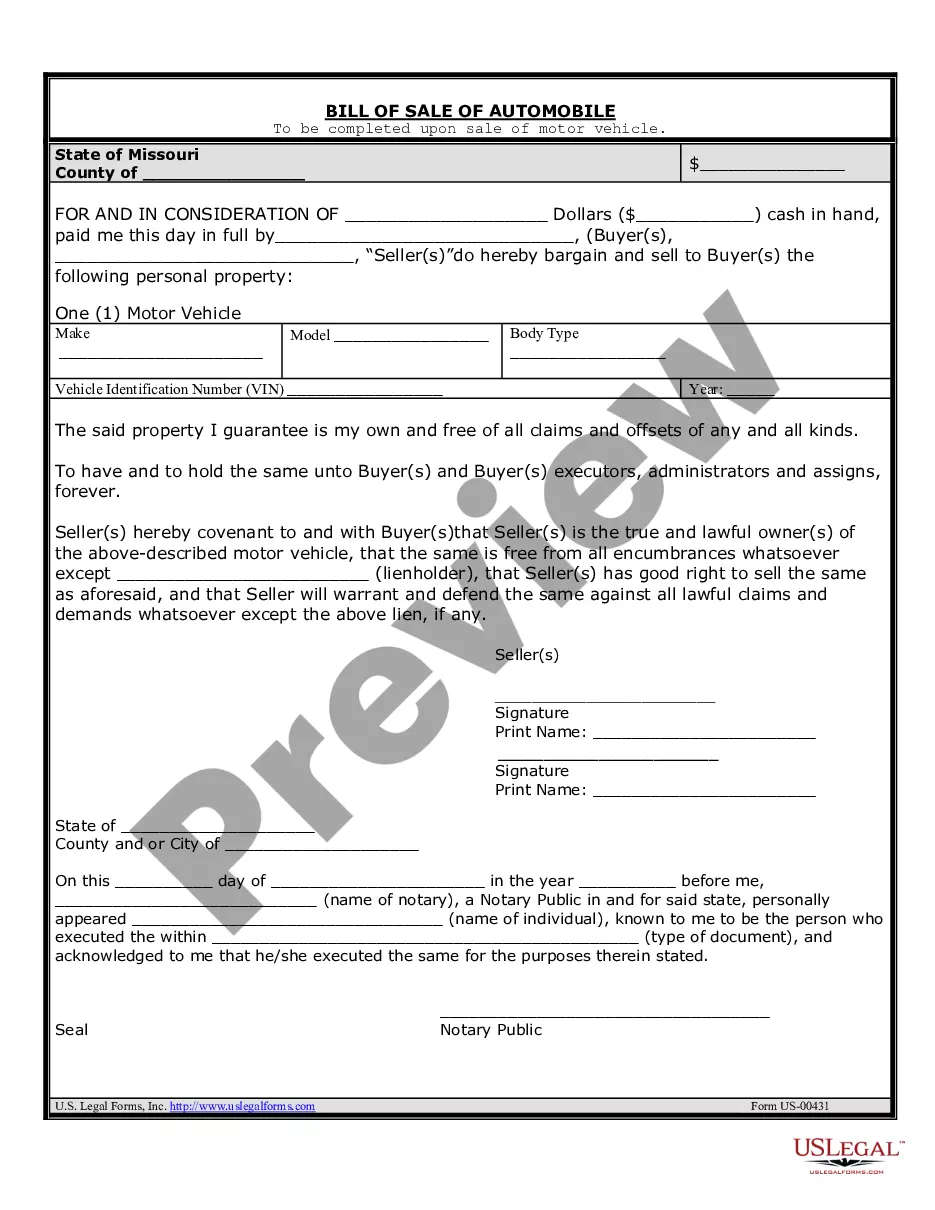

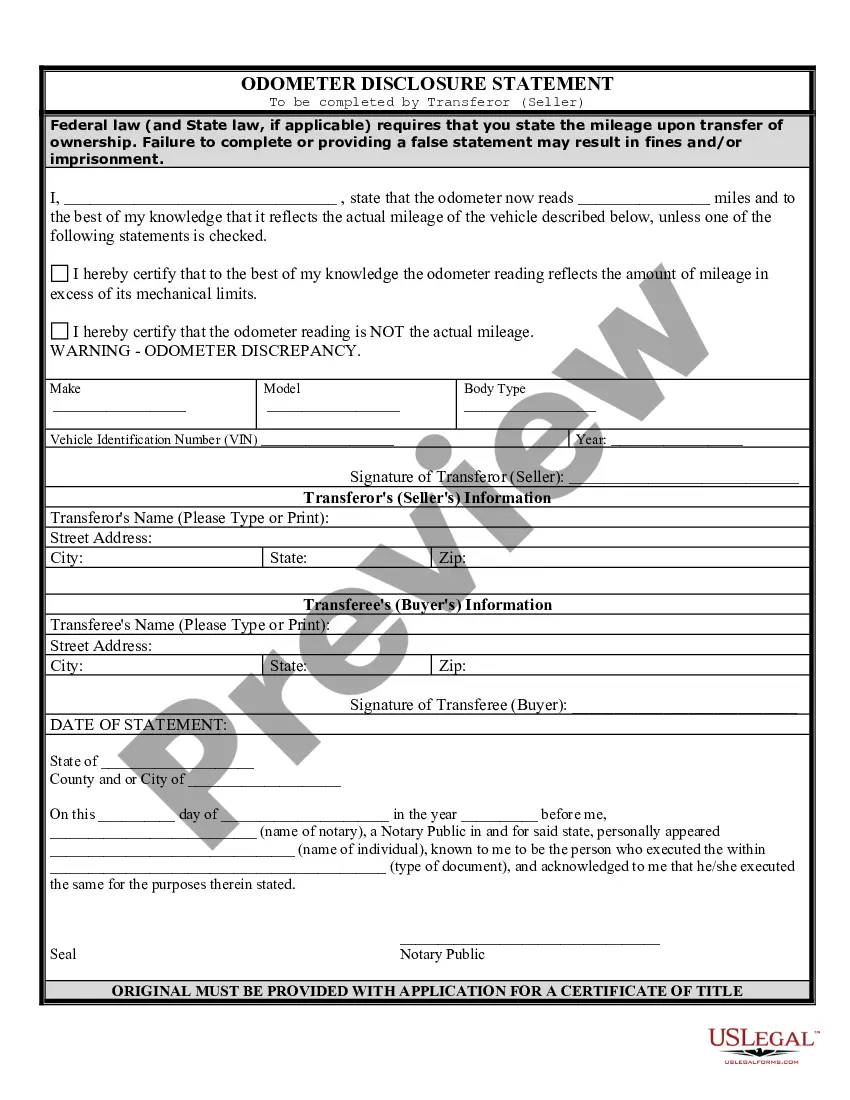

This Bill of Sale of Automobile contains the following information: the make/model of the car, VIN number and other information. Seller guarantees that the property is his/her own and is free of all claims and offsets of any kind. The form also contains the Odometer Disclosure Statement required by Federal Law and State Law, where applicable, which must be signed in the presence of a notary public.

Missouri Odometer Statement with Address: An Overview A Missouri odometer statement with address is a legal document used for reporting a vehicle's mileage during the process of buying or selling a motor vehicle in the state of Missouri, United States. It serves as a crucial piece of evidence to ensure transparency and prevent fraud in odometer readings. Typically, the statement includes relevant details about the vehicle, the parties involved in the transaction, and the vehicle's accurate mileage reading. Types of Missouri Odometer Statement with Address: 1. Odometer Disclosure Statement (ODS): This is the most commonly used form for reporting the vehicle's mileage accurately. It is essential for almost all vehicle sales, transfers, or lease terminations in Missouri. The ODS is often submitted during the title transfer process, usually at the time of the sale. This statement contains critical information such as the owner's name, the buyer's name and address, vehicle details (make, model, year, VIN), and the vehicle's current mileage reading. 2. Odometer Correction Statement: In certain cases, corrections or updates to the initially reported mileage may be required due to human error, mechanical malfunctions, or other factors. The correction statement is used when there is a need to amend the recorded mileage on a previously submitted Odometer Disclosure Statement. It must include the corrected mileage, the reason for the correction, and the date the correction was made. 3. Odometer Statement for Exempt Vehicles: This variant of the Missouri odometer statement applies to vehicles that are exempt from disclosing their mileage due to their age or type. For example, vehicles over 10 years old are typically exempt from mileage disclosure requirements. This statement certifies that the vehicle falls under the exemption category and does not require mileage reporting. 4. Odometer Statement for Vehicles with Discrepancy: This statement is used when there is a discrepancy between the vehicle's recorded mileage and its actual mileage. It serves as documentation of the inconsistent or suspicious odometer readings. This statement should include the details of the discrepancy, such as the date and mileage recorded at the time of purchase, the current mileage, and any information regarding previous unknown mileage discrepancies. Ensuring the accuracy and completeness of the Missouri odometer statement with address is crucial to protect both buyers and sellers from any potential fraud or misrepresentation. It is always recommended consulting with local authorities or the Missouri Department of Revenue's Motor Vehicle Bureau for the most up-to-date information and specific requirements regarding odometer statements in Missouri.