. After signing and notarizing the deed, you must record it at the county registry of deeds. Utilizing a Maine deed trust for sale can streamline this process and ensure compliance with all legal requirements.