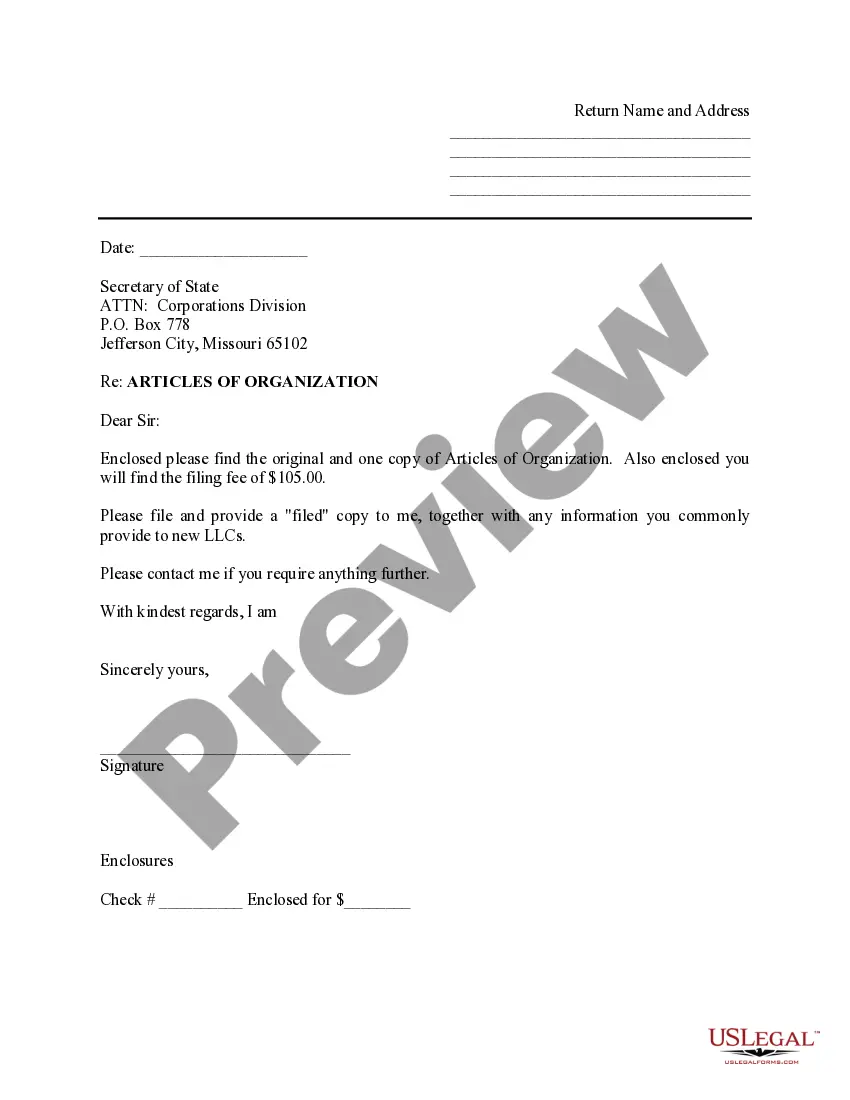

This is a sample cover letter for use with filing LLC Articles of Organization or Certificate of Formation with the Secretary of State.

Llc Articles State For Real Estate

Description

Form popularity

FAQ

Yes, the state where you set up your LLC can have major implications for your real estate business. Each state has unique requirements and benefits that influence operations, taxation, and compliance. Focusing on LLC articles state for real estate allows you to make a better-informed decision. Utilizing platforms like USLegalForms can help clarify these differences and streamline the formation process.

Some states, like Wyoming and Nevada, are often highlighted for their favorable tax structures for LLCs. However, low taxes shouldn’t be the only factor to consider; you should also look into the overall business environment and regulatory landscape. This makes understanding LLC articles state for real estate crucial, as these elements can directly affect your investment success. A reliable resource like USLegalForms can guide you through this analysis.

Yes, the state you choose for your LLC can impact your business significantly. States have different regulations, fees, and tax structures that may affect your operations. When dealing with LLC articles state for real estate, it’s essential to understand how each state’s rules apply. An informed decision can lead to better financial outcomes and compliance.

When forming your real estate LLC, consider the state where you plan to do business. Local laws, tax implications, and real estate regulations can vary significantly between states. It's wise to research these factors and how they relate to LLC articles state for real estate. For many, consulting a professional or using a platform like USLegalForms can help simplify the process.

If privacy is a primary concern, consider forming your LLC in Wyoming or Nevada. These states provide enhanced privacy protections, allowing you to keep personal information off public records. By leveraging LLC articles state for real estate, you can establish a business structure that maintains your anonymity while complying with legal requirements.

For non-residents, Delaware and Wyoming are top choices for LLC formation. These states do not require a physical presence and offer strong asset protection laws. Additionally, their processes are straightforward, making it easy for non-residents to manage their LLCs from afar. Incorporating LLC articles state for real estate in these states can simplify your legal obligations.

Yes, it does matter what state you choose for your LLC formation. The regulations, taxes, and costs can vary significantly from one state to another. By selecting the right state and utilizing LLC articles state for real estate, you can optimize your business's operational efficiency and legal standing. Consider your long-term goals when making this decision.

The best state to create an LLC often depends on your specific needs. Delaware is a popular choice due to its flexible laws and efficient court system. Florida and Texas also rank highly for their simplicity in registration and favorable tax structures. Utilizing LLC articles state for real estate can streamline your process and ensure you meet all legal requirements.

When forming a holding company, consider states like Delaware and Nevada. These states offer favorable regulations and tax benefits. Delaware, in particular, is renowned for its business-friendly laws. By utilizing LLC articles state for real estate in these jurisdictions, you can enjoy enhanced asset protection and privacy for your holdings.

Many investors still consider the 2% rule relevant, although market conditions can change its applicability. While some argue it may not fit modern investment strategies, it can serve as a quick screening tool for potential properties. It's essential to adapt the rule based on current market dynamics. Leverage your knowledge of LLC articles state for real estate while evaluating investment opportunities.