Life Estate Deed Mississippi With Mortgage

Description

How to fill out Life Estate Deed Mississippi With Mortgage?

How to obtain professional legal documents that adhere to your state laws and create the Life Estate Deed Mississippi With Mortgage without consulting an attorney? Numerous online services provide templates to address various legal scenarios and procedures. However, it may require some time to ascertain which of the accessible samples align with both your specific needs and legal standards.

US Legal Forms is a reliable platform that assists you in finding official documents created in accordance with the latest state legal updates, helping you save costs on legal services.

US Legal Forms is not just a typical web directory. It is a compilation of over 85,000 verified templates for diverse business and personal situations. All documents are categorized by area and state to streamline your search and enhance convenience. Moreover, it integrates with powerful solutions for PDF modification and electronic signatures, allowing users with a Premium subscription to efficiently complete their paperwork online.

The acquired templates remain yours: you can always revisit them in the My documents section of your profile. Sign up for our platform and produce legal documents independently like a skilled legal professional!

- It requires minimal effort and time to secure the necessary documents.

- If you already possess an account, Log In and confirm your subscription status.

- Download the Life Estate Deed Mississippi With Mortgage using the associated button beside the file name.

- If you do not hold an account with US Legal Forms, follow the instructions below.

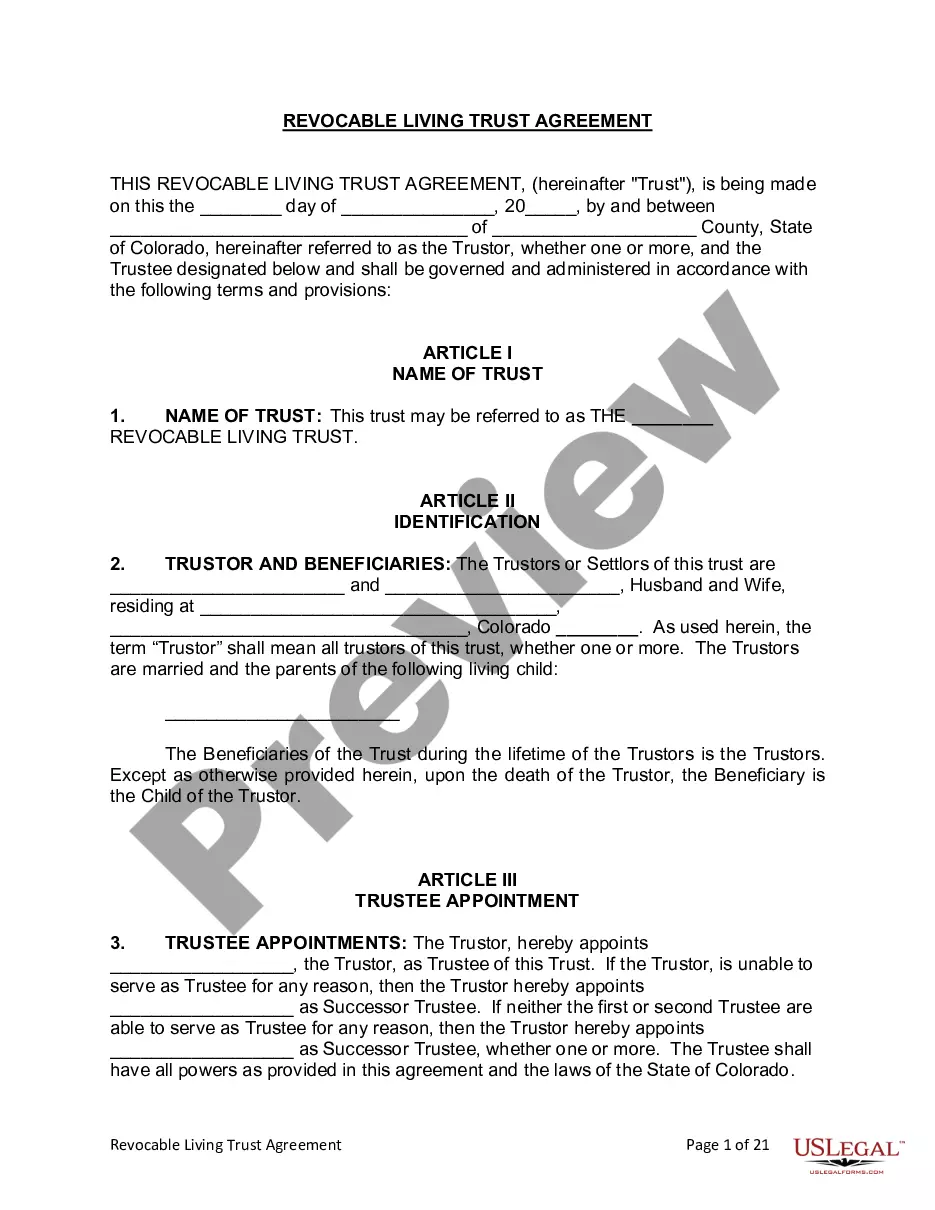

- Review the webpage you have accessed and verify if the form meets your requirements.

- Utilize the form description and preview options if available.

- Search for another template in the header indicating your state if needed.

- Click the Buy Now button when you locate the appropriate document.

- Choose the most suitable pricing plan, then Log In or set up an account.

- Select your payment method (by credit card or via PayPal).

- Alter the file format for your Life Estate Deed Mississippi With Mortgage and click Download.

Form popularity

FAQ

Generally, a life estate holder cannot mortgage the property without the consent of the remaindermen, who hold the future interest in the property. This restriction exists because a mortgage creates a lien that can affect the interest of everyone involved. If you consider using a life estate deed Mississippi with mortgage, it is essential to understand the limitations and seek assistance from a legal expert who can guide you through the process properly.

A life estate deed can limit your ability to make decisions about the property. When you create a life estate deed in Mississippi, you assign rights to the property for the duration of someone's lifetime, which may conflict with future financial needs. Additionally, property taxes and maintenance responsibilities fall on the life tenant, potentially adding financial strain if you have a mortgage. It's wise to consult a professional to navigate these complexities regarding a life estate deed Mississippi with mortgage.

In Mississippi, anyone can prepare a deed, but it is advisable to have an experienced attorney to ensure everything is completed correctly. This is especially important for a life estate deed Mississippi with mortgage, as the specifics must adhere to state laws. Platforms like USLegalForms offer resources and templates that can simplify this preparation process.

The fastest way to transfer a deed is to prepare the deed and file it with the local county clerk’s office. Utilizing a life estate deed Mississippi with mortgage can expedite the process as it allows you to transfer property while retaining certain rights. You may want to consider using a trusted platform like USLegalForms to guide you through this process efficiently.

Yes, Mississippi is a deed state where property ownership transfers are documented through deeds. This makes the life estate deed Mississippi with mortgage a relevant option for many homeowners looking to transfer property while maintaining some rights. Understanding this can help you navigate estate planning and property transfer more effectively.

To obtain the deed to your house in Mississippi, you typically need to request a copy from the county clerk’s office where the property is located. It helps to provide the legal description of the property or the parcel number. If you are looking into a life estate deed Mississippi with mortgage, be sure to specify this during your request to receive the correct document.

To transfer a deed in Mississippi after someone dies, you need to identify the type of deed that was held and whether a life estate deed with mortgage is involved. If the deceased owned the property outright, the heirs may need to go through probate to obtain the deed. Utilizing resources like US Legal Forms can simplify the process, ensuring you follow the correct legal procedures.

In a life estate in Mississippi, the person holding the life estate, known as the life tenant, owns the property during their lifetime. After the life tenant passes away, ownership transfers to the designated remainderman. This arrangement can be beneficial for estate planning, as it allows property to bypass probate and directly transfer to the next owner.

A warranty deed with reservation of life estate in Mississippi allows you to transfer ownership of property to a new owner while retaining the right to live there until death. This type of deed ensures the new owner has guarantee against any claims. It is an effective way to manage estate planning, particularly for those wanting to maintain control over their residence while providing for heirs.

Yes, you can prepare your own deed in Mississippi, including a life estate deed if you understand the legal language required. However, it's wise to consult a legal professional or utilize services like US Legal Forms to ensure accuracy and compliance with state laws. Drafting a deed incorrectly can lead to complications, so exercising caution is crucial.