Discharge of Lien - Individual

Note: This summary is not

intended to be an all-inclusive discussion of Minnesota's construction

or mechanic's lien laws, but does include basic provisions.

What is a construction or mechanic's lien?

Every state permits

a person who supplies labor or materials for a construction project to

claim a lien against the improved property. While some states differ

in their definition of improvements and some states limit lien claims to

buildings or structures, most permit the filing of a document with the

local court that puts parties interested in the property on notice that

the party asserting the lien has a claim. States differ widely in

the method and time within which a party may act on their lien. Also

varying widely are the requirements of written notices between property

owners, contractors, subcontractors and laborers, and in some cases lending

institutions. As a general rule, these statutes serve to prevent

unpleasant surprises by compelling parties who wish to assert their legal

rights to put all parties who might be interested in the property on notice

of a claim or the possibility of a claim. This by no means constitutes

a complete discussion of construction lien law and should not be interpreted

as such. Parties seeking to know more about construction laws in

their state should always consult their state statutes directly.

Who can claim a lien in this state?

Minnesota law permits

any party who performs engineering or land surveying services with respect

to real estate, or contributes to the improvement of real estate by performing

labor, or furnishing skill, material or machinery for any of the purposes

hereinafter stated, whether under contract with the owner of such real

estate or at the instance of any agent, trustee, contractor or subcontractor

of such owner, to have a lien upon the improvement. M.S.A. §514.01

How long does a party have to claim a lien?

A lien claimant

must file a statement of Lien within one hundred twenty (120) days of the

completion of work or forfeit his/her claim of lien. M.S.A. §514.08(1).

By what method is a lien filed in this state?

A statement of Lien

must be filed with the county recorder within one hundred and twenty (120)

days of the completion of work. A copy of the statement must be served

personally or by certified mail upon the owner or his agent. M.S.A.

§ 514.08.

How long is a lien good for?

Minnesota requires a

lien claimant to bring a legal action to enforce the lien within one (1)

year of the date of the last labor, skill, or material provided.

M.S.A. § 514.12.

Are liens assignable?

Minnesota statutes on

construction liens do not specifically speak to whether liens may be assigned

to other parties.

Does this state require or provide for a notice

from contractors and subcontractors to property owners?

Yes. Minnesota

law provides for a series of notices between contractors, subcontractors

and property owners. First, a contractor must provide the form

language contained in M.S.A. §514.011 advising the property owner

of his rights and the possibility of a lien. If there is a contract,

this notice must be included with the contract. If not, it must be supplied

separately.

Second, in order

for a subcontractor to be eligible to claim a lien, the subcontractor must

have provided notice to the property owner within forty-five (45) days

of the beginning of work. The form of this notice is contained in

statute §514.011(2) and advises the property owner of the right

to pay subcontractors directly.

Third, Minnesota statutes

provide for a subcontractor to demand that the contractor provide the

name and address of the property owner. Failure of the contractor

to provide this information renders the contractor liable for any damages

the subcontractor suffers as a result of the refusal. M.S.A. §514.011(3)

Finally, a subcontractor

who has not been paid may provide notice of the non-payment directly to

the property owner. M.S.A. §514.02(2).

Does this state require or provide for a notice

from the property owner to the contractor, subcontractor, or laborers?

Yes. Property

owners may, within fifteen days of the completion of the contract, demand

that any party having a lien furnish the owner with an itemized account

of the lien, the total amount due, and the full name and address of the

lien claimant. Lien claimants may not enforce their lien through

legal action until this information is provided.

Also, Minnesota statutes provide

for a notice from the property owner to the contractor advising that a

subcontractor has not been paid. M.S.A. §514.02(2).

Does this state require a notice prior to starting

work, or after work has been completed?

No. Minnesota

statutes do not require a Notice of Commencement or a Notice of Completion

as required in some other states.

Does this state permit a person with an interest

in property to deny responsibility for improvements?

Yes. Minnesota

statutes permit a party with an interest in property being improved to

serve notice on the parties improving the property that the interested

party will not be responsible and will not be subject to a lien.

This notice must be provided by certified mail, personal service, or posting

on the property within five (5) days of discovery that the work is taking

place by the party in interest. M.S.A. §514.06.

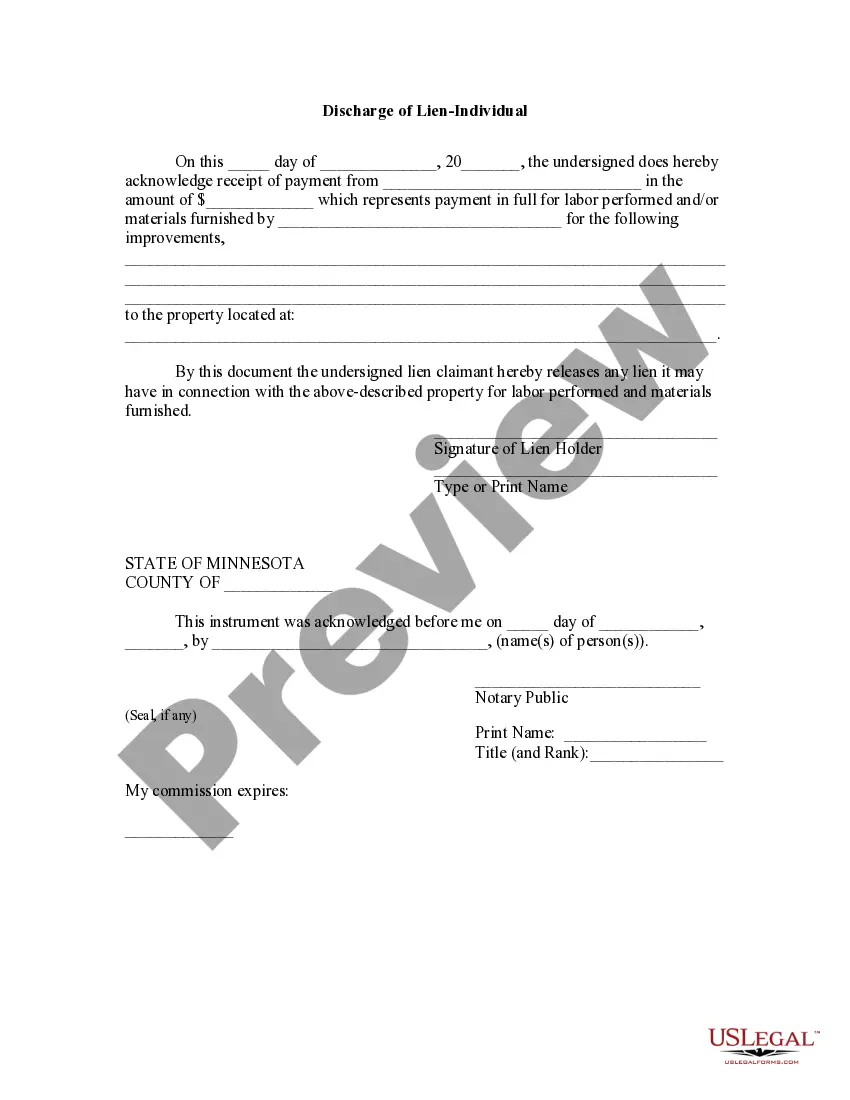

Is a notice attesting to the satisfaction of a

lien provided for or required?

No. Minnesota

statutes do not provide for or require that a lien holder who has been

paid produce or file a notice to that effect. However, please see

MN-10-09 Release of Lien as an example of a form that could be used by

a lien holder to provide a property owner with documentation that the lien

has been satisfied after payment in full.

By what method does the law of this state permit

the release of a lien?

As stated above,

Minnesota statutes have no specific provision for the release of a lien,

other than the automatic dissolution that occurs if a lien statement is

not filed within one hundred twenty (120) days of the completion of work,

or if suit to enforce the lien is not brought within one (1) year.

Does this state permit the use of a bond to release

a lien?

No.

Minnesota law does not have a provision under which a bond may be filed

for the purposes of releasing a lien.