A life estate deed is a legal arrangement in real estate that grants a person the right to use and live on a property for the duration of their lifetime. This type of deed is commonly used for estate planning purposes to provide housing and support for a family member, typically an elderly parent or a disabled child, while still allowing the property to pass to another person or entity upon the individual's death. A life estate deed ensures that the beneficiary, known as the life tenant, has the right to occupy and enjoy the property during their lifetime. However, they do not have the power to sell, mortgage, or transfer the property to another person without the consent of the remainder man — the person or entity named to inherit the property after the life tenant's death. There are different types of life estate deeds that can be utilized depending on specific circumstances and preferences. Some commonly used ones include: 1. Traditional Life Estate Deeds: This is the most straightforward type of life estate deed, where the life tenant holds the right to live on the property until they pass away. Once the life tenant dies, the property transfers to the remainder man automatically, without the need for probate. 2. Life Estate Deeds with Powers: Also known as an enhanced life estate or a life estate deed with powers of sale, this variation grants the life tenant additional rights, allowing them to sell, mortgage, or otherwise encumber the property during their lifetime, providing a greater degree of flexibility. However, the remainder man still retains the right to inherit the property after the life tenant's death. 3. Life Estate Deeds with Automatic Termination: In this type of life estate deed, a specific event or condition triggers the automatic termination of the life estate. For example, the life estate may terminate if the life tenant remarries or if they no longer use the property as their primary residence. In such cases, the remainder man gains full ownership of the property. 4. Life Estate Deeds with Remainder Interest: This variation of a life estate deed allows the life tenant to name multiple remainder men who will inherit the property after their death, either in equal proportions or as determined by the life tenant. If one remainder man passes away, their share typically transfers to the remaining remainder men. Life estate deeds provide a valuable estate planning tool, offering a way to ensure a loved one has a place to live while preserving the property's ultimate ownership and inheritance. By understanding the different types of life estate deeds available, individuals can choose the option that best suits their specific needs and goals.

Life Estate Deed Explained

Description

How to fill out Life Estate Deed Explained?

Working with legal paperwork and operations can be a time-consuming addition to your entire day. Life Estate Deed Explained and forms like it often need you to look for them and navigate the best way to complete them appropriately. Therefore, whether you are taking care of economic, legal, or individual matters, having a thorough and hassle-free online library of forms when you need it will greatly assist.

US Legal Forms is the number one online platform of legal templates, boasting over 85,000 state-specific forms and numerous resources to assist you to complete your paperwork effortlessly. Discover the library of relevant documents available to you with just one click.

US Legal Forms gives you state- and county-specific forms offered by any moment for downloading. Protect your papers administration procedures using a top-notch services that lets you make any form within minutes without additional or hidden fees. Just log in in your profile, find Life Estate Deed Explained and download it right away from the My Forms tab. You can also access formerly downloaded forms.

Is it the first time making use of US Legal Forms? Sign up and set up up a free account in a few minutes and you’ll gain access to the form library and Life Estate Deed Explained. Then, follow the steps below to complete your form:

- Make sure you have discovered the right form by using the Preview feature and reading the form description.

- Choose Buy Now when all set, and select the subscription plan that fits your needs.

- Choose Download then complete, sign, and print out the form.

US Legal Forms has twenty five years of experience helping users manage their legal paperwork. Get the form you require today and enhance any operation without having to break a sweat.

Form popularity

FAQ

The most common way to create a life estate, as the life estate deed explained suggests, is through a written deed that specifies the life tenant and the remainderman. This deed legally transfers ownership rights while allowing the original owner to live in the property for the remainder of their life. It’s prudent to consult with an attorney or use resources like uslegalforms to ensure proper execution and to understand the implications of this arrangement.

Understanding the benefit of a life estate deed explained can help you make informed decisions in estate planning. One major benefit is that it allows property owners to give their property to heirs while retaining the right to live in it during their lifetime. This arrangement can also avoid probate, saving time and reducing costs for the family after the owner passes away, creating a smoother transition.

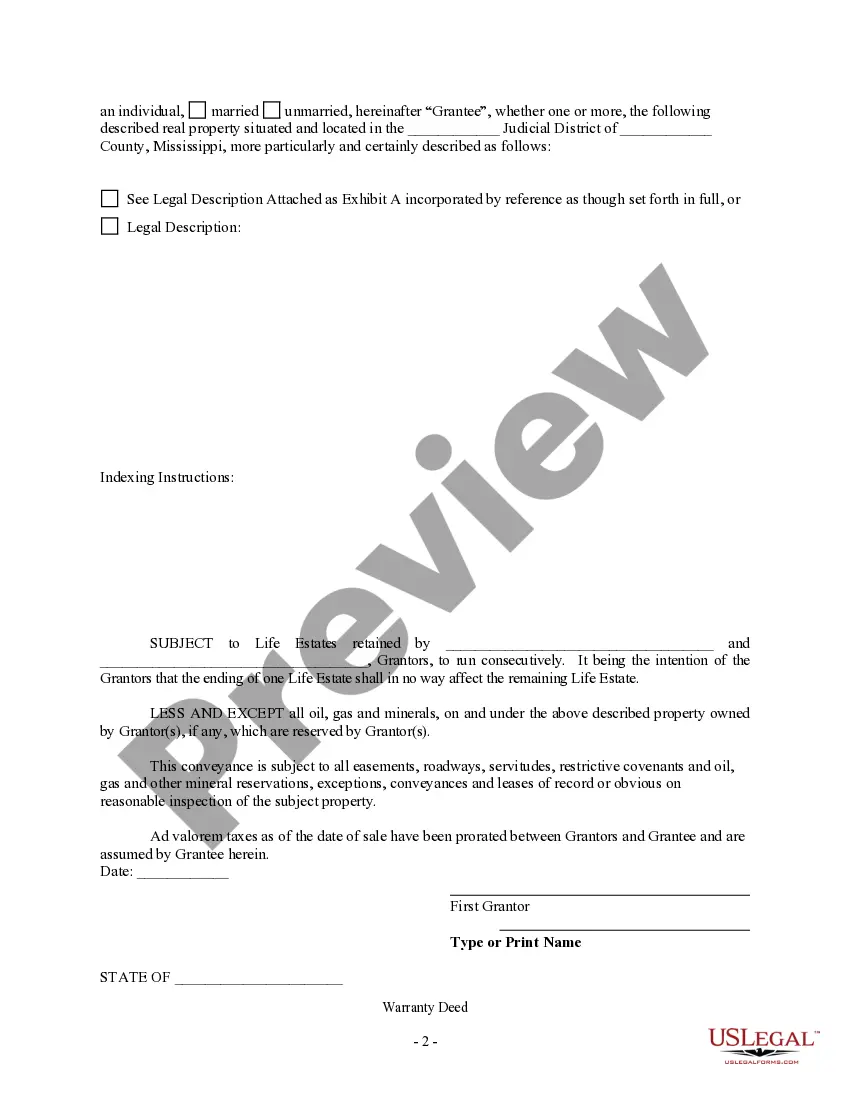

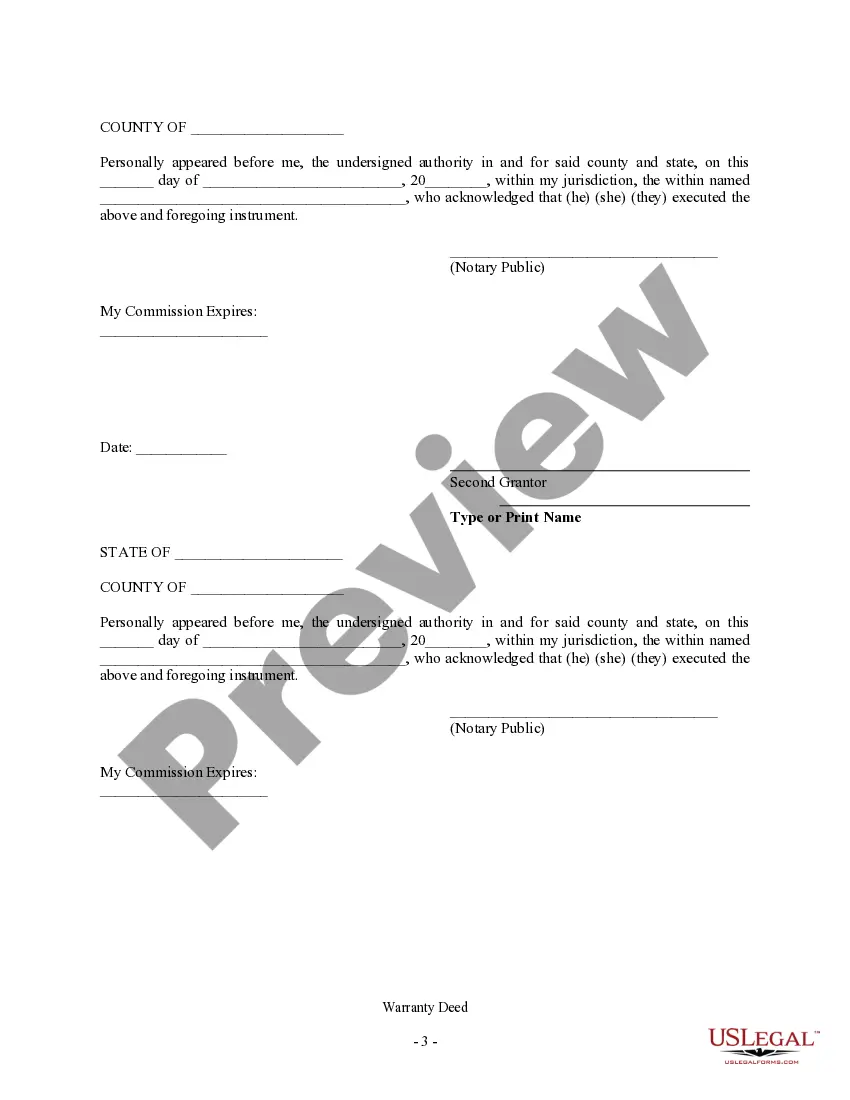

Filing a life estate deed explained involves a few key steps. First, you should prepare the deed, which outlines the specific terms and details regarding the life estate. Afterward, the deed must be signed, notarized, and then filed with the county clerk or recorder's office in the jurisdiction where the property is located. For assistance with this process, consider using the services offered by uslegalforms to ensure compliance with your local laws.

When exploring the concept of a life estate deed explained, it's important to consider some drawbacks. One significant disadvantage is that the original owner relinquishes control of the property while alive, limiting their ability to sell or mortgage it without the consent of the remainderman. Additionally, if the property incurs liabilities or taxes, the life tenant may be responsible for those costs, which can complicate financial planning.

Selling a house that is subject to a life estate is possible, but it requires the consent of both the life tenant and the remainderman. The life estate deed explained allows the life tenant to occupy the property for their lifetime, and selling typically means transferring this right. It is recommended to seek professional advice to ensure all parties' rights are protected during the sale process.

To create a life estate deed explained, you need to include key elements such as the names of the life tenant and the remainderman, a clear description of the property, and the duration of the life estate. It's advisable to use specific language to clarify the intentions. Moreover, consider using resources like US Legal Forms, which provide templates and guidance to help in the preparation of a legally sound deed.

A will cannot override a life estate deed explained, as the life estate takes precedence over any future instructions in a will. If a property is conveyed through a life estate, the life tenant has rights to use the property during their lifetime, regardless of what is stated in the will. However, it is crucial to consult legal advice to understand the interactions between both documents.

When considering a life estate deed explained, it's essential to understand its drawbacks. The life tenant cannot sell or transfer ownership without the consent of the remainderman. Additionally, if the life tenant incurs debts or legal issues, the property may be at risk. Lastly, less flexibility exists in managing the property compared to outright ownership.

Breaking a life estate deed involves legally terminating the rights of the life tenant. One common method is to obtain mutual consent between the life tenant and the remainderman, often through a written agreement. Alternatively, a court may be involved if disagreements arise, and a legal process can be initiated to dissolve the life estate. Understanding the implications of a life estate deed explained can guide you through this process smoothly.

Whether a life estate deed is a good idea often depends on individual circumstances. It can provide a streamlined way to transfer property and avoid the probate process, making it an attractive option for many. However, it's essential to weigh the unique advantages and disadvantages before deciding. Consulting with professionals and utilizing platforms like US Legal Forms can assist you in making an informed decision about whether this estate planning tool suits your needs.