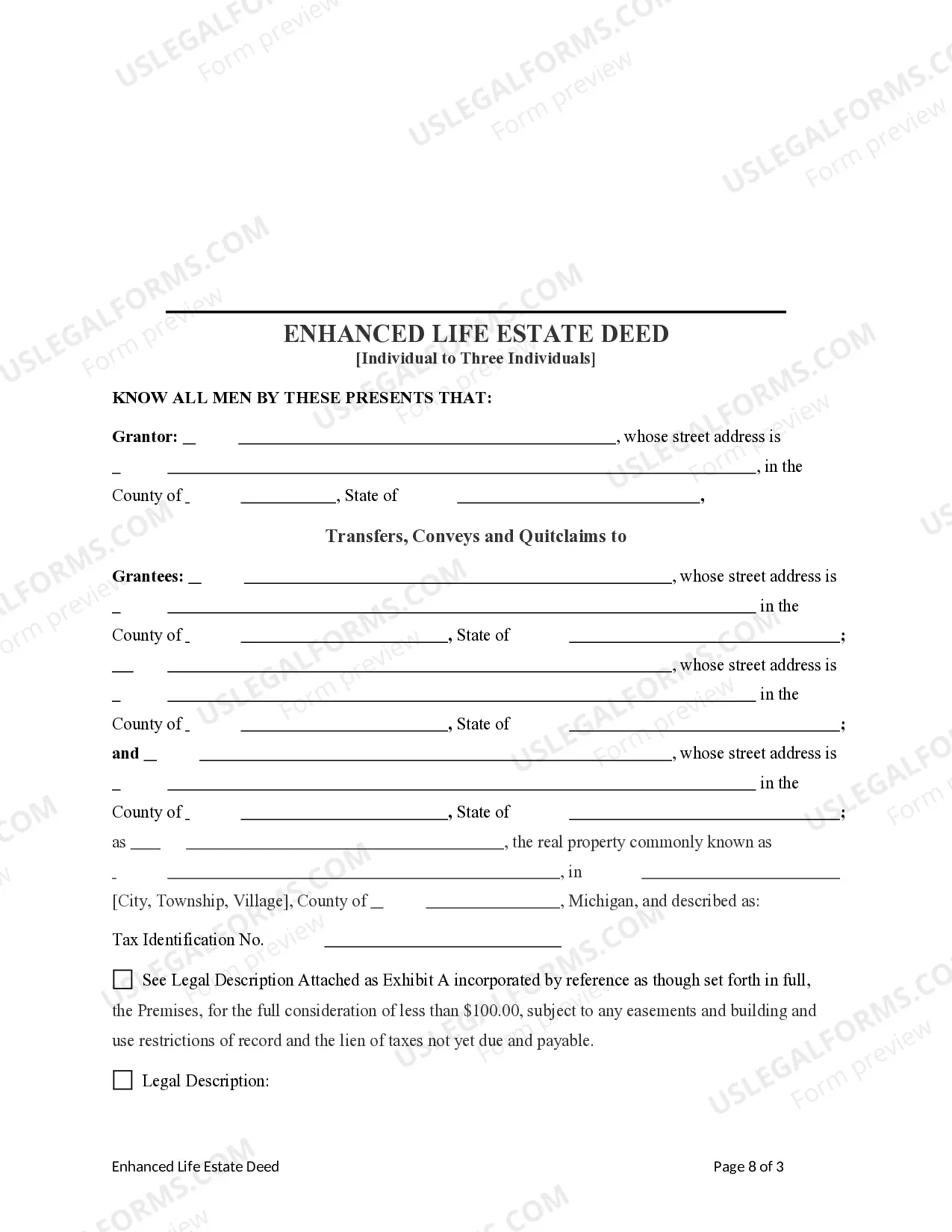

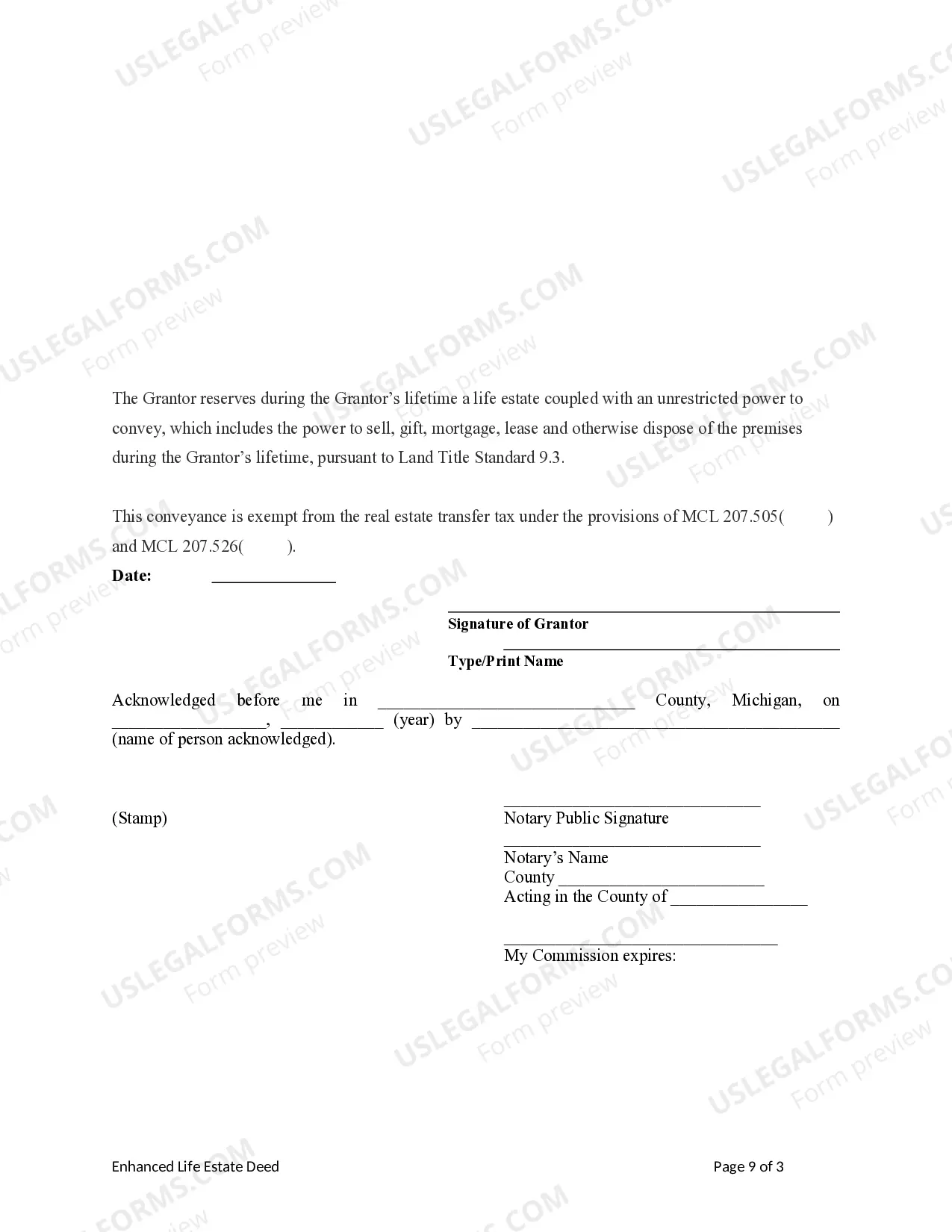

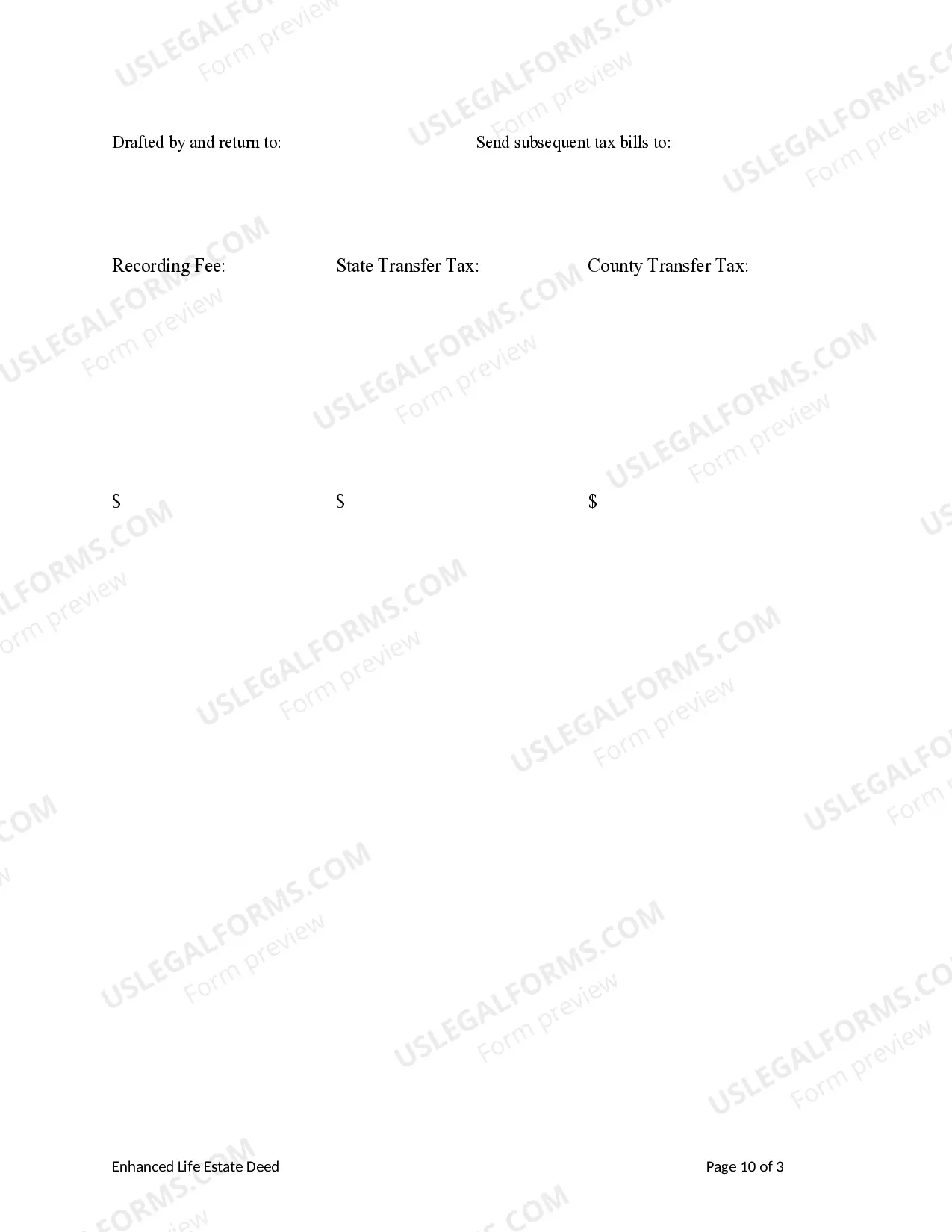

This form is a Quitclaim Deed with a retained Enhanced Life Estate where the Grantor is an individual and the Grantees are three individuals. It is also known as a "Lady Bird" Deed. Grantor conveys the property to Grantees subject to an enhanced retained life estate. The Grantor retains the right to sell, encumber, mortgage or otherwise impair the interest Grantees might receive in the future, without joinder or notice to Grantees, with the exception of the right to transfer the property by will. This deed complies with all state statutory laws.

Transfer On Death Deed Form Michigan

Description

How to fill out Transfer On Death Deed Form Michigan?

There's no longer a need to waste time searching for legal documents to meet your local state standards. US Legal Forms has compiled all of them in a single location and made them easier to access.

Our platform offers over 85,000 templates for any business or personal legal situation categorized by state and purpose. All forms are properly drafted and verified for validity, so you can be assured of obtaining an up-to-date Transfer On Death Deed Form Michigan.

If you are familiar with our service and already possess an account, ensure your subscription is active before accessing any templates. Log In/">Log In to your account, select the document, and click Download. You can also return to all saved documents at any time by navigating to the My documents tab in your profile.

You can print your form to complete it by hand or upload the document if you prefer using an online editor. Preparing legal documents under federal and state laws is quick and simple with our library. Try US Legal Forms now to keep your paperwork organized!

- If you have not yet utilized our service, the process will require a few additional steps to complete.

- Carefully examine the page content to confirm it contains the sample you need.

- To do so, make use of the form description and preview options if available.

- Use the Search field above to look for another sample if the current one does not meet your needs.

- Once you locate the right one, click Buy Now next to the template title.

- Choose the most appropriate pricing plan and register for an account or Log In/">Log In.

- Proceed to make payment for your subscription using a card or through PayPal.

- Select the file format for your Transfer On Death Deed Form Michigan and download it to your device.

Form popularity

FAQ

To obtain a transfer on death deed in Michigan, first, you need to fill out the proper form, often referred to as the transfer on death deed form Michigan. You can find this form online through platforms like US Legal Forms, which provide easy access to state-specific documents. After completing the form, file it with your local county clerk's office to make it legally binding. It is a straightforward process, but you may want to seek assistance from a legal expert to ensure every detail is correct.

You can create your own ladybird deed in Michigan, but it is advisable to use the correct legal language to ensure its validity. A well-drafted transfer on death deed form Michigan can prevent potential disputes among heirs and ensure your wishes are clearly expressed. Consider using a reputable resource to obtain the correct form, as mistakes can lead to complications later on. Always consult with a legal professional to confirm that your deed meets Michigan law requirements.

Yes, Michigan does allow a transfer on death deed. This deed enables property owners to name beneficiaries who will automatically acquire the property upon their death, thus bypassing the probate process. Utilizing a transfer on death deed form Michigan is a powerful estate planning tool that can simplify property transfer and provide peace of mind to property owners.

To transfer a property deed from a deceased relative in Michigan, you will first need to determine if there was a transfer on death deed form Michigan in place. If such a deed exists, you can follow the instructions provided to transfer ownership directly, avoiding probate. If no deed exists, you may have to go through probate court to gain rightful ownership of the property.

Transferring property after a death in Michigan can be straightforward if proper planning is in place. If a transfer on death deed form Michigan was utilized, beneficiaries can claim the property without entering probate. If not, you may need to initiate a probate process to properly transfer the estate's assets, which can be arduous without guidance.

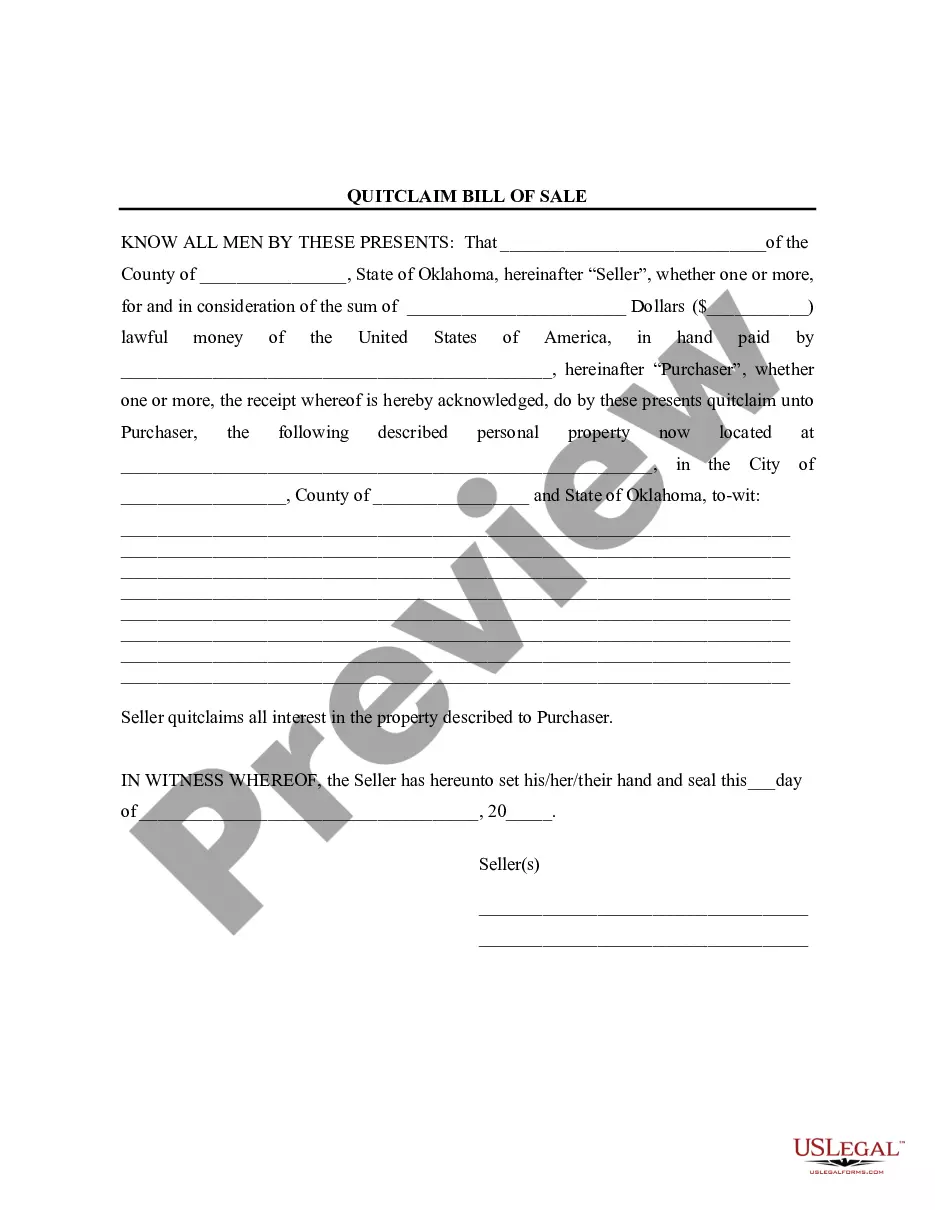

The main difference lies in the control and rights each deed provides. A quitclaim deed transfers whatever interest the owner has in the property with no guarantees, while a ladybird deed allows the owner to retain their rights during their lifetime. This distinction impacts how property is ultimately handled after death, making the transfer on death deed form Michigan a crucial aspect to consider.

Yes, a ladybird deed can effectively avoid probate in Michigan. By designating beneficiaries to inherit the property upon the owner’s death, it sidesteps the lengthy and often costly probate process. This feature makes it an attractive option for many individuals looking to utilize a transfer on death deed form Michigan, ultimately simplifying property transfer for loved ones.

The ladybird deed does have some disadvantages in Michigan. While it enables property owners to retain control during their lifetime, it can complicate tax situations for beneficiaries. Additionally, if the property owner becomes incapacitated, the deed might not provide the desired protection. Understanding these aspects can help you make informed decisions regarding the transfer on death deed form Michigan.

To create a transfer on death deed in Michigan, start by obtaining the transfer on death deed form Michigan from a reliable source, such as USLegalForms. Fill out all required information, including your name, the names of the beneficiaries, and a legal description of the property. Once completed, this form must be signed and filed with the county register of deeds to ensure it is valid and enforceable.

When one person on a deed dies in Michigan, the property typically passes to the surviving co-owners if they hold the deed in joint tenancy. If the deceased owner had a transfer on death deed form Michigan in place, the property would transfer directly to the named beneficiary without going through probate. Understanding these options can simplify matters for the surviving family members.