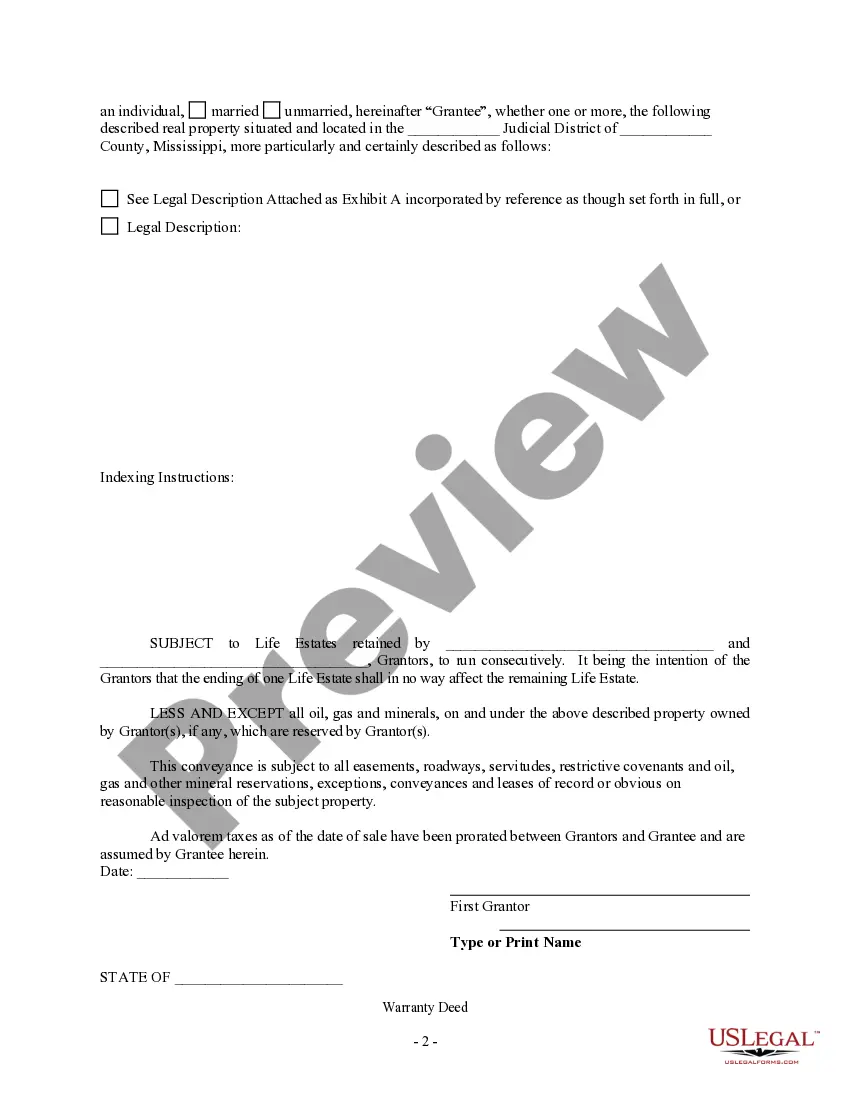

A life estate deed with full powers is a legal instrument that allows an individual to transfer their ownership interest in real property while retaining certain rights and powers during their lifetime. In the context of Mississippi and Maryland, there are specific considerations and variations related to the life estate deed with full powers. Let's delve into the details. Life Estate Deed Mississippi with Full Powers: A life estate deed in Mississippi with full powers grants the owner (referred to as the life tenant) the authority to exercise complete control over the property during their lifetime. Here are the key features worth mentioning: 1. Life Tenant's Powers: The life tenant has the right to use, possess, and manage the property in any way they see fit, including leasing, collecting rental income, and making improvements. 2. Powers of Disposition: The life tenant can also sell, gift, or mortgage the property, altering the ownership structure, subject to certain limitations, such as the original granter's approval or the requirement to invest the proceeds into a replacement property. 3. Life Tenant's Responsibilities: The life tenant is responsible for property taxes, insurance, and general maintenance costs associated with the property. 4. Remainder Interest: Upon the death of the life tenant, the property passes automatically to the designated remainder man(s) or remainder beneficiary(IES). This ensures that the property will avoid probate. Life Estate Deed Maryland with Full Powers: A life estate deed in Maryland with full powers follows a similar structure as in Mississippi, with a few additional considerations based on the state's laws: 1. Homestead Protection: In Maryland, if the property is the principal residence of the life tenant, it may qualify for homestead protection, providing certain exemptions from creditor claims and increasing the available assets for the life tenant. 2. Medicaid Planning: Maryland has specific Medicaid rules that impact the utilization and protection of the property when seeking long-term care assistance. Understanding these rules is crucial to ensure the life estate deed is structured appropriately. Different Types of Life Estate Deeds: While there are no specific variations mentioned for life estate deeds with full powers in Mississippi or Maryland, it's important to identify potential modifications or alternative arrangements that may exist to suit individual circumstances. These variations could include: 1. Enhanced Life Estate (Lady Bird) Deed: This type of life estate deed allows the life tenant to retain more powers, such as the ability to sell or mortgage the property without obtaining consent from the remainder man. It also allows the life tenant to reclaim the property entirely during their lifetime. 2. Qualified Personnel Residence Trust (PRT): Instead of transferring the property directly to a life tenant, a PRT allows an individual to transfer their residence into an irrevocable trust, designating themselves as the life tenant. This approach provides potential estate tax benefits and capital gains tax planning. In conclusion, a life estate deed with full powers in Mississippi and Maryland empowers the owner to maintain control and enjoy the benefits of their property during their lifetime while enabling a smooth transition of ownership upon their passing. Understanding the specific laws and potential variations is essential for those considering this estate planning tool.

Life Estate Deed Mississippi With Full Powers Maryland

Description

How to fill out Life Estate Deed Mississippi With Full Powers Maryland?

Legal managing may be mind-boggling, even for the most skilled specialists. When you are looking for a Life Estate Deed Mississippi With Full Powers Maryland and do not get the time to spend looking for the correct and updated version, the procedures may be stressful. A strong online form library can be a gamechanger for everyone who wants to deal with these situations efficiently. US Legal Forms is a market leader in web legal forms, with over 85,000 state-specific legal forms accessible to you at any moment.

With US Legal Forms, you can:

- Access state- or county-specific legal and business forms. US Legal Forms covers any needs you could have, from personal to enterprise documents, all in one place.

- Make use of innovative resources to complete and control your Life Estate Deed Mississippi With Full Powers Maryland

- Access a useful resource base of articles, guides and handbooks and materials related to your situation and requirements

Help save time and effort looking for the documents you will need, and use US Legal Forms’ advanced search and Review feature to get Life Estate Deed Mississippi With Full Powers Maryland and acquire it. If you have a subscription, log in for your US Legal Forms account, search for the form, and acquire it. Review your My Forms tab to see the documents you previously downloaded as well as to control your folders as you can see fit.

Should it be the first time with US Legal Forms, create an account and get unrestricted usage of all advantages of the platform. Here are the steps to take after getting the form you want:

- Verify it is the proper form by previewing it and reading through its information.

- Ensure that the sample is accepted in your state or county.

- Pick Buy Now when you are ready.

- Select a subscription plan.

- Pick the formatting you want, and Download, complete, eSign, print out and send your papers.

Benefit from the US Legal Forms online library, backed with 25 years of expertise and stability. Change your day-to-day papers managing in to a smooth and easy-to-use process today.

Form popularity

FAQ

To file a life estate deed in Mississippi with full powers, you should first prepare the deed document, which clearly states the terms of the life estate. Next, ensure you include the necessary details about the grantor, grantee, and the property involved. After that, you need to sign the deed in front of a notary public. Finally, file the completed deed with the appropriate county clerk's office to officially record the life estate deed Mississippi with full powers in Maryland.

Typically, the life tenant is responsible for paying property taxes during their lifetime. The remainderman does not have financial obligations for the property until they become the owner. Knowing this detail can help clarify the responsibilities associated with a life estate deed Mississippi with full powers Maryland, empowering both tenants and remaindermen.

The remainderman does not own the property during the life tenant's lifetime. They will gain ownership only after the life tenant passes away. This structured arrangement is why understanding a life estate deed Mississippi with full powers Maryland is crucial for both parties involved, ensuring expectations are clear.

The power of appointment allows the life tenant to choose who will receive the property after their death. This can provide greater flexibility and control over the future of the property. Incorporating the power of appointment into a life estate deed Mississippi with full powers Maryland can enhance estate planning and fulfill specific wishes.

Yes, someone with a life estate can sell their interest in the property, but they cannot sell the property outright. The new owner would have the same life estate privileges, meaning the life tenant retains the right to use the property during their lifetime. Therefore, understanding the implications of a life estate deed Mississippi with full powers Maryland can help in making informed decisions.

A life estate in Mississippi allows an individual to use and enjoy a property for their lifetime. After the individual's death, the property automatically passes to a predetermined remainderman, meaning that the life estate deed holds significant importance. This arrangement provides clarity about ownership and use, making the life estate deed Mississippi with full powers Maryland a valuable tool for estate planning.

No, a will cannot override a life estate deed. Once a life estate is established, it takes precedence over the instructions in a will regarding the property. This principle holds true for a life estate deed in Mississippi with full powers in Maryland. Therefore, consider your estate planning carefully to ensure your wishes are respected.

A life estate with powers allows the life tenant certain rights beyond enjoying the property, such as the ability to sell or mortgage it. In contrast, a life estate without powers restricts these options, limiting the life tenant's control. Understanding the difference is essential when establishing a life estate deed in Mississippi with full powers in Maryland, as it affects the level of control a tenant holds over the property.

One disadvantage of a life estate deed is that the life tenant cannot sell or transfer the property without consent from the remainderman. This restriction can limit the ability to liquidate assets or use the property for financing. Additionally, life estate deeds do not offer the same level of flexibility as outright ownership, which can be a consideration when evaluating a life estate deed in Mississippi with full powers in Maryland.

In Mississippi, a life estate means that the person holding the life estate, known as the life tenant, has the right to use and enjoy the property during their lifetime. However, this right is subject to the underlying ownership of the remainderman, who receives the property after the death of the life tenant. It's important to understand these dynamics when crafting a life estate deed in Mississippi with full powers in Maryland, as it impacts property rights significantly.