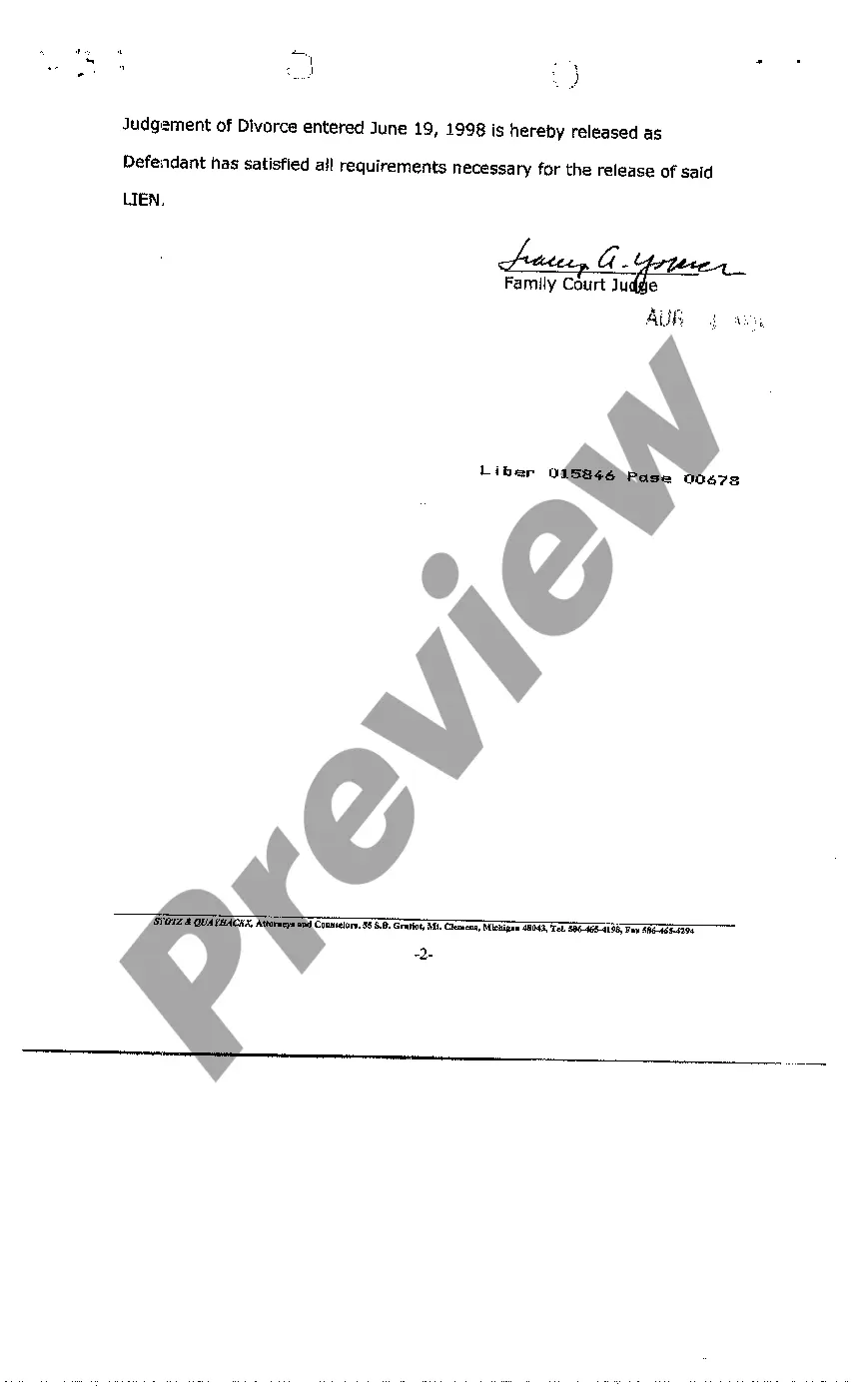

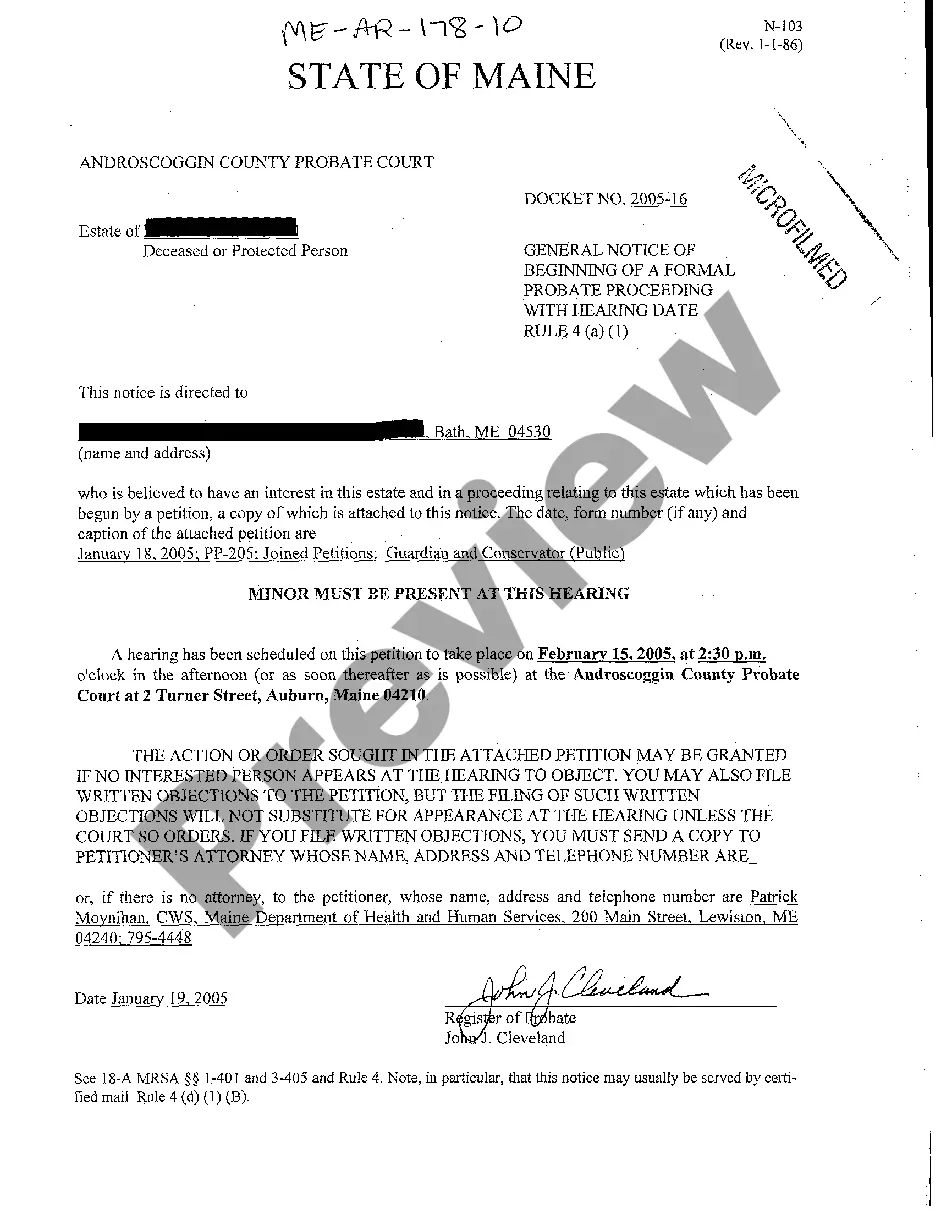

Title: Understanding Lien Release Letter for Car Format | Types and Guidelines Introduction: A lien release letter for a car is a crucial document issued by a lender or financial institution to acknowledge that the borrower or owner of the vehicle has paid off their debt in full. This letter serves as proof that the lien holder relinquishes all legal claims on the car's title, ensuring the owner's complete ownership. In this article, we will dive into the details of the lien release letter format, its significance, and explore any variations that exist. Key Elements: 1. Contact Information: — Full name and address of the lien holder. — Full name, address, and contact details of the borrower or vehicle owner. 2. Vehicle Details: — Year, make, model, and VIN (Vehicle Identification Number) of the car involved. 3. Lien Identification: — Clearly state that the purpose of the letter is to release the lien on the specified vehicle. 4. Loan Information: — State the loan/lien amount originally owed. — Mention the date when the loan was initiated. — Include the loan account number or any other relevant identification number. 5. Statement of Lien Release: — Explicitly state that the lien holder releases all rights, title, and interest in the vehicle. — Highlight that the lien has been satisfied or paid in full. — State the date of final payment. 6. Signatures and Notarization: — Both the lien holder and the borrower/vehicle owner should sign and date the letter. — Notarization may be required depending on local regulations or lender requirements. Types of Lien Release Letter Formats: 1. Standard Lien Release Letter Format: — This format is applicable to regular auto loans, where a lien is placed on the title until the debt is cleared. 2. Conditional Lien Release Letter Format: — This format is used when the borrower pays off a portion of the debt but has an outstanding balance to clear. It confirms that the lien will be released once all payments are completed. 3. Electronic Lien Release Letter Format: — With the digitization of lien processes, some lenders may provide electronically generated lien release letters. These follow similar formats but may require additional digital authentication. Guidelines to Follow: 1. Use official company letterhead for the document. 2. Ensure accurate information regarding the vehicle and parties involved. 3. Keep the letter concise, clear, and professional in tone. 4. Include any specific legal language required by the local jurisdiction or lender. 5. Notarize the letter if mandated. 6. Keep a copy for both the lien holder and the borrower. Conclusion: A lien release letter for a car signifies the end of the financial obligation between the borrower and the lender. By adhering to the appropriate format and considering the specific type of lien release letter required, borrowers can obtain proof of their vehicle's clear ownership. Clear communication, accurate details, and adherence to guidelines ensure the letter's effectiveness, minimizing any future complications.

Lien Release Letter For Car Format

Description title lien release letter

How to fill out Vehicle Release Letter Format?

Working with legal documents and procedures might be a time-consuming addition to your day. Lien Release Letter For Car Format and forms like it typically require that you look for them and navigate how to complete them correctly. Consequently, if you are taking care of financial, legal, or individual matters, using a extensive and practical online catalogue of forms close at hand will go a long way.

US Legal Forms is the best online platform of legal templates, featuring over 85,000 state-specific forms and a variety of resources that will help you complete your documents quickly. Discover the catalogue of appropriate documents accessible to you with just one click.

US Legal Forms provides you with state- and county-specific forms available at any time for downloading. Shield your document management operations with a top-notch service that lets you put together any form within minutes without extra or hidden cost. Just log in to the profile, find Lien Release Letter For Car Format and download it immediately in the My Forms tab. You may also access formerly saved forms.

Would it be your first time utilizing US Legal Forms? Sign up and set up up your account in a few minutes and you will get access to the form catalogue and Lien Release Letter For Car Format. Then, follow the steps below to complete your form:

- Be sure you have discovered the right form by using the Preview feature and reading the form information.

- Choose Buy Now once ready, and select the subscription plan that suits you.

- Choose Download then complete, eSign, and print the form.

US Legal Forms has 25 years of expertise helping users control their legal documents. Get the form you require today and enhance any process without having to break a sweat.

lien release letter for car Form popularity

car lien release letter Other Form Names

lien letter for car FAQ

Under New Jersey state law, a person can only be named a POA, if they meet the following requirements. Competent adult. Signed and dated a power of attorney form. Two witnesses declared a power of attorney form was signed when declarant was of sound mind and body.

Especially as between a husband and wife or a parent and adult child, the law does not delegate legal decision making in favor of a spouse or child in the absence of a written power of attorney, guardianship or conservatorship.

In New Jersey, a durable power of attorney for finances is considered legally valid when it has been signed by the principal in the presence of a notary public. While not required by law, the document should also be signed by two witnesses who can attest to the sound mind of the principal at the time of signing.

A power of attorney is an important document that you want to get right. NJSA B-8.9 provides that a power of attorney must be in writing, duly signed and acknowledged, and notarized, said Catherine Romania, an estate planning attorney with Witman Stadtmauer in Florham Park.

What does it normally cost to get a Power of Attorney form in New Jersey? The fees associated with hiring and working with a lawyer to draft a Power of Attorney might range between $200 and $500.

State laws regulate how power of attorneys are processed and what is required to make it legal, which means this type of document is best created with the guidance of a New Jersey attorney.

To make a power of attorney in New Jersey, you must sign your POA in the presence of a notary public.

What does it normally cost to get a Power of Attorney form in New Jersey? The fees associated with hiring and working with a lawyer to draft a Power of Attorney might range between $200 and $500.