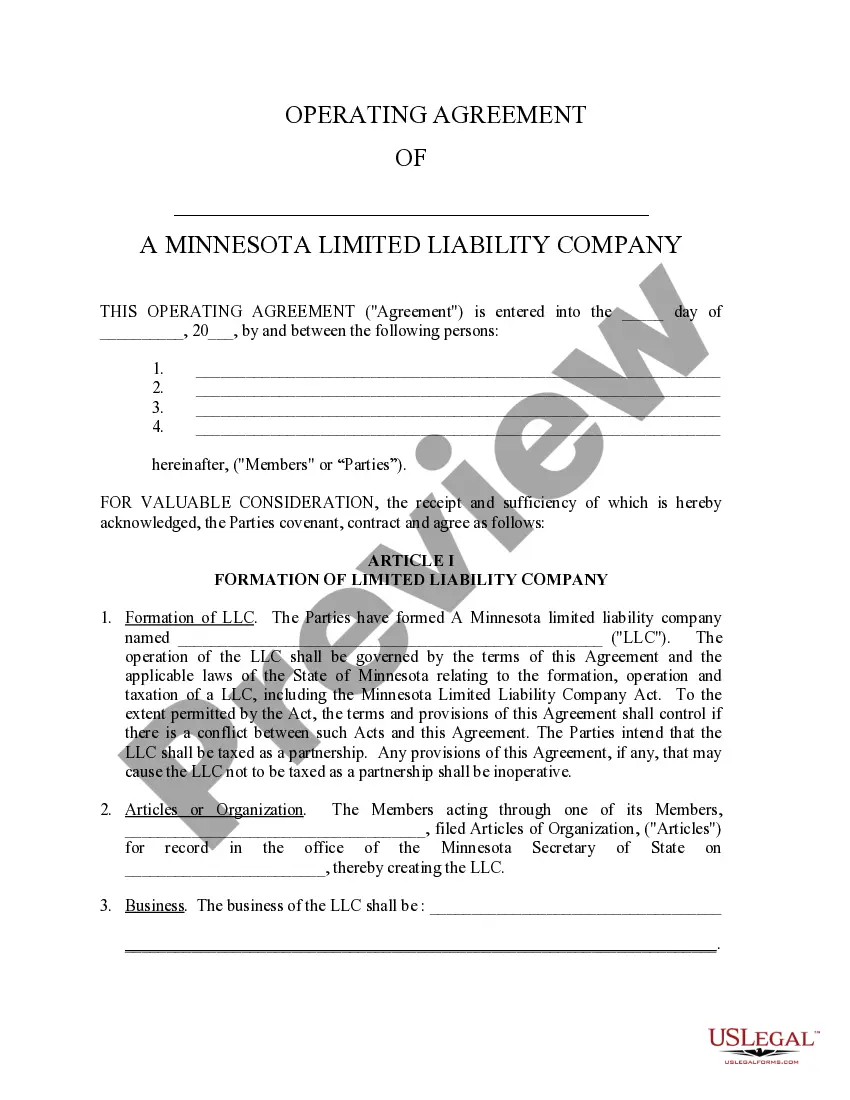

Minnesota Llc Operating Agreement Form

Description

How to fill out Minnesota Llc Operating Agreement Form?

There's no longer a necessity to squander hours searching for legal documents to meet your local state obligations. US Legal Forms has compiled all of them in a single location and streamlined their accessibility.

Our website provides over 85,000 templates for any business and personal legal matters categorized by state and area of application.

All forms are properly prepared and validated for accuracy, so you can be confident in obtaining an accurate Minnesota LLC Operating Agreement Form.

Select Buy Now next to the template title once you identify the appropriate one. Choose the most fitting pricing plan and register for an account or Log In. Complete your payment with a credit card or via PayPal to continue. Opt for the file format for your Minnesota LLC Operating Agreement Form and download it to your device. Print out your form to fill it out manually or upload the sample if you wish to edit it in an online editor. Preparing formal paperwork under federal and state regulations is rapid and straightforward with our platform. Try out US Legal Forms today to keep your documents organized!

- If you are acquainted with our platform and already possess an account, ensure your subscription is current before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents whenever required by opening the My documents tab in your profile.

- If this is your first time using our platform, the procedure will require a few additional steps to finalize.

- Here's how new users can acquire the Minnesota LLC Operating Agreement Form in our library.

- Read the page content attentively to verify it features the sample you require.

- To do so, utilize the form description and preview options if available.

- Use the Search bar above to find another sample if the prior one wasn’t suitable.

Form popularity

FAQ

An operating agreement is ONLY required in the five (5) States of California, Delaware, Maine, Missouri, and New York. In all other States, an operating agreement is not required but is recommended to be written and signed by all members of the LLC.

Why do you need an operating agreement? To protect the business' limited liability status: Operating agreements give members protection from personal liability to the LLC. Without this specific formality, your LLC can closely resemble a sole proprietorship or partnership, jeopardizing your personal liability.

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

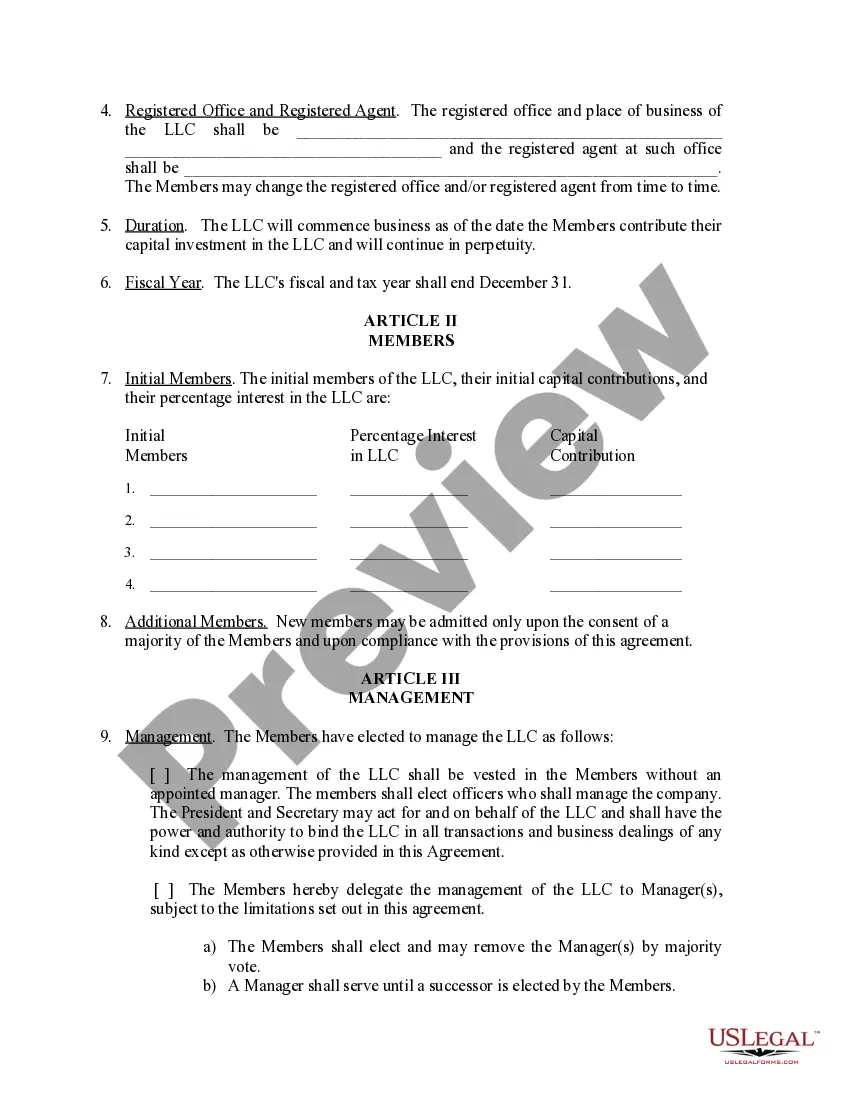

Every Minnesota LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

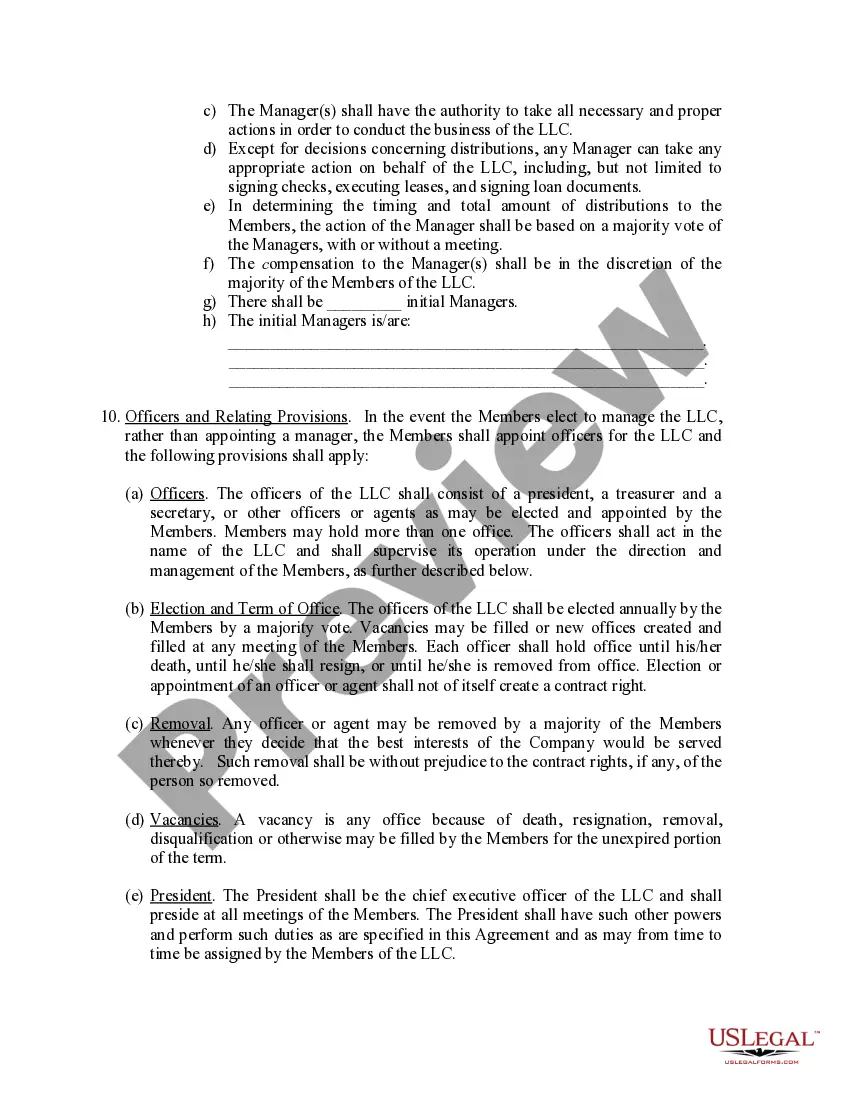

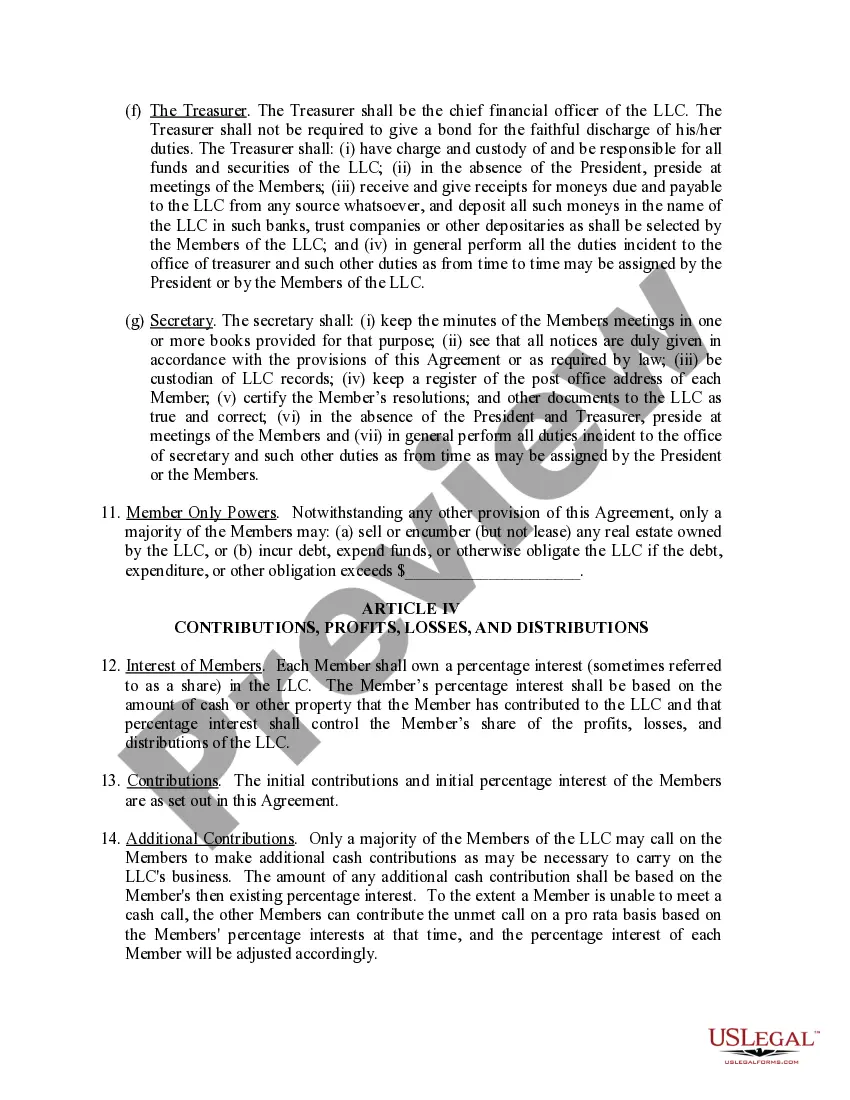

Most LLC operating agreements are short and sweet, and they typically address the following five points:Percent of Ownership/How You'll Distribute Profits.Your LLC's Management Structure/Members' Roles And Responsibilities.How You'll Make Decisions.What Happens If A Member Wants Out.More items...?