Michigan Sample Articles Incorporation For Church

State:

Michigan

Control #:

MI-PC-TL

Format:

Word;

Rich Text

Instant download

Description Please Address Incorporation

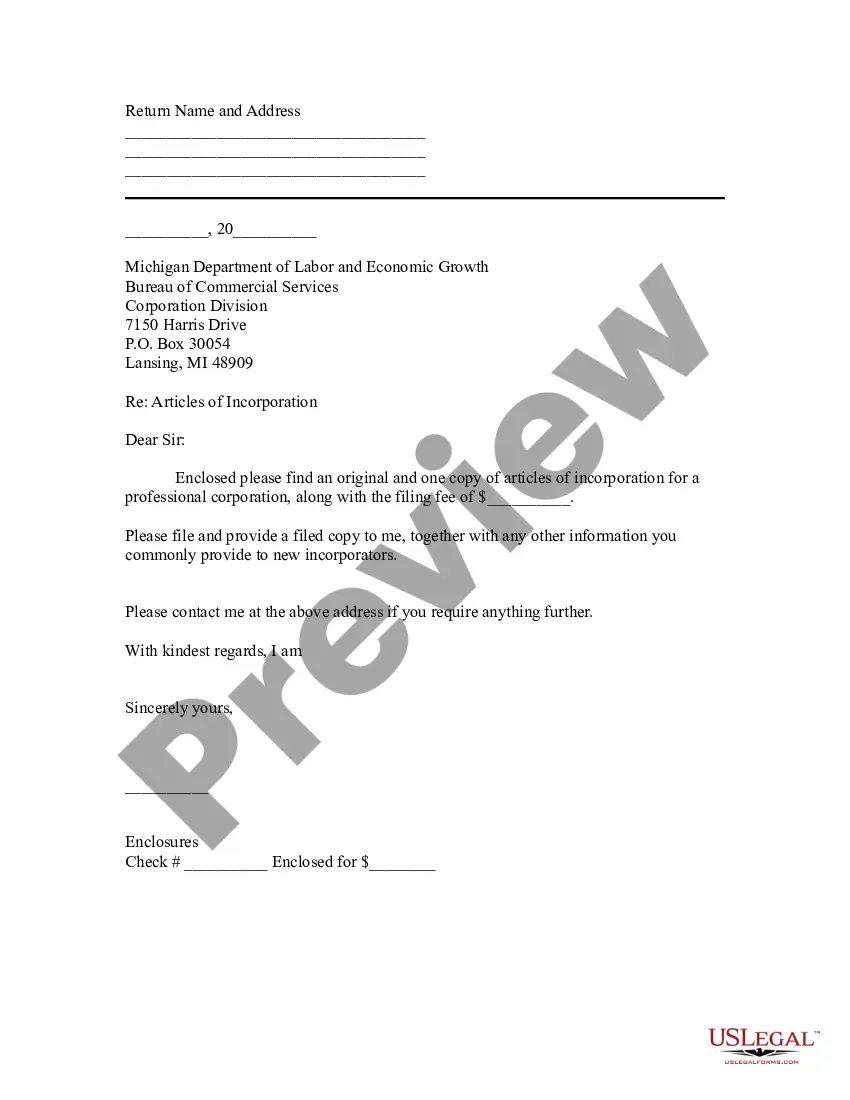

This sample transmittal letter can accompany the Articles of Incorporation when filed with the Corporations Department.