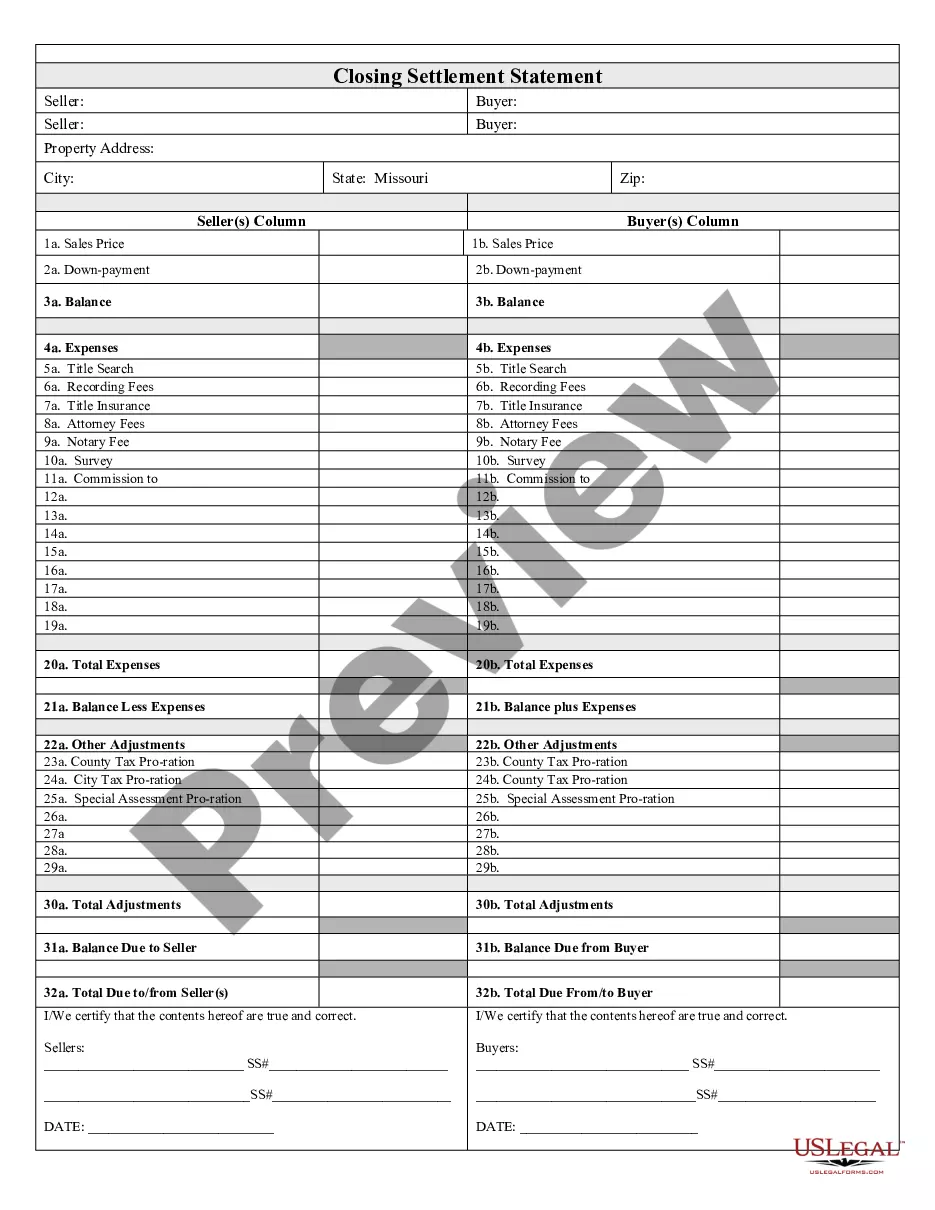

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Missouri Closing Costs for Seller: A Comprehensive Guide When selling a property in Missouri, it is crucial to have a clear understanding of the closing costs involved. Closing costs refer to the fees and expenses that buyers and sellers incur during the real estate transaction process. While buyers typically bear the brunt of the closing costs, sellers are responsible for their fair share as well. This article will delve into the various types of Missouri closing costs for sellers, shedding light on their importance and the potential expenses involved. 1. Real Estate Agent Commission: The most significant closing cost for sellers in Missouri is the real estate agent commission. Sellers are generally responsible for paying both their listing agent's commission and the buyer's agent commission. The commissions are usually calculated as a percentage (typically 5-6%) of the final sale price of the property. 2. Title Insurance: Another important closing cost is title insurance. This insurance protects the buyer against any potential ownership disputes or claims on the property's title. In Missouri, sellers are typically responsible for purchasing the owner's title insurance policy, which ensures that the property's title is clear and marketable for the buyer. The cost varies based on the property's value but can range from around 0.5% to 1% of the purchase price. 3. Transfer Taxes: Missouri imposes a transfer tax on the sale of real estate, with the responsibility falling on the seller. The transfer tax rate is typically $3.00 for every $1,000 of the property's sale price. These taxes help fund various public services and infrastructure improvements in the state. 4. Attorney Fees: While not mandatory in Missouri, sellers often choose to hire an attorney to handle the legal aspects of the closing process. Attorney fees can vary based on the complexity of the sale, the attorney's experience, and the services rendered. Having an attorney ensures all legal documents are drafted correctly, protecting the seller's interests and facilitating a smooth closing process. 5. Prorated Property Taxes: Sellers are required to pay a share of the property taxes up until the closing date. These taxes are prorated based on the number of days the seller owned the property during the tax year. The exact amount depends on the municipality and tax rates, and is usually calculated by the title company or closing attorney. 6. Recording Fees: When completing the sale of a property, certain documents must be recorded with the county or local government offices. Sellers are responsible for paying the fees associated with filing these documents, which can range from $25 to $100. 7. Home Warranty: Sometimes sellers choose to offer a home warranty as an added incentive to buyers. The cost of the home warranty can vary based on the coverage level and the provider chosen. While not mandatory, it can increase the overall appeal of the property and provide peace of mind to potential buyers. Understanding Missouri closing costs for sellers is crucial to ensure a smooth and financially aware transaction. Sellers should consult with their real estate agent, attorney, or closing company to get a comprehensive estimate of the expenses involved. Being prepared and knowledgeable about these costs will help sellers budget accordingly and avoid any surprises during the closing process.