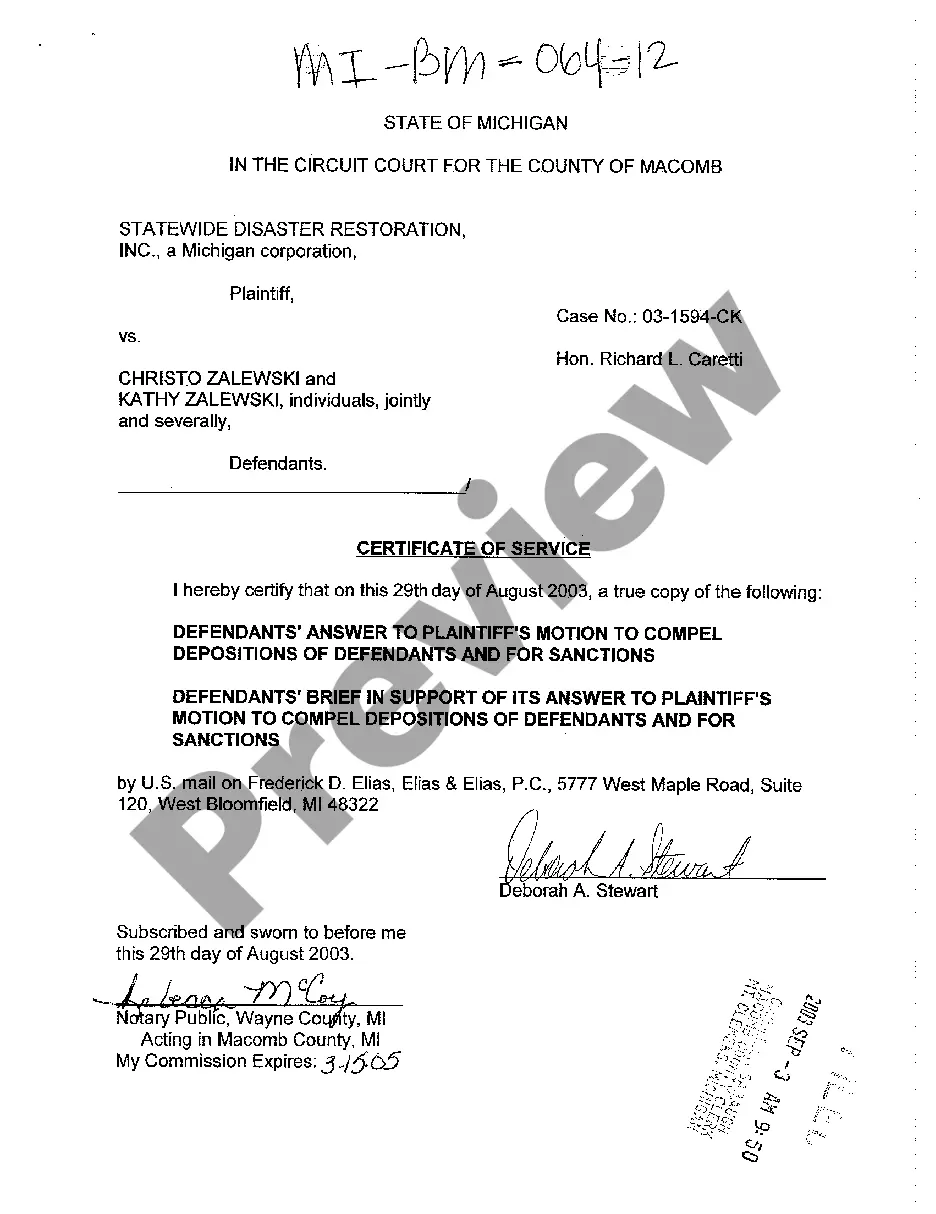

Michigan Certificate Of Service Withdrawal

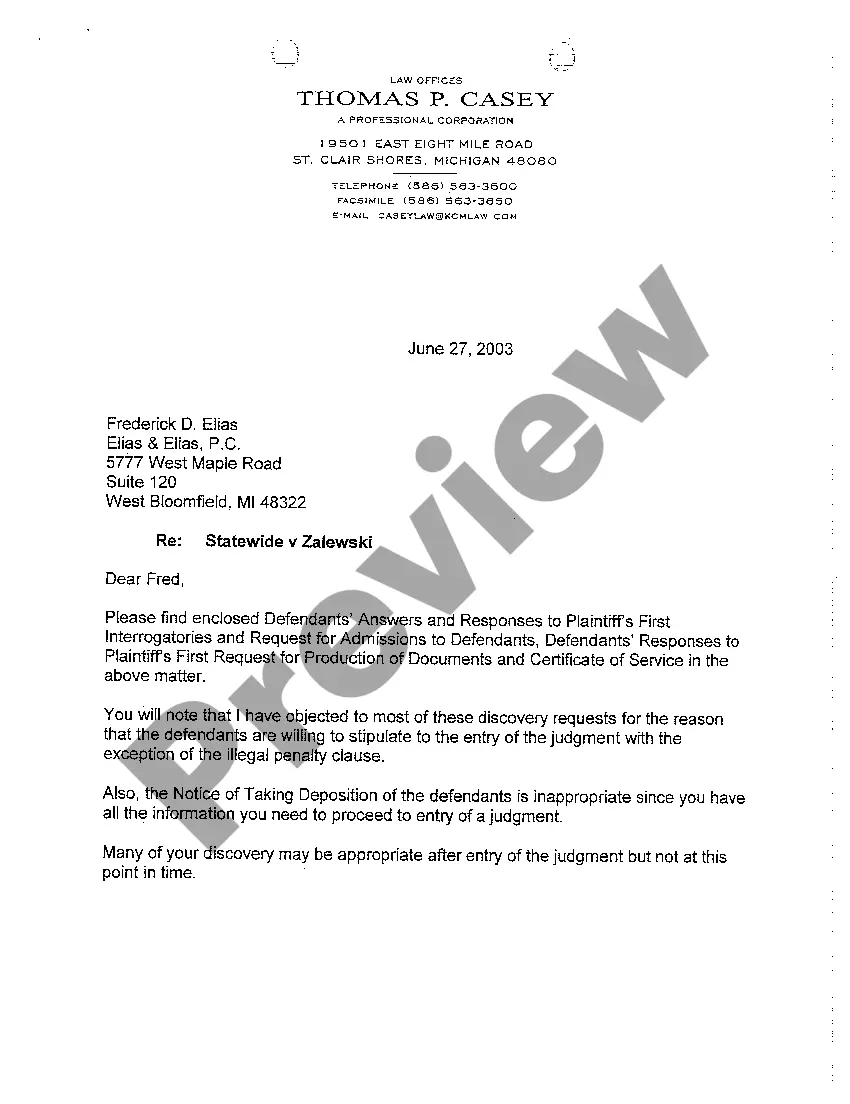

Description

How to fill out Michigan Certificate Of Service Withdrawal?

Whether you handle paperwork frequently or you need to send a legal document from time to time, it is essential to find a resource where all the examples are connected and current.

The first step you should take with a Michigan Certificate Of Service Withdrawal is to verify that it is the most updated version, as it determines its suitability for submission.

If you wish to streamline your search for the most recent document samples, look for them on US Legal Forms.

Utilize the search feature to locate the document you need.

- US Legal Forms is a repository of legal documents which includes nearly every type of document sample you might seek.

- Search for the templates you need, evaluate their relevance immediately, and discover more about their applications.

- With US Legal Forms, you gain access to over 85,000 document templates across various fields.

- Obtain the Michigan Certificate Of Service Withdrawal samples in just a few clicks and save them anytime in your account.

- A US Legal Forms account will allow you to conveniently access all the samples you need without hassle.

- Simply click Log In in the website header and navigate to the My documents section, having all the forms you require at your fingertips, eliminating the need to spend time looking for the best template or checking its validity.

- To acquire a form without creating an account, follow these instructions.

Form popularity

FAQ

In the event that a foreign corporation holding a Certificate of Authority desires to withdraw from this state, it is required to file an Application for Certificate of Withdrawal (form CSCL/CD-561). A tax clearance must be requested from the Michigan Department of Treasury within 60 days of filing the withdrawal.

A certificate of withdrawal is a form for surrendering the certificate of authority of an out of state corporation or limited liability company and withdrawing from the state. State laws, which vary by state, govern the requirements for a certificate of withdrawal.

To dissolve your LLC in Michigan, submit a completed Michigan Certificate of Dissolution form to the Department Licensing and Regulatory Affairs (LARA) by mail or in person. The form cannot be filed online. Use of LARA forms is optional.

To dissolve your LLC in Michigan, submit a completed Michigan Certificate of Dissolution form to the Department Licensing and Regulatory Affairs (LARA) by mail or in person. The form cannot be filed online. Use of LARA forms is optional.

To change the resident agent or the address of the registered office, a Certificate of Change of Registered Office/Agent (CSCL/CD 520) should be filed. After a certificate of authority has been issued, changes may occur which will require the filing of additional documents with the Corporations Division.