Estate Formal Accounting

Description

How to fill out Estate Formal Accounting?

Maneuvering through the red tape of standard documents and templates can be challenging, particularly when one does not engage in that work professionally.

Even selecting the appropriate template for the Estate Formal Accounting can be labor-intensive, as it needs to be legitimate and precise to the last figure.

However, you will require considerably less time acquiring a suitable template if it originates from a source you can rely on.

Acquire the correct form in a few simple steps: Input the document title in the search box. Find the accurate Estate Formal Accounting in the list of outcomes. Review the sample outline or open its preview. When the template meets your needs, click Buy Now. Continue to select your subscription plan. Use your email and create a secure password to set up an account at US Legal Forms. Choose a credit card or PayPal payment method. Save the template document on your device in the format of your choice. US Legal Forms can save you considerable time verifying whether the form you found online is appropriate for your needs. Establish an account and gain unlimited access to all the templates you require.

- US Legal Forms is a service that streamlines the process of finding the right forms online.

- US Legal Forms is a singular destination where one can obtain the latest examples of documents, check their usage, and download these examples to complete them.

- This is a compilation with over 85K forms applicable in numerous sectors.

- When looking for an Estate Formal Accounting, you will not have to doubt its validity as all the forms are authenticated.

- An account at US Legal Forms will ensure you have all the essential samples at your disposal.

- Store them in your history or add those to the My documents directory.

- You can access your saved forms from any device by clicking Log In at the library site.

- If you still lack an account, you can always search again for the template you require.

Form popularity

FAQ

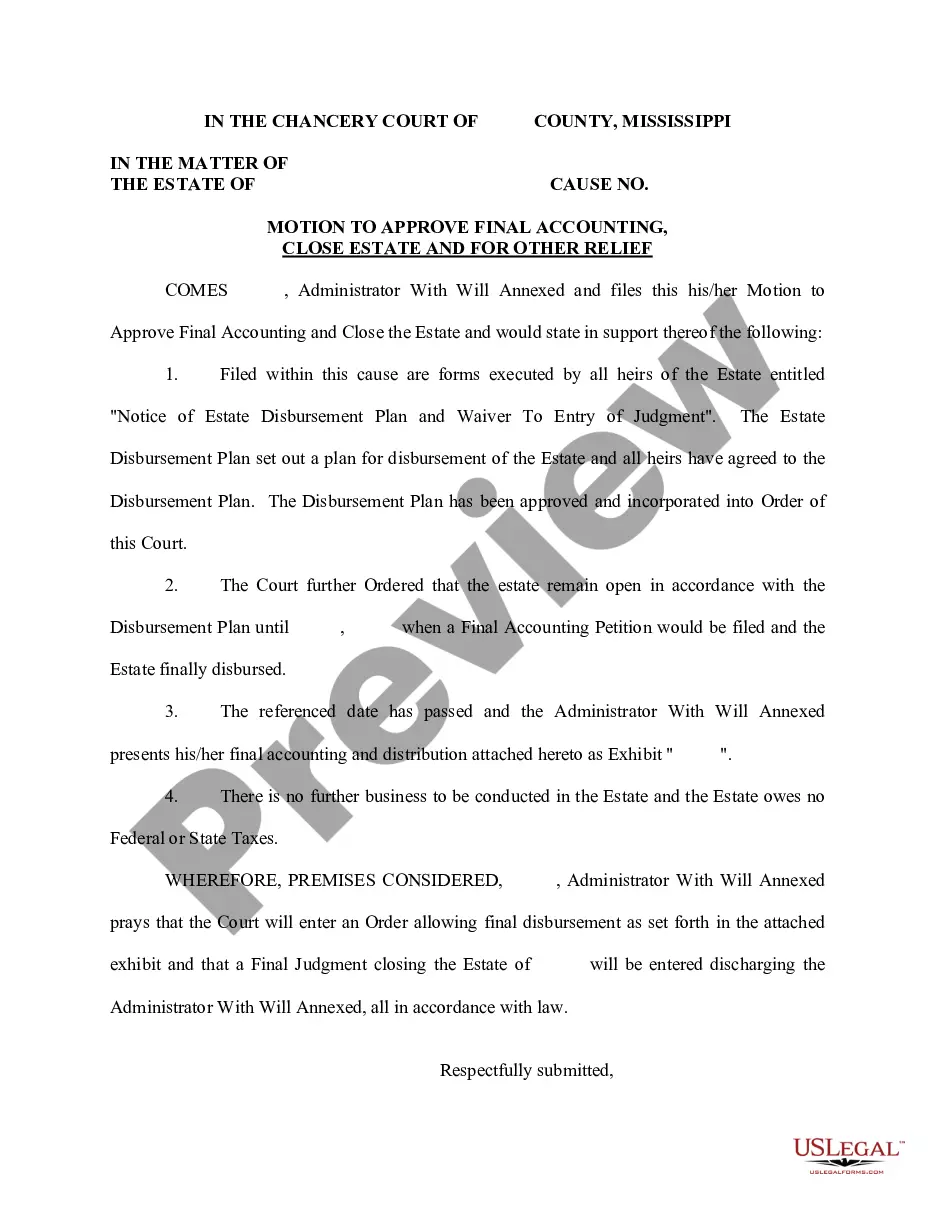

A final accounting for an estate typically includes a complete breakdown of all estate assets, liabilities, and financial transactions throughout the estate administration. It should be detailed, showing how funds were managed, distributed, and any expenses incurred. This document serves as a transparent summary for beneficiaries and complies with estate formal accounting standards.

Yes, the executor must present bank statements as part of the estate formal accounting process. These statements provide essential proof of the estate's financial activity and transparency to beneficiaries. By including bank statements, the executor demonstrates accountability and ensures all estate transactions are valid and documented.

Formal accounting for an estate refers to the systematic process of documenting all financial transactions related to the estate's management. This includes all income, expenses, and distributions, presented in a manner that meets legal standards. Engaging in formal accounting is crucial for fulfilling fiduciary duties and ensures transparency for beneficiaries.

To prepare a final accounting for an estate, gather all financial documentation, including receipts, bills, and bank statements. Organize these documents to present a comprehensive overview of the estate's transactions. A well-prepared final accounting simplifies the probate process and satisfies the requirements for estate formal accounting.

A formal accounting record serves as an official document that outlines all financial activities related to an estate. This record includes a list of assets, liabilities, income, and expenses, formatted to meet legal standards. Having an accurate formal accounting record ensures compliance and provides a clear financial picture for beneficiaries and the court.

Preparing an estate accounting involves compiling a detailed record of the estate's financial activities. First, list all estate assets, liabilities, and receipts. Then, organize these details chronologically to create a transparent overview of transactions that will fulfill the requirements for estate formal accounting.

Filling out an estate document requires accuracy and attention to detail. Start by gathering all relevant information, including the decedent's assets and debts. Use a comprehensive estate form to document this information clearly, ensuring you follow state-specific requirements for estate formal accounting.

Formal accounting involves adhering to specific legal standards and requirements, providing a thorough financial overview of an estate. Informal accounting, on the other hand, does not follow strict regulations and may lack documentation. While both methods track estate assets and expenditures, formal accounting is essential for transparency and accountability, especially in legal proceedings.

Beneficiaries typically have the right to access bank statements as part of the estate formal accounting process. This access allows them to verify the financial activities associated with the estate. If you're a beneficiary, it's essential to request this information from the executor, who is responsible for providing it in a timely manner.

Yes, an executor is generally obligated to provide bank statements to beneficiaries during estate formal accounting. This transparency helps beneficiaries understand the financial situation of the estate and ensures that the executor is fulfilling their fiduciary duties. If you have concerns regarding access to these statements, it’s best to communicate directly with your executor for clarification.