Life estate deed Mississippi withholding refers to the process of withholding taxes on the transfer of property ownership through a life estate deed in the state of Mississippi. A life estate deed is a legal document that allows an individual (the life tenant) to retain the right to use and possess a property for the duration of their life while passing on the ownership to another individual (the remainder man) upon their death. Mississippi has specific rules and regulations regarding the taxation of property transfers through a life estate deed. When such a transfer occurs, certain taxes may be withheld from the proceeds of the property sale or transfer to ensure compliance with state tax laws. There are two main types of life estate deed Mississippi withholding: 1. Withholding for Capital Gains Taxes: When a property is transferred through a life estate deed, capital gains taxes may be applicable if the property has appreciated in value. In such cases, a portion of the sale proceeds may be withheld to cover the potential capital gains tax liability. This withholding is calculated based on the estimated gain on the property and helps ensure that the necessary taxes will be paid. 2. Withholding for Mississippi State Income Taxes: Another type of withholding that may occur with a life estate deed in Mississippi is for state income taxes. If the property transfer triggers a potential income tax liability, a portion of the proceeds from the sale or transfer may be withheld to cover those taxes. This helps ensure that the necessary taxes are accounted for and paid to the state of Mississippi. It is important to note that the specific withholding requirements and rates may vary depending on the circumstances of the property transfer and the relevant tax laws in Mississippi. Property owners and those involved in the transfer process should consult with a qualified tax professional or legal advisor to understand the specific withholding obligations and ensure compliance with state tax laws. In summary, life estate deed Mississippi withholding is the process of withholding taxes on property transfers through a life estate deed in Mississippi. It involves withholding for capital gains taxes and Mississippi state income taxes. Understanding and complying with these withholding requirements is crucial for property owners and individuals involved in the transfer process to avoid any potential tax issues or penalties.

Life Estate Deed Mississippi Withholding

Description

How to fill out Life Estate Deed Mississippi Withholding?

Handling legal papers and operations might be a time-consuming addition to your day. Life Estate Deed Mississippi Withholding and forms like it often require you to search for them and understand how to complete them appropriately. As a result, regardless if you are taking care of financial, legal, or individual matters, using a thorough and hassle-free online catalogue of forms at your fingertips will greatly assist.

US Legal Forms is the number one online platform of legal templates, featuring more than 85,000 state-specific forms and numerous resources to assist you to complete your papers quickly. Check out the catalogue of pertinent documents open to you with just one click.

US Legal Forms gives you state- and county-specific forms available at any time for downloading. Safeguard your papers administration operations by using a high quality service that lets you make any form within minutes with no extra or hidden charges. Just log in to your account, find Life Estate Deed Mississippi Withholding and download it right away from the My Forms tab. You may also access previously saved forms.

Could it be the first time using US Legal Forms? Sign up and set up up your account in a few minutes and you will get access to the form catalogue and Life Estate Deed Mississippi Withholding. Then, stick to the steps listed below to complete your form:

- Make sure you have found the proper form using the Review feature and looking at the form information.

- Choose Buy Now when ready, and choose the subscription plan that fits your needs.

- Select Download then complete, sign, and print out the form.

US Legal Forms has twenty five years of expertise helping users handle their legal papers. Discover the form you require right now and enhance any process without breaking a sweat.

Form popularity

FAQ

A life estate in Mississippi allows a person to occupy and use a property throughout their lifetime, after which the property reverts to a designated remainderman. The life tenant enjoys benefits such as control and occupancy, but they cannot sell the property without the remainderman's permission. This arrangement is often used in estate planning to avoid probate and ensure smooth transitions. For comprehensive guidance on life estate deed Mississippi withholding, consider exploring more resources on this topic.

In Mississippi, a deed typically takes precedence over a will regarding property transfer. If you place an asset in a life estate deed, that property will pass to the remainderman directly upon the life tenant's death, regardless of what a will states. This can lead to complications if individuals expect property distribution based on a will rather than a life estate deed. Knowing about life estate deed Mississippi withholding can help clarify how your intentions align with legal outcomes.

In Mississippi, a life estate generally cannot be reversed once created; however, it might be terminated under specific circumstances. If both the life tenant and the remainderman agree, they can cancel the life estate through a formal agreement. Additionally, if the life tenant becomes unable to care for the property, a court might allow a change. Awareness of life estate deed Mississippi withholding is crucial for navigating these situations.

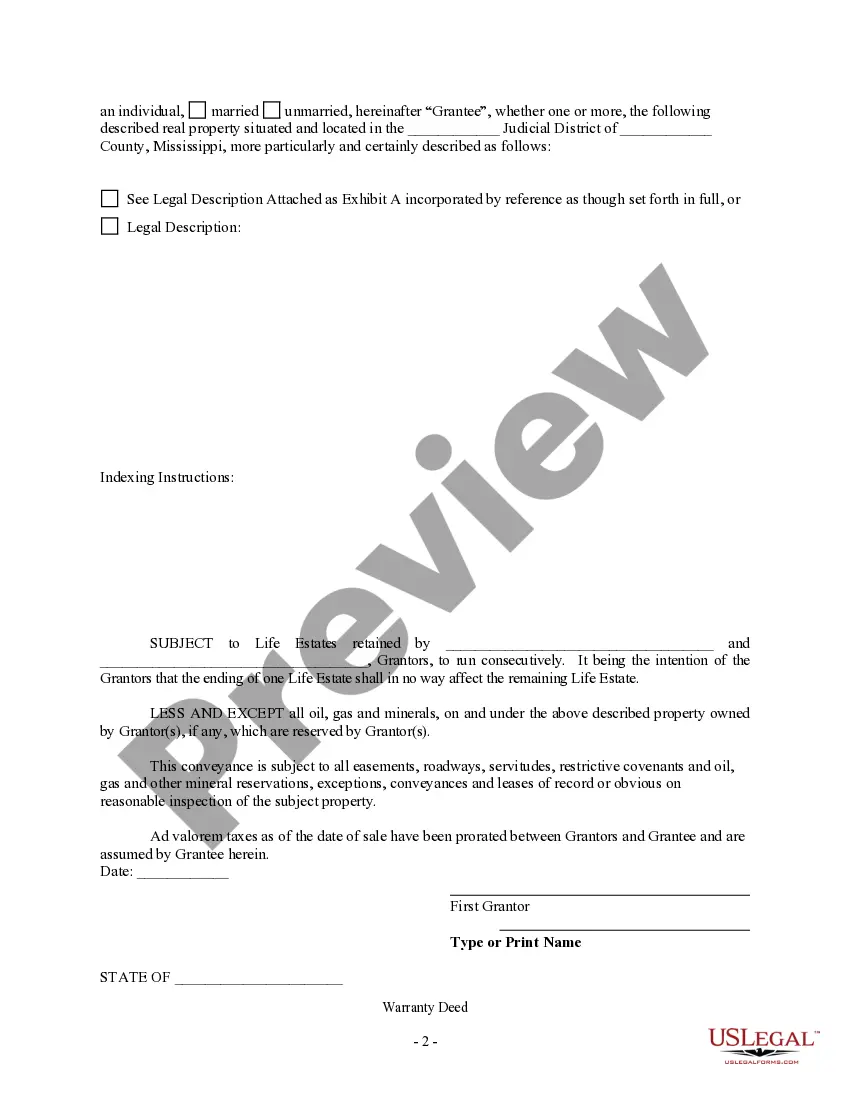

In Mississippi, a warranty deed with a reservation of life estate allows the property owner to convey their property while still using it for their lifetime. This deed type ensures that the new owner receives a clear title and demonstrates the grantor's intent to retain certain rights. This arrangement can be beneficial in estate planning and simplifies future property transfers. Understanding life estate deed Mississippi withholding can clarify how this structure works.

One disadvantage of a life estate deed is the potential loss of control over the property. The life tenant cannot sell or modify the property without the consent of the remainderman. Additionally, creditors may still seek claims against the property, causing issues for the life tenant. When considering life estate deed Mississippi withholding, it's essential to weigh these factors carefully.

In Mississippi, a life estate allows a person, known as the life tenant, to hold the property for their lifetime. Upon the death of the life tenant, the property typically passes to a remainderman, who is the individual named in the deed. This arrangement establishes clear ownership rights during the life tenant's lifetime, allowing for both use and enjoyment of the property. Understanding life estate deed Mississippi withholding can help you manage these transitions effectively.

While life estates have benefits, they also come with certain drawbacks. The life tenant cannot sell or mortgage the property without the remainderman's consent. Additionally, the life estate can complicate inheritance matters and may impact property taxes or Medicaid eligibility. Being informed about life estate deed Mississippi withholding is essential for evaluating if this estate planning tool is right for you.

In most cases, a will cannot override a life estate deed. When you create a life estate deed in Mississippi, you establish a legal right for the life tenant to use the property during their lifetime. Even if you later draft a will, the life estate remains valid, and the property will typically pass to the designated remainderman upon the life tenant's death. Understanding life estate deed Mississippi withholding can help clarify some estate planning scenarios.

A life estate may limit the ability of the life tenant to sell or mortgage the property, as they cannot transfer full ownership. Additionally, property taxes and maintenance costs remain the tenant's responsibility, which can be burdensome. Furthermore, if the life tenant has considerable debts, creditors might pursue the property, which complicates life estate deed Mississippi withholding. We recommend looking into US Legal Forms for guidance on how to navigate these challenges effectively.

To file a life estate deed, you must complete the deed form that complies with Mississippi law, clearly stating the life tenant and remainderman. After completing the form, you need to sign it in front of a notary and then file it with the county clerk's office. Keep in mind that life estate deed Mississippi withholding may apply during this process. For assistance, consider using the services provided by US Legal Forms to ensure all necessary steps are handled correctly.