Planning Your Estate With Stock Options

Category:

State:

Michigan

Control #:

MI-WIL-801

Format:

Word;

Rich Text

Instant download

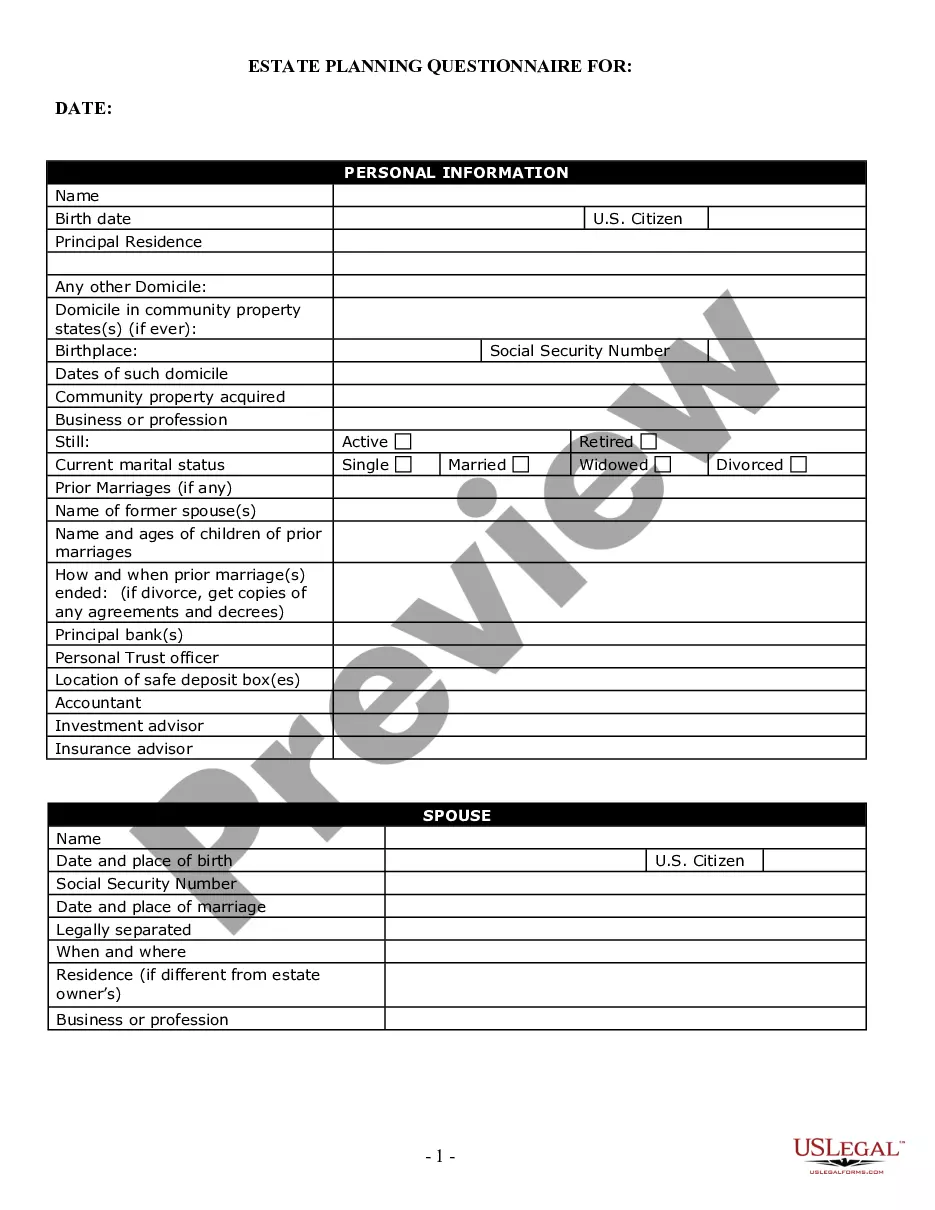

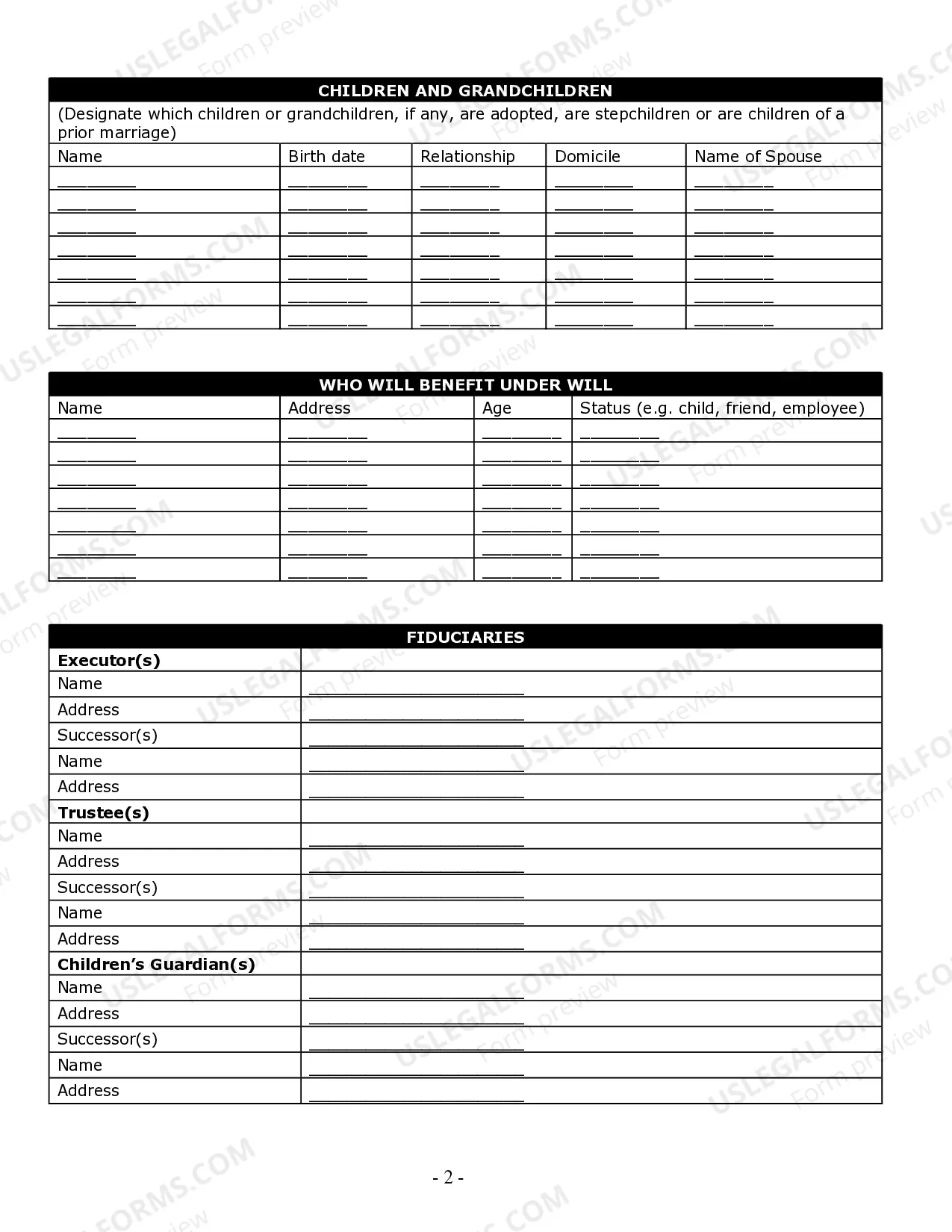

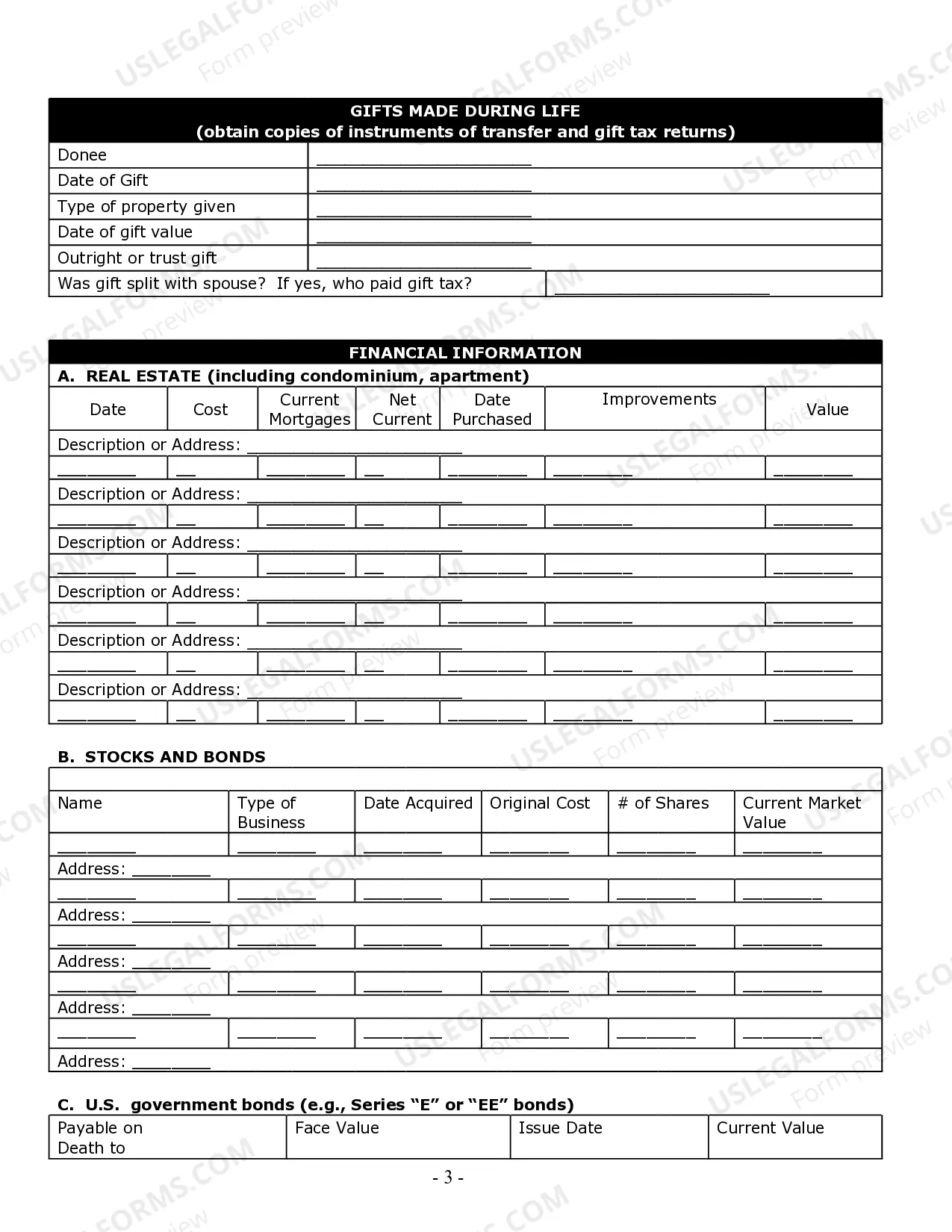

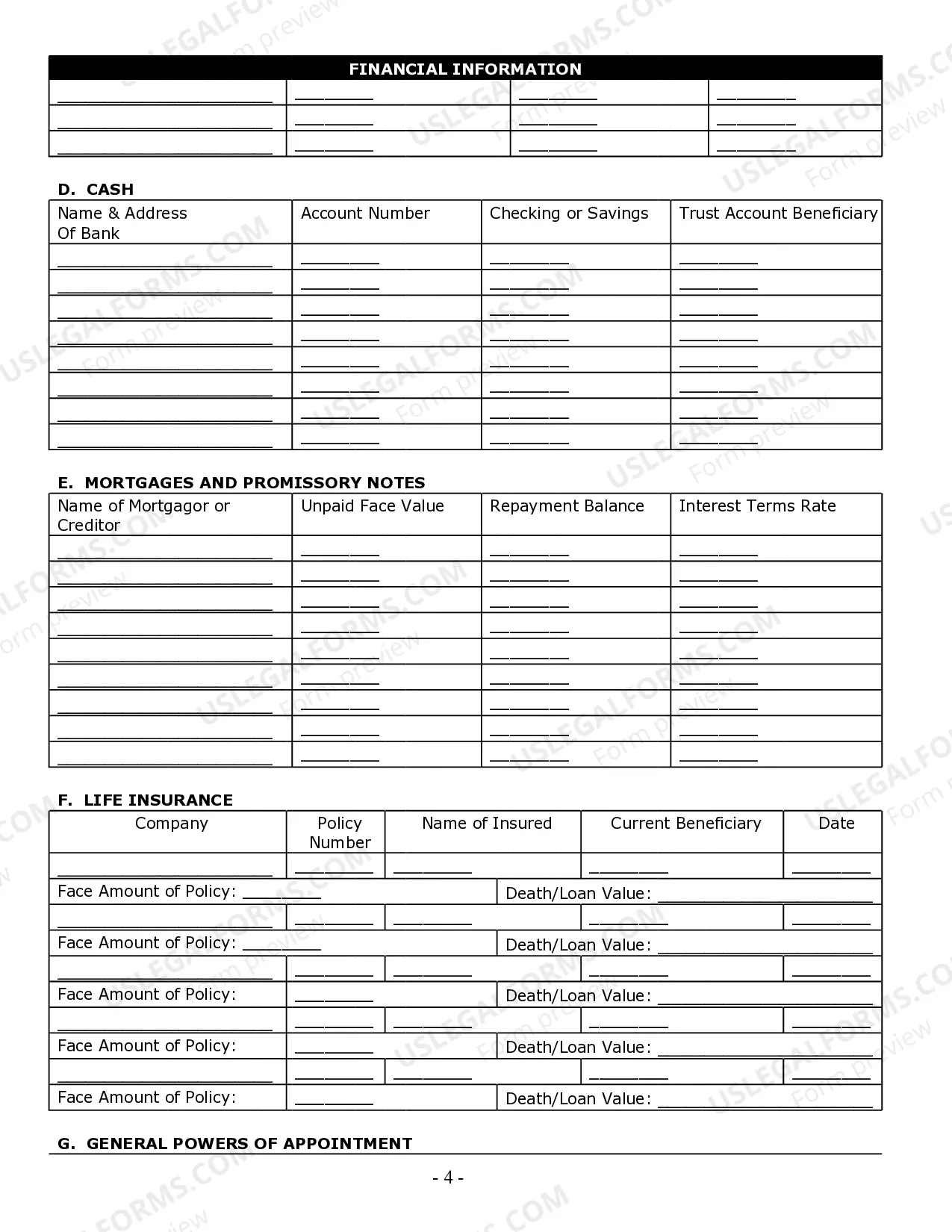

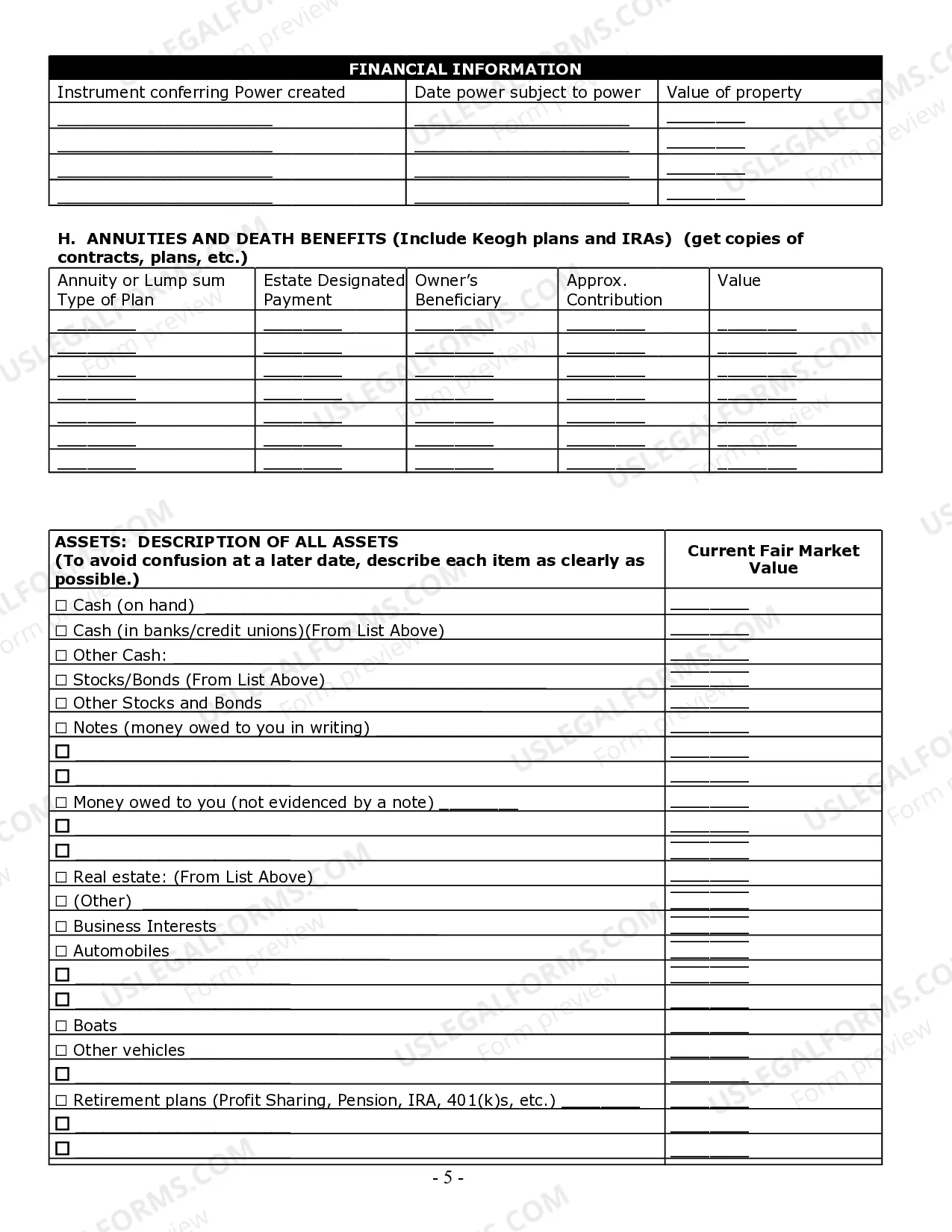

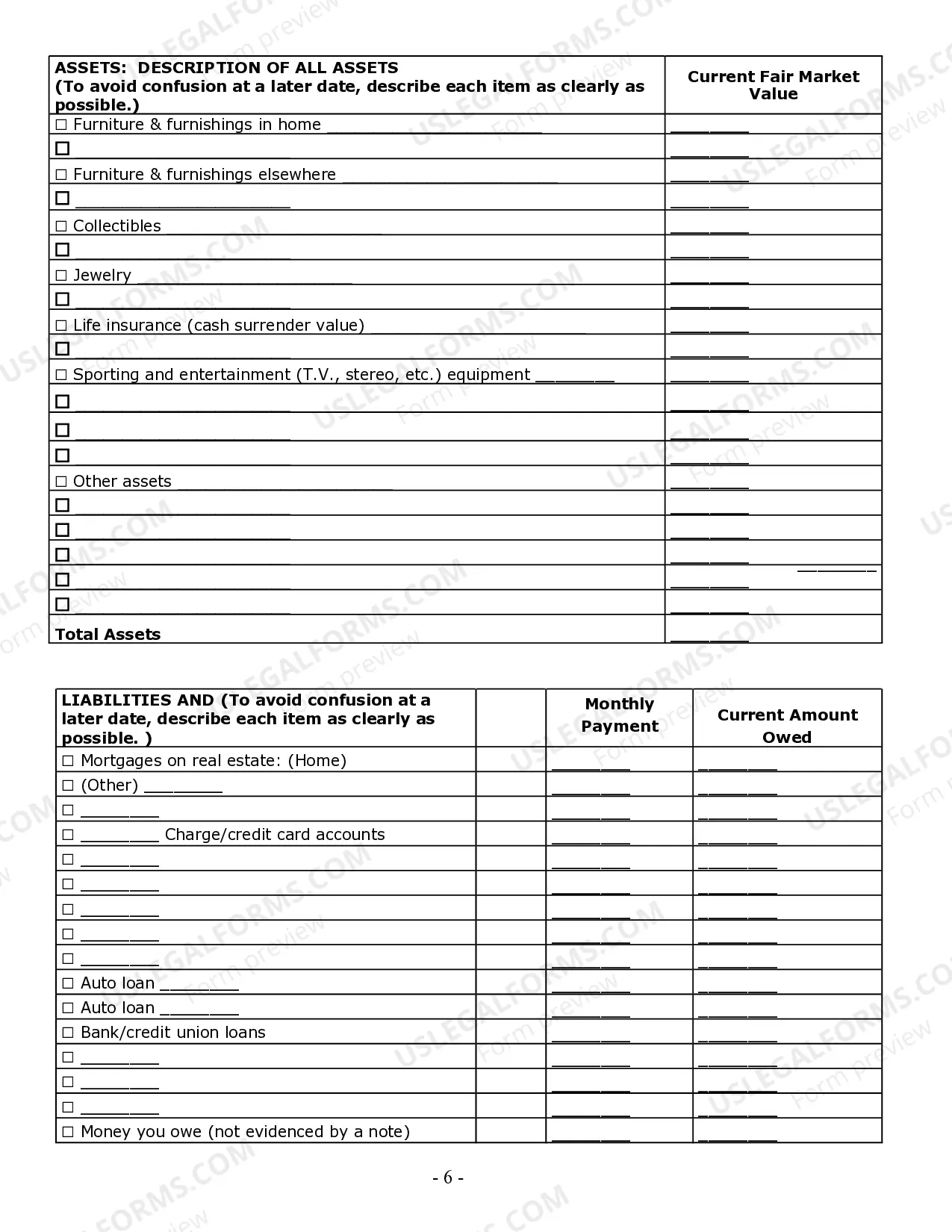

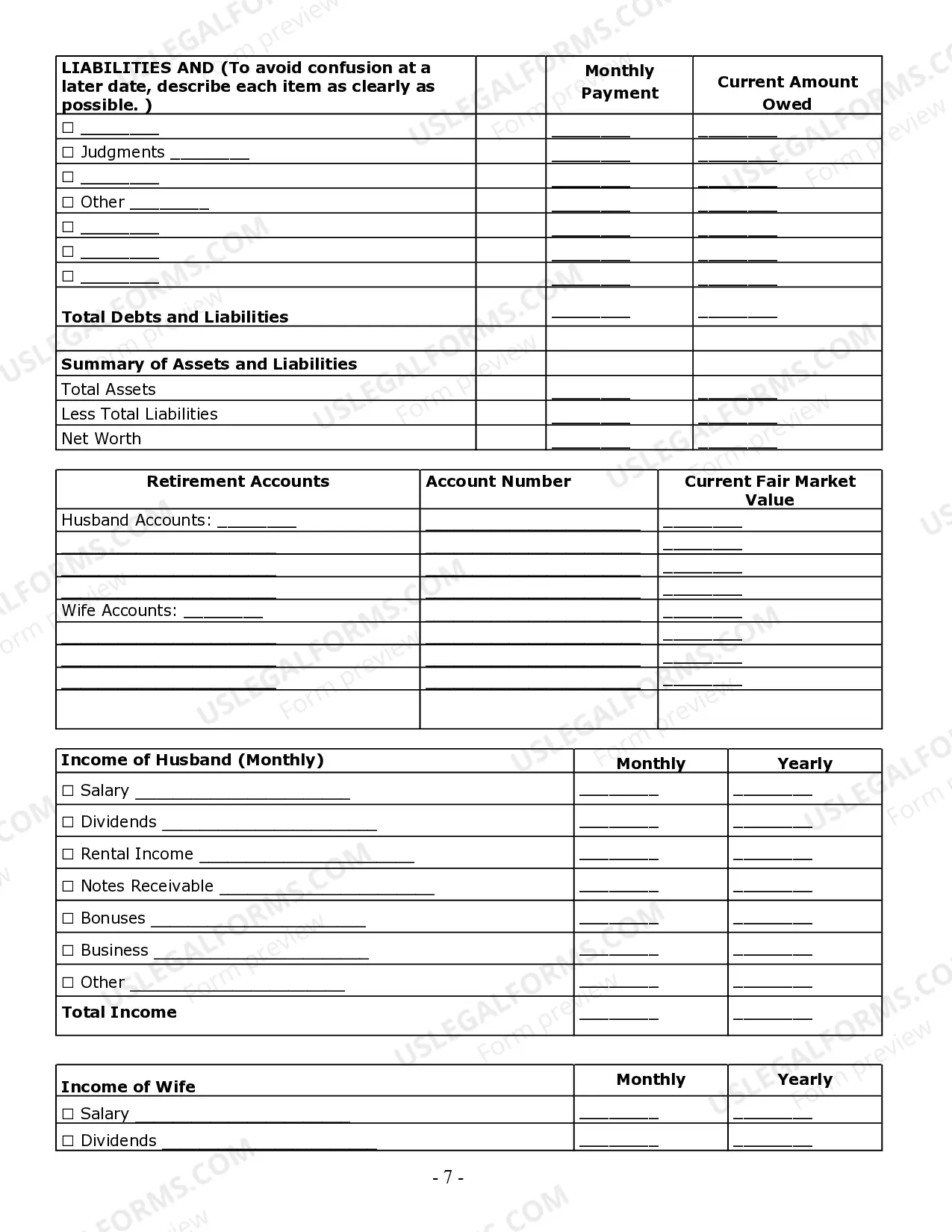

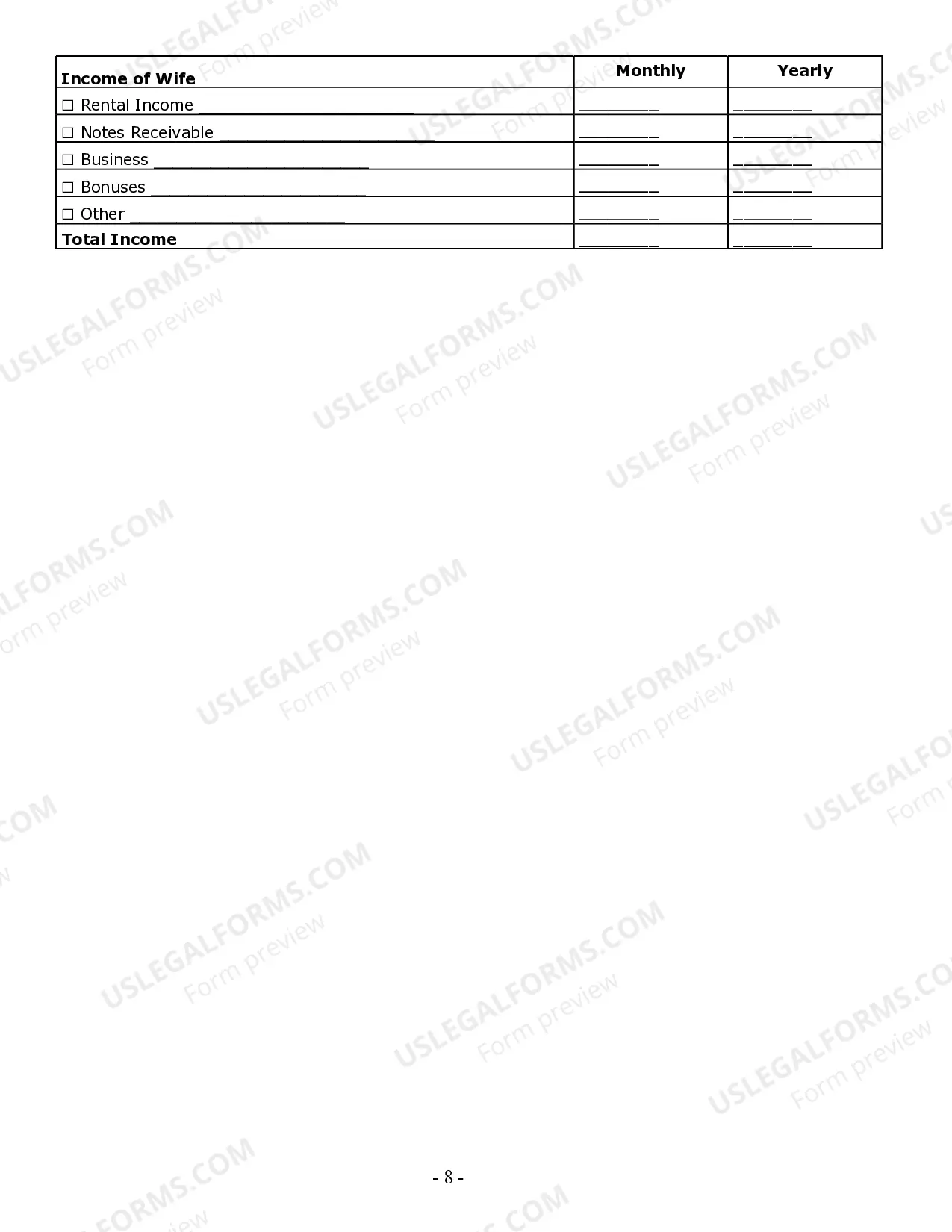

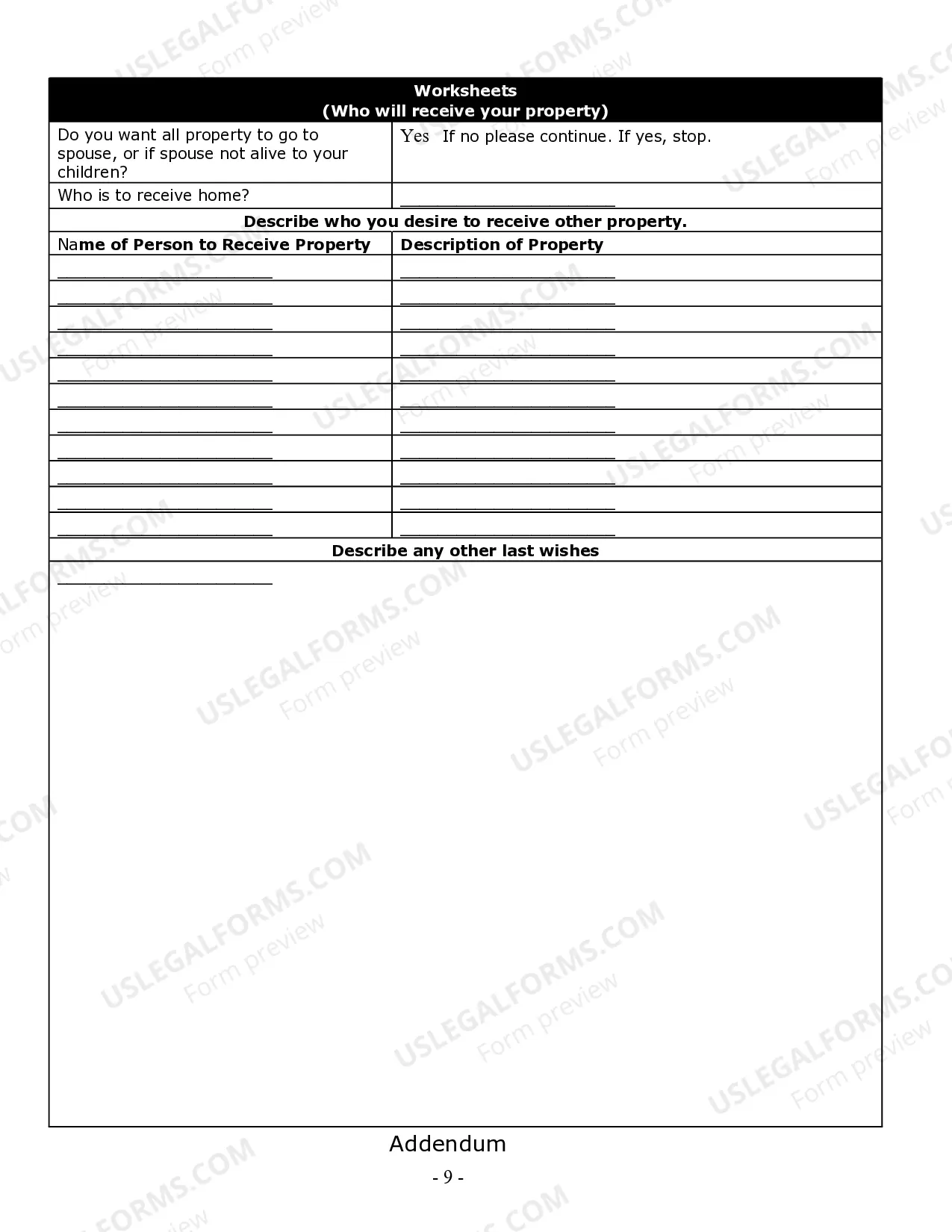

Description Estate Planning Checklist Pdf

This Estate Planning Questionnaire and Worksheet is for completing information relevant to an estate. It contains questions for personal and financial information. You may use this form for client interviews. It is also ideal for a person to complete to view their overall financial situation for estate planning purposes.

Free preview Estate Planning Form