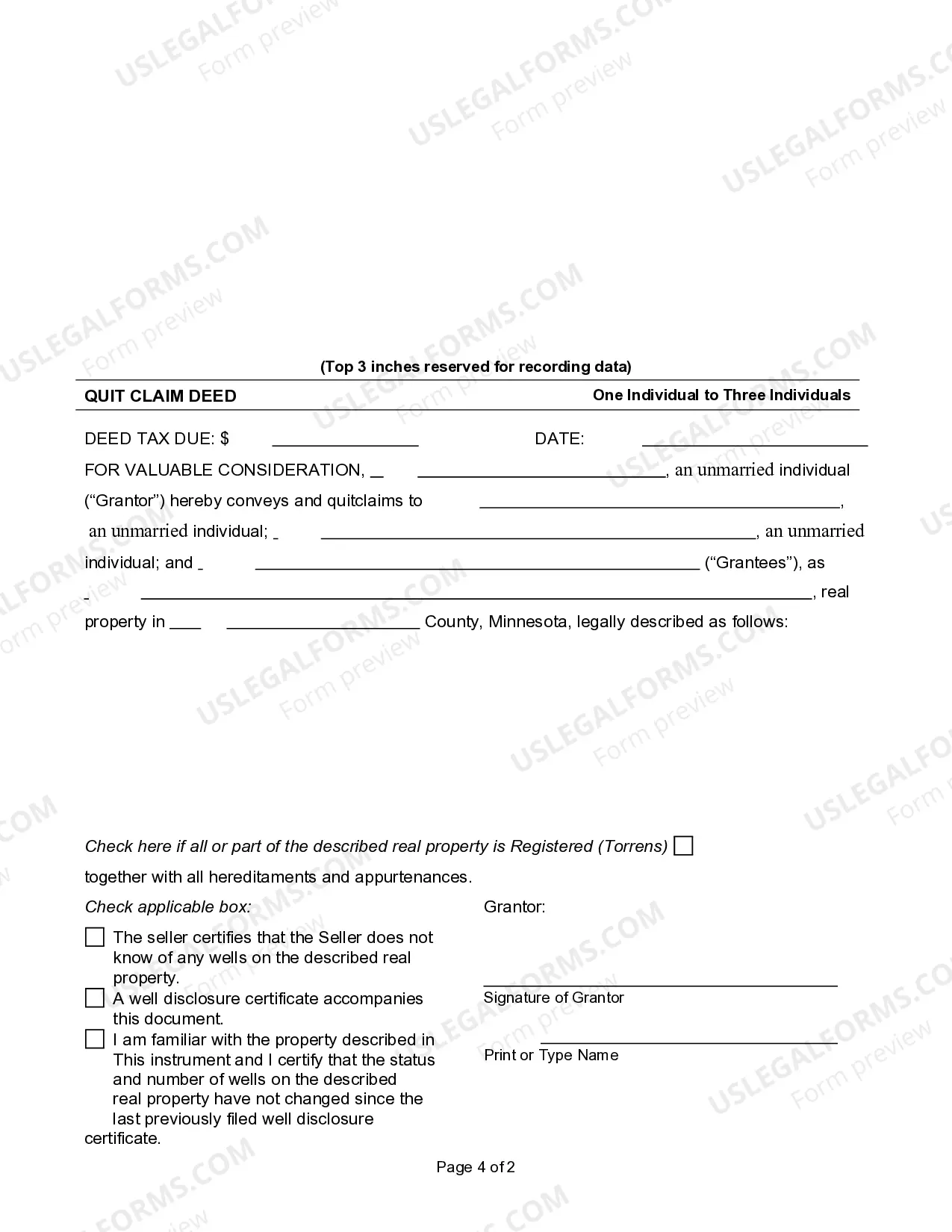

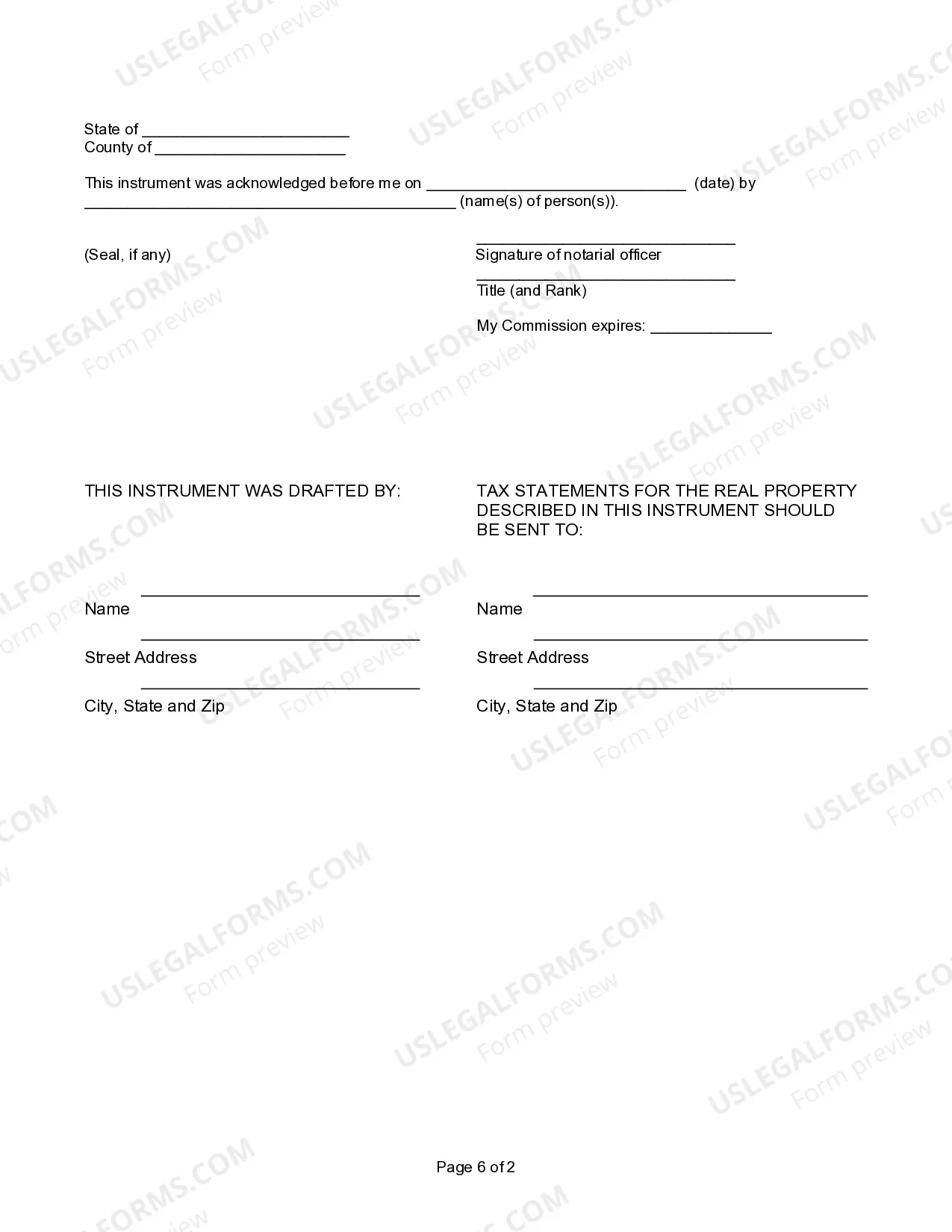

This form is a Quitclaim Deed where the Grantor is an individual and the Grantees are three individuals. Grantees take the property as tenants in common or joint tenants with the right of survivorship. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

Minnesota Life Estate Deed Form with Mortgage: A Comprehensive Guide When it comes to property transfers in Minnesota, particularly in cases where individuals want to ensure the smooth transfer of assets and protect their heirs' interests, the Minnesota life estate deed form with a mortgage comes into play. This legal document establishes a life estate, which grants a person the right to use and reside in a property during their lifetime, while also securing a mortgage against the property. A Minnesota life estate deed form with a mortgage serves multiple purposes. Firstly, it guarantees the property owner, known as the life tenant, the right to live on the premises until their death, or until they decide to relinquish their rights voluntarily. At the same time, this form allows the life tenant to take out a mortgage against the property, using it as collateral for the loan. This means that the life tenant can maintain financial flexibility and utilize the property for their needs while still ensuring that their heirs will inherit the remaining value of the estate upon their passing. In Minnesota, there are different types of life estate deed forms with mortgages, depending on specific circumstances and the needs of the parties involved. Some of the most common types include: 1. Traditional Life Estate Deed with Mortgage: This is the standard form used when the property owner wants to establish a life estate and secure a mortgage against the property simultaneously. It provides flexibility and financial security for the life tenant while preserving the property's value for the remainder beneficiaries. 2. Joint Tenancy Life Estate Deed with Mortgage: This form is appropriate when two or more individuals wish to establish a joint life estate and obtain a mortgage against the property together. It ensures that all involved parties have equal rights to live on the property during their lifetimes and safeguards their mutual interests in the mortgage. 3. Enhanced Life Estate Deed (Lady Bird Deed) with Mortgage: This specialized form grants the life tenant expanded powers, allowing them to sell, mortgage, or transfer the property without obtaining consent from the remainder beneficiaries. It offers greater control and flexibility while maintaining the ability to secure a mortgage on the property. Regardless of the specific type, a Minnesota life estate deed form with a mortgage must adhere to certain legal requirements to be considered valid. It must include the property's accurate description, the names and roles of the parties involved (granter, life tenant, remainder beneficiaries), the scope of the life tenant's rights and responsibilities, as well as any specific conditions or limitations related to the mortgage. Utilizing a Minnesota life estate deed form with a mortgage can offer individuals in this state the ability to manage their property and financial matters effectively while planning for the future. However, it is essential to consult with a legal professional experienced in real estate and estate planning to navigate the complexities of this legal arrangement successfully.