Life Estate For Property

Description

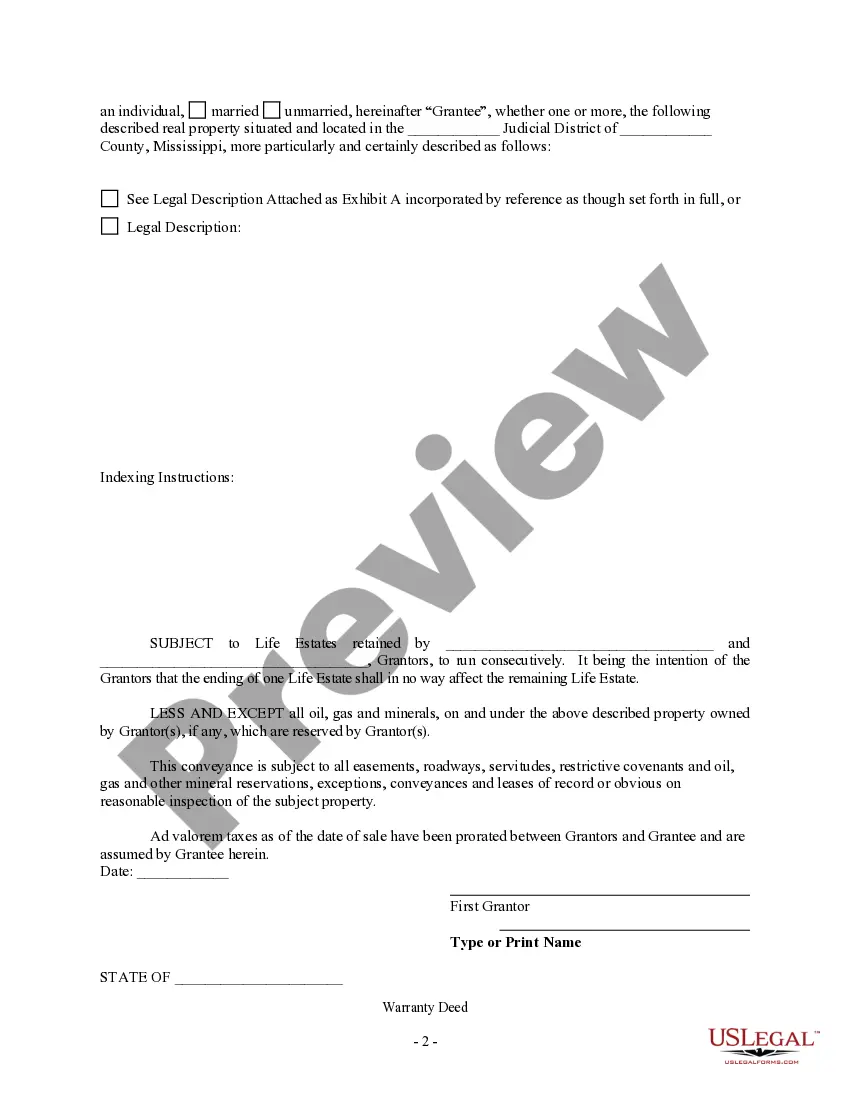

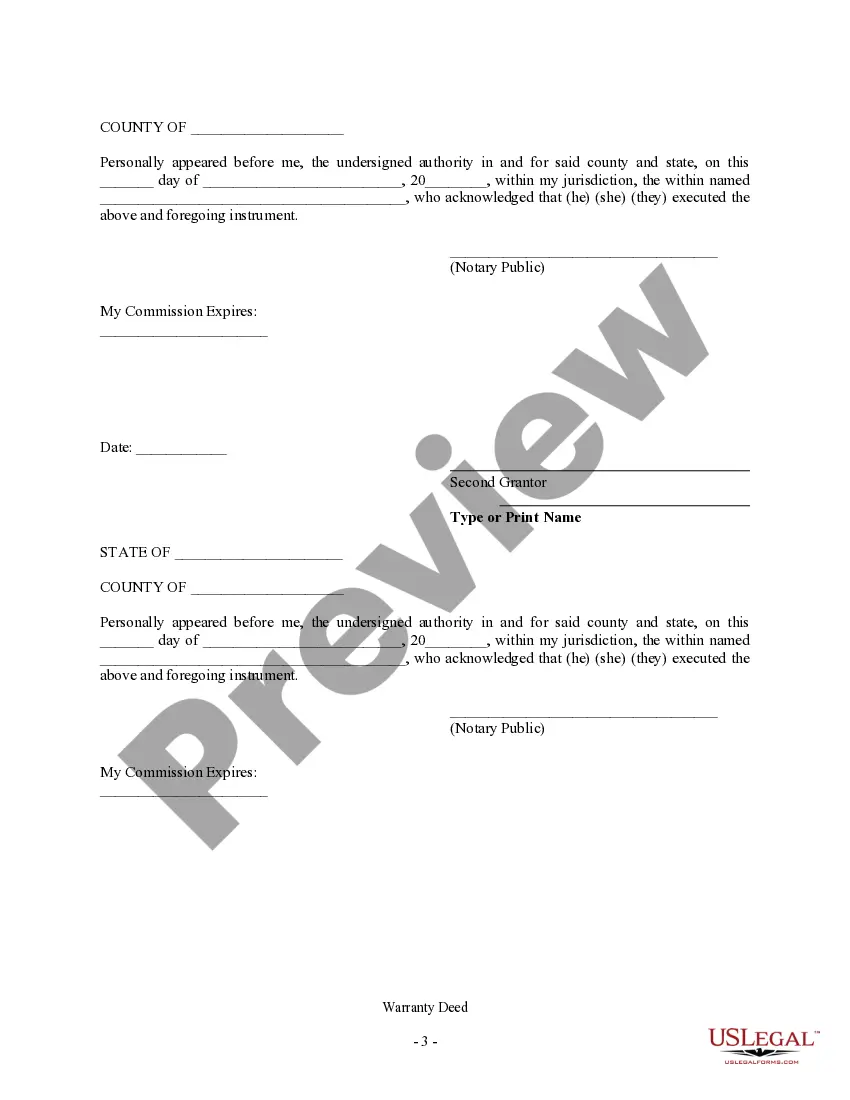

How to fill out Mississippi Warranty Deed To Child Reserving A Life Estate In The Parents?

- Log in to your existing US Legal Forms account to download your required form template. Ensure your subscription is active to avoid interruptions.

- If it's your first visit, start by navigating to the Preview mode and scrutinize the form description. Make sure it aligns with your specific needs and local jurisdiction.

- Search for alternative templates if something doesn't fit your requirements. Use the Search tab to find the right document suited to your situation.

- Proceed to purchase your document by clicking the Buy Now button. Select a subscription plan that meets your needs and create an account for full access.

- Complete your purchase by entering your payment details using either a credit card or PayPal, finalizing your subscription.

- Once your payment is confirmed, download your form to your device for immediate use. You can also find it later in the My Forms section of your profile.

US Legal Forms empowers you to easily navigate the legal landscape. With a vast library of over 85,000 forms, including a robust collection specifically for life estates, you have the resources needed for effective estate planning.

Don't hesitate to take control of your legal needs—visit US Legal Forms today to find the perfect document for your life estate requirements.

Form popularity

FAQ

A life estate for property in New York allows an individual to use and benefit from a property for their lifetime. Upon their passing, the property automatically transfers to a designated beneficiary. This arrangement can simplify the transfer of assets and help avoid probate. If you're considering a life estate, our US Legal Forms platform can guide you through the legal documents necessary to establish this arrangement correctly.

Typically, the life tenant is responsible for paying property taxes on a life estate. This arrangement allows the life tenant to maintain their ownership rights and responsibilities during their lifetime. However, the remainderman may also face tax implications, especially after the life tenant passes away. Consult with uslegalforms to understand your obligations and ensure compliance when dealing with a life estate for property.

In North Carolina, a life estate is created when a property owner grants rights to a life tenant for their lifetime. The life tenant enjoys the property, but the remainderman holds a future interest. Additionally, life estate rules in NC dictate that both parties must follow proper procedures for any transactions, like selling or transferring interests. Knowing the specifics of life estate for property in your state helps to avoid complications.

A life estate deed can present several disadvantages. Primarily, it limits the life tenant's ability to sell or mortgage the property without consent from the remainderman. Additionally, the property may be subject to estate taxes upon the life tenant's passing, potentially leading to significant financial burden. It is essential to weigh these factors carefully when considering a life estate for property.

Yes, the remainderman of a life estate can sell their interest in the property, but they cannot sell the property itself while the life tenant is alive. The life estate gives the life tenant full rights to use and enjoy the property. However, the new owner will only hold a future interest in the property until the life tenant passes away, at which point they will gain full ownership. Understanding these rights is crucial when dealing with a life estate for property.

Selling a house that is part of a life estate can be complicated. The life tenant must obtain consent from remainder beneficiaries before making a sale. If both parties agree, the sale can proceed; however, it is essential to understand the legal implications involved, and partnering with a platform like US Legal Forms can help ensure compliance and smooth transactions.

In a life estate for property, the life tenant is typically responsible for property taxes during their lifetime. This responsibility ensures that the property remains in good standing and is compliant with local regulations. As such, it is important for life estate holders to budget for this ongoing expense to avoid potential issues.

The negatives of a life estate for property often include restrictions on the owner's ability to alter or sell the property. Furthermore, the property may not qualify for certain tax breaks, which can lead to unexpected costs. It is vital to weigh these considerations against the benefits and perhaps seek professional guidance to navigate this complex area.

To establish a life estate for property, specific language must be included in the deed. Common phrases include 'to John Doe for his lifetime' and 'remainder to Jane Doe.' Clear and precise wording is crucial to ensure that legal rights and responsibilities are correctly defined, making it beneficial to use a trusted service like US Legal Forms for accurate documentation.

While a life estate for property offers various benefits, it does come with drawbacks. One significant downside is that the original owner cannot sell or mortgage the property without the consent of the remainder beneficiaries. Additionally, the owner is responsible for property maintenance and taxes, which can be a financial burden if not managed well.