Rental Agreement Residential With Guarantor

Description

How to fill out Rental Agreement Residential With Guarantor?

What is the most dependable service to obtain the Rental Agreement Residential With Guarantor and other updated versions of legal documents? US Legal Forms is the solution!

It's the largest collection of legal paperwork for virtually any scenario. Every template is expertly crafted and confirmed for adherence to federal and local laws. They are organized by region and state of applicability, making it easy to find what you require.

US Legal Forms is an excellent resource for anyone needing to handle legal paperwork. Premium subscribers benefit even further as they can fill out and sign previously downloaded documents electronically at any time within the integrated PDF editing tool. Explore it today!

- Experienced users of the site just need to Log In to the platform, verify their subscription status, and click the Download button next to the Rental Agreement Residential With Guarantor to obtain it.

- Once saved, the template remains accessible for future reference in the My documents section of your account.

- If you do not yet have an account with us, here are the steps necessary to create one.

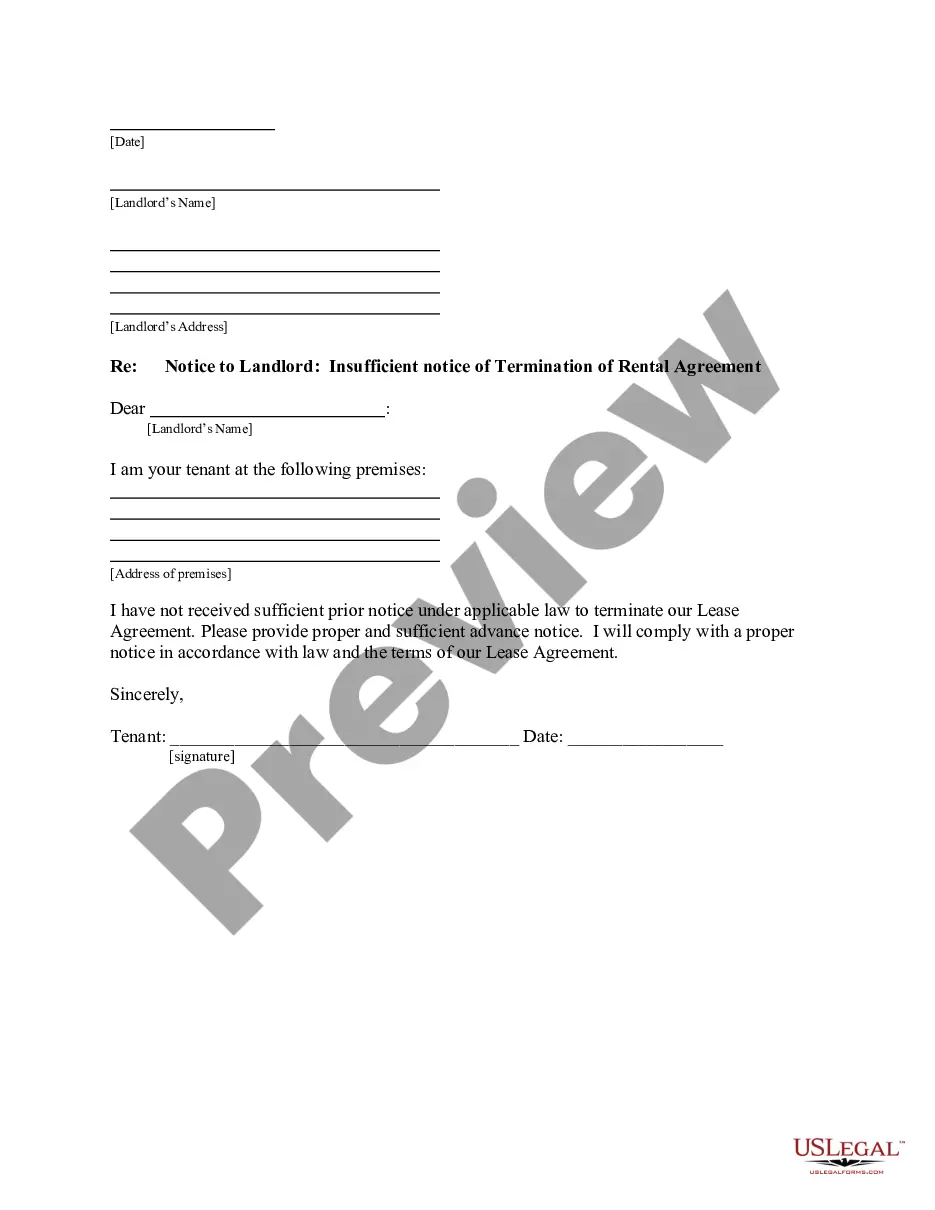

- Form compliance review. Before acquiring any template, ensure it aligns with your intended use and complies with your state or county's regulations. Review the form description and utilize the Preview option if available.

Form popularity

FAQ

The most important difference between a cosigner and a guarantor is that a cosigner is immediately responsible for paying rent, just as the tenant is. A guarantor is only responsible for paying rent when the tenant fails to do so themselves.

Who can be a guarantor. Guarantors are usually a relative or close friend of the tenant, but they don't have to be. Guarantors usually need a good credit history and income or savings above a certain amount.

Yes, you can request the primary applicant to add a guarantor to the application. This will email your primary applicant and ask them to add a guarantor to undersign their application and any lease agreements.

Adding a Guarantor AgreementTypically, a Guarantor Agreement is appended to the end of a lease agreement as an addendum. If, for whatever reason, you need to add a guarantor to a lease that has already been signed, be sure to have all tenants sign the agreement as well as the guarantor.

To be a guarantor you'll need to be over 21 years old, with a good credit history and financial stability. If you're a homeowner, this will add credibility to the application.