Mississippi Compensation With Trust

Description

Form popularity

FAQ

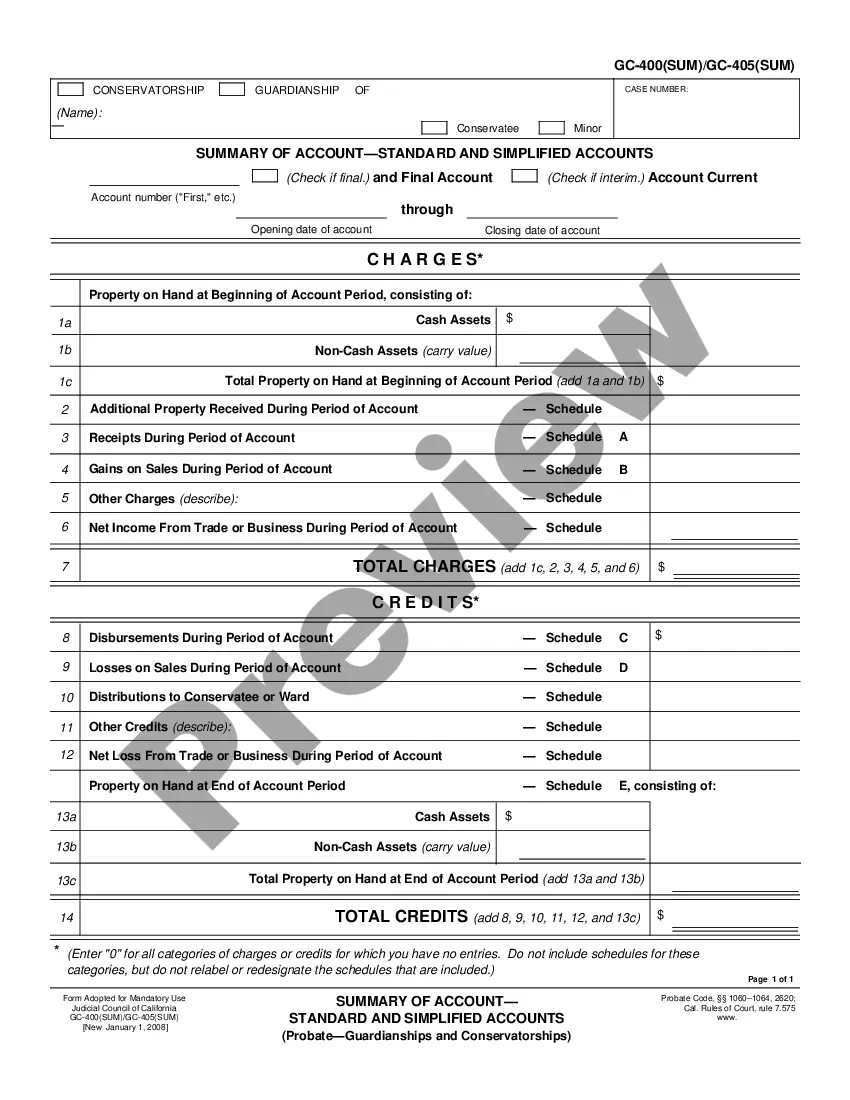

The Mississippi State Agencies Workers Compensation Trust is a program designed to provide employers with a reliable option for workers' compensation coverage. By participating in this trust, businesses can gain access to affordable Mississippi compensation with trust while ensuring their employees receive necessary support in case of work-related injuries. This program helps streamline the claims process, making it easier for businesses to manage their responsibilities. Utilizing resources like the US Legal Forms platform can assist employers in navigating requirements and understanding their obligations under this crucial trust.

The maximum compensation rate in Mississippi is determined annually and can change based on wage trends in the state. For 2023, the limit is set to provide sufficient financial support for workers injured on the job. Staying informed about these rates is essential, as Mississippi compensation with trust relies on understanding the benefits available to employees.

In Mississippi, certain employees are exempt from workers' compensation laws, including independent contractors and specific types of agricultural workers. Additionally, some small businesses may not be required to provide coverage if they have fewer than five employees. Understanding these exemptions can help business owners navigate Mississippi compensation with trust, ensuring they comply with all legal requirements.

The Mississippi Government Employees Deferred Compensation Plan and Trust offers public workers an opportunity to save for retirement through tax-deferred accounts. This plan helps employees enhance their financial security by allowing them to invest a portion of their salary before taxes are deducted. By participating in this plan, Mississippi employees can improve their overall compensation with trust, ensuring a more secure retirement.

The State Compensation Insurance Fund provides essential insurance coverage for employees in Mississippi. It helps businesses comply with state laws regarding workers' compensation and protects employees in case of workplace injuries. By facilitating claims and managing funds, the State Compensation Insurance Fund plays a crucial role in enhancing Mississippi compensation with trust.

One downside of having a trust is that they can involve complex setup and maintenance, which may incur legal fees. Additionally, if not properly managed, a trust may lead to confusion among beneficiaries regarding their rights and responsibilities. However, when leveraging Mississippi compensation with trust effectively, you can significantly mitigate these risks by setting up clear guidelines and maintaining communication.

The Mississippi State Agencies Workers Compensation trust is designed to provide a safety net for employees injured on the job. This trust ensures that injured workers receive the necessary benefits while protecting employers from excessive liabilities. Utilizing a trust structure helps streamline the management of Mississippi compensation with trust, ensuring an efficient claims process.

Yes, Mississippi does accept federal extensions for trusts, allowing additional time to file tax returns. If you file a Form 7004 for an automatic extension, make sure to follow any state-specific guidelines. This can provide everyone involved with valuable time to manage their Mississippi compensation with trust appropriately.

A significant mistake parents often make when setting up a trust fund is failing to communicate their intentions with the beneficiaries. Without clear instructions and understanding, beneficiaries may not appreciate the reasons behind the trust, leading to misuse or disputes. Effectively managing Mississippi compensation with trust means having open discussions about goals and expectations.

To place a house in a trust in Mississippi, you typically need to draft a trust document that outlines how the asset should be managed. Next, you would execute a new deed transferring ownership of the property to the trust. This process helps secure your Mississippi compensation with trust by ensuring that the property is preserved for the intended beneficiaries and managed according to your plan.