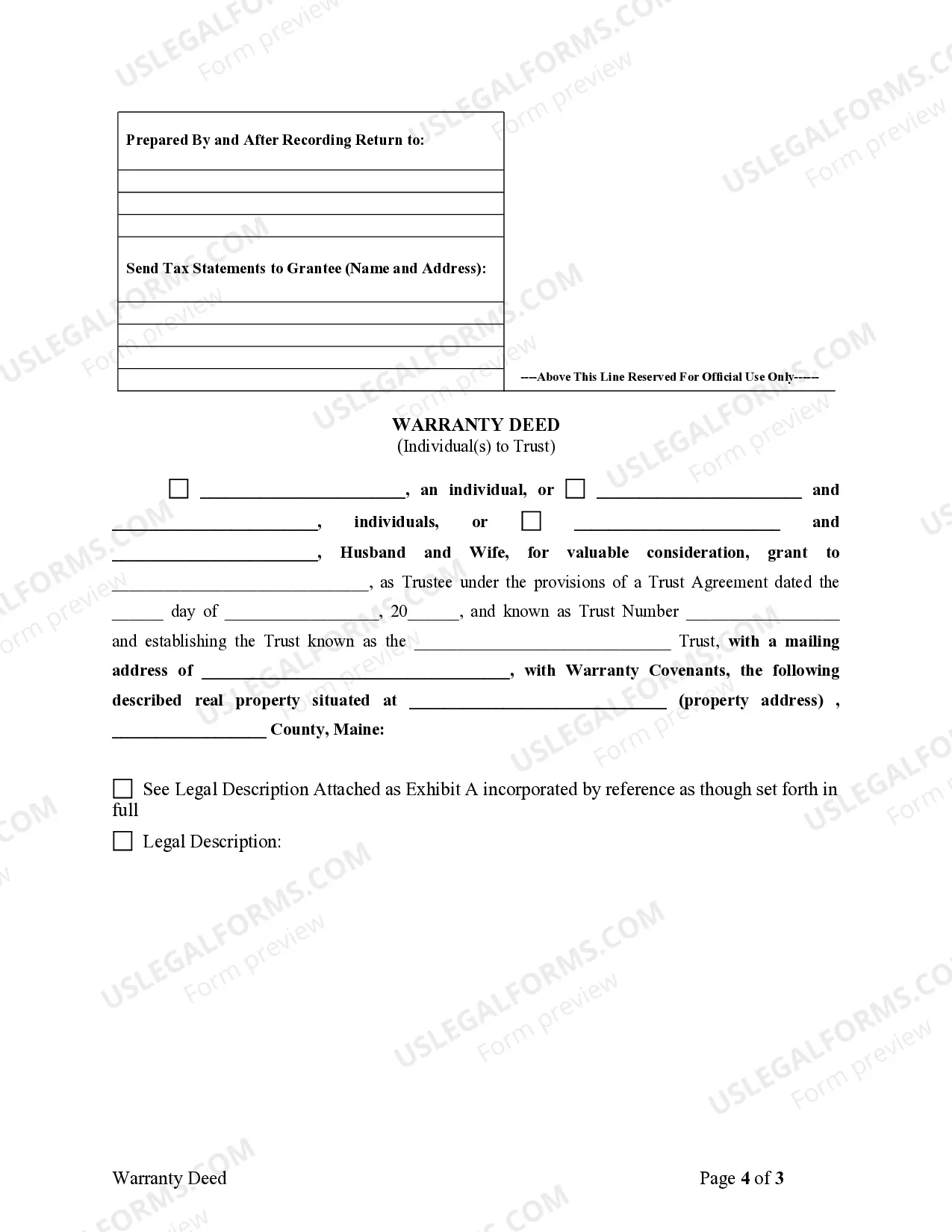

This form is a Warranty Deed where the grantor is an individual and the grantee is a trust.

Maine Deed Trust Form

Description

How to fill out Maine Deed Trust Form?

Individuals frequently connect legal documents with something intricate that only an expert can manage.

In a way, this is accurate, as preparing the Maine Deed Trust Form necessitates a thorough comprehension of the relevant criteria, encompassing state and local laws.

However, with US Legal Forms, matters have become more straightforward: pre-made legal templates for any personal and business circumstance specific to state statutes are compiled in a unified online repository and are now accessible to everyone.

Print your document or upload it to an online editor for a faster completion process. All templates in our library are reusable: once obtained, they remain stored in your profile. You can access them anytime through the My documents tab. Explore all the advantages of using the US Legal Forms platform. Subscribe today!

- Review the page content carefully to confirm it meets your requirements.

- Examine the form description or inspect it through the Preview option.

- Find another example via the Search field above if the previous one does not meet your criteria.

- Click Buy Now once you discover the suitable Maine Deed Trust Form.

- Choose the subscription plan that suits your preferences and financial plan.

- Create an account or sign in to continue to the payment page.

- Pay for your subscription using PayPal or with your credit card.

- Select the format for your document and click Download.

Form popularity

FAQ

Form 3520-A must be filed by the trustee of a foreign trust that has U.S. owners. This form provides important information about the trust's activities and finances. If you are involved with such a trust, ensure that the trustee is aware of this filing requirement to avoid any potential penalties.

To report a grantor trust letter on your Form 1040, simply include the relevant income on the appropriate lines of the tax form. Since the income belongs to you as the grantor, you must assess it alongside your other personal income. Ensure that your records reflect the grantor trust information accurately, as this will facilitate a smooth reporting process.

The tax rate for trusts in Maine can vary based on the income level of the trust. Maine imposes a progressive tax system, meaning the tax rate increases as income increases. It's advisable to consult with a tax professional familiar with Maine tax laws to understand how these rates might apply to your particular trust situation.

A grantor trust generally does not file a separate tax return because its income is reported on the grantor's personal tax return. Instead, you should include the income on your Form 1040. It’s crucial to maintain accurate records related to the grantor trust transactions, as these will assist you in preparing your taxes each year.

Form 3520 and Form 3520A are both related to trusts, but they serve different purposes. Form 3520 is used to report transactions with foreign trusts or the receipt of certain foreign gifts. On the other hand, Form 3520A is an annual information return for foreign trusts with U.S. owners, providing detailed information about the trust’s activities. If you are dealing with trusts, it's essential to understand which form applies to your situation.

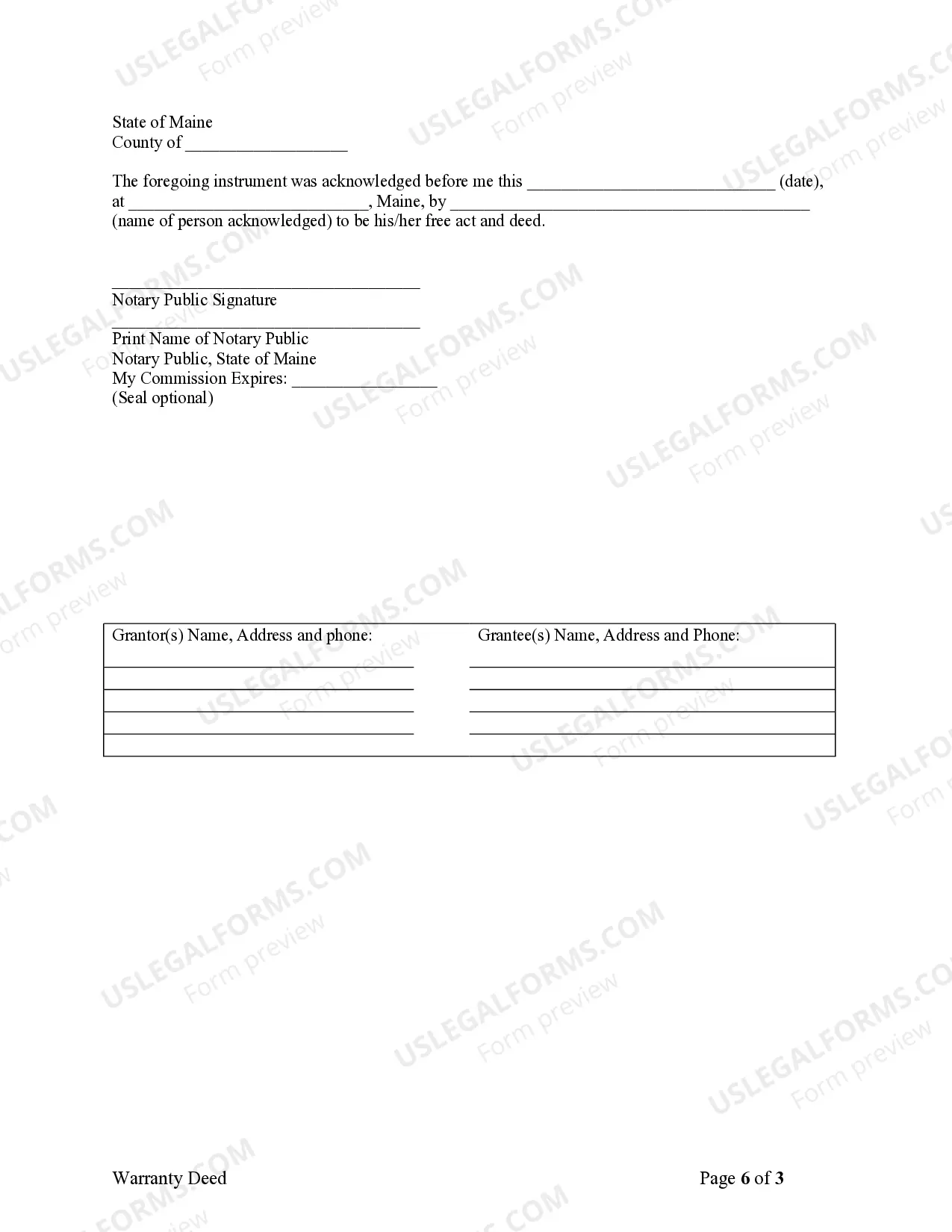

When creating a trust in Maine, you typically need to file a Maine deed trust form to establish the trust's legal presence. This form outlines essential information regarding the trust, such as the grantor, trustee, and beneficiaries. Remember to check if any additional documents are required for specific types of trusts, as this can vary based on your individual circumstances.

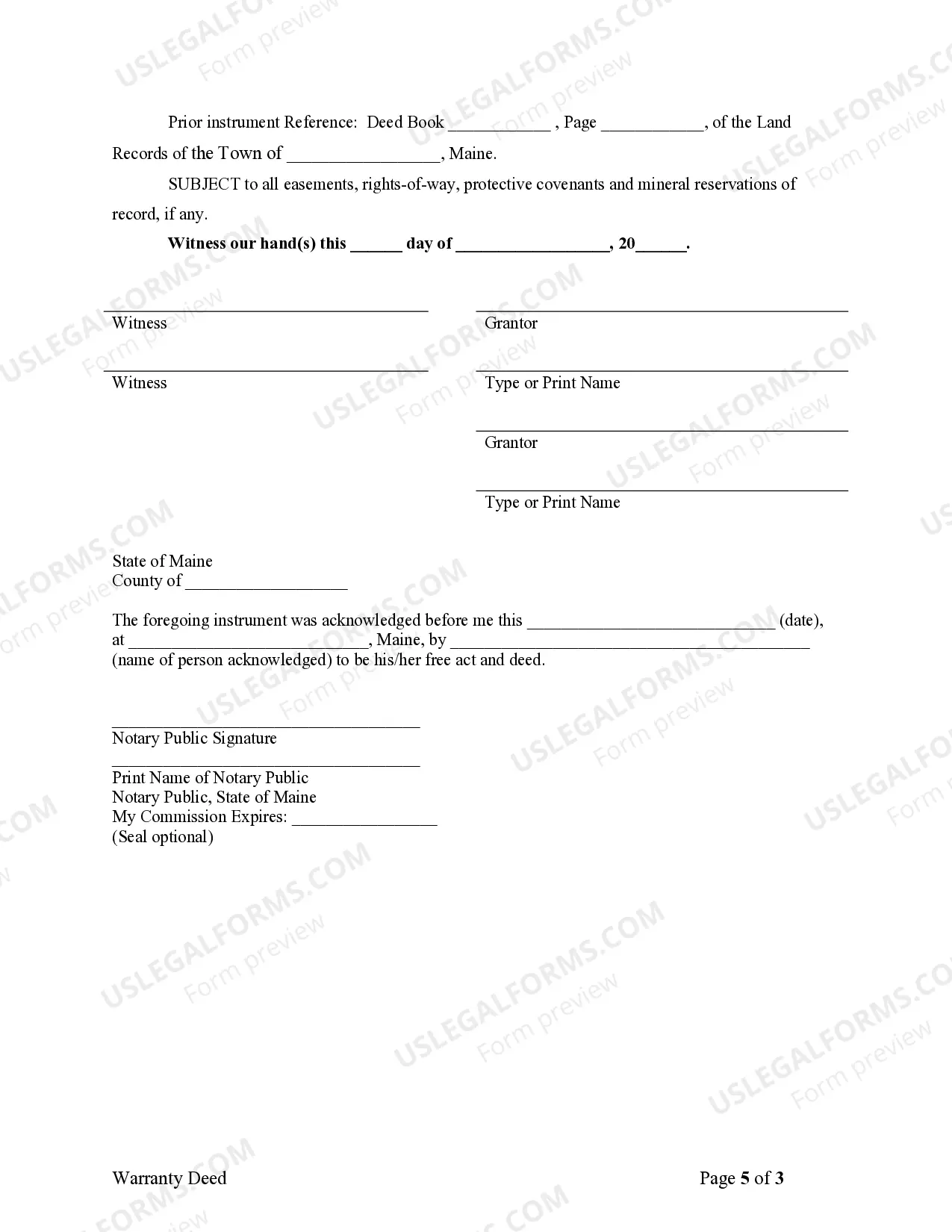

To set up a trust in Maine, begin by defining your goals and the type of trust that suits your needs. You will need to prepare a Maine deed trust form that includes details about the trust assets and beneficiaries. After drafting the document, have it signed and notarized to ensure its validity. Lastly, consider consulting with a legal professional to guide you through the process and to ensure compliance with state laws.

Yes, Maine is considered a deed of trust state. This means that lenders can secure loans using a deed of trust, which creates a legal pledge on the property. Utilizing a Maine deed trust form allows you to navigate lending arrangements effectively while ensuring all legal obligations are met.

To obtain a trust deed, you can either draft one yourself or utilize a professional service for accuracy and compliance. Many individuals find it beneficial to use platforms like US Legal Forms, where you can access ready-to-use templates for Maine deed trust forms. These forms streamline the process and help you adhere to state regulations.

In Maine, a deed must include essential elements such as the names of the parties involved, a clear description of the property, and the signature of the grantor. It also needs to be notarized and recorded with the appropriate registry of deeds. Using a Maine deed trust form helps ensure that you meet all legal requirements effectively.