Michigan Probate With Known Creditors

Description

How to fill out Michigan Probate With Known Creditors?

When you need to complete Michigan Probate With Known Creditors according to your local state's rules, there may be numerous options available. There's no need to review every document to ensure it satisfies all the legal requirements if you are a US Legal Forms member.

It is a dependable service that can assist you in acquiring a reusable and current template on any subject. US Legal Forms boasts the largest online repository with over 85k ready-to-use documents for professional and personal legal situations. All forms are confirmed to adhere to each state's regulations.

Thus, when downloading Michigan Probate With Known Creditors from our platform, you can be assured that you possess a legitimate and updated document.

Select the most fitting subscription plan, Log Into your account, or create a new one. Pay for a subscription (PayPal and credit card options are accessible). Download the template in your preferred file format (PDF or DOCX). Print the document or complete it electronically using an online editor. Obtaining professionally formulated legal documents becomes simple with US Legal Forms. Additionally, Premium users can also benefit from the robust integrated tools for online PDF editing and signing. Give it a try today!

- Acquiring the necessary template from our site is quite straightforward.

- If you already possess an account, simply Log In to the system, ensure your subscription is active, and save the chosen file.

- In the future, you can access the My documents tab in your profile and retrieve the Michigan Probate With Known Creditors at any moment.

- If this is your first visit to our library, kindly follow the instructions below.

- Browse the suggested page and verify it for conformity with your standards.

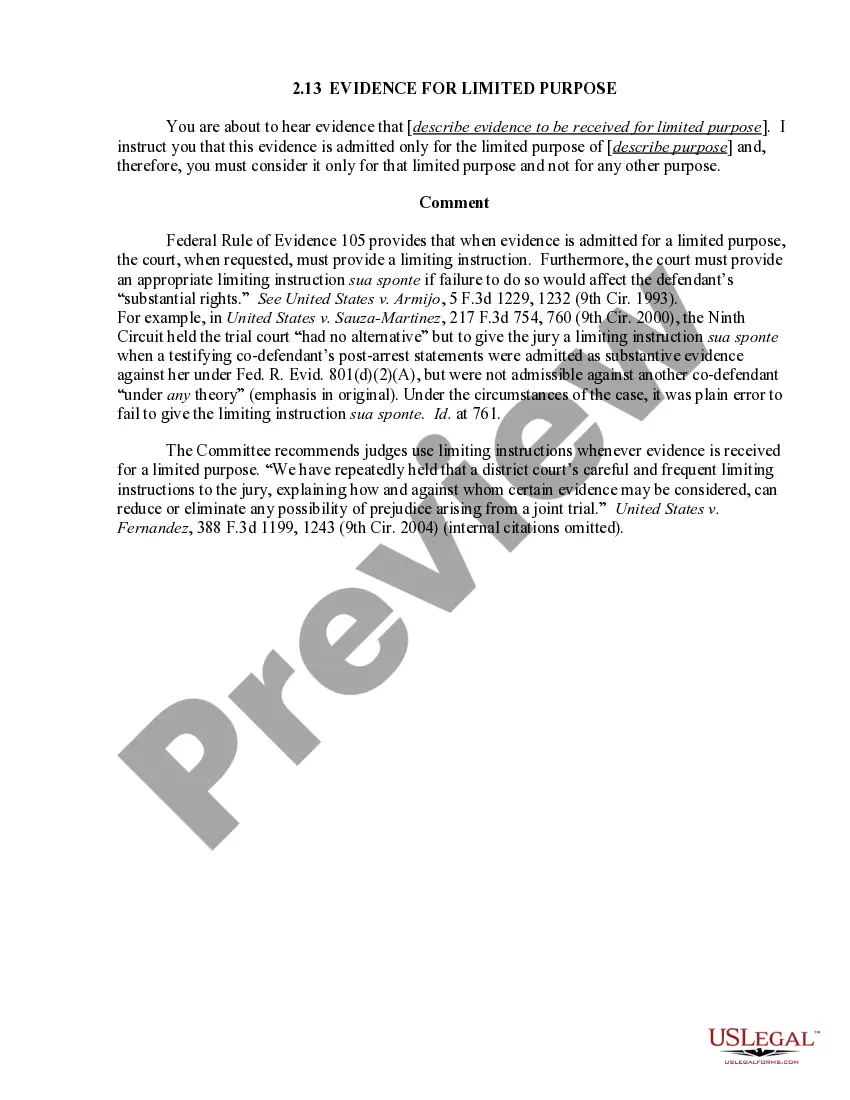

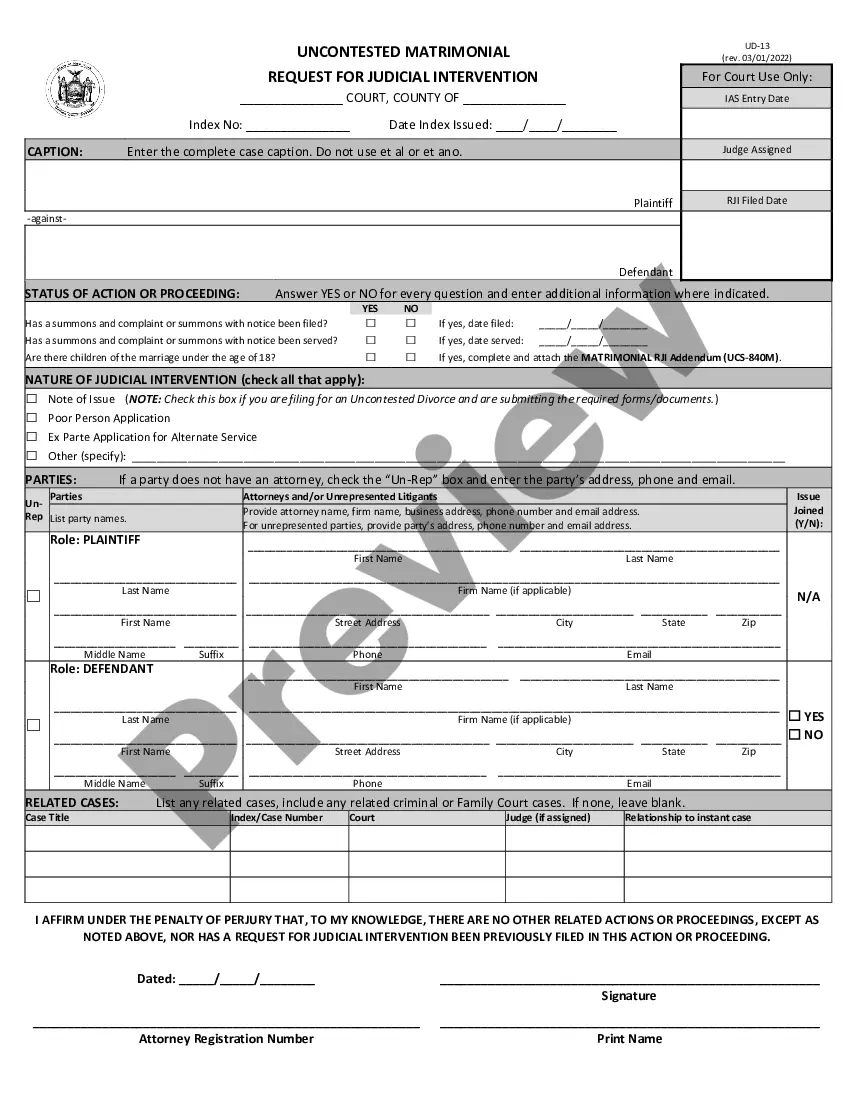

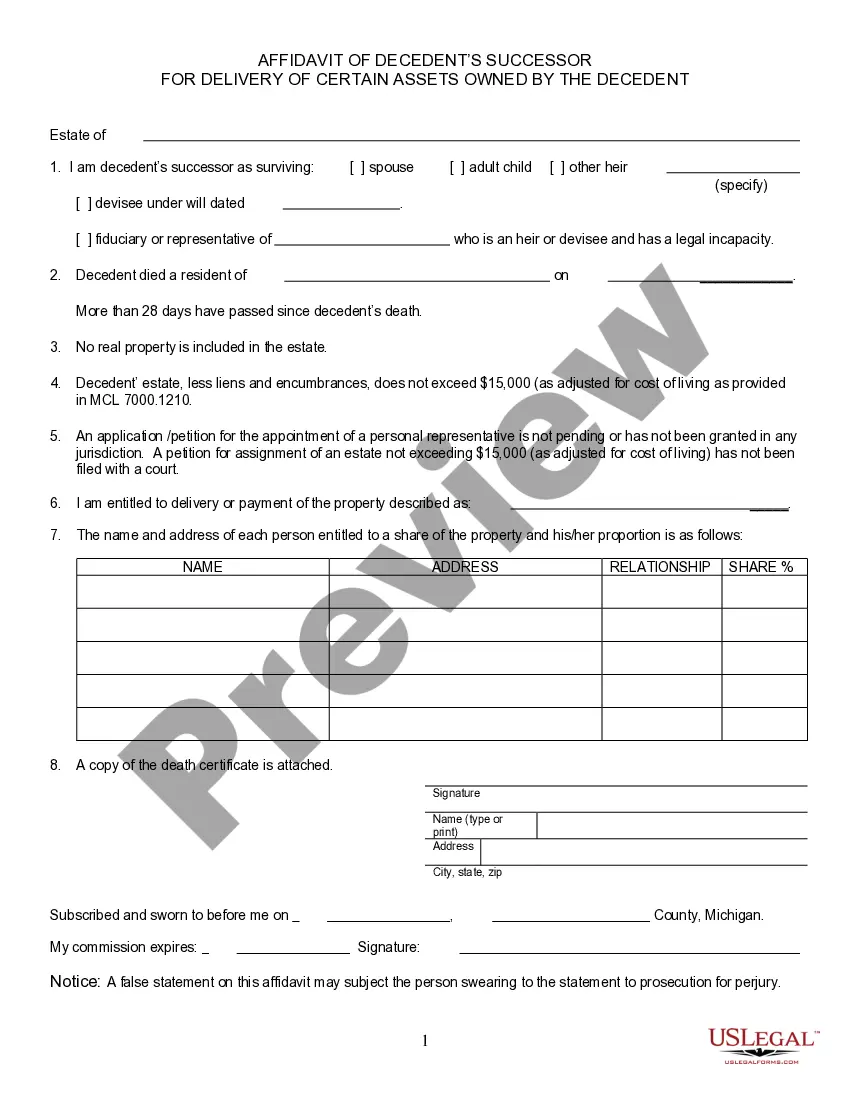

- Utilize the Preview mode to review the form description if present.

- Search for an additional template using the Search field in the header if necessary.

- Click Buy Now once you locate the correct Michigan Probate With Known Creditors.

Form popularity

FAQ

Creditors in Michigan have a limited time frame to pursue a debt following the notice in Michigan probate with known creditors. Generally, creditors have up to four months from the date of the notice to file their claims against the estate. After this period, creditors may lose their rights to seek payment unless they have timely filed. Staying aware of these deadlines ensures a smoother probate process for everyone involved.

During Michigan probate with known creditors, a specific notice is sent to inform them about the probate proceedings. This notice typically includes the name of the deceased, details of the estate, and a deadline by which creditors must submit their claims. The personal representative must ensure that all known creditors receive this formal communication to uphold the estate's integrity. Proper notice safeguards against potential disputes later.

In Michigan, certain assets are exempt from probate, which can simplify the process for your heirs. Common exempt assets include jointly owned property, life insurance policies, and retirement accounts with named beneficiaries. These exemptions reduce the overall size of the probate estate, allowing surviving family members to access their inheritance more quickly. Understanding these exemptions is crucial when planning your estate.

Yes, a notice to creditors is required in Michigan probate with known creditors. This legal requirement ensures that all known creditors receive timely notice regarding the deceased's estate. The personal representative must send this notice within four months of starting the probate process. By doing this, creditors have the opportunity to present their claims against the estate.

Yes, in Michigan, the probate process typically needs to be settled within one year of the date of death. However, this can vary based on the complexity of the estate and any outstanding claims. Settling an estate promptly helps beneficiaries receive their inheritance faster and supports the efficient handling of Michigan probate with known creditors. Using resources from USLegalForms can aid in managing this process effectively.

Once a claim is accepted in the probate process, creditors typically have an additional six months to collect the debt from the estate. This is important for managing obligations and ensuring that all debts are settled through the Michigan probate with known creditors process. Being aware of these timeframes helps creditors protect their interests and ensure that they follow the proper channels for collection.

If you believe you have a valid claim against an estate in Michigan, you must file it within four months of the notice of administration being sent out. This deadline is vital for ensuring your claim is considered during the probate process. Engaging with a platform like USLegalForms can provide necessary templates and resources to help you file your claim accurately within the designated timeframe related to Michigan probate with known creditors.

In Michigan, creditors have six years to bring a lawsuit against you to collect a debt. This timeline can begin from the date the debt was due or the last payment was made. Understanding these time limits is essential for both creditors and debtors involved in Michigan probate with known creditors. Having clear knowledge can prevent unexpected legal actions and ensure rights are protected.

In Michigan, creditors have a specific window to file claims against an estate. They generally have four months from the date of the probate notice to submit their claims. This timeframe is crucial, as it ensures that all debts are accounted for in the Michigan probate with known creditors process. If a claim is not filed within this period, creditors may lose their right to collect from the estate.

A notice to creditors in a deceased estate serves as an official announcement to inform all potential creditors about the death and the estate’s probate process. This notice is critical, as it invites creditors to submit their claims against the estate within a specified timeframe. Effectively managing this notice is key under Michigan probate with known creditors, ensuring proper debt settlement.