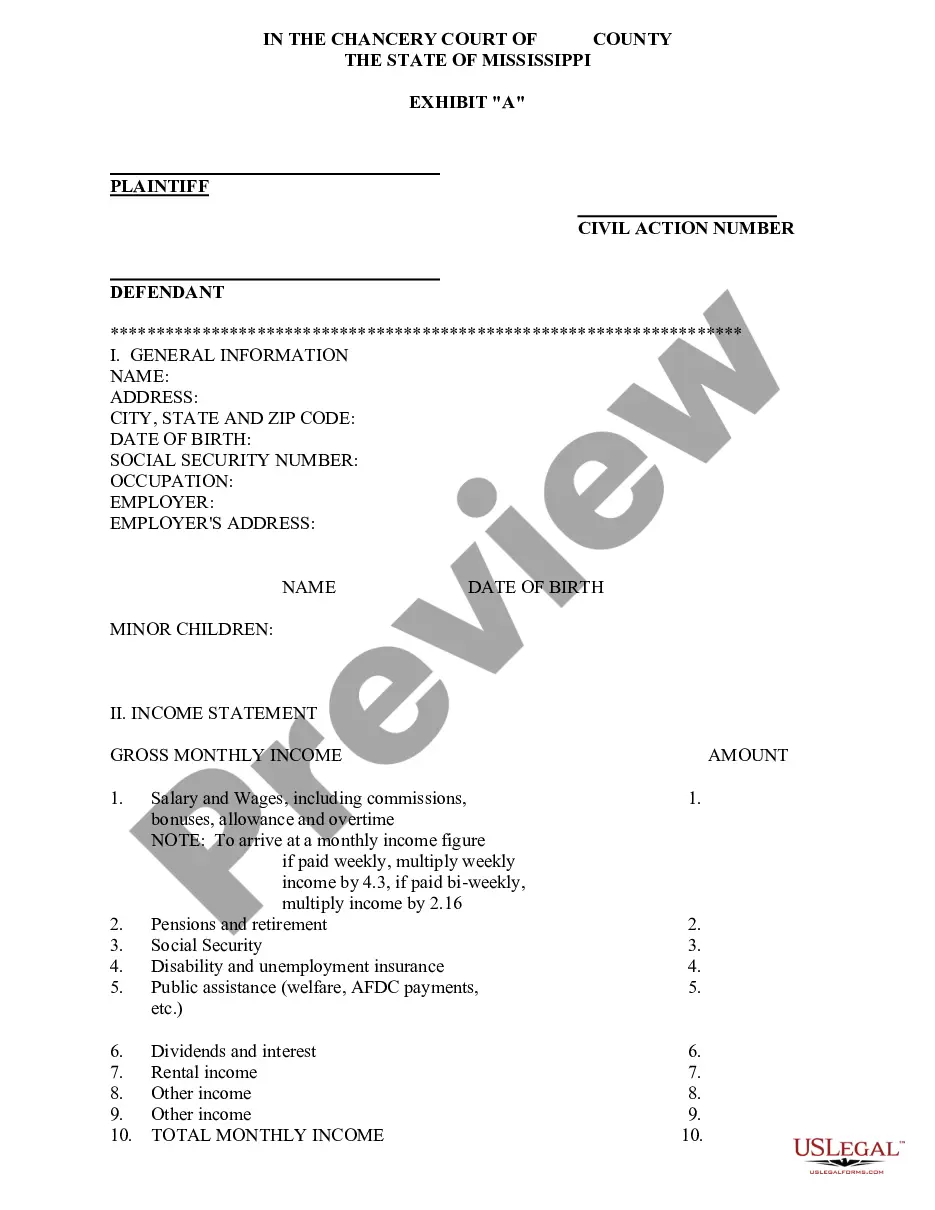

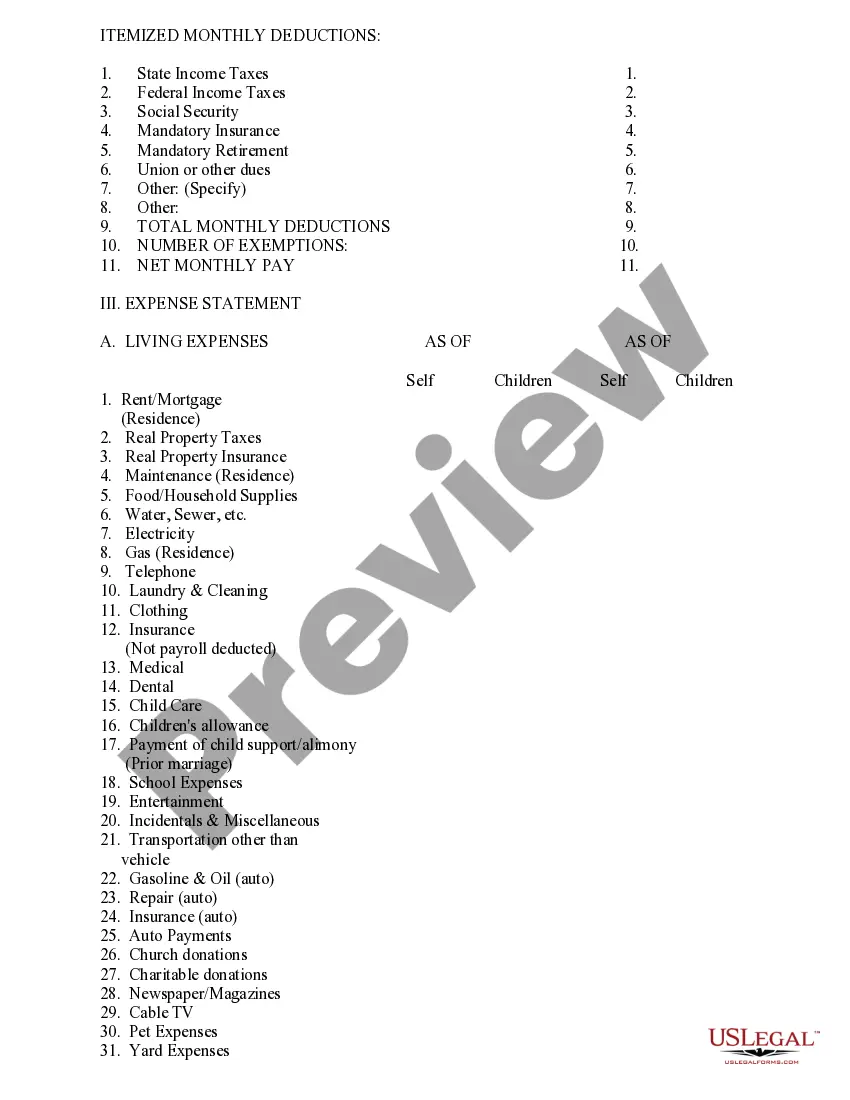

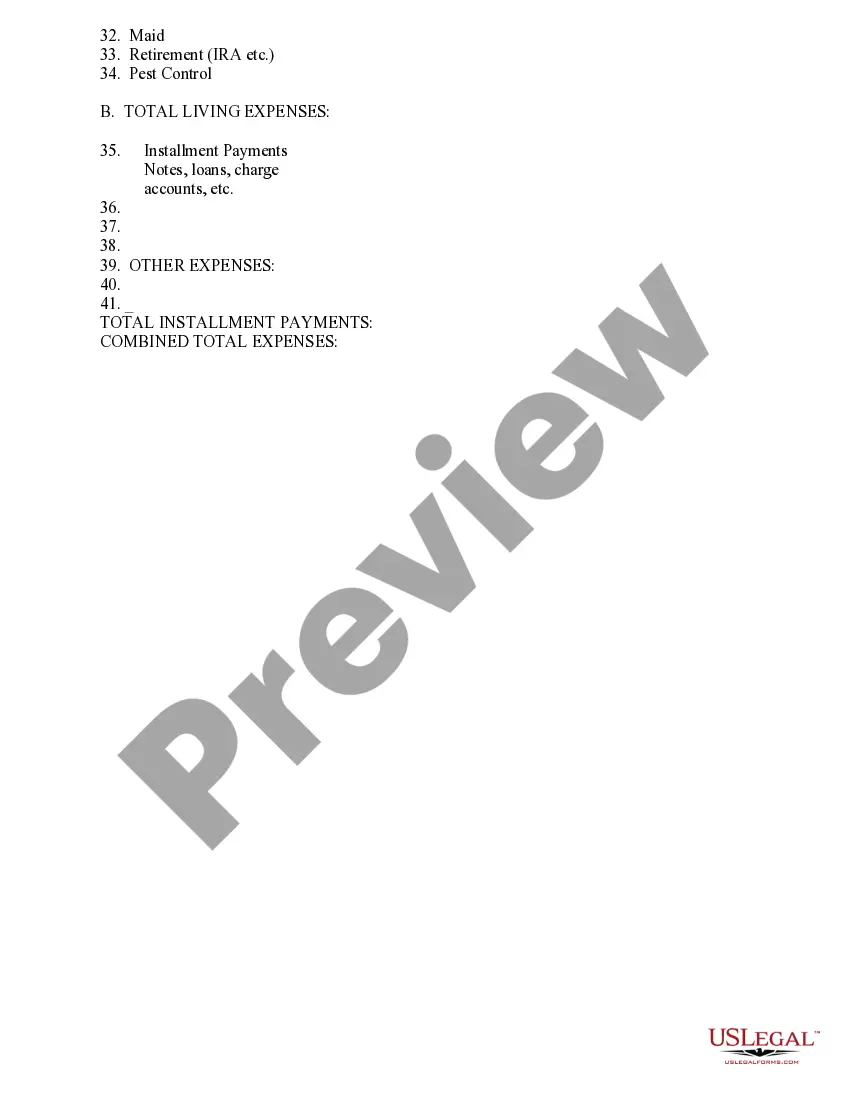

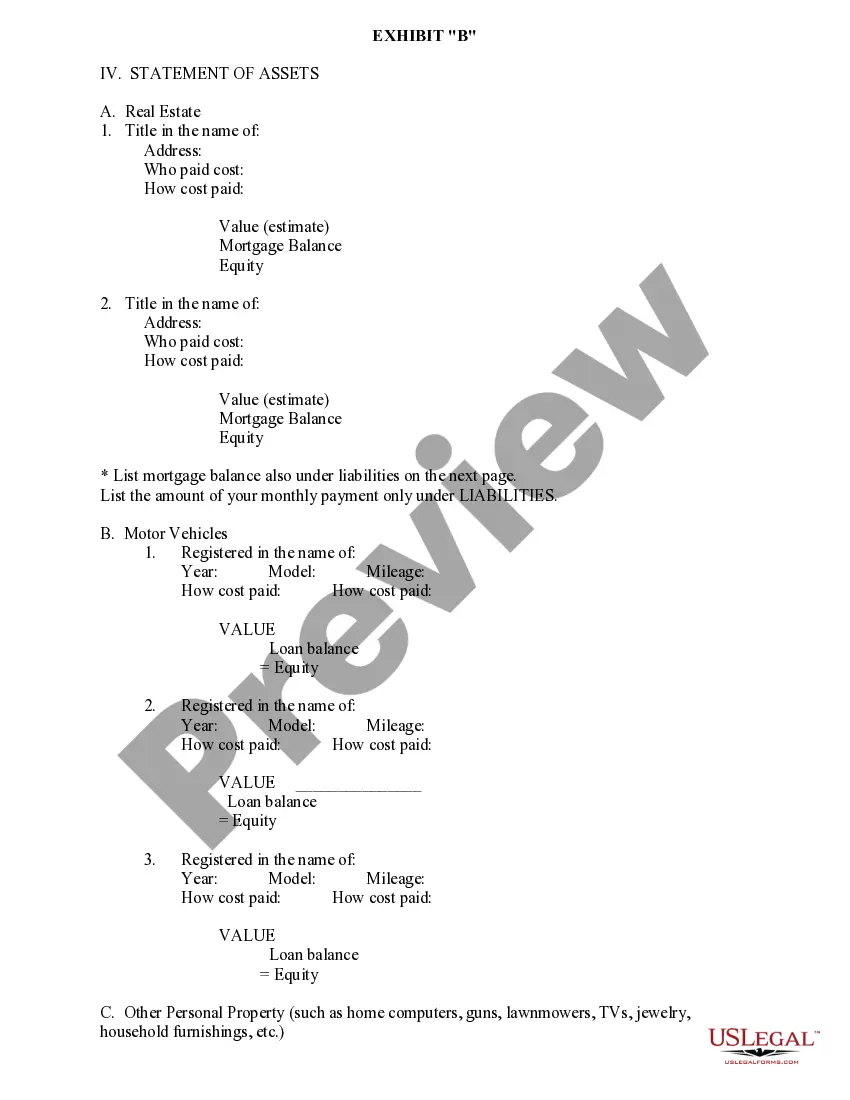

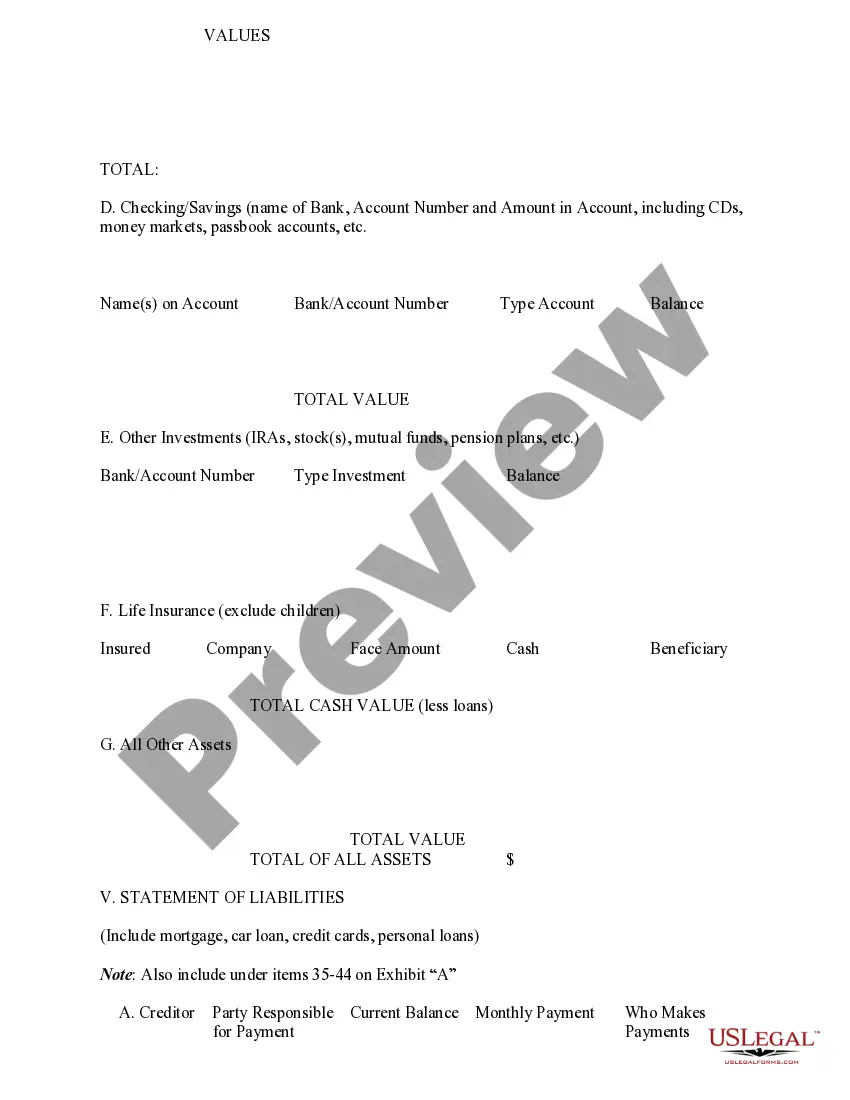

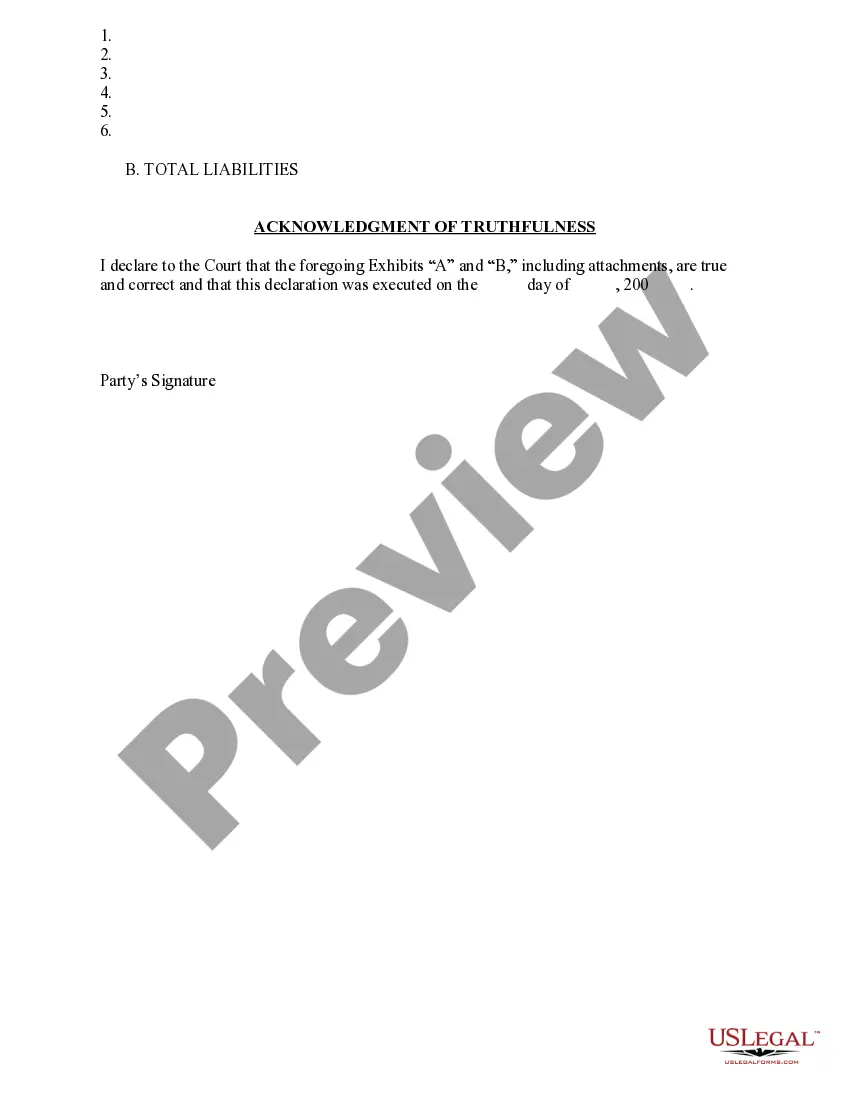

Rule 8 05 financial statement Mississippi withholding tax refers to the reporting and disclosure requirements for businesses operating in the state of Mississippi related to their withholding tax obligations. This rule enforces transparency and accountability in regard to employers' withholding tax responsibilities and ensures that accurate financial statements are reported to the Mississippi Department of Revenue. The Rule 8 05 financial statement primarily applies to employers who are required to withhold state income taxes from their employees' wages. It outlines the necessary forms, guidelines, and reporting procedures that employers must follow to fulfill their withholding tax obligations. The Rule 8 05 financial statement Mississippi withholding tax encompasses various components, including: 1. Mississippi Withholding Tax Returns: Employers must file periodic withholding tax returns, usually on a monthly basis, using the appropriate forms provided by the Mississippi Department of Revenue. These returns summarize the total wages paid, taxes withheld, and any other relevant income tax information. 2. Mississippi Withholding Tax Deposit: Employers are required to remit withholding taxes through the appropriate payment methods provided by the Mississippi Department of Revenue. The rule specifies the deadlines by which employers must make these deposits, ensuring timely payment of withheld taxes to the state. 3. Financial Statement Reporting: Rule 8 05 stipulates that employers must include withholding tax information in their financial statements. This reporting requirement ensures transparent disclosure of withholding tax liabilities and associated expenses, providing a comprehensive view of an employer's financial standing. It is important to note that the specific types of Rule 8 05 financial statement Mississippi withholding tax may vary depending on factors such as the type of business and its size. However, the fundamental principles and obligations remain consistent across all types of businesses subject to Mississippi withholding tax regulations. In summary, Rule 8 05 financial statement Mississippi withholding tax establishes guidelines for employers to accurately report and fulfill their withholding tax obligations. By complying with this rule, businesses contribute to the state's revenue collection efforts, facilitate transparency in financial reporting, and ensure the proper management of payroll-related tax liabilities.

Mississippi Rule 8 05 Waiver Withholding

State:

Mississippi

Control #:

MS-61758

Format:

Word

Instant download

Description Mississippi Statement Rule

This is a Financial Statement Required by Rule 8.05. It is needed in divorce causes of action, in order to properly distribute the couple's marital assets and debts.

Free preview Statement Rule Contract