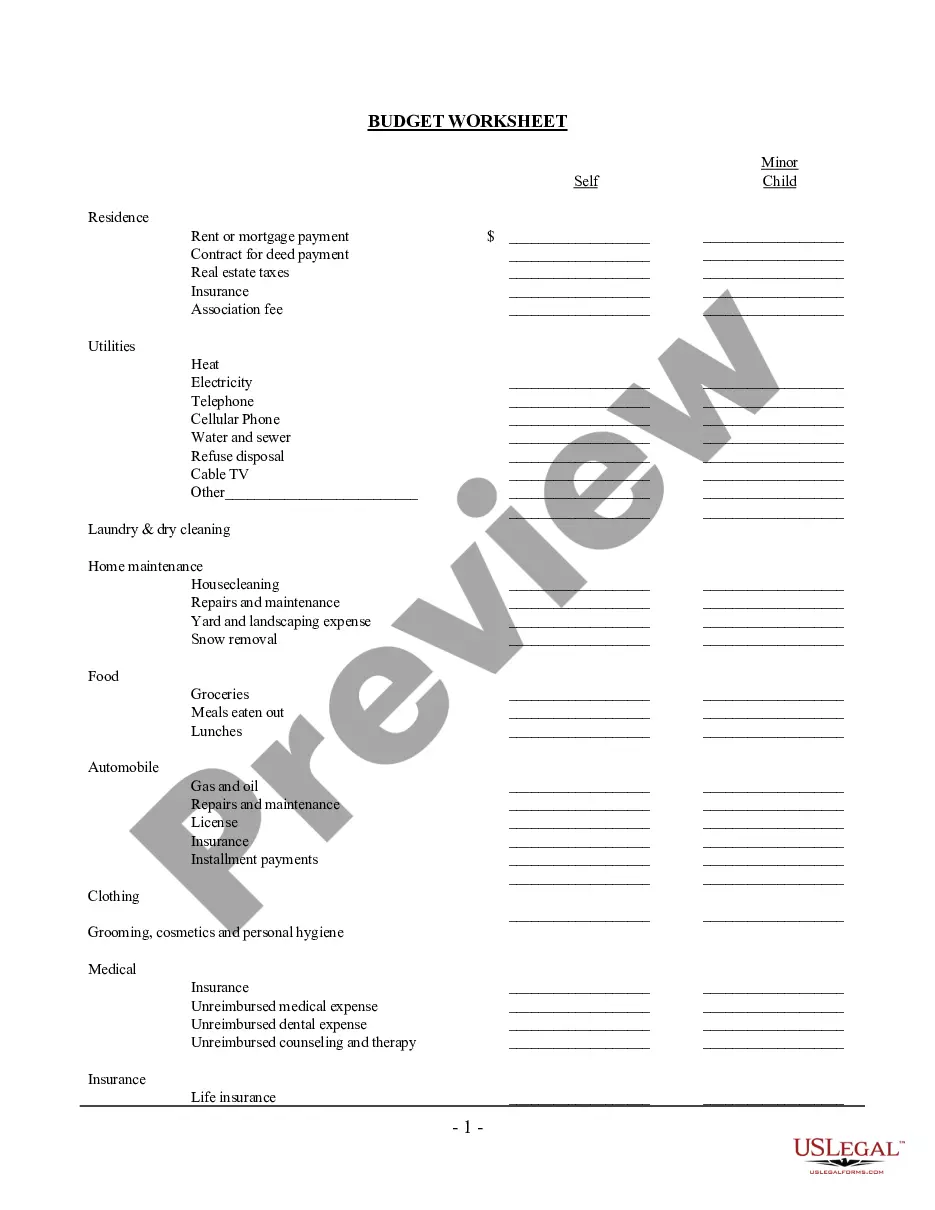

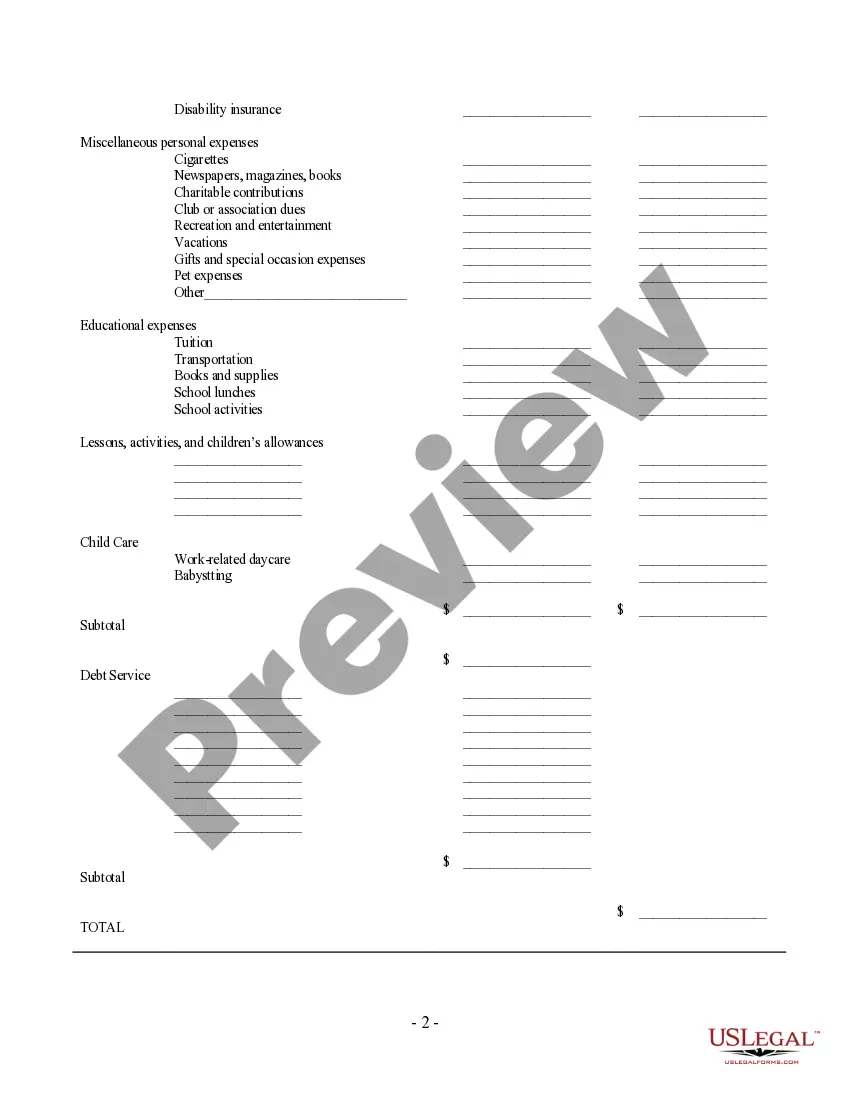

Monthly Budget Worksheet For Divorce

Description

Form popularity

FAQ

The 50 30 20 budget rule is a budgeting framework that divides your after-tax income into three distinct categories: 50% for necessities, 30% for luxuries or discretionary spending, and 20% for savings and debt repayment. This structure provides a balanced approach to spending and saving. Adopting a monthly budget worksheet for divorce can effectively help you implement this rule, ensuring you remain financially stable during and after this transition.

A 50/30/20 rule of budgeting worksheet is a tool that helps you visualize your financial allocations according to the 50/30/20 guideline. It typically includes sections for income, needs, wants, and savings, making it easier to track and manage your budget. Using a monthly budget worksheet for divorce ensures that you have a clear plan, especially when adjusting to new financial circumstances.

To calculate the 50/30/20 rule, first determine your net income after taxes. Next, multiply this amount by 0.50 for needs, 0.30 for wants, and 0.20 for savings. This straightforward calculation is particularly beneficial when creating a monthly budget worksheet for divorce, allowing you to allocate funds efficiently as you plan for your financial future.

To write a monthly budget, start by listing all sources of income and tallying their total. Next, categorize your expenses into needs, wants, and savings. For practical use, deploying a monthly budget worksheet for divorce allows you to organize these figures clearly, making it easier to see where you can cut back or save more as you adjust to new financial realities.

The 50%, 30%, 20% rule of budgeting directs you to spend half of your income on necessities, 30% on non-essentials, and 20% on savings or debt payment. This simple guideline helps you manage your finances systematically. For those facing a divorce, incorporating this strategy into your monthly budget worksheet for divorce can provide clarity and structure during a financially challenging time.

The 75-15-10 rule is a budgeting method where you allocate 75% of your income to needs and wants, 15% to savings, and 10% to charitable donations or giving back. This approach prioritizes essential expenses while ensuring you save and contribute to your community. If you’re navigating a divorce, a monthly budget worksheet for divorce can assist you in applying this rule to your new financial situation.

The 50/30/20 budget rule divides your after-tax income into three categories: needs, wants, and savings. For instance, if you earn $4,000 a month, you would allocate $2,000 (50%) to essential expenses like housing and food, $1,200 (30%) for discretionary spending, and $800 (20%) for savings or debt repayment. Using a monthly budget worksheet for divorce can help you visualize these allocations and manage your finances effectively during this transition.

The 70/20/10 budget rule is a simple guideline for managing your finances effectively. According to this rule, you allocate 70% of your income to needs and wants, 20% to savings or debt repayment, and 10% to charity or investments. Implementing this rule within a monthly budget worksheet for divorce can help you achieve balance and ensure you are thinking about both your present and future financial well-being. This approach encourages a thoughtful mindset towards budgeting.

Filling out a monthly budget sheet is straightforward and helps clarify your financial situation. Start by listing your sources of income at the top, followed by fixed and variable expenses. Categorize each expense and input the amounts, ensuring you total everything to see your overall budget balance. Using a monthly budget worksheet for divorce can guide you through this process and simplify your financial planning.

Budgeting for separation involves creating a detailed plan that reflects your new financial reality. Begin by listing all essential expenses, such as housing, utilities, and food, while also considering your income. A monthly budget worksheet for divorce is particularly useful, as it provides a framework to organize your finances effectively. This approach can help you adjust to your new situation while maintaining financial stability.