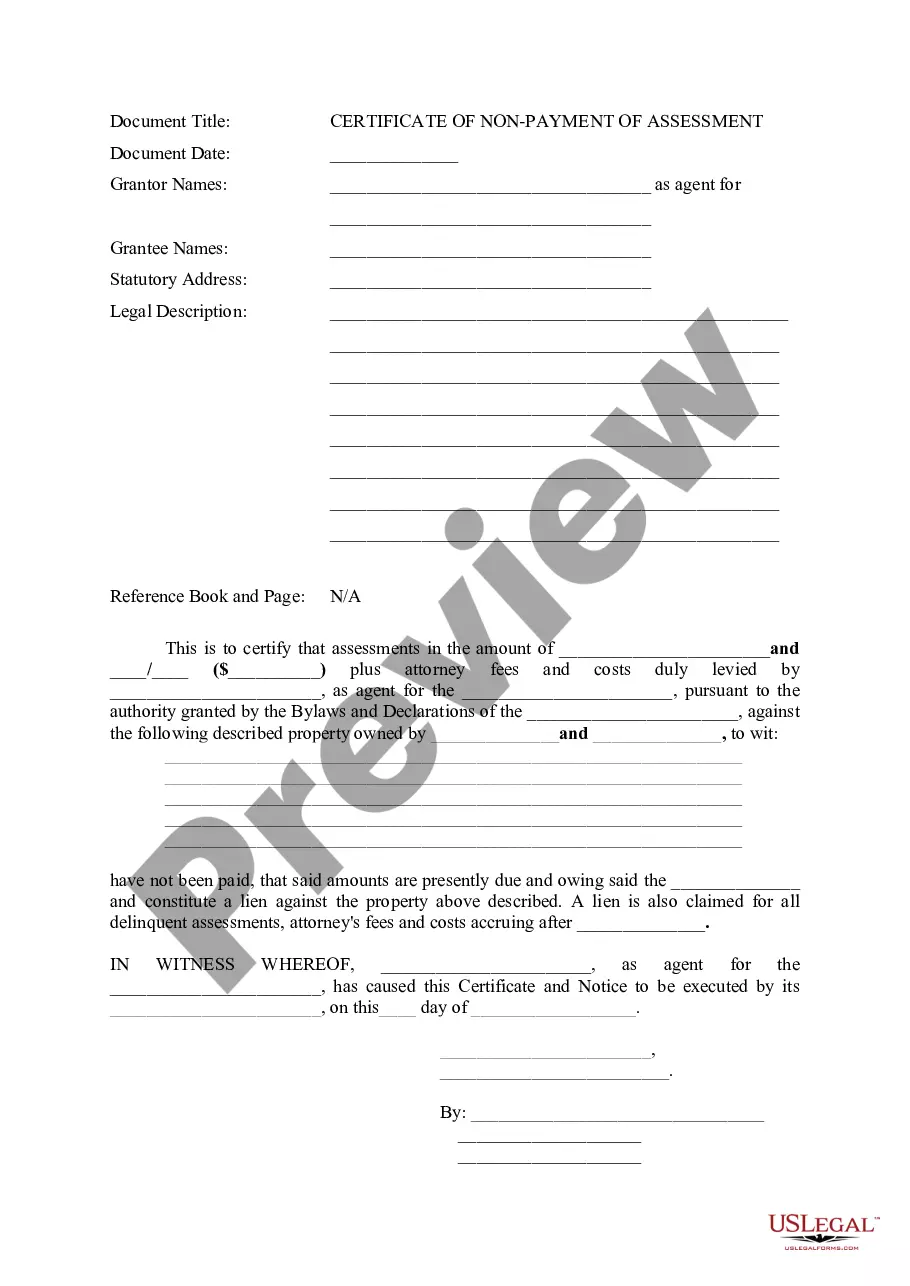

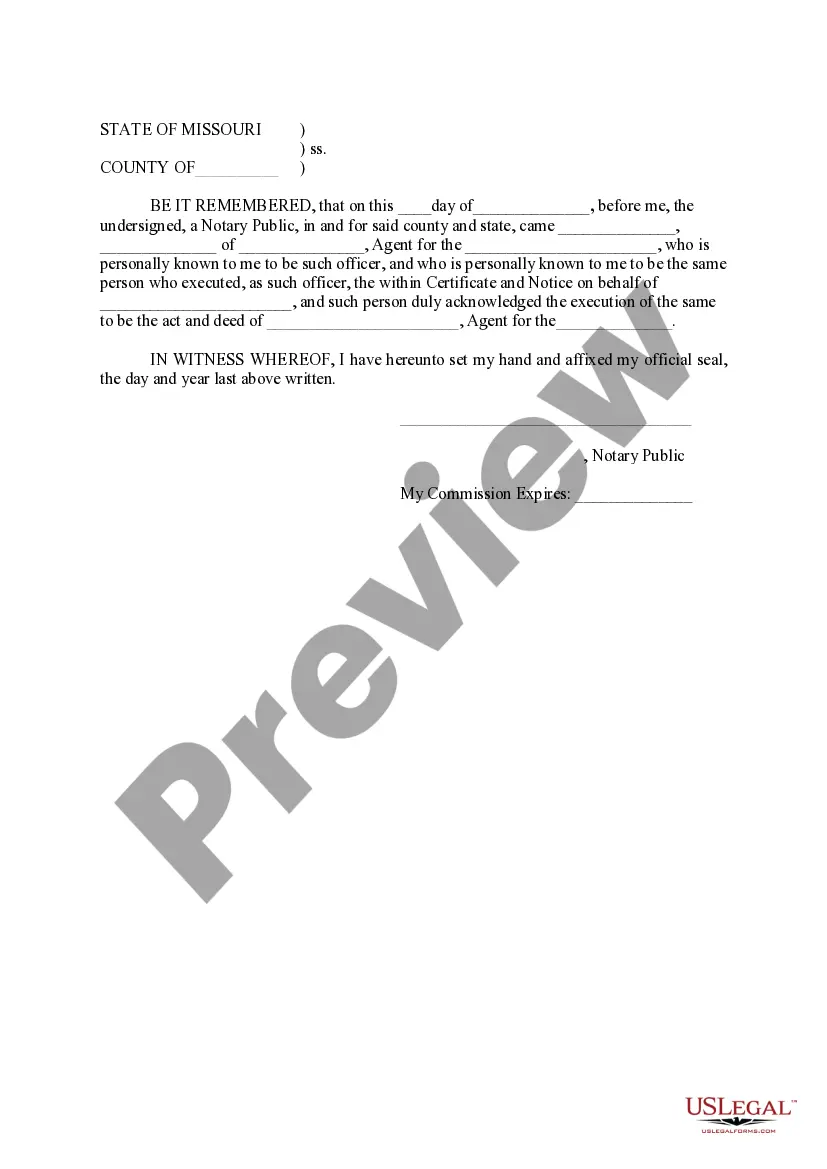

A Statement of Non-Assessment Missouri for non-highway use is a document that declares a property to be exempt from assessment for road and highway purposes within the state of Missouri. This statement is typically issued by the Missouri Department of Transportation (Moot) or the local county assessor's office. The purpose of this statement is to acknowledge that the property in question is not being used as a public roadway or a highway and therefore should not be subject to assessment or taxation based on its use for non-highway purposes. This exemption is applicable to land or parcels that are currently being utilized for non-highway purposes, such as residential, commercial, industrial, or agricultural use. This statement is especially important for property owners who wish to ensure that their land is not mistakenly considered as part of a public roadway or highway, which could potentially lead to additional assessments or property tax liabilities. By obtaining this statement, property owners can protect their rights and assert that their land does not serve as a public right of way. Different types of Statement of Non-Assessment Missouri for non-highway use may include: 1. Residential Property Statement of Non-Assessment: This type of statement is specifically applicable to residential properties that are utilized for non-highway purposes, including single-family homes, apartments, condominiums, or any other type of residential structure. 2. Commercial Property Statement of Non-Assessment: This type of statement is relevant for commercial properties that are used for non-highway purposes, such as office buildings, retail stores, restaurants, or any other type of commercial establishment. 3. Industrial Property Statement of Non-Assessment: This statement is applicable to industrial properties that are utilized for non-highway use, including factories, warehouses, manufacturing plants, or any other type of industrial facility. 4. Agricultural Property Statement of Non-Assessment: This type of statement is specifically designed for agricultural properties that are being used for non-highway purposes, such as farms, ranches, or any land primarily used for cultivation, animal husbandry, or crop production. Obtaining a Statement of Non-Assessment Missouri for non-highway use is an essential step for property owners who want to protect their land from being taxed or assessed as part of the public road network. It ensures that the property's non-highway use is officially recognized, providing peace of mind and potential financial savings. Property owners should consult with their local county assessor's office or Moot to determine the specific requirements and procedures for obtaining this statement based on the type of property involved.

Statement Of Non Assessment Missouri For Non-highway Use

Description Sample Letter Of Closure Of Business To Bir

How to fill out Closing Sample Letter Of Closure Of Business To Bir?

Handling legal papers and operations might be a time-consuming addition to your entire day. Statement Of Non Assessment Missouri For Non-highway Use and forms like it often require that you look for them and understand how you can complete them properly. For that reason, whether you are taking care of financial, legal, or individual matters, having a thorough and hassle-free online catalogue of forms close at hand will help a lot.

US Legal Forms is the number one online platform of legal templates, featuring over 85,000 state-specific forms and a variety of tools to help you complete your papers easily. Explore the catalogue of appropriate documents available to you with just one click.

US Legal Forms gives you state- and county-specific forms offered by any moment for downloading. Shield your document managing processes having a top-notch support that allows you to make any form within minutes without additional or hidden cost. Just log in to your profile, identify Statement Of Non Assessment Missouri For Non-highway Use and download it immediately in the My Forms tab. You can also gain access to formerly saved forms.

Could it be the first time utilizing US Legal Forms? Register and set up a free account in a few minutes and you will get access to the form catalogue and Statement Of Non Assessment Missouri For Non-highway Use. Then, stick to the steps below to complete your form:

- Ensure you have found the proper form by using the Review feature and reading the form description.

- Choose Buy Now when ready, and select the monthly subscription plan that is right for you.

- Choose Download then complete, sign, and print out the form.

US Legal Forms has twenty five years of experience assisting consumers manage their legal papers. Find the form you require today and improve any operation without having to break a sweat.