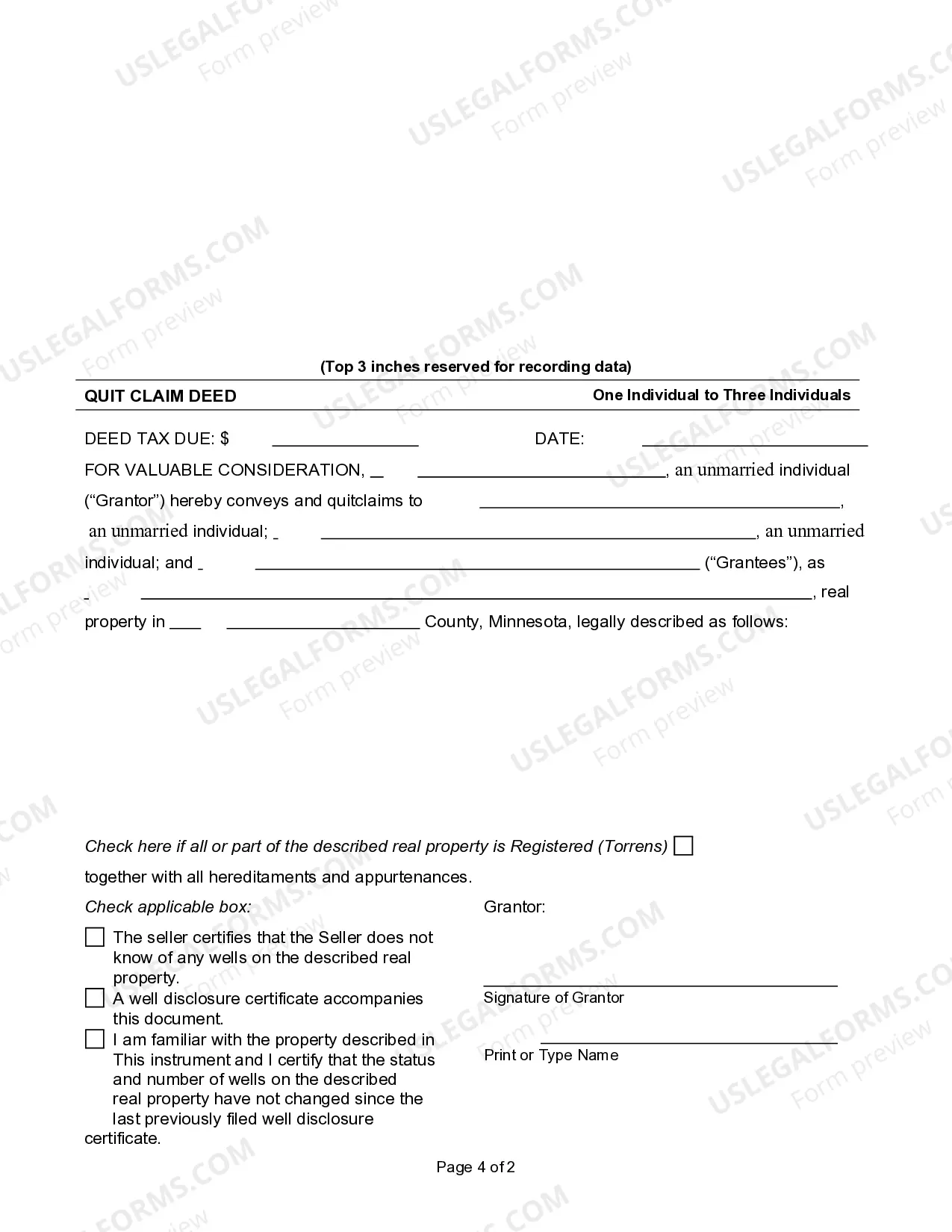

This form is a Quitclaim Deed where the Grantor is an individual and the Grantees are three individuals. Grantees take the property as tenants in common or joint tenants with the right of survivorship. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

A Minnesota life estate deed form is a legal document used in Florida to create a life estate interest in real property while designating a remainder man who will become the full owner of the property upon the death of the life tenant. This form ensures that the life tenant retains the right to use and occupy the property during their lifetime, providing them with security and control over the property. The Minnesota life estate deed form for Florida transfers the property ownership but allows the life tenant to retain certain rights, such as the right to live on the property, collect rental income, and make decisions regarding the property. This type of deed form can be highly beneficial for individuals who wish to plan their estate and ensure that their loved ones are taken care of after their passing. There are different variations of the Minnesota life estate deed form for Florida, including the Enhanced Life Estate Deeds (also known as "Lady Bird Deeds") and the Traditional Life Estate Deeds. — Enhanced Life Estate Deed (Lady Bird Deeds): This type of life estate deed form grants the life tenant the ability to freely transfer, sell, or mortgage the property without obtaining the consent of the remainder man. It also provides an added advantage of avoiding probate upon the death of the life tenant. — Traditional Life Estate Deed: This form establishes a life estate but restricts the life tenant from transferring or selling the property without the consent of the remainder man. In this case, the life tenant has limited control over the property and requires the cooperation of the remainder man for any transactions. Both variations of the Minnesota life estate deed form for Florida serve the purpose of achieving a smooth transfer of property upon the life tenant's death, circumventing the need for probate and ensuring the desired distribution of assets. It is crucial for individuals in Florida to carefully consider their specific circumstances and consult with legal professionals to determine which form best suits their needs for estate planning.