Life Estate For Real Estate

Description

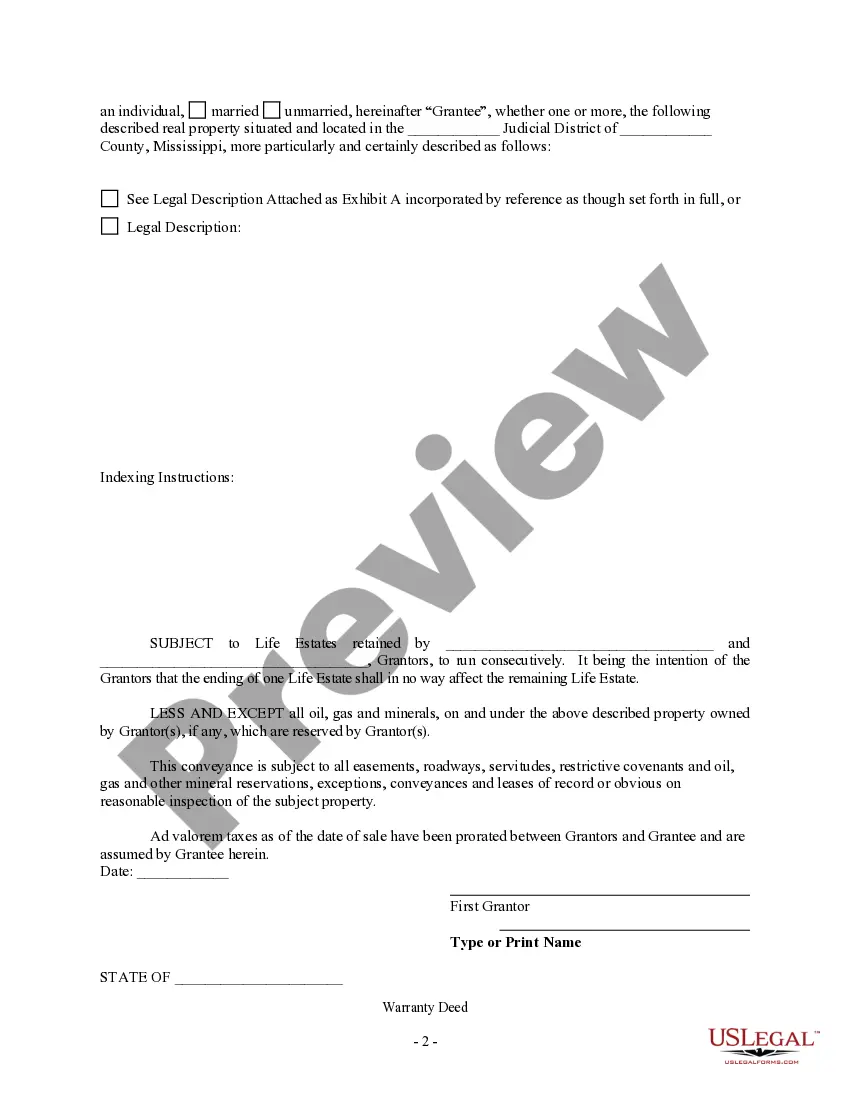

How to fill out Mississippi Warranty Deed To Child Reserving A Life Estate In The Parents?

- Log into your existing US Legal Forms account and ensure your subscription is current. If necessary, renew it to maintain uninterrupted access.

- Review the available templates in the preview mode and check the descriptions to confirm you have selected the right form that meets your state’s legal requirements.

- If needed, utilize the search feature to explore additional templates that best suit your situation.

- Proceed to purchase your chosen document by clicking the 'Buy Now' button, selecting your preferred subscription plan, and creating an account for library access.

- Complete your purchase using a credit card or PayPal to secure your subscription.

- Download your selected form to your device. You can always revisit it through the 'My Forms' section of your account.

By following these straightforward steps, you can quickly obtain the necessary forms while benefiting from the extensive resources offered by US Legal Forms.

Start managing your real estate matters confidently today. Visit US Legal Forms and explore our collection!

Form popularity

FAQ

Selling a house within a life estate is possible, but it often requires the consent of those with vested interests. The life tenant can sell their rights, but this typically does not include the underlying ownership transferred to heirs. If you are considering this option, consulting with experts in life estate for real estate can provide clarity and guidance for your transaction. They can help ensure that your rights and interests are protected.

A legal life estate is established by law, offering specific rights and responsibilities to the owner. On the other hand, an equitable life estate arises from fair principles, often determined by a court's judgment or agreement among parties. Recognizing these distinctions is vital for understanding your rights within life estate for real estate. Each type influences how property can be used or transferred.

Another common term for a life estate is 'estate for life.' This name reflects the temporary nature of the ownership, which lasts until the owner passes away. Understanding these terms enhances your ability to navigate discussions on life estate for real estate. Knowing the terminology equips you with the knowledge to manage your real estate effectively.

Utilizing a life estate deed can be a smart strategy for many homeowners. This deed allows you to retain living rights while transferring property ownership to heirs, potentially avoiding probate. However, it is essential to review your unique situation with a legal professional who understands life estate for real estate. This approach can offer security and financial advantages.

A legal life estate arises from the law, typically created by a court or statute. In contrast, an ordinary life estate is usually established through a will or a deed. Understanding this difference is crucial when navigating property rights and real estate transactions. Both types ensure rights during an individual's lifetime, but their origins and implications differ.

In a life estate for real estate, property taxes are usually the responsibility of the life tenant. This person has the right to live in and use the property, so they are generally accountable for keeping up with property taxes and other related expenses. It is essential for life tenants to budget for these costs to avoid potential issues with the property.

The two main types of life estate are conventional life estates and legal life estates. A conventional life estate is created voluntarily through a deed, while a legal life estate arises from state law, often in cases of spousal death or inheritance. Both serve to enable individuals to retain use of the property during their lifetime, but the specifics can vary.

To claim a life estate, you need to have the appropriate documentation that establishes your rights as the life tenant. This usually involves obtaining a deed that clearly outlines the life estate arrangement. It is advisable to consult with an attorney or a service like US Legal Forms to ensure that your claim is properly documented and recognized by local authorities.

While a life estate for real estate provides benefits, there are also downsides to consider. For example, the life tenant cannot sell or modify the property without the remainderman's consent, which can limit their control. Additionally, any debts associated with the property, such as mortgages or taxes, may still affect the life tenant during their lifetime.

Releasing a life estate involves a legal process where the life tenant formally relinquishes their rights to the property. This can often be accomplished through a written agreement or deed that specifies the release of the life estate. Additionally, using platforms like US Legal Forms can simplify the necessary paperwork and ensure compliance with all legal requirements.