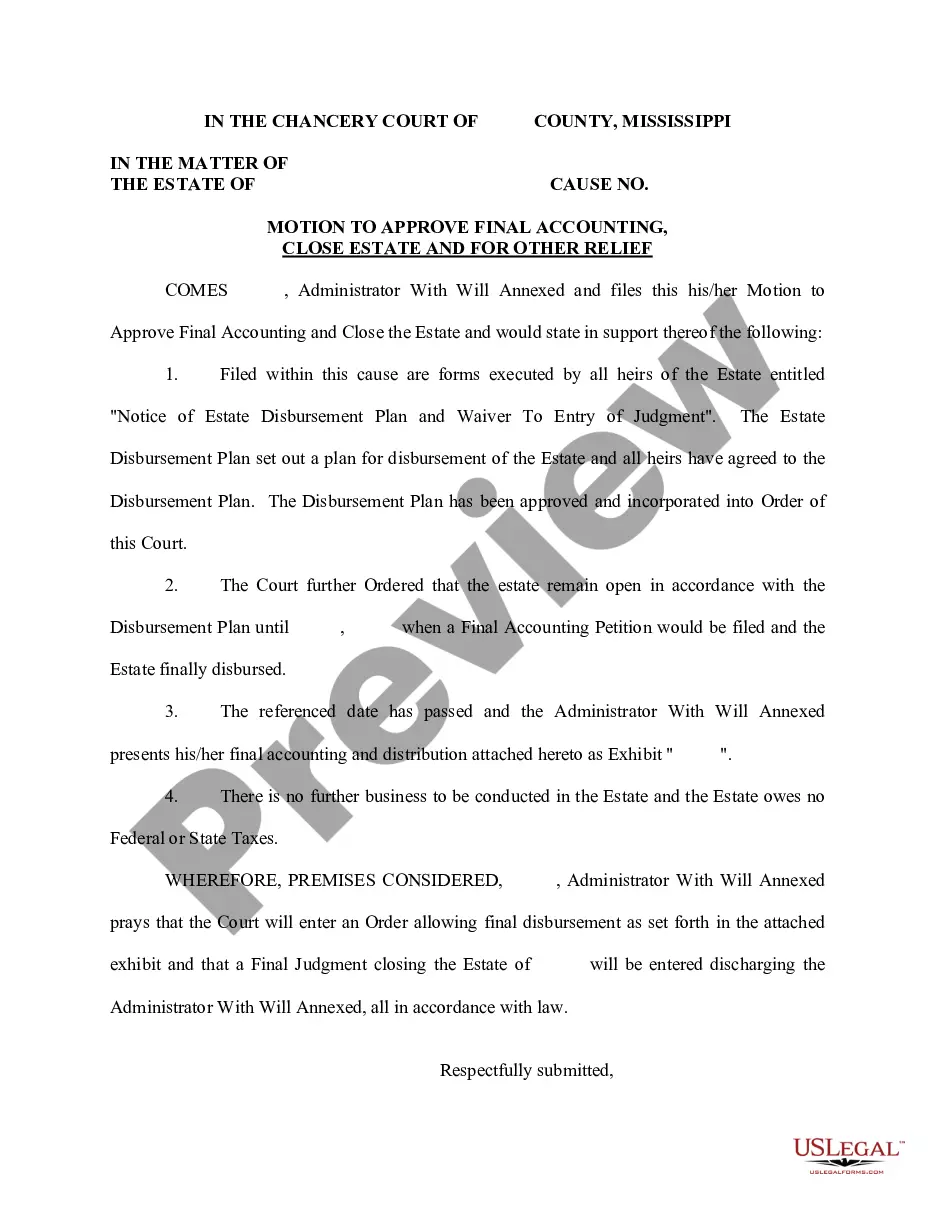

Estate Final Accounting Form

Description

How to fill out Mississippi Motion To Approve Final Accounting, Close Estate And For Other Relief (after Finalization Of Disbursement Plan)?

How to locate professional legal documents that comply with your state regulations and complete the Estate Final Accounting Form without consulting an attorney.

Numerous online services offer templates to address various legal situations and formalities.

However, it may require time to determine which of the provided samples meet both your usage requirements and legal standards.

If you don’t have an account with US Legal Forms, follow the instructions below: Review the webpage you've accessed and verify whether the form meets your requirements. To assist you, use the form description and preview options when available. If needed, search for another sample in the header indicating your state. Click the Buy Now button when you find the appropriate document. Choose the most suitable pricing plan, then Log In or pre-register for an account. Select the payment method (by credit card or through PayPal). Adjust the file format for your Estate Final Accounting Form and click Download. The downloaded templates are yours to keep: you can always access them in the My documents tab of your profile. Join our service and draft legal documents independently like a seasoned legal professional!

- US Legal Forms is a reliable platform that assists you in finding official documents created in line with the latest updates in state law, helping you save on legal fees.

- US Legal Forms is more than just an ordinary online directory; it's a compilation of over 85,000 validated templates for diverse business and personal situations.

- All documents are categorized by area and state to enhance your searching experience, making it quicker and less complicated.

- It also incorporates advanced tools for editing PDFs and electronic signatures, allowing Premium subscribers to promptly complete their paperwork online.

- Acquiring the necessary documents requires minimal time and effort.

- If you already possess an account, Log In and verify the activity of your subscription.

- Download the Estate Final Accounting Form using the respective button adjacent to the file name.

Form popularity

FAQ

Final expenses of an estate typically include funeral costs, debts, taxes, and administrative fees. It’s crucial to track these expenses accurately for your estate final accounting form. Doing so ensures that all financial matters are settled before assets are distributed to beneficiaries. Consider using tools from uslegalforms to streamline the organization of these expenses.

To file a deceased person's final tax return, you'll need Form 1040 for the year of death. Gather all the necessary documents, including income records and deductions. Completing an estate final accounting form can help organize these materials and ensure that you report everything accurately. If you need support, services like those offered by uslegalforms can simplify this process.

A final distribution from an estate is generally not taxable to the beneficiary. However, any income generated from that distribution may be subject to taxes. When preparing your estate final accounting form, documenting these distributions accurately is essential for clarity. If you have questions, utilizing resources from uslegalforms can help you manage these processes efficiently.

Inherited distributions are typically not taxable to the beneficiary. However, if the distribution generates income after the death of the decedent, that income may be taxable. Understanding how this affects your estate final accounting form is crucial for accurate financial reporting. To navigate these rules effectively, professional tax advice can be valuable.

You are not required to file a final Form 1041 for the estate if there is no income. However, it’s still important to complete an estate final accounting form for record-keeping and transparency purposes. This information can help beneficiaries understand the estate’s finances, even if no tax return is submitted. Always consider seeking guidance from a tax expert to ensure compliance.

1 form from an estate can indicate income distributed to beneficiaries, which may be taxable. Depending on the estate's income, you may need to report this income on your tax return. It's essential to review the details provided in the K1 carefully, as it affects your estate final accounting form. Consulting a tax professional can further clarify any tax implications.

In Wisconsin, a car may not need to go through probate if it is solely titled in the deceased's name. However, if the vehicle is part of a larger estate, it may require administration. Utilizing the estate final accounting form can help clarify the process for handling such assets.

To close a probate estate in Michigan, you must settle all debts and distribute the remaining assets according to the will. After that, you will need to file a final accounting with the probate court, often utilizing the estate final accounting form for convenience. Once the court approves your final accounting, you can request the closure of the estate, completing your responsibilities as the executor.

A final account for an estate is a comprehensive report outlining all financial transactions during the estate's administration. It includes details about income, expenses, distributions, and any remaining assets. Completing the estate final accounting form is essential to verify asset distribution and ensure transparency among beneficiaries.

While an executor has significant authority in managing the estate, they must act in accordance with the law and the wishes of the deceased as outlined in the will. The executor must also make decisions that are fair and reasonable, often requiring approval from the probate court. The estate final accounting form is crucial in demonstrating that the executor has acted responsibly and followed legal guidelines.