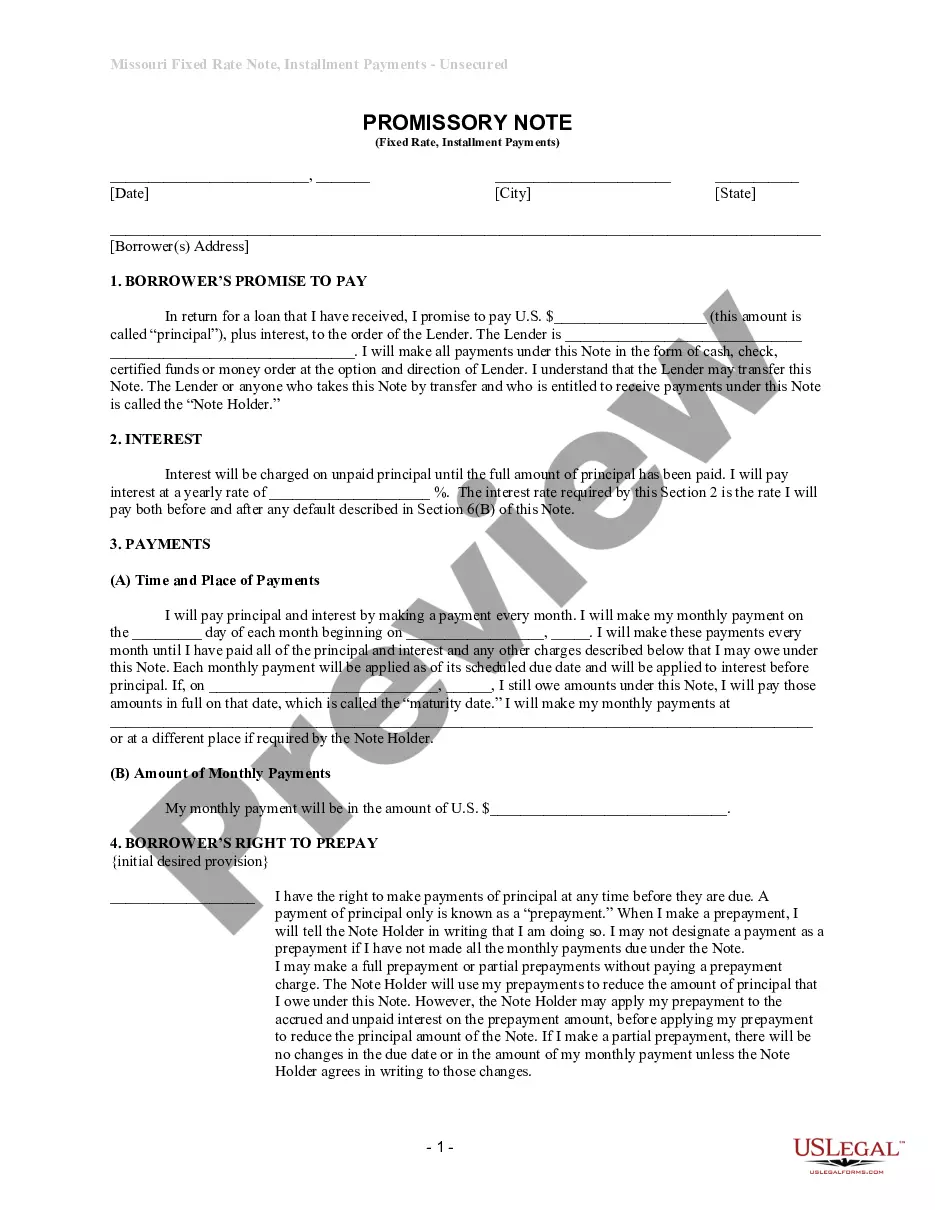

Missouri Promissory Note With Collateral

Description

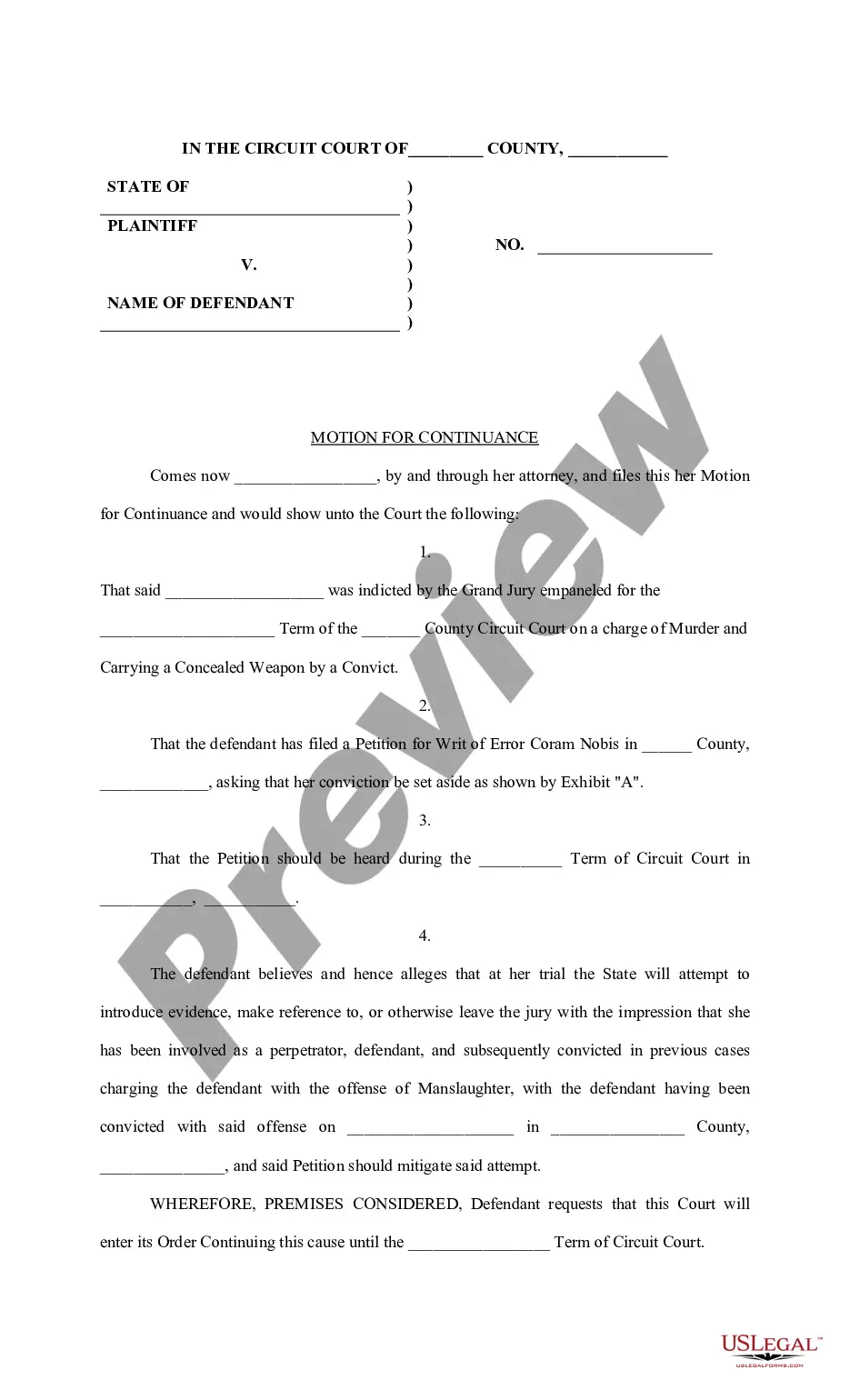

How to fill out Missouri Unsecured Installment Payment Promissory Note For Fixed Rate?

Bureaucracy necessitates accuracy and detail.

Unless you handle paperwork like Missouri Promissory Note With Collateral regularly, it may lead to some misunderstanding.

Choosing the right example from the beginning will assure that your document submission will proceed seamlessly and avoid any troubles of re-sending a document or repeating the entire task from the beginning.

Acquiring the correct and updated examples for your documentation is a matter of mere minutes with an account at US Legal Forms. Set aside the bureaucratic worries and simplify your work with forms.

- Identify the template by utilizing the search box.

- Ensure the Missouri Promissory Note With Collateral you’ve found is applicable for your state or jurisdiction.

- View the preview or examine the description that includes the particulars on the use of the template.

- When the result aligns with your search, click the Buy Now button.

- Select the suitable option among the suggested pricing plans.

- Log In to your account or create a new one.

- Complete the transaction using a credit card or PayPal option.

- Receive the document in the format of your preference.

Form popularity

FAQ

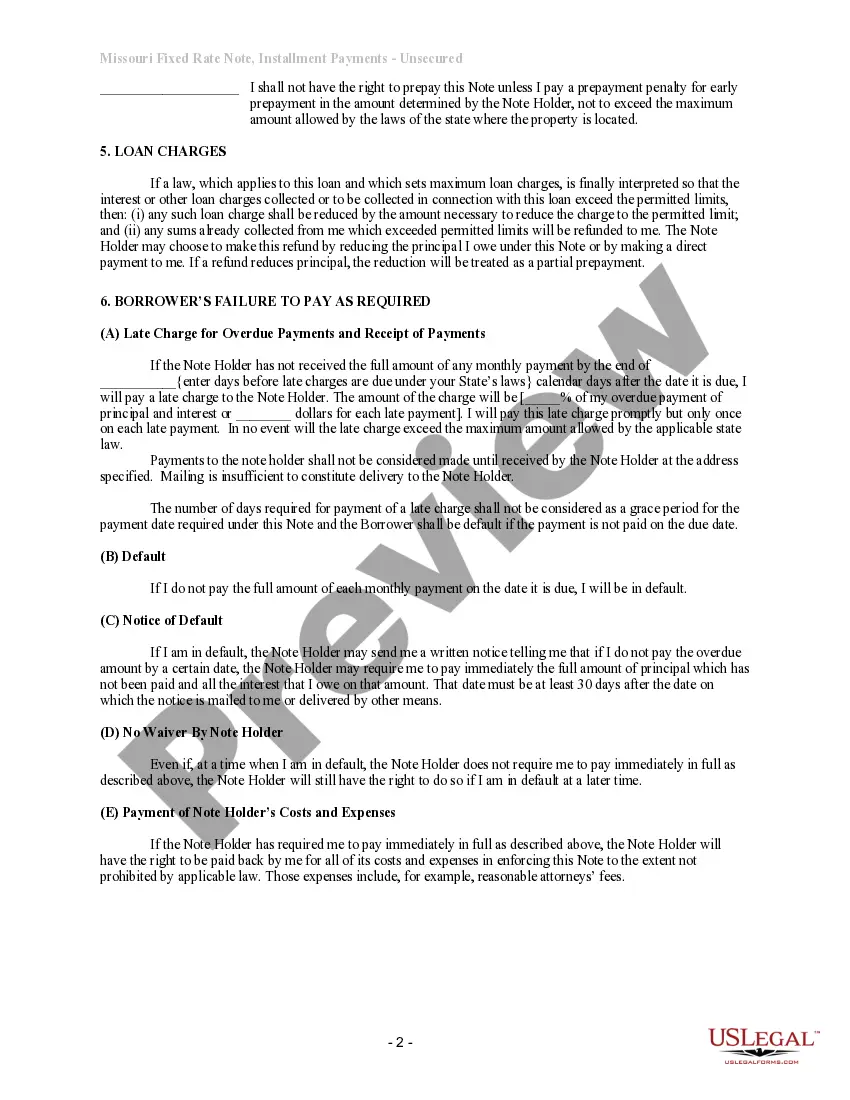

There is no legal requirement to have a Missouri promissory note notarized. The promissory note needs to be signed and dated by the borrower and any co-signer.

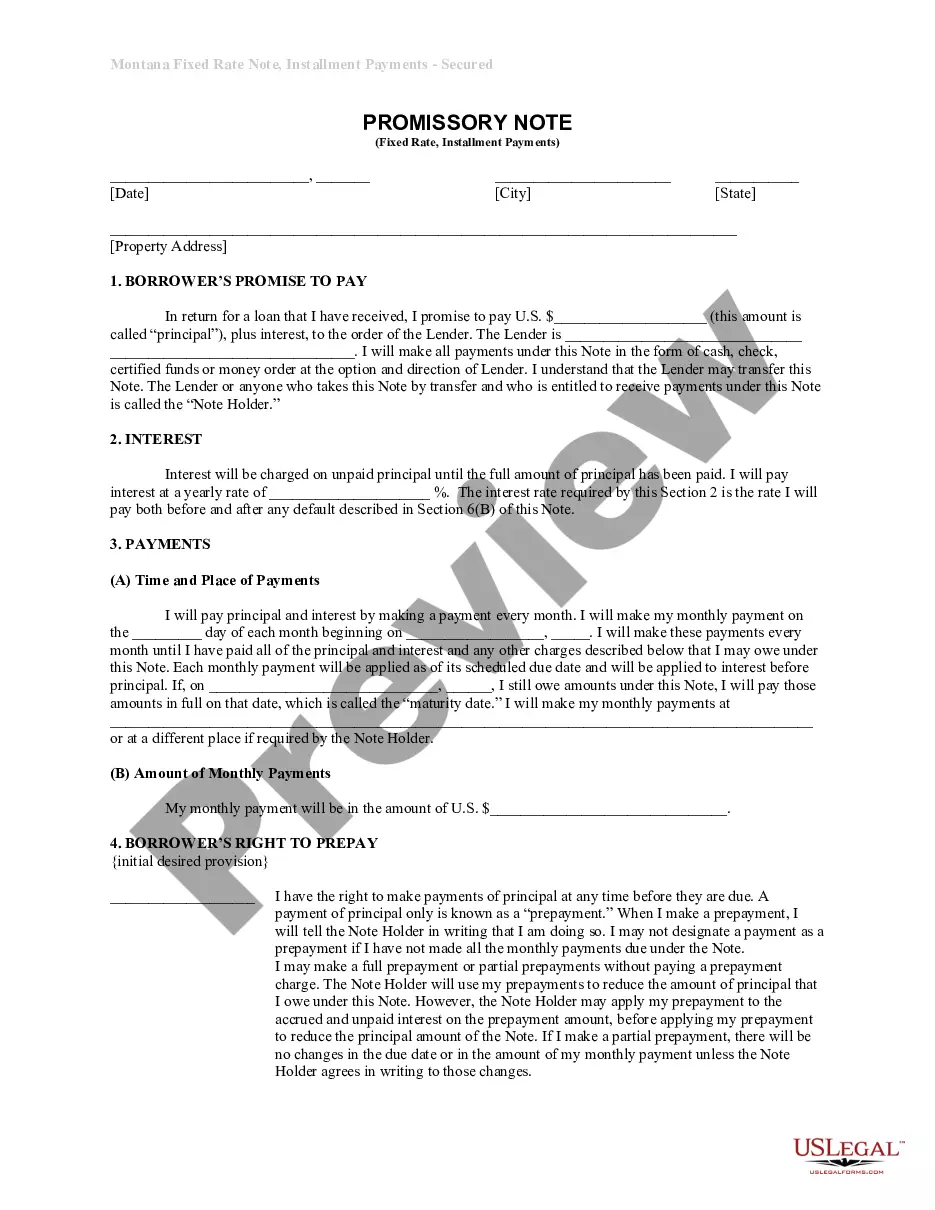

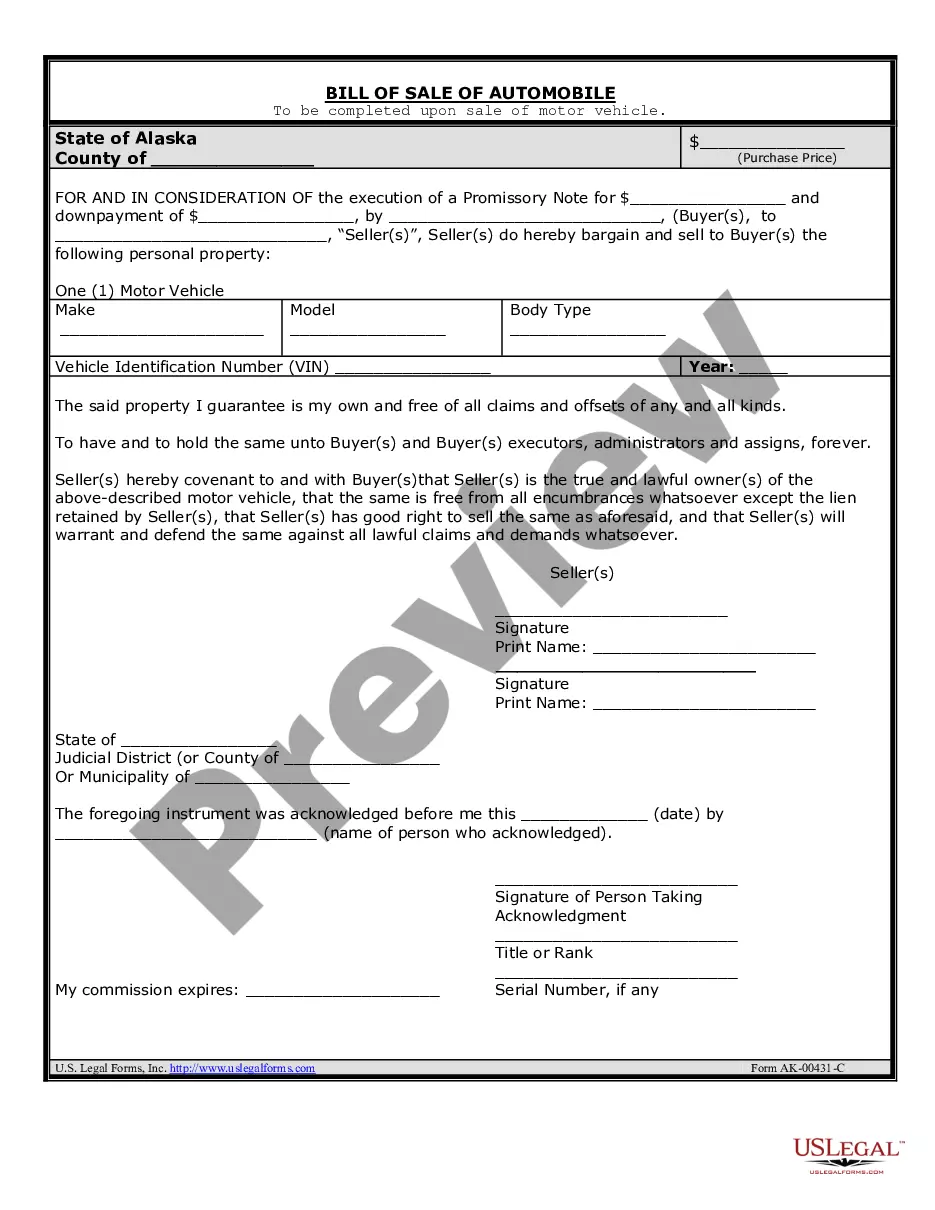

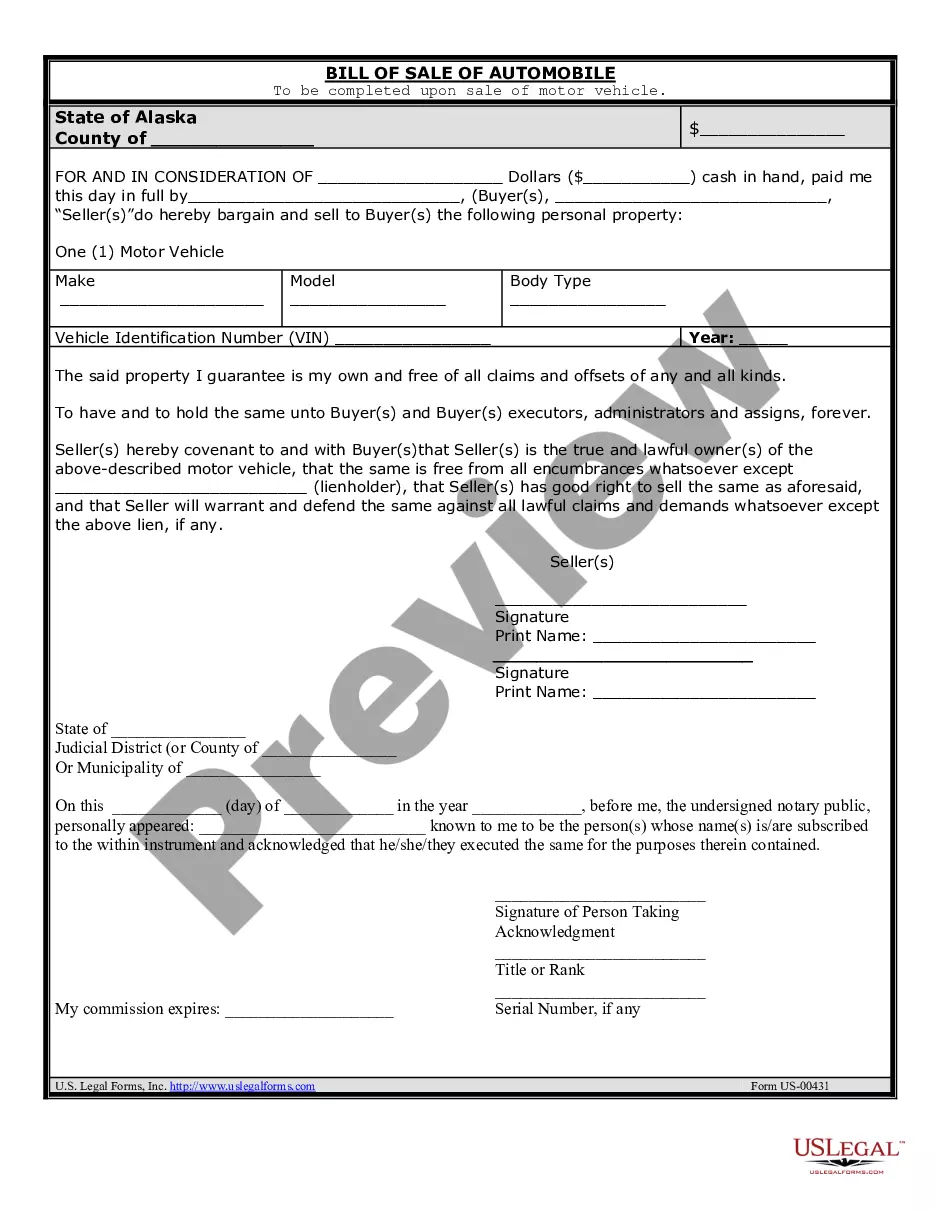

A secured promissory note should clearly identify the collateral backing the loan. For example, if collateral is being secured by business vehicles, the note should provide their vehicle identification numbers. A small business that is extending credit should also verify collateral is worth enough to cover the debt.

Secured Promissory NotesThe property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.