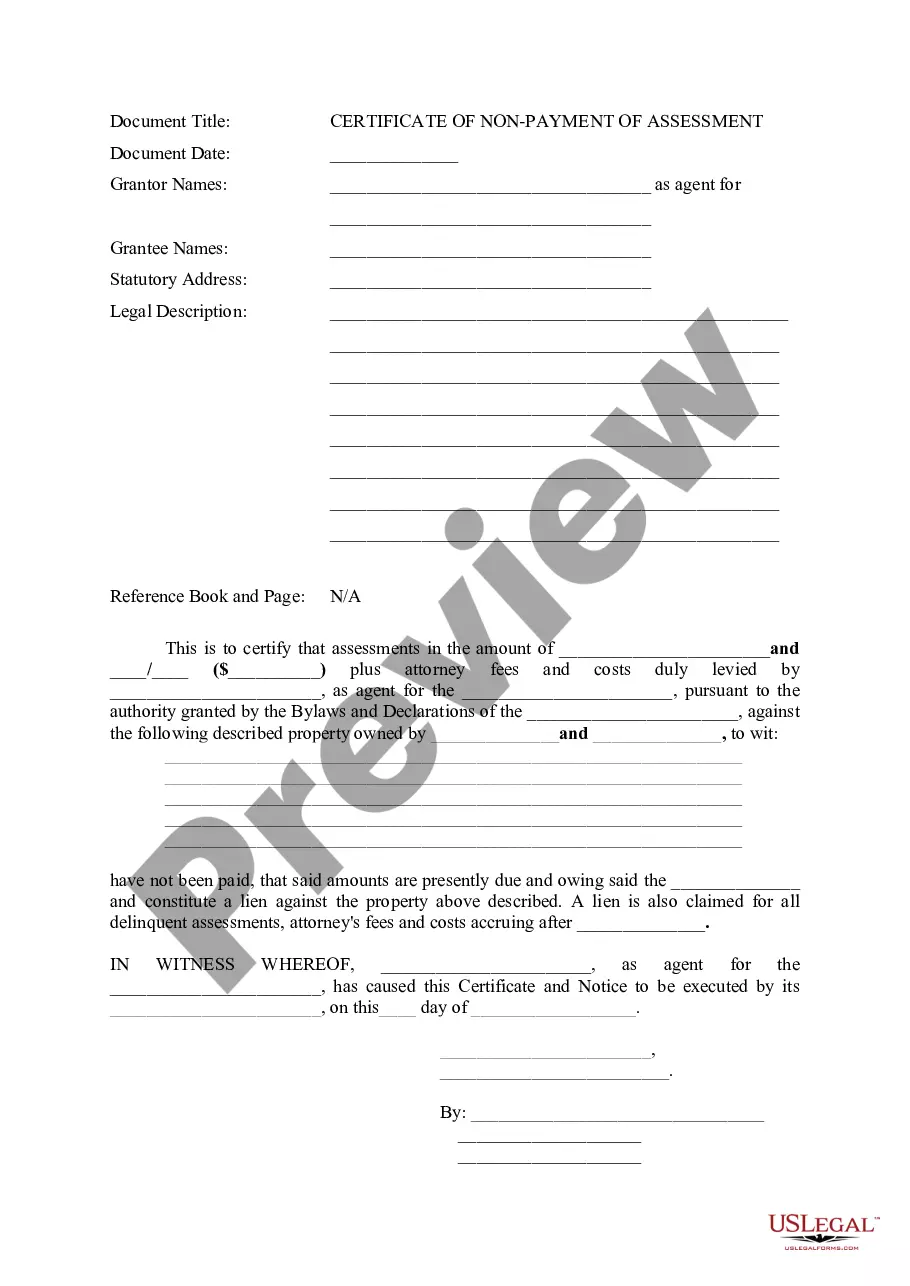

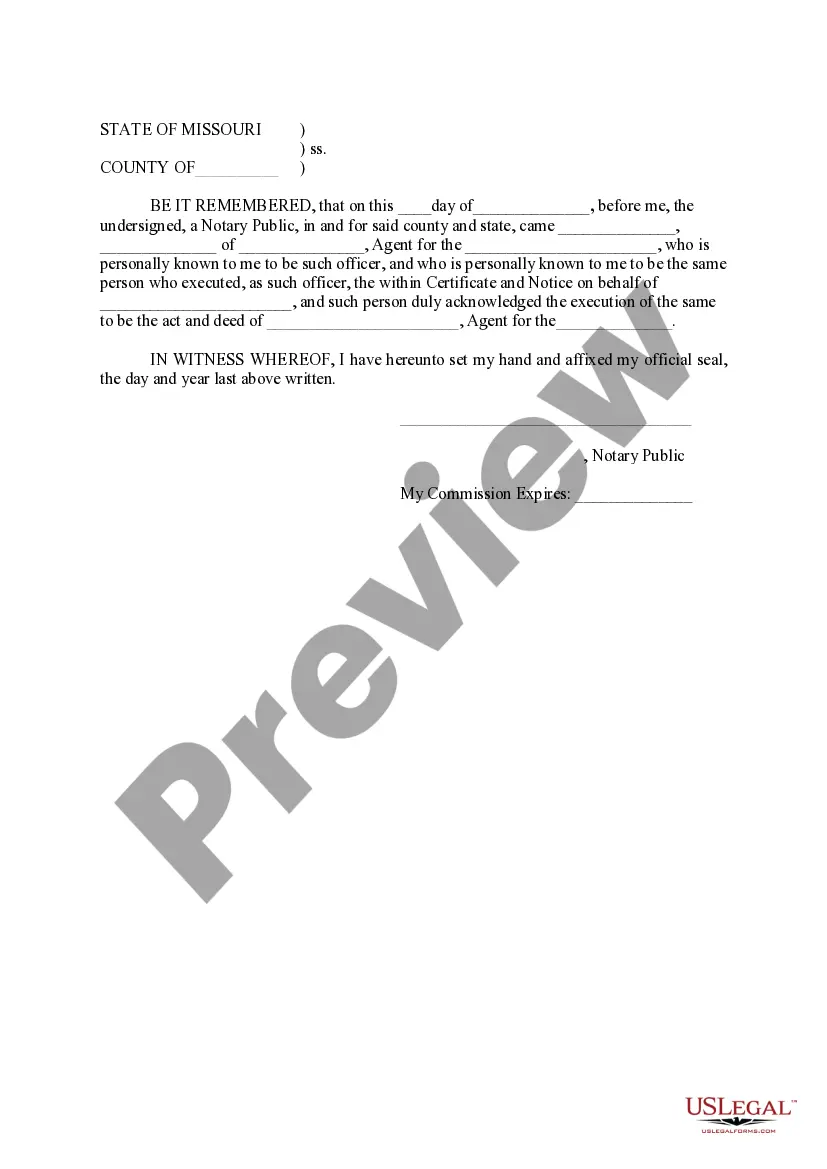

The Statement of Non-Assessment in Missouri is an official document used to indicate that a property has not been assessed for property taxes due to its exempt status. This statement is often required by individuals or organizations to provide proof that a property is exempt from taxation. One type of Statement of Non-Assessment in Missouri is the Non-Profit Statement of Non-Assessment. This statement is issued to non-profit organizations that own or lease properties used for charitable, religious, educational, scientific, or other qualifying purposes. It certifies that the property is exempt from property taxes as defined by Missouri state law, such as Section 137,100 RSM. For example, a church in Missouri may need to obtain a Non-Profit Statement of Non-Assessment to confirm its exemption from property taxes. By obtaining this statement, the church can fulfill any requirements set by local government bodies or lending institutions, demonstrating that their property is not subject to tax assessment. Another type of Statement of Non-Assessment in Missouri is the Government Entity Statement of Non-Assessment. This statement applies to properties owned by local, state, or federal government entities that are exempt from property taxes. It serves as official documentation supporting their exemption. For instance, a public school district in Missouri may need a Government Entity Statement of Non-Assessment to provide evidence that its school buildings are exempt from property taxes. This statement can be useful for securing funding or applying for grants, as it assures concerned parties that the properties in question have been legally surveyed and deemed exempt. In summary, the Statement of Non-Assessment in Missouri is a vital document that certifies the exempt status of a property. It is necessary for non-profit organizations, government entities, or any property owner seeking to prove their exemption from property taxes. These statements, such as the Non-Profit and Government Entity variations, play a significant role in fulfilling legal and financial requirements.

Statement Of Non Assessment Missouri With Example

Description missouri statement of non assessment

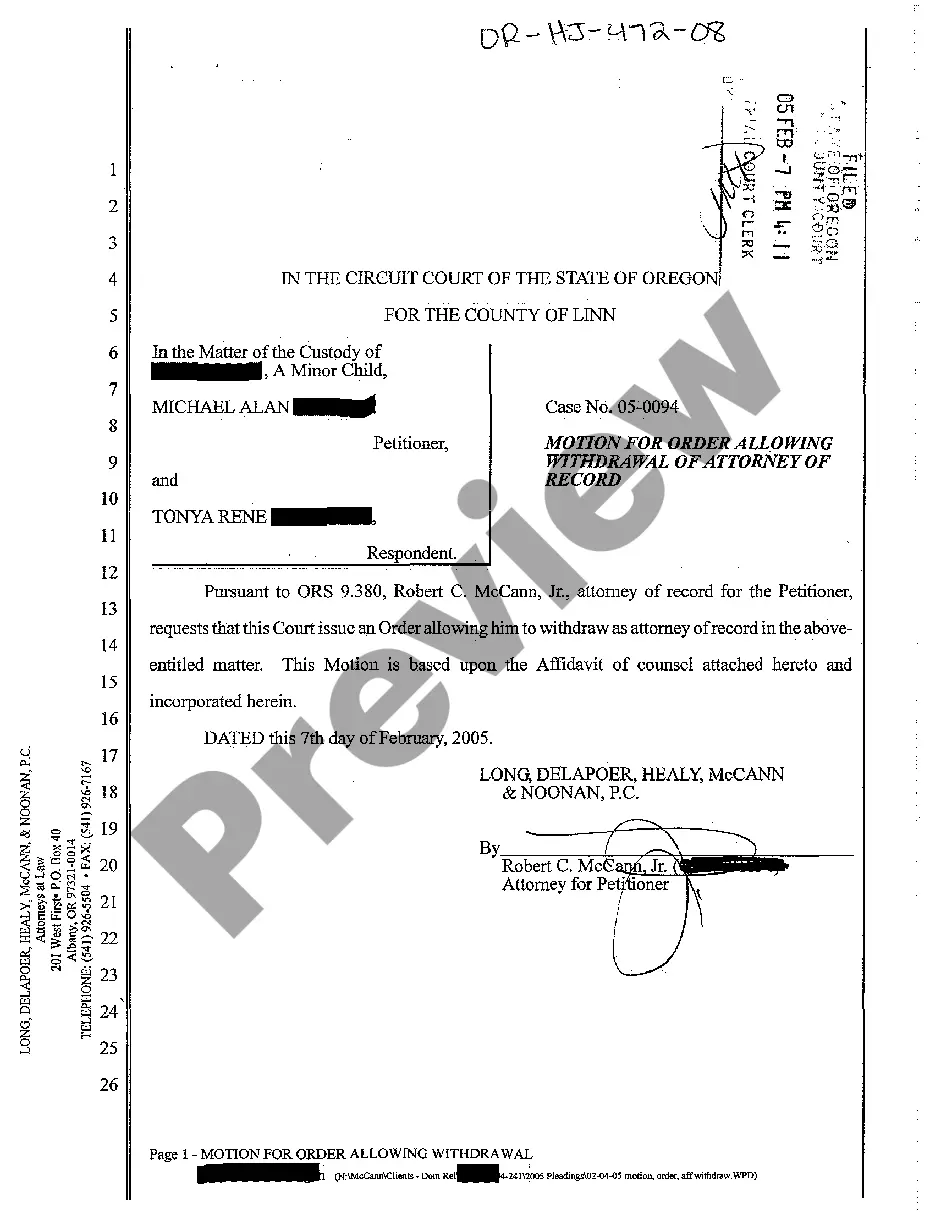

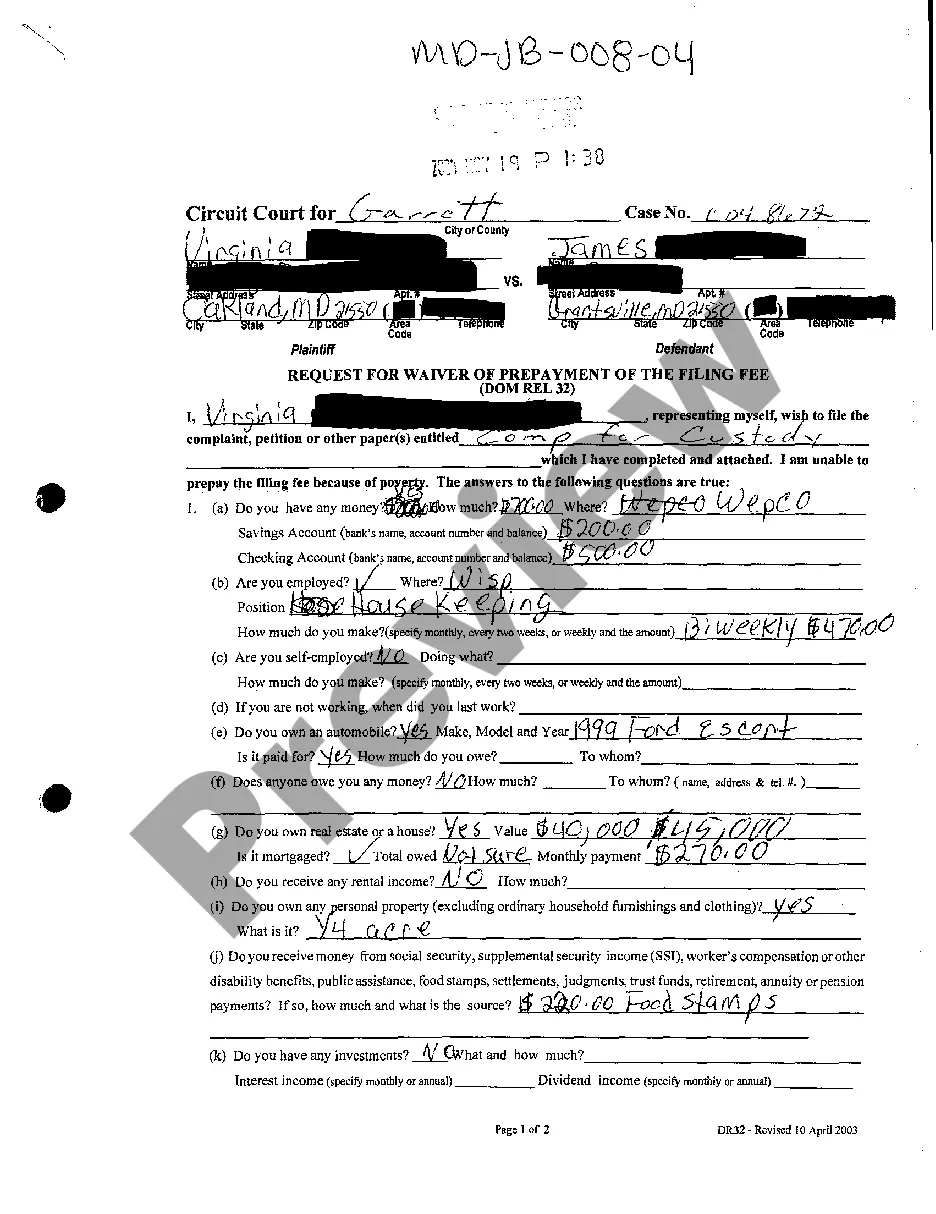

How to fill out Statement Of Non Assessment Missouri With Example?

Legal document managing might be mind-boggling, even for the most experienced specialists. When you are looking for a Statement Of Non Assessment Missouri With Example and do not get the a chance to devote searching for the right and up-to-date version, the operations might be stress filled. A robust online form catalogue can be a gamechanger for everyone who wants to handle these situations efficiently. US Legal Forms is a market leader in online legal forms, with more than 85,000 state-specific legal forms accessible to you anytime.

With US Legal Forms, you may:

- Access state- or county-specific legal and organization forms. US Legal Forms handles any requirements you may have, from personal to enterprise papers, all in one location.

- Utilize innovative tools to finish and control your Statement Of Non Assessment Missouri With Example

- Access a resource base of articles, instructions and handbooks and resources related to your situation and requirements

Save effort and time searching for the papers you will need, and employ US Legal Forms’ advanced search and Preview tool to discover Statement Of Non Assessment Missouri With Example and acquire it. For those who have a monthly subscription, log in to your US Legal Forms profile, look for the form, and acquire it. Review your My Forms tab to see the papers you previously saved as well as control your folders as you see fit.

If it is your first time with US Legal Forms, register an account and get unlimited use of all benefits of the library. Listed below are the steps to consider after downloading the form you want:

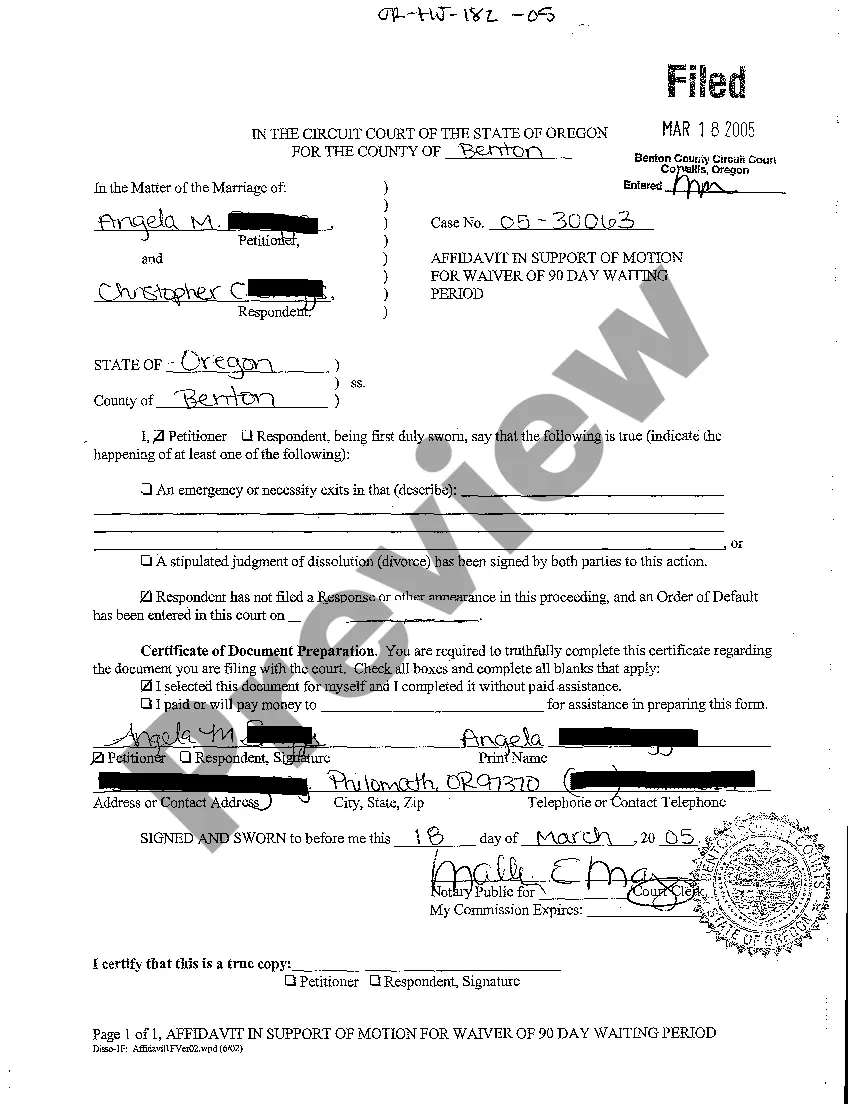

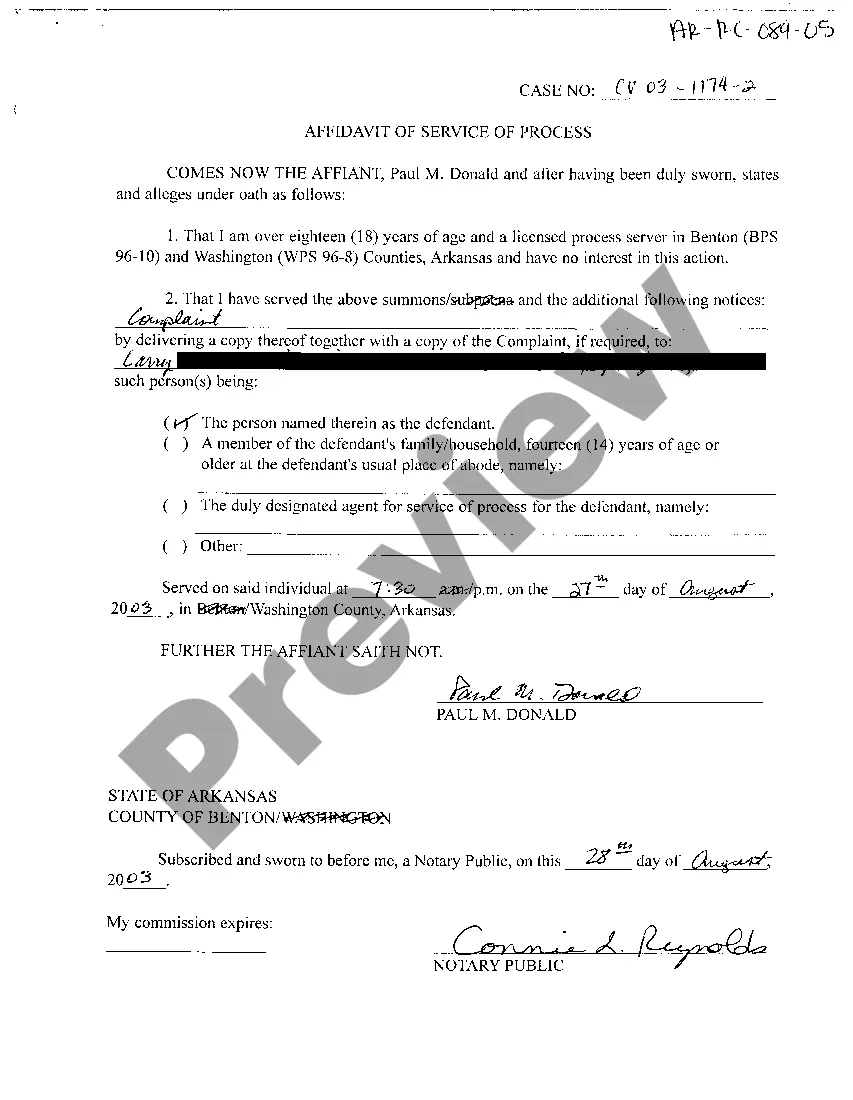

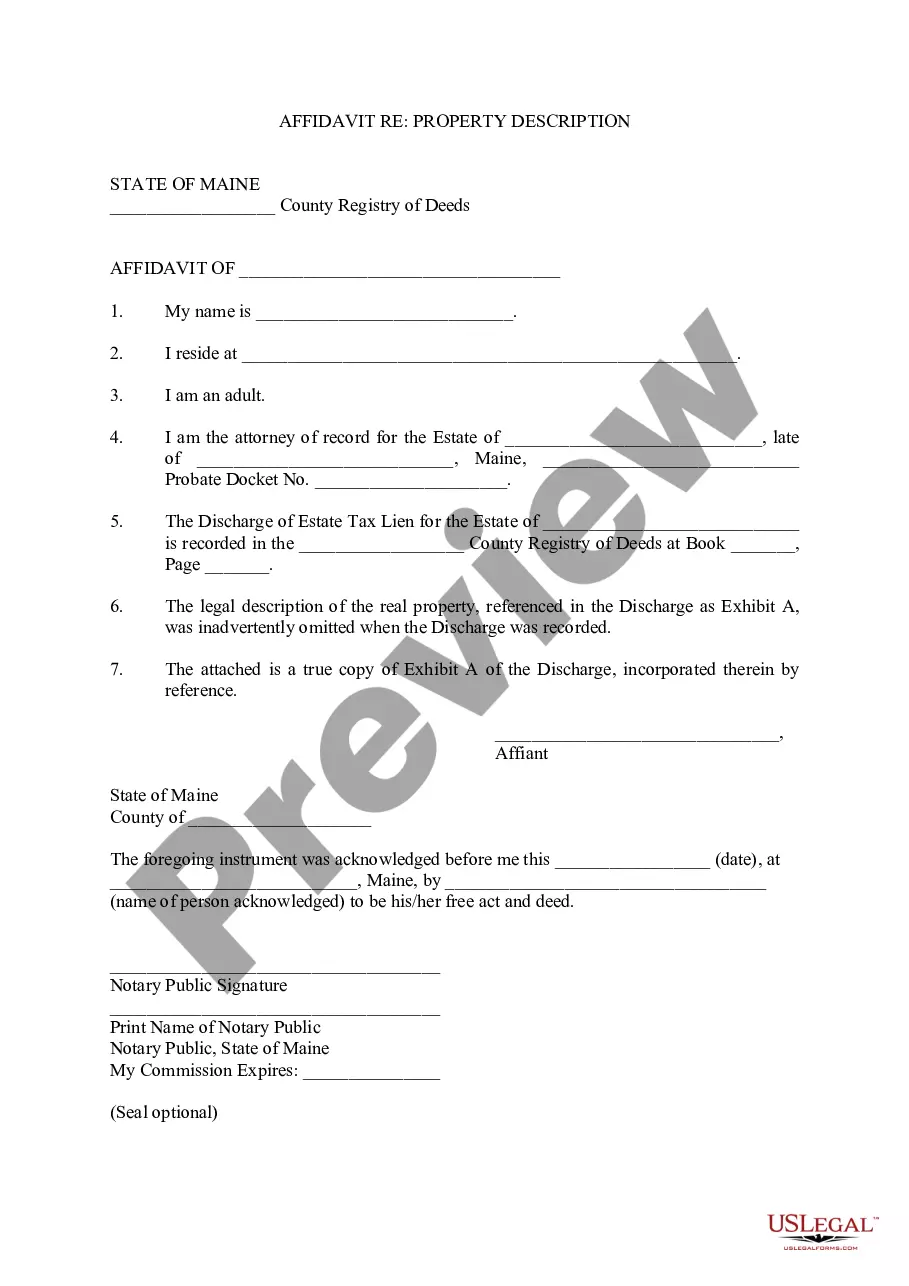

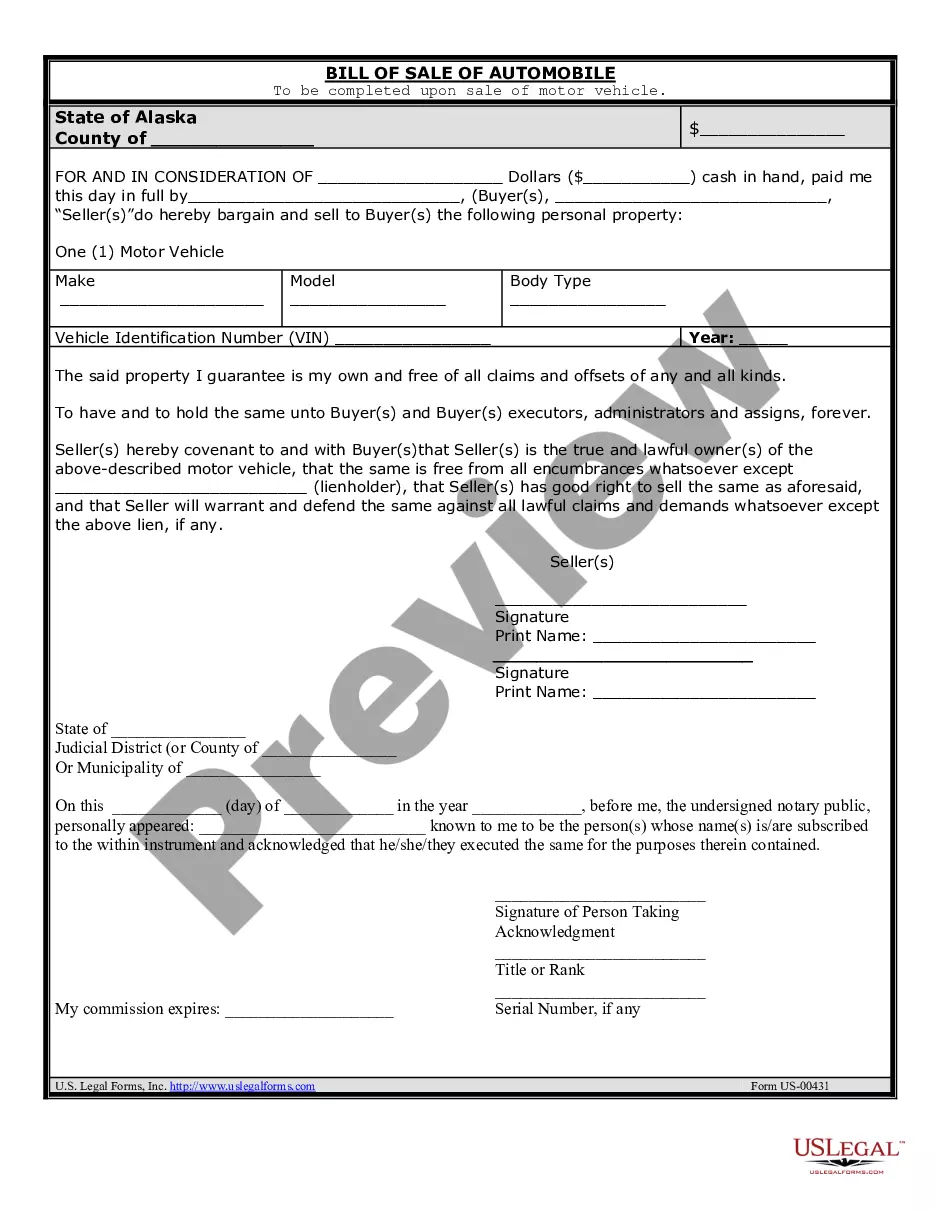

- Confirm it is the correct form by previewing it and reading its description.

- Ensure that the sample is acknowledged in your state or county.

- Choose Buy Now when you are all set.

- Choose a monthly subscription plan.

- Find the file format you want, and Download, complete, eSign, print and deliver your document.

Enjoy the US Legal Forms online catalogue, backed with 25 years of expertise and trustworthiness. Transform your day-to-day document administration in to a easy and user-friendly process today.

Form popularity

FAQ

If you are removing a vehicle you will need to show proof of the reason for removal: sale or trade papers, 'Date of Loss' letter from an insurance company, repossession papers, police report for a stolen vehicle, receipt from a salvage yard, etc.

If you have never owned personal property or are new to MO, then you may also need a waiver (statement or non-assessment). You have several options of establishing your personal property account: online via our customer service portal, by visiting on of our office or via virtual appointment.

assessment is issued to a county resident when no personal property tax was assessed for the prior year. This certificate is used in lieu of a paid personal property tax receipt when registering a vehicle or renewing license plates. No fee is charged for a certificate of nonassessment.

You will need to contact the assessor in the county of your residence to request the statement or non-assessment and to be added to the assessment roll for the subsequent tax year.

A taxpayer is presumed to owe taxes on property unless the taxpayer demonstrates qualification for a certificate of non-assessment. To obtain a certificate of non-assessment, contact the Jackson County Assessment Department or call 816-881-1330.