Michigan Probate With Close

Instant download

Description Copy Of Petition And Order Of Assignment Michigan

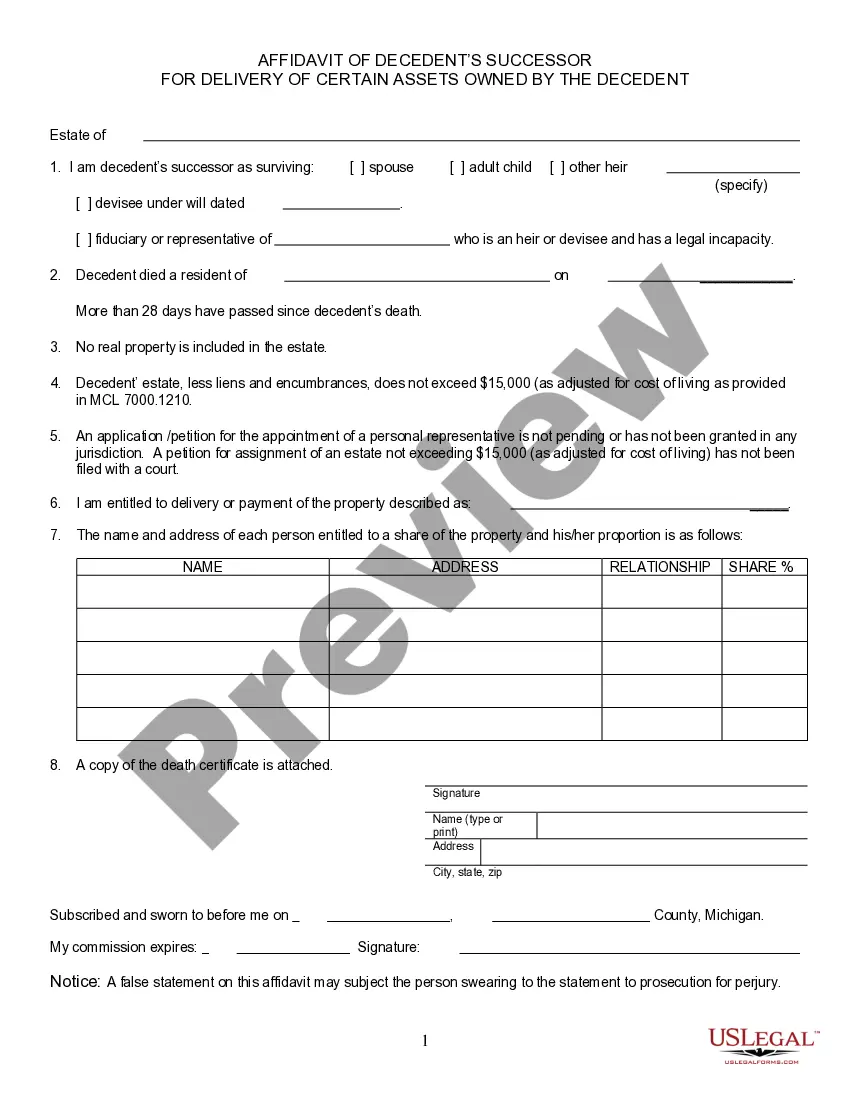

Under Michigan statute, this petition is to be completed and filed by the heir or individual who paid the funeral bill of the decedent. An itemized funeral bill and a copy of the decedent's death certificate along with a list of all assets must be attached to this form.