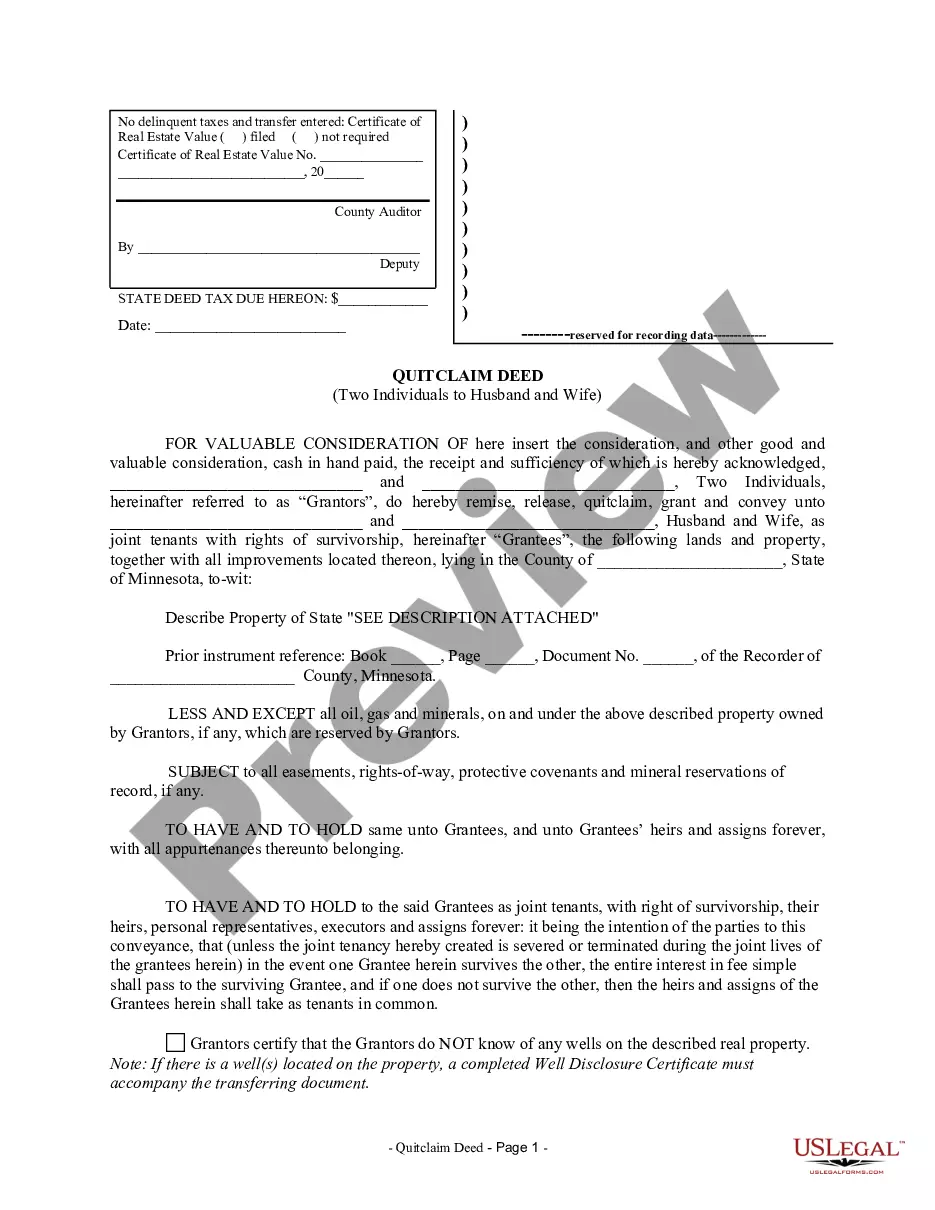

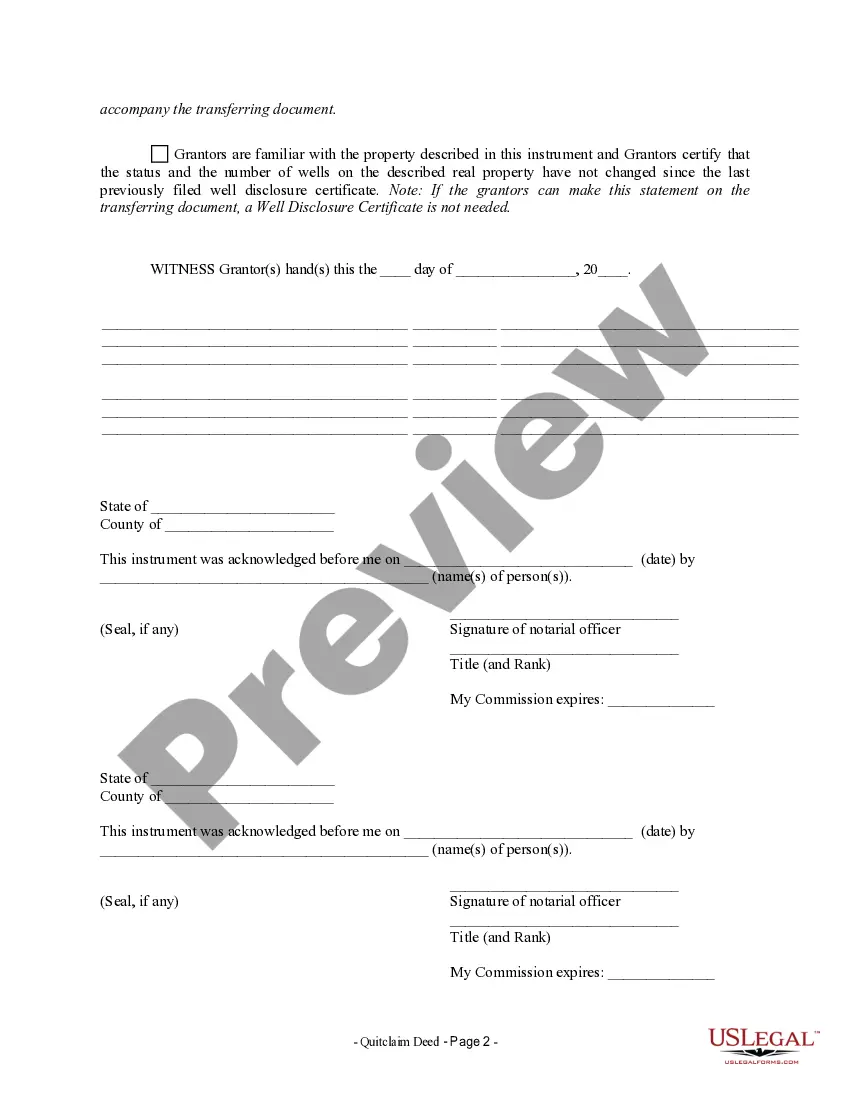

Minnesota Quitclaim Deed With Life Estate Clause

Description mn quit claim deed

How to fill out Minnesota Quitclaim Deed With Life Estate Clause?

What is the most reliable service to obtain the Minnesota Quitclaim Deed With Life Estate Clause and other updated versions of legal documents? US Legal Forms is the answer!

It is the largest selection of legal forms for any situation. Every document is meticulously drafted and verified for compliance with federal and local regulations. They are organized by jurisdiction and state of application, making it easy to find what you require.

US Legal Forms is an ideal solution for anyone needing to handle legal documents. Premium users can additionally fill out and authorize previously saved forms electronically at any time using the built-in PDF editing feature. Discover it today!

- Experienced users of the platform simply need to Log In to the system, verify that their subscription is active, and click the Download button next to the Minnesota Quitclaim Deed With Life Estate Clause to retrieve it.

- Once saved, the document is accessible for future use in the My documents section of your account.

- If you do not yet have an account with our library, follow these steps to create one.

- Form compliance check. Before you obtain any document, ensure it aligns with your usage requirements and your state or county's regulations. Review the form description and utilize the Preview option if available.

Form popularity

FAQ

While a life estate deed can provide benefits, there are disadvantages to consider. For instance, the life tenant may face limitations regarding selling or transferring the property since they cannot encumber it without the consent of the remainderman. This lack of control can lead to complications if life circumstances change. Therefore, evaluating a Minnesota quitclaim deed with life estate clause is vital to ensure that your estate planning goals align with your needs.

In Texas, the property in a life estate arrangement is owned by the life tenant for their lifetime. Once the life tenant passes, the property transfers to the remainderman, who then gains full ownership. This division of ownership can help individuals plan their estates more effectively, ensuring that heirs receive property according to the owner's wishes. The Minnesota quitclaim deed with life estate clause can be a strong option for achieving similar goals.

A quitclaim deed with reservation of life estate allows an individual to transfer property ownership to another while reserving the right to live there for the rest of their life. This means that the grantor can continue to enjoy the property without claiming outright ownership. If you are exploring this option in Minnesota, consider the Minnesota quitclaim deed with life estate clause, as it clearly outlines your intentions and protects your rights.

One disadvantage of using a deed, including a Minnesota quitclaim deed with life estate clause, is that it may limit your ability to manage the property freely after the transfer. Once the deed is executed, the property rights of the life tenant are typically restricted. Additionally, tax implications can arise for both parties at different stages, leading to potential financial considerations that need careful planning.

A life estate deed in Minnesota allows a property owner to transfer their rights to another party while retaining the right to live in the property for their lifetime. This arrangement creates two distinct interests: the life estate for the current owner and the remainderman interest for the individual who will receive the property after the owner's death. Utilizing a Minnesota quitclaim deed with life estate clause helps ensure that your intentions regarding property use and ownership are formalized.

In Massachusetts, the property in a life estate arrangement belongs to the life tenant during their lifetime. Upon the death of the life tenant, ownership transfers to the remainderman. This structure allows the life tenant to use the property but does not give them the authority to transfer ownership through a deed. If you're considering a similar setup, the Minnesota quitclaim deed with life estate clause can provide clarity and security.

To fill out a Minnesota quitclaim deed with life estate clause, you need to include the names of both the grantor and the grantee, along with the property description. Make sure to clearly state the life estate clause in the document, as it specifies the rights to the property during the owner’s lifetime. Using a platform like USLegalForms can simplify this process, providing guided templates and expert support to ensure accurate completion.

Yes, a Minnesota quitclaim deed with life estate clause must be notarized. This means that the person signing the deed must do so in the presence of a notary public. The notary will then confirm the identity of the signer and ensure that the signing is done voluntarily. It’s important to follow these steps correctly to prevent any legal complications.

The strongest form of deed is generally considered to be the warranty deed because it provides the highest level of protection to the grantee. This type of deed ensures that the grantor defends the title against any claims. However, for specific purposes like transferring property with a life estate, the Minnesota quitclaim deed with life estate clause may be more practical.

The best deed to transfer property often depends on the specific situation and the level of protection desired. While a warranty deed is usually preferred for its assurances, the Minnesota quitclaim deed with life estate clause is ideal for straightforward transfers among trusted individuals. Evaluating your circumstances can help you choose the most suitable option.