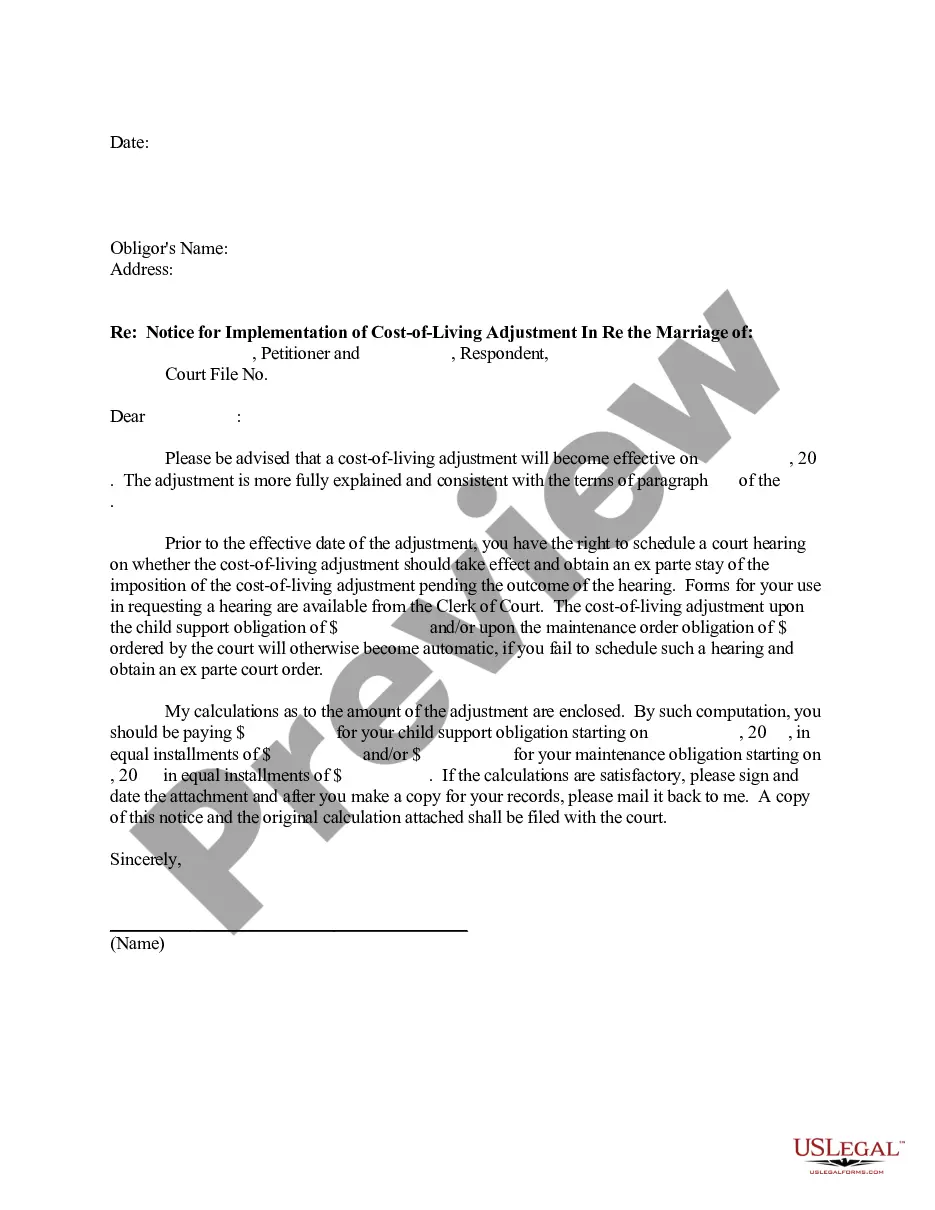

Cost Of Living Adjustment Letter For Public Servants 2020

Description

How to fill out Cost Of Living Adjustment Letter For Public Servants 2020?

When you are required to submit a Cost Of Living Adjustment Letter For Public Employees 2020 in line with your regional state's statutes and guidelines, there can be several alternatives to select from.

There's no requirement to verify every document to ensure it meets all the legal specifications if you are a US Legal Forms member.

It is a dependable service that can assist you in obtaining a reusable and contemporary template on any subject.

In addition, Premium members can also benefit from the powerful integrated tools for online document editing and signing. Try it out today!

- US Legal Forms is the most extensive online repository with a collection of over 85,000 readily available documents for business and personal legal matters.

- All templates are verified to comply with each state's statutes and regulations.

- Thus, when downloading the Cost Of Living Adjustment Letter For Public Employees 2020 from our site, you can feel assured that you have a legitimate and current document.

- Acquiring the required template from our platform is exceedingly simple.

- If you already possess an account, merely Log Into the system, confirm that your subscription is active, and save the chosen file.

- In the future, you can access the My documents tab in your profile and retain access to the Cost Of Living Adjustment Letter For Public Employees 2020 at any time.

- If it’s your initial experience with our library, please follow the instructions below.

- Browse the suggested page and review it for compliance with your criteria.

Form popularity

FAQ

For context, the typical rate of inflation is usually closer to 3% a year. In fact, companies that give out cost-of-living raises (as opposed to merit raises, which are based on performance) commonly boost workers' pay by about 3% year after year. But given recent inflation, that won't really cut it going into 2022.

You give annual salary cost of living adjustments, so you raise each employee's wages by 1.5%. So, if you have an employee who earns $35,000 per year, you would add 1.5% to their wages. Due to the cost of living increase of 1.5%, this employee will now earn $35,525.

Calculates each category or item's CPI by dividing the current year's average price by the base year's average price and multiplying the total by 100.

It is based on the percentage increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from the third quarter of the last year a COLA was determined to the third quarter of the current year. If there is no increase, there can be no COLA.