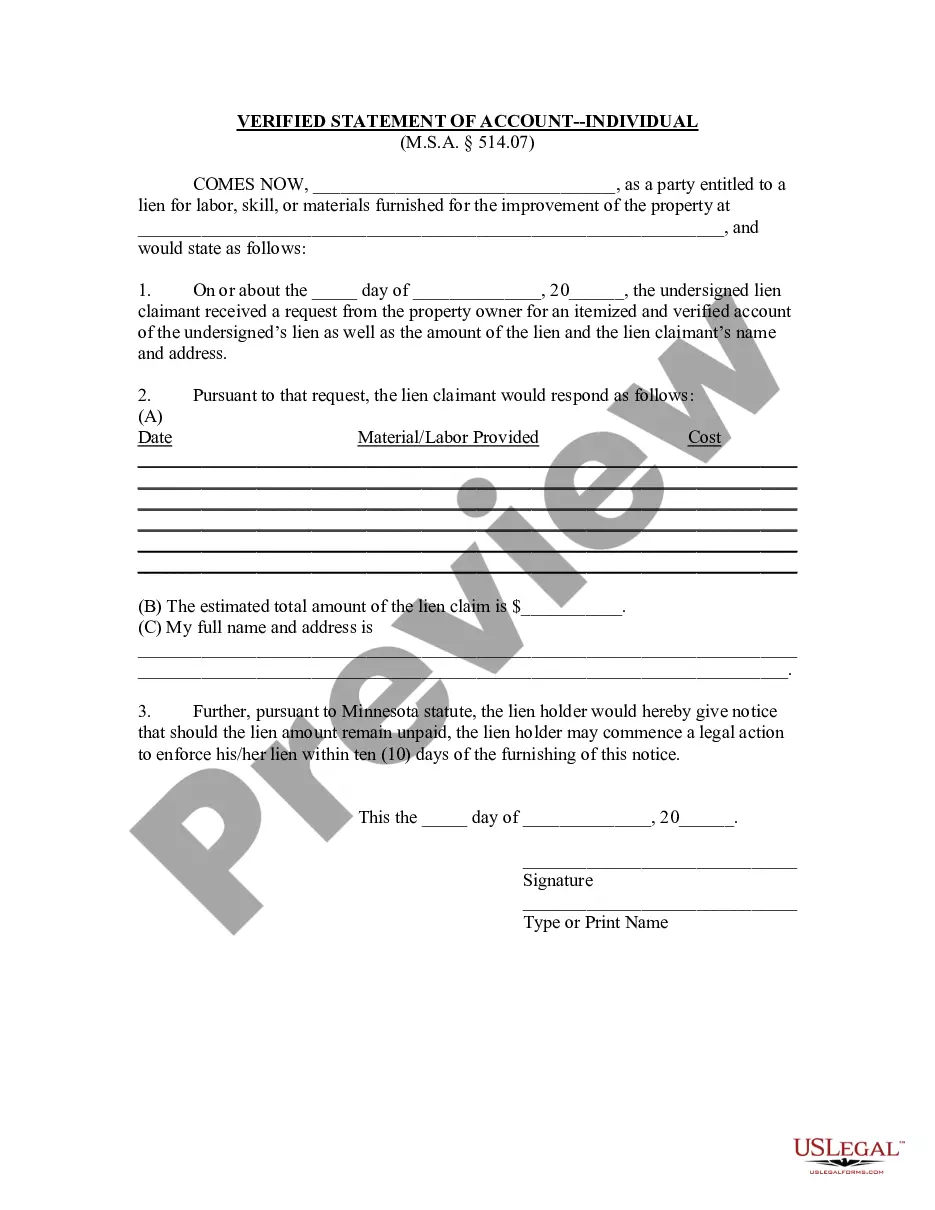

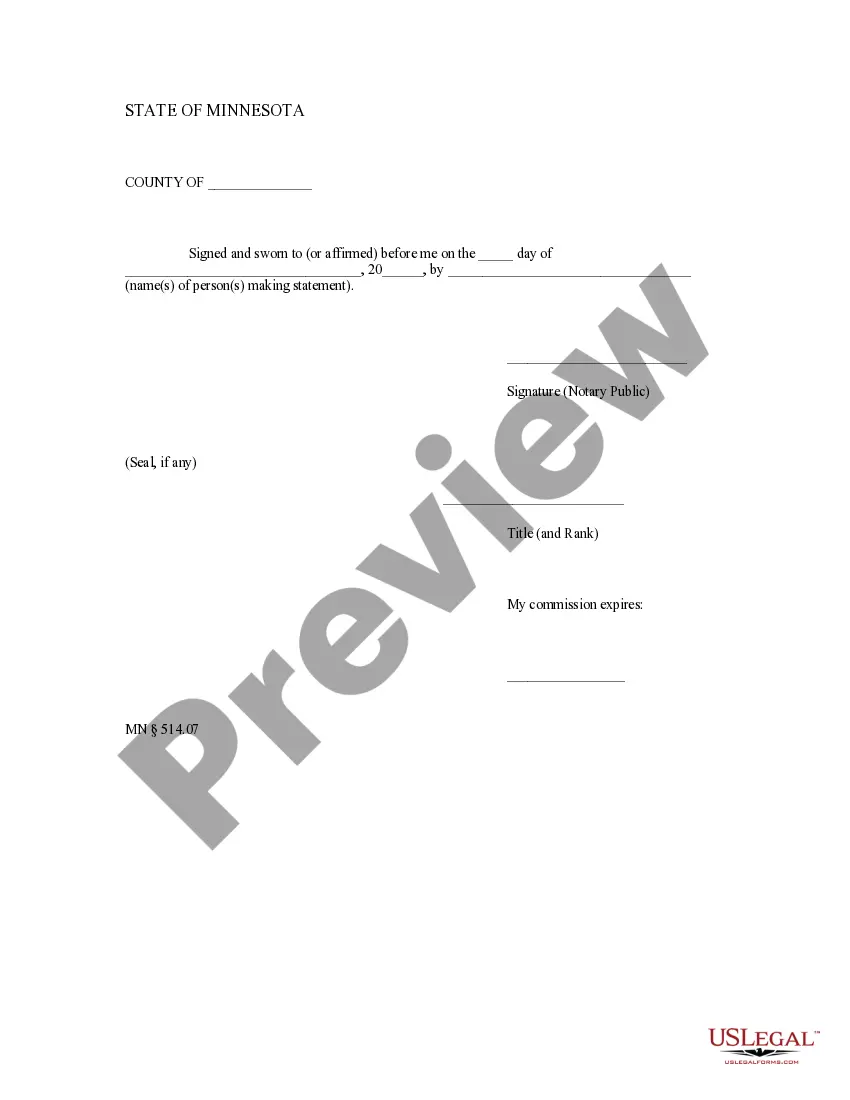

This form is used by a lien claimant to respond to a property owner's request for information about the lien. The request must be made within fifteen (15) days of the completion of work and the lien claimant may not pursue a court action to enforce the lien until ten days after the information is provided.

Minnesota 514 Foreign Tax Credit

Description

How to fill out Minnesota 514 Foreign Tax Credit?

Accurately composed official documents are one of the essential safeguards for preventing problems and legal disputes, but obtaining them without an attorney's assistance may require time.

Whether you need to swiftly locate a current Minnesota 514 Foreign Tax Credit or any other forms for work, family, or business circumstances, US Legal Forms is consistently available to assist.

The procedure is even more straightforward for current users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and click the Download button next to the selected document. Moreover, you can access the Minnesota 514 Foreign Tax Credit at any time since all documents ever acquired on the platform can be found within the My documents section of your profile. Save time and money on preparing official documents. Try US Legal Forms now!

- Verify that the form is appropriate for your circumstance and locality by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar located in the page header.

- Click Buy Now once you identify the suitable template.

- Choose the pricing option, Log Into your account or create a new one.

- Select your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Choose PDF or DOCX file format for your Minnesota 514 Foreign Tax Credit.

- Click Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

Taxpayers who meet specific criteria can claim the Minnesota 514 foreign tax credit without filing form 1116. Generally, if your foreign tax credits total below a certain threshold, you may not need to file the form. Always verify your personal circumstances with a tax professional to ensure compliance. USLegalForms can provide guidance on necessary documentation and filing.

You report the foreign tax credit on your IRS Form 1040. After completing Form 1116, you will transfer the calculated credit amount to the appropriate line on your Form 1040. This step is essential for effectively utilizing the Minnesota 514 foreign tax credit as part of your overall tax strategy.

The 1099 forms do not specifically list the foreign tax credit. However, they report your income, and any foreign tax withheld may be indicated. It is crucial to track foreign income accurately and to reference your 1099s when filling out your tax forms, especially when calculating the Minnesota 514 foreign tax credit.

When filing your taxes, you will submit Form 1116 alongside your 1040 form. For those opting for a deduction instead of a credit, you will list the foreign taxes directly on Schedule A. Make sure to follow the instructions carefully to ensure the Minnesota 514 foreign tax credit is applied correctly. Platforms like USLegalForms can simplify this step for you.

Certain individuals may qualify for exemptions from Minnesota income tax, including some retirees and low-income residents. Additionally, those meeting specific criteria for foreign income could benefit from the Minnesota 514 foreign tax credit, which also plays a role in determining your state tax obligations. Consulting a tax advisor can help clarify eligibility and exemptions.

The Minnesota foreign earned income exclusion allows residents to exclude a portion of their income earned abroad from state taxation. This can result in significant tax savings for eligible individuals. Utilizing this exclusion can complement your strategy for claiming the Minnesota 514 foreign tax credit, maximizing your benefits.

Yes, Minnesota taxes non-resident income, but the specifics can vary. Non-residents are generally taxed only on income sourced from Minnesota. To navigate these rules effectively and potentially benefit from the Minnesota 514 foreign tax credit, it's essential to consult with a tax professional.