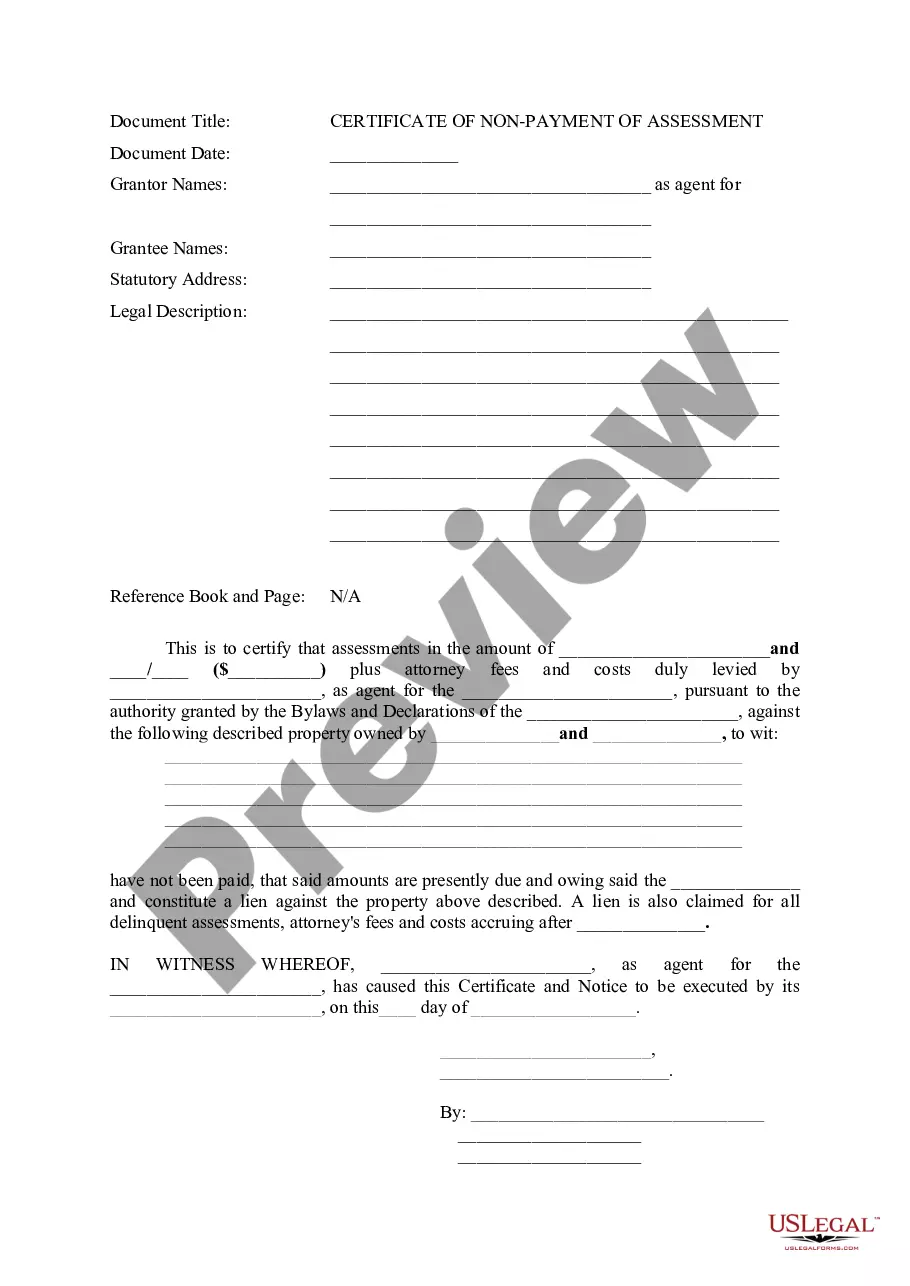

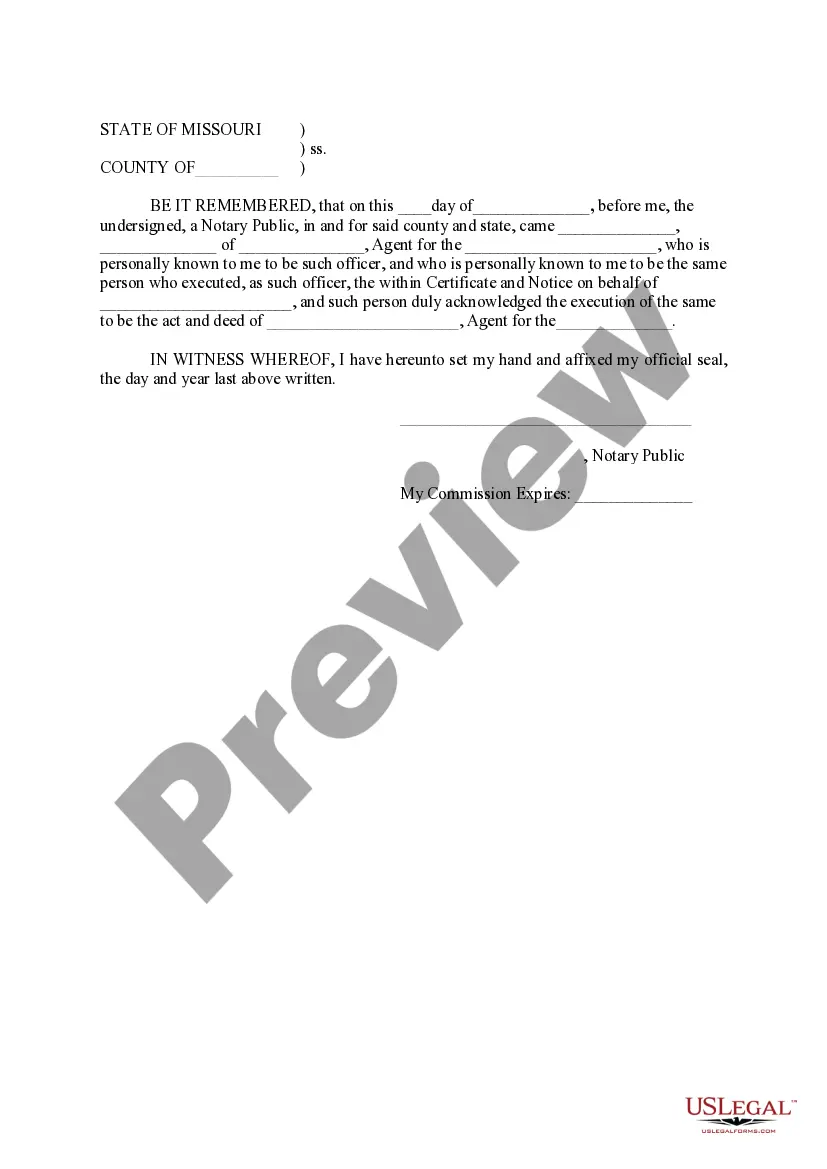

Statement Of Non Assessment Missouri With Example

Description

How to fill out Missouri Certificate Of Non-Payment Of Assessment?

Handling legal documents can be perplexing, even for the most seasoned professionals.

If you are seeking a Statement Of Non Assessment Missouri With Example and don't have the opportunity to spend time searching for the correct and updated version, the process can be overwhelming.

Tap into a repository of articles, guidelines, and materials related to your circumstances and needs.

Save time and energy looking for the documents you require, and use US Legal Forms’ advanced search and Preview feature to locate Statement Of Non Assessment Missouri With Example and obtain it.

Ensure that the template is recognized in your state or region. Select Buy Now when you are prepared. Choose a monthly subscription plan. Select the file format you prefer, and Download, complete, eSign, print, and send your document. Enjoy the US Legal Forms online library, supported by 25 years of experience and reliability. Revolutionize your daily document management into a straightforward and user-friendly process today.

- If you have a monthly subscription, Log In to your US Legal Forms account, find the form, and download it.

- Check your My documents section to view the documents you have previously saved as well as manage your folders as necessary.

- If it’s your first time using US Legal Forms, create an account to gain unlimited access to all the perks of the library.

- Here are the steps to follow after downloading the form you desire.

- Verify it is the correct document by previewing it and reading its details.

- Access state- or region-specific legal and business documents.

- US Legal Forms addresses any needs you may have, from personal to business paperwork, all in one place.

- Employ creative tools to complete and manage your Statement Of Non Assessment Missouri With Example.

Form popularity

FAQ

If you are removing a vehicle you will need to show proof of the reason for removal: sale or trade papers, 'Date of Loss' letter from an insurance company, repossession papers, police report for a stolen vehicle, receipt from a salvage yard, etc.

If you have never owned personal property or are new to MO, then you may also need a waiver (statement or non-assessment). You have several options of establishing your personal property account: online via our customer service portal, by visiting on of our office or via virtual appointment.

assessment is issued to a county resident when no personal property tax was assessed for the prior year. This certificate is used in lieu of a paid personal property tax receipt when registering a vehicle or renewing license plates. No fee is charged for a certificate of nonassessment.

You will need to contact the assessor in the county of your residence to request the statement or non-assessment and to be added to the assessment roll for the subsequent tax year.

A taxpayer is presumed to owe taxes on property unless the taxpayer demonstrates qualification for a certificate of non-assessment. To obtain a certificate of non-assessment, contact the Jackson County Assessment Department or call 816-881-1330.