Planning Your Estate With Stepchildren

Description

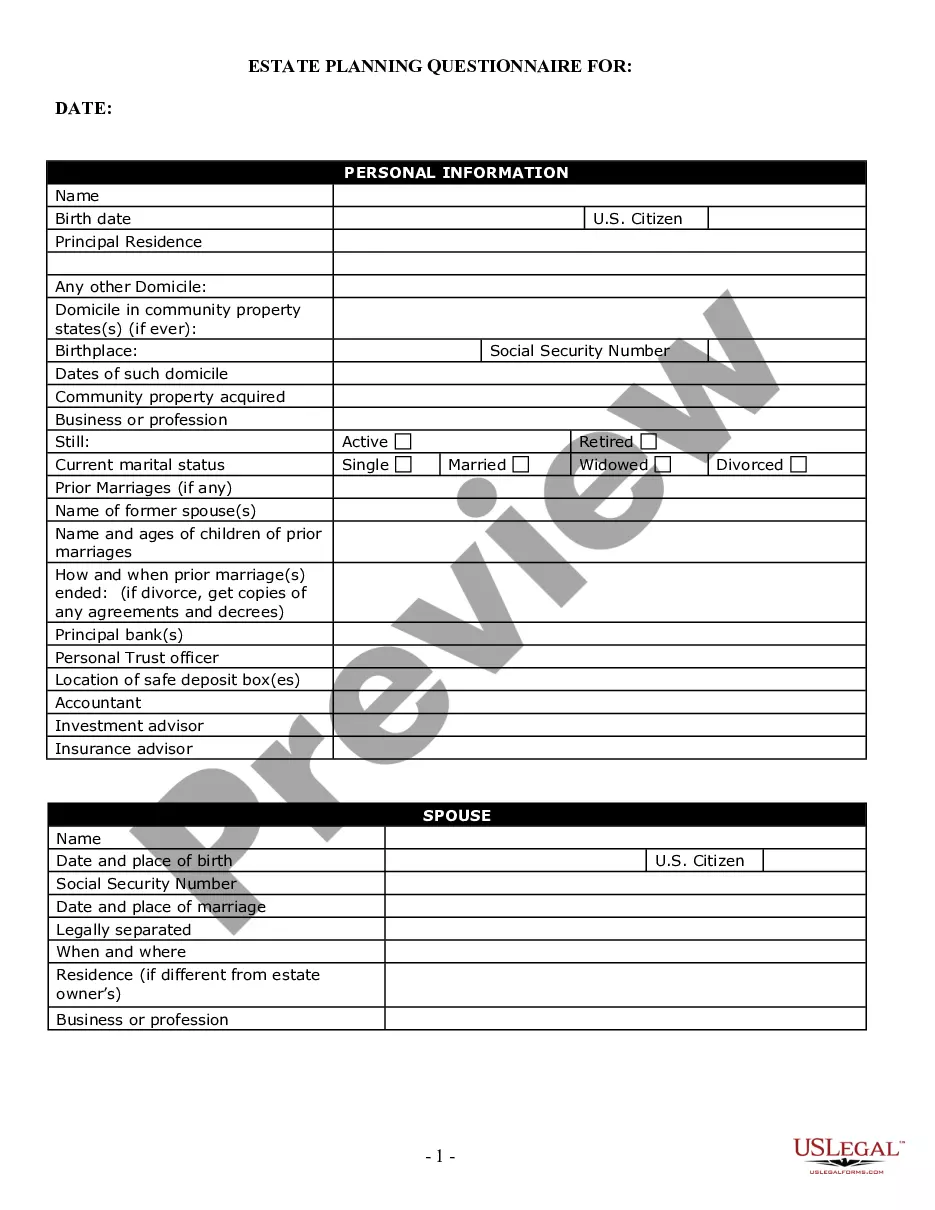

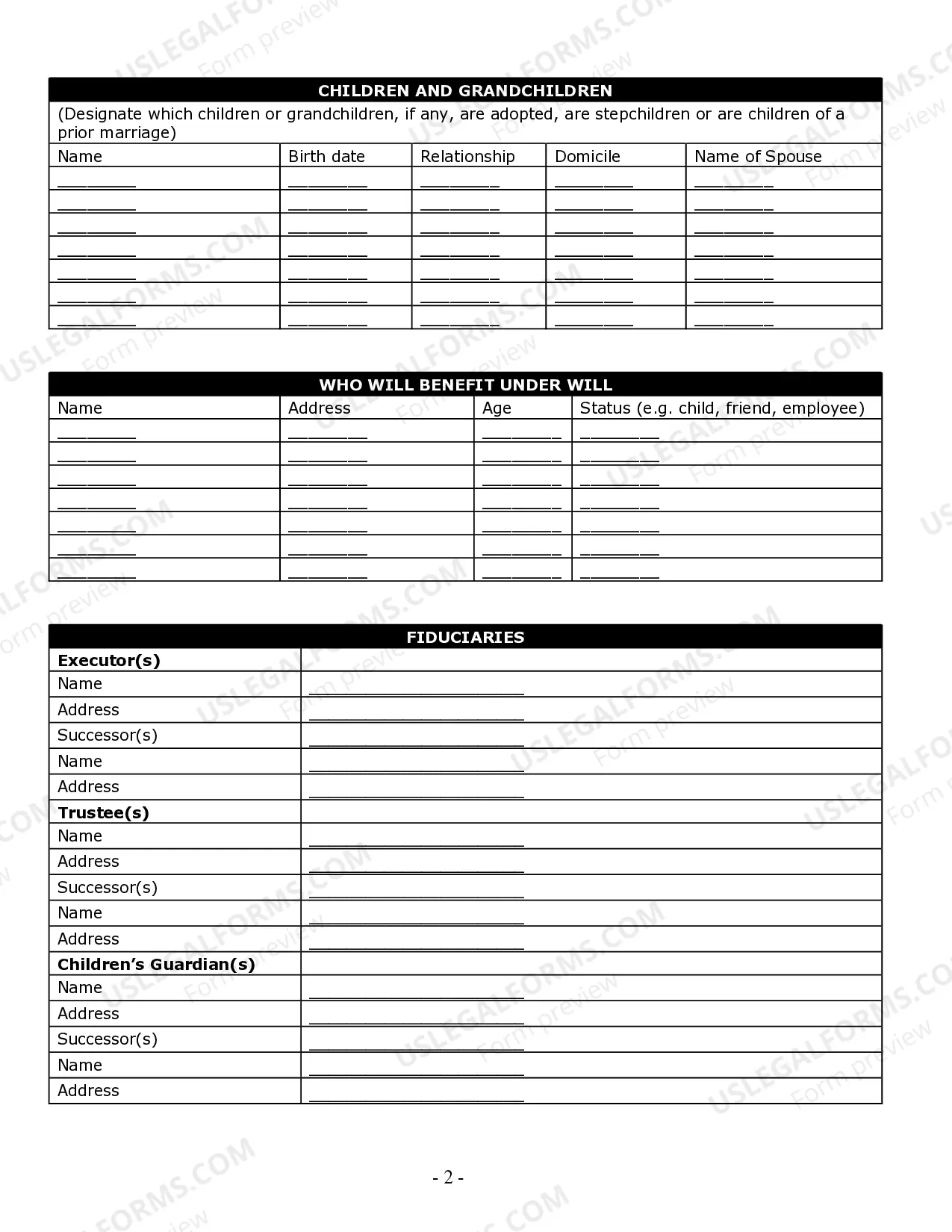

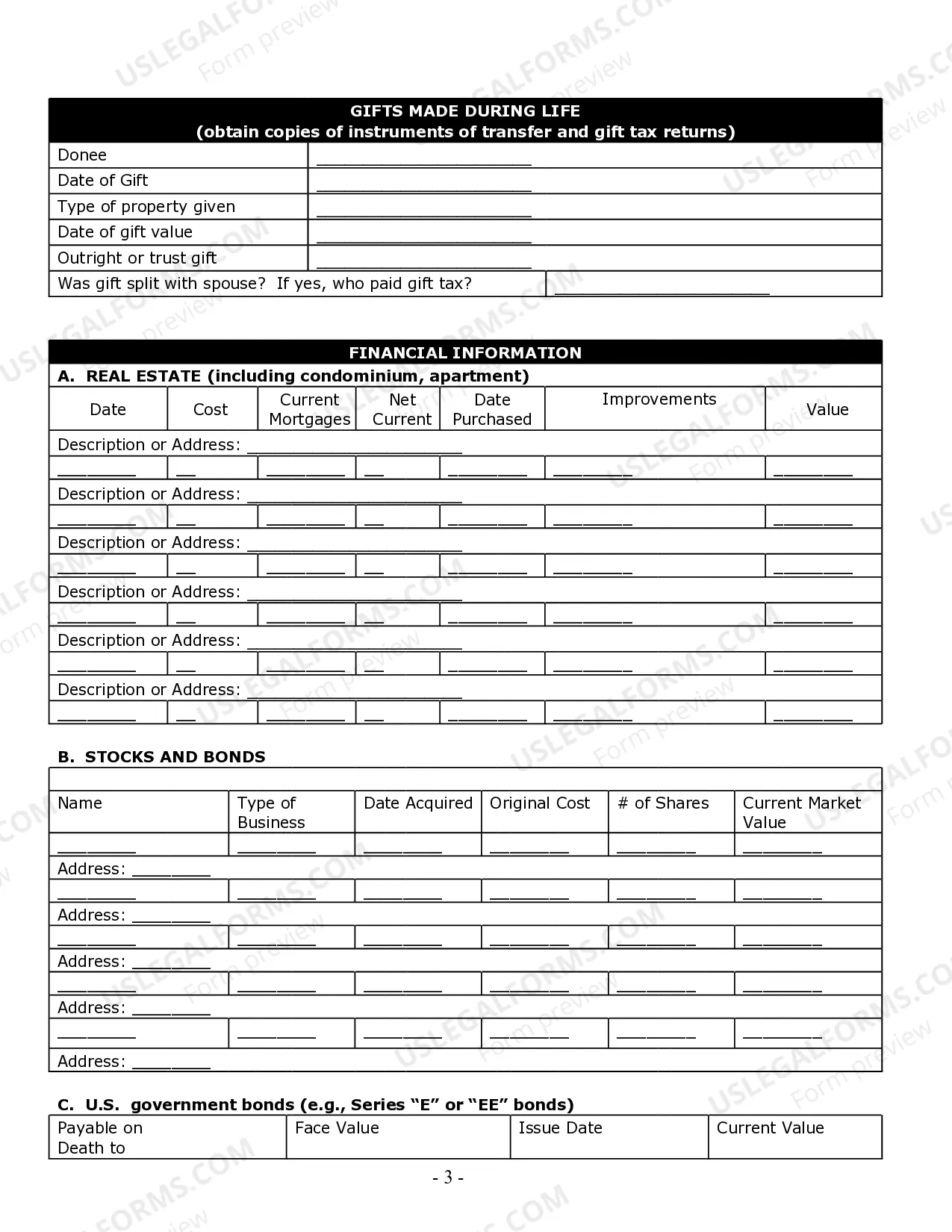

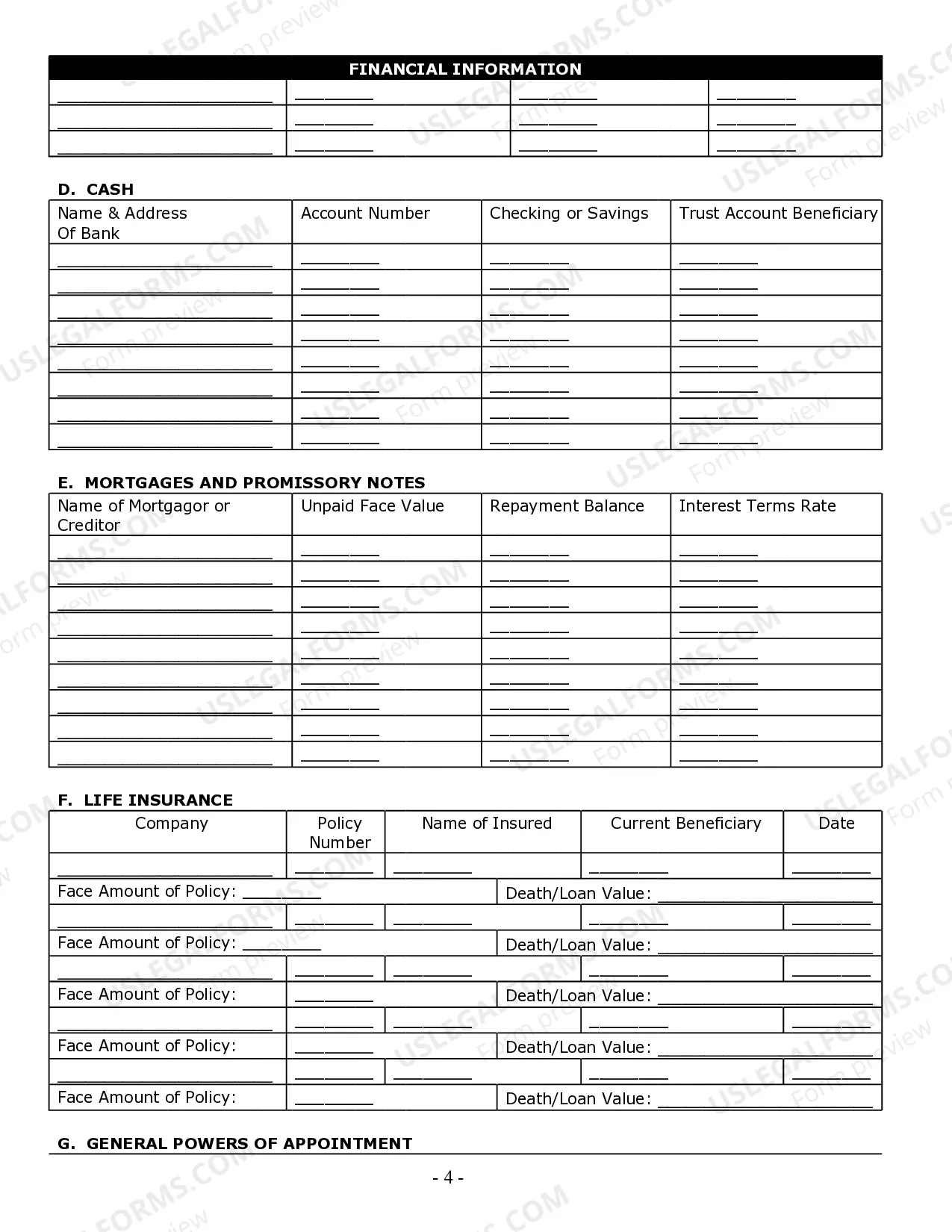

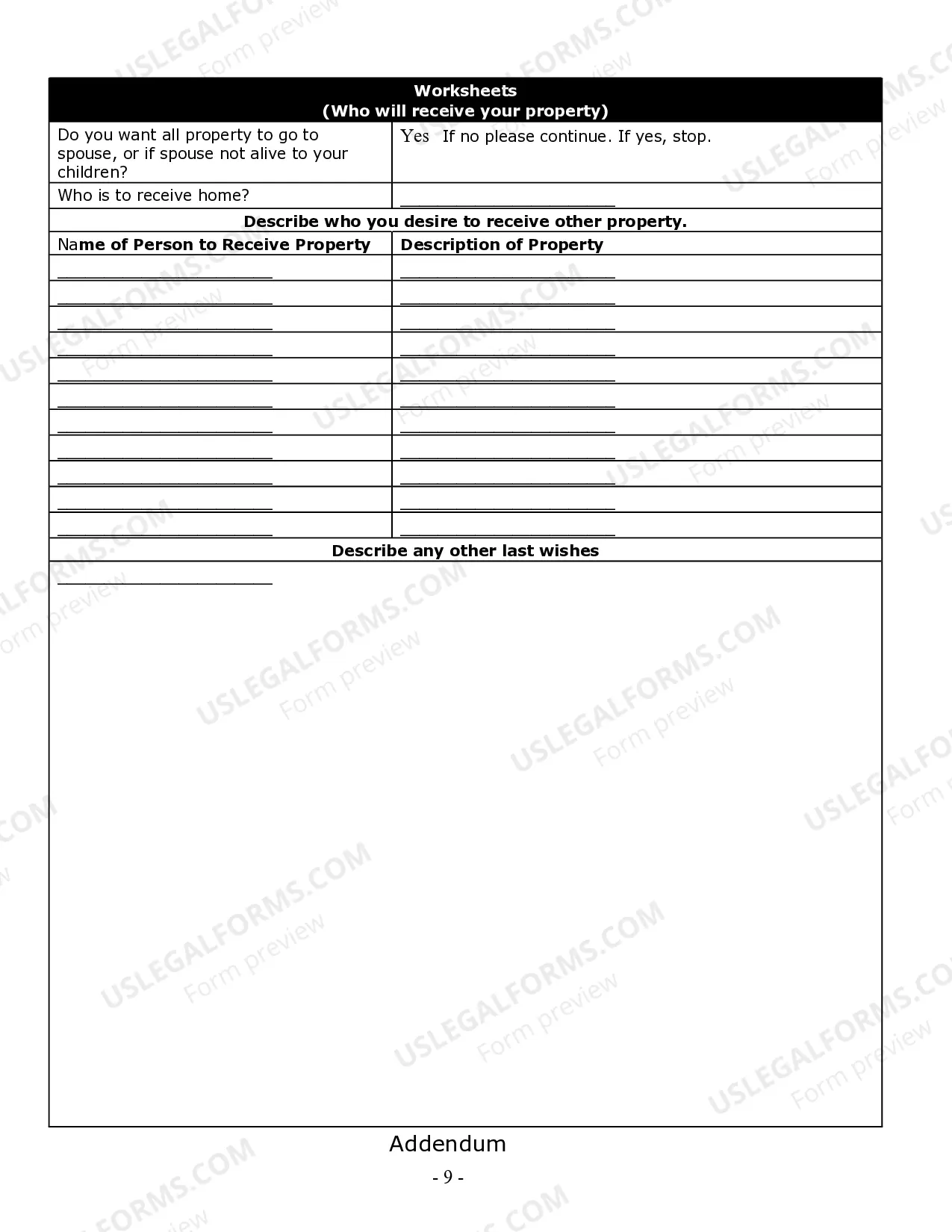

How to fill out Michigan Estate Planning Questionnaire And Worksheets?

Which is the most reliable service to acquire the Planning Your Estate With Stepchildren and other recent editions of legal documents.

US Legal Forms provides the solution! It boasts the largest assortment of legal forms for every situation.

For those without an account, here are the steps to create one: Form compliance assurance. Prior to acquiring any template, ensure it meets your use case requirements and adheres to your state or county's laws. Review the form description and utilize the Preview feature if available. Alternative document search. If any discrepancies arise, use the search bar in the page header to look for another template. Click Buy Now to select the right one. Account registration and subscription acquisition. Select the best pricing plan, Log In or register your account, and settle your subscription payment through PayPal or credit card. Document download. Choose the format in which you want to save Planning Your Estate With Stepchildren (PDF or DOCX) and click Download to retrieve it. US Legal Forms is an excellent choice for anyone needing to manage legal documents. Premium users benefit even more as they can complete and authorize previously saved files electronically at any time using the integrated PDF editing tool. Try it out today!

- Each template is professionally crafted and confirmed for adherence to federal and local regulations.

- They are categorized by field and jurisdiction, ensuring that finding the required document is straightforward.

- Seasoned users of the platform simply need to Log In, verify the validity of their subscription, and click the Download button next to Planning Your Estate With Stepchildren to acquire it.

- Once downloaded, the document is accessible for future use under the My documents section of your account.

Form popularity

FAQ

When planning your estate with stepchildren, it's essential to communicate openly with your family. You should consider creating a will that clearly outlines your wishes for each child, including stepchildren. In many cases, setting up a trust can also provide additional security and clarity regarding assets. Using a reliable platform like U.S. Legal Forms can help you navigate these complexities and ensure your intentions are documented properly.

The 5 and 5 rule in estate planning allows a beneficiary to withdraw a specific dollar amount or a percentage from the trust, aiming to facilitate access and proper management of funds. This rule minimizes tax implications and is particularly useful when planning your estate with stepchildren, as it can help in providing for their needs over time. By carefully applying the 5 and 5 rule, you can create a more balanced approach, ensuring fair treatment of all heirs. Consider using US Legal Forms for guidance in drafting your estate plan effectively.

The 5 or 5 rule refers to a provision in trust agreements that allows beneficiaries a certain level of access to trust funds without triggering negative tax consequences. This rule can grant beneficiaries the ability to withdraw a limited amount each year, fostering effective financial planning when considering your stepchildren. It’s important to incorporate this rule thoughtfully while planning your estate, ensuring you meet the needs of all beneficiaries. We encourage you to explore the tools available on US Legal Forms to simplify your estate planning process.

One of the biggest mistakes parents make when establishing a trust fund involves not considering all their heirs, especially stepchildren. Failing to include them can lead to disputes and hurt feelings later. It's crucial to be clear and intentional about your wishes while planning your estate with stepchildren. US Legal Forms provides resources and templates that can help parents navigate these complexities, ensuring that everyone feels included and valued.

The 5 and 5 rule allows a beneficiary of an irrevocable trust to take out up to 5% of the trust's value or $5,000, whichever is greater, each year without incurring any tax implications. This rule serves to give beneficiaries some flexibility while planning your estate with stepchildren. It ensures that stepchildren can benefit from the trust without triggering heavy tax burdens. Utilizing this rule can help in striking a balance between providing for your stepchildren and preserving the trust's value.

The 5 5 rule is a provision in estate planning, particularly related to trusts. It allows a beneficiary to withdraw up to 5% of the trust’s value each year or up to $5,000, whichever is greater, without tax implications. Understanding this rule can be beneficial when planning your estate with stepchildren, as it provides flexibility in how trust assets are accessed. To ensure compliance, consider using platforms like US Legal Forms to create a robust estate plan that aligns with your goals.

When planning your estate with stepchildren, one effective method to protect inheritance is to establish a trust. A trust allows you to specify how and when your assets are distributed, thus safeguarding them from potential claims by stepchildren. Additionally, you can designate beneficiaries clearly in your will. This proactive approach reduces the chances of disputes and ensures your estate is managed according to your wishes.

To exclude stepchildren from your will while planning your estate with stepchildren, you should clearly state your intentions in the document. It’s important to identify your stepchildren by name and specify that they will not inherit any portion of your estate. This can help avoid confusion and ensure that your wishes are upheld. Consulting with a legal professional can guide you in properly drafting your will to prevent unexpected claims.

To protect your estate from potential claims by stepchildren, it's critical to include explicit instructions in your estate plan. Clearly outline your wishes in your will or trust, specifying the inheritance structure. Consulting with professionals, like those at US Legal Forms, can ensure you create an effective plan that safeguards your assets.

To ensure tax efficiency when passing property to a child, consider the current tax laws and gift exclusions. Utilizing a trust can also help manage taxes, allowing properties to be transferred with minimized tax liabilities. Planning your estate with stepchildren in mind can aid in creating a balanced and fair approach.